- Israel

- /

- Trade Distributors

- /

- TASE:MNIN

Middle Eastern Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The Middle Eastern markets have recently experienced a mix of gains and losses, with most Gulf markets buoyed by strong corporate earnings while the Saudi index continues to face challenges. In this dynamic environment, dividend stocks can offer a reliable income stream and potential portfolio stability, making them an attractive option for investors seeking to navigate these fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.48% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.03% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.42% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.48% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.64% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.69% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.08% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 5.73% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.16% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.26% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S. operates as a provider of converged telecommunication and technology services across Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY205 billion.

Operations: Turkcell Iletisim Hizmetleri A.S. generates revenue primarily from its Turkcell Turkey segment, which accounts for TRY148.31 billion, and its Techfin segment, contributing TRY9.29 billion.

Dividend Yield: 3.9%

Turkcell Iletisim Hizmetleri has shown a commitment to dividend payouts, with recent approval of TRY 8 billion in dividends for fiscal year 2024, distributed in two installments. The company's dividend yield is competitive within the Turkish market, and its cash payout ratio suggests dividends are well-covered by cash flows. However, Turkcell's dividend history has been volatile over the past decade. Recent strategic collaborations and financing initiatives indicate a focus on strengthening infrastructure and financial resilience.

- Get an in-depth perspective on Turkcell Iletisim Hizmetleri's performance by reading our dividend report here.

- Our valuation report here indicates Turkcell Iletisim Hizmetleri may be undervalued.

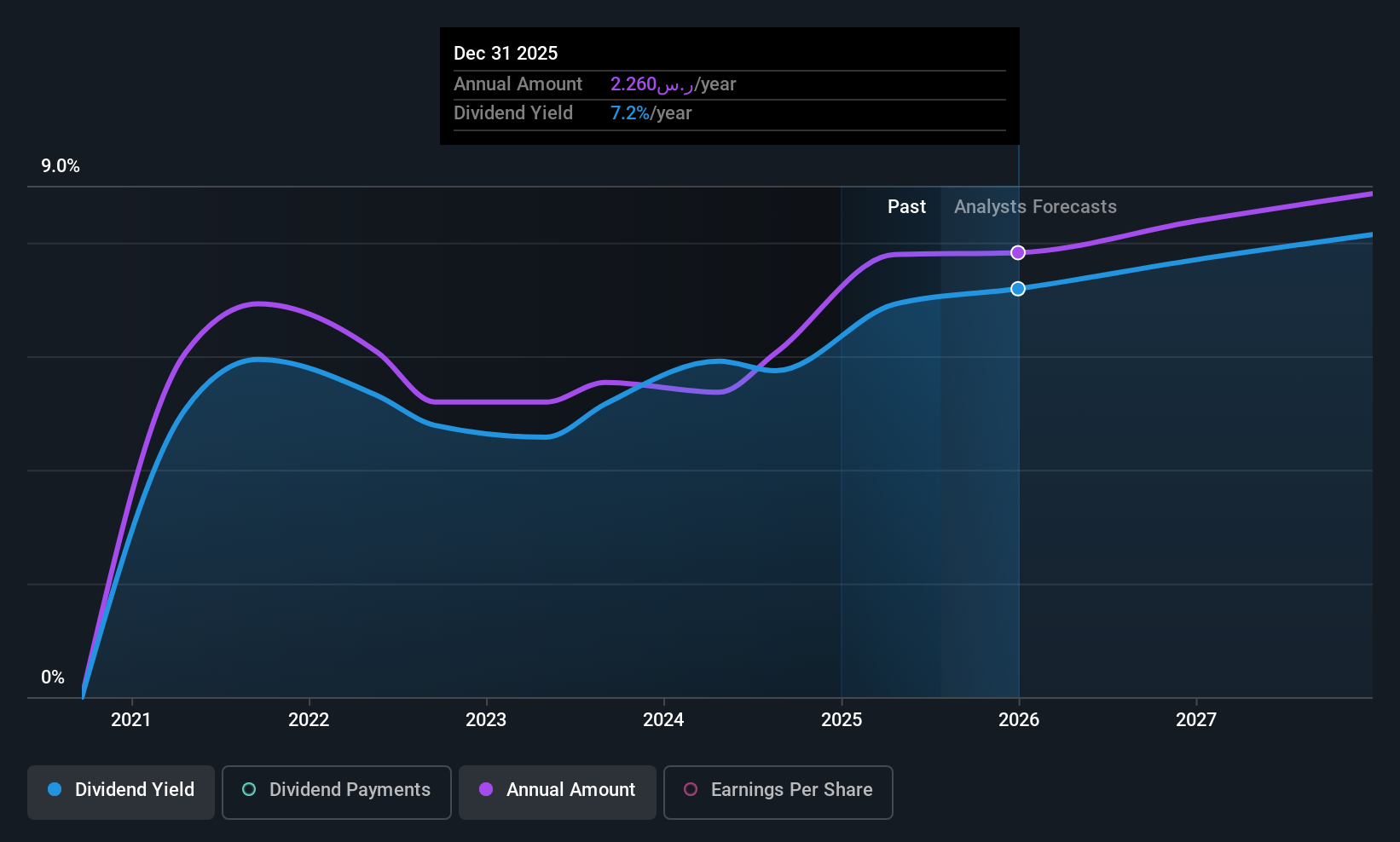

Riyadh Cement (SASE:3092)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Riyadh Cement Company produces and sells cement across several Middle Eastern countries, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman, with a market cap of SAR3.76 billion.

Operations: Riyadh Cement Company's revenue from cement manufacturing is SAR825.73 million.

Dividend Yield: 7.2%

Riyadh Cement's dividend yield ranks in the top 25% of the Saudi Arabian market, supported by earnings and cash flows with payout ratios of 85.4% and 88.2%, respectively. Although dividends have increased over four years, they remain volatile and less reliable due to an unstable track record. The company trades at a good value compared to peers, with revenue growth projected at 7% annually. Recent board changes may influence future strategic decisions but are not directly related to dividend stability.

- Unlock comprehensive insights into our analysis of Riyadh Cement stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Riyadh Cement is priced lower than what may be justified by its financials.

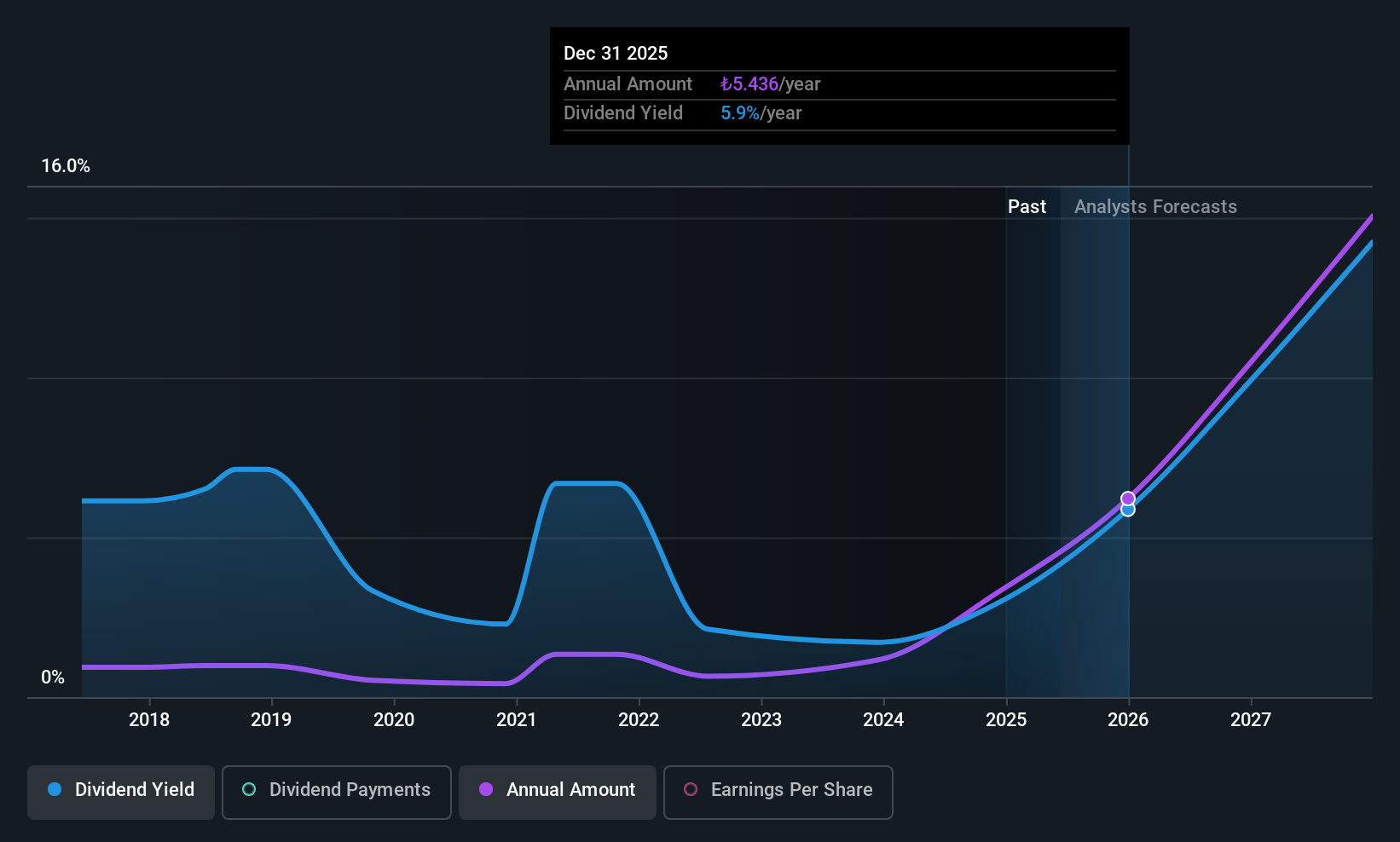

Mendelson Infrastructures & Industries (TASE:MNIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mendelson Infrastructures & Industries Ltd. (TASE:MNIN) operates in the infrastructure and industrial sectors with a market cap of ₪709.99 million.

Operations: Mendelson Infrastructures & Industries Ltd. generates revenue from three primary segments: Infrastructure (₪290.91 million), Construction and Plumbing (₪481.04 million), and Elevators and Air Conditioning (₪266.40 million).

Dividend Yield: 3.4%

Mendelson Infrastructures & Industries offers a mixed dividend profile. Despite a 27.4% earnings growth last year and reasonable payout ratios of 51.8% from earnings and 26.5% from cash flows, dividends have been volatile over the past decade, with periods of significant annual drops. The dividend yield is relatively low at 3.38%, below top-tier levels in Israel's market, yet dividends have increased over ten years despite their unreliability. Recent quarterly sales rose to ILS 253.96 million, though net income decreased slightly to ILS 9.54 million compared to the previous year.

- Navigate through the intricacies of Mendelson Infrastructures & Industries with our comprehensive dividend report here.

- Our valuation report here indicates Mendelson Infrastructures & Industries may be overvalued.

Next Steps

- Click here to access our complete index of 72 Top Middle Eastern Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MNIN

Mendelson Infrastructures & Industries

Mendelson Infrastructures & Industries Ltd.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives