As we step into January 2025, the global markets present a mixed landscape with major indices like the S&P 500 and Nasdaq Composite closing out another strong year despite some recent volatility. Economic indicators such as the Chicago PMI and GDP forecasts highlight challenges in manufacturing and growth, yet opportunities remain for discerning investors to uncover potential in small-cap stocks that may have been overlooked amidst broader market movements. In this environment, identifying a promising stock involves looking for companies with solid fundamentals that can navigate economic fluctuations while potentially benefiting from specific sector trends or unique market positions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Value Rating: ★★★★☆☆

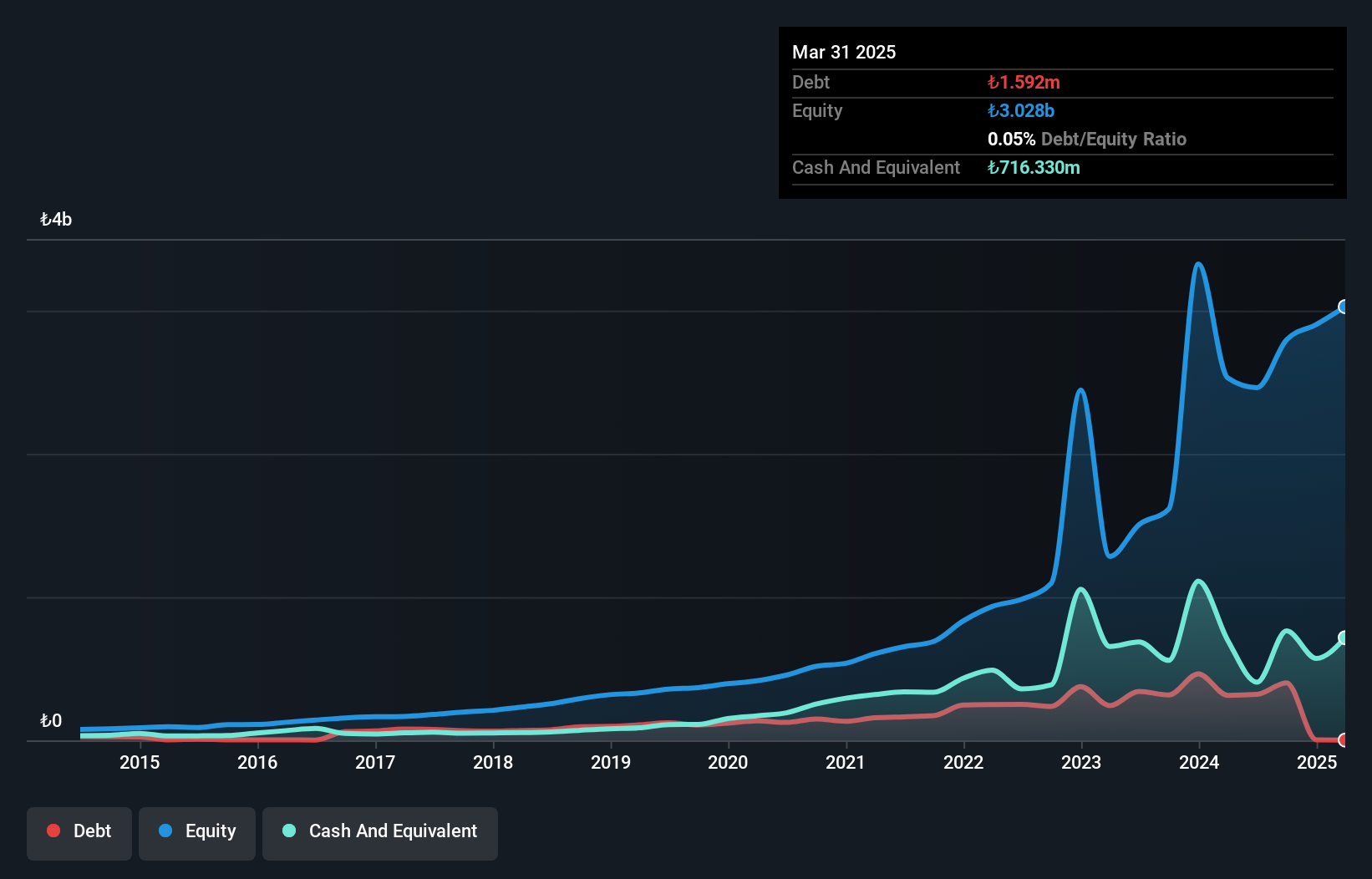

Overview: Logo Yazilim Sanayi ve Ticaret A.S. is a company that develops and markets software solutions in Turkey and Romania, with a market capitalization of TRY11.38 billion.

Operations: Logo Yazilim generates revenue primarily from the software industry, amounting to TRY3.56 billion.

Logo Yazilim, a notable player in the software sector, has seen its earnings grow by 13.7% annually over the past five years, although recent growth of 102.6% matched industry averages. Despite having high-quality earnings and more cash than total debt, interest payments are not well covered with EBIT at 2.1x coverage. The company's price-to-earnings ratio stands at 41.9x, slightly below the industry average of 42.6x, suggesting potential value for investors seeking opportunities in smaller companies within the tech space. Recent financials show a turnaround with TRY 111 million net income in Q3 from a prior loss of TRY 149 million last year.

Youcare Pharmaceutical Group (SHSE:688658)

Simply Wall St Value Rating: ★★★★★★

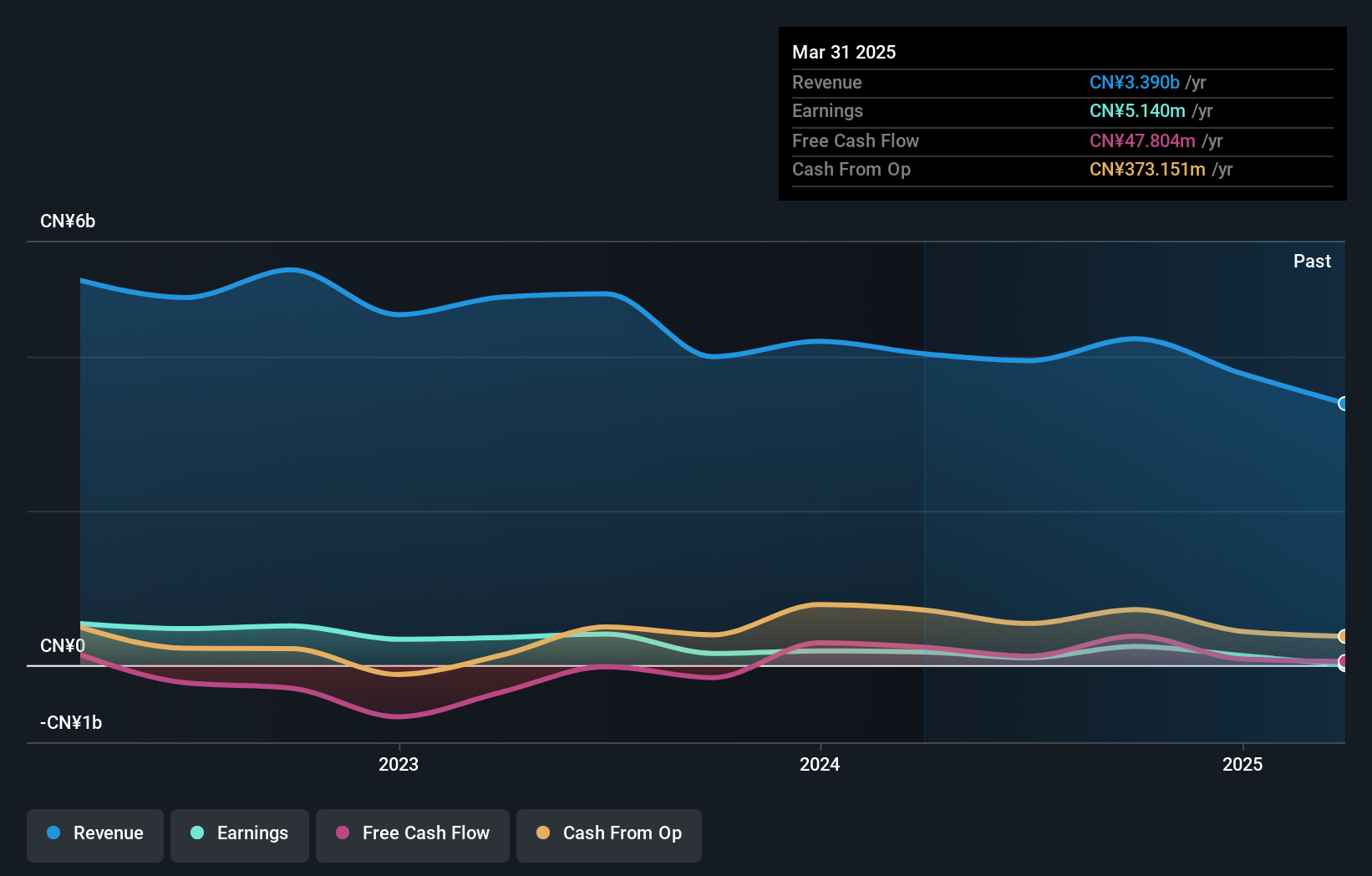

Overview: Youcare Pharmaceutical Group Co., Ltd. focuses on the research, development, manufacture, distribution, and sale of pharmaceutical products with a market capitalization of CN¥6.52 billion.

Operations: The company generates revenue primarily from the sale of pharmaceutical products. It has a market capitalization of CN¥6.52 billion, indicating its scale in the industry.

Youcare Pharma, a nimble player in the pharmaceutical sector, has shown impressive earnings growth of 59.4% over the past year, outpacing industry averages. Trading at 91.1% below estimated fair value suggests potential undervaluation. The company's debt-to-equity ratio improved from 40.8% to 19% over five years, indicating stronger financial health. Recent earnings reports highlight a rise in net income to CNY 209 million from CNY 152 million, with basic EPS climbing to CNY 0.47 from CNY 0.34 year-on-year for nine months ending September 2024, showcasing robust operational performance amidst industry challenges.

AnyMind Group (TSE:5027)

Simply Wall St Value Rating: ★★★★★☆

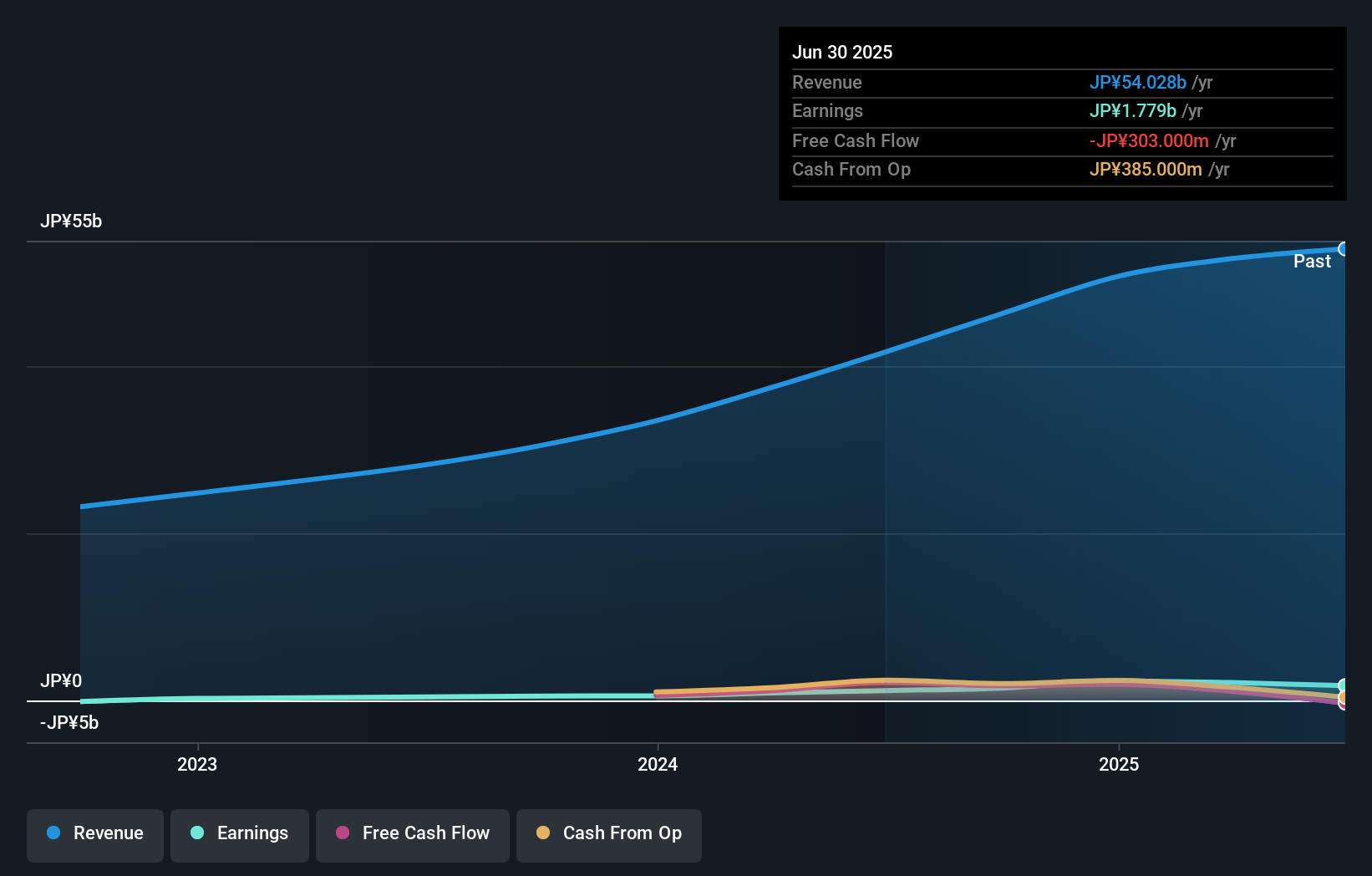

Overview: AnyMind Group Inc. operates a comprehensive platform offering integrated services for brand design, planning, production, e-commerce enablement, marketing, and logistics with a market cap of ¥63.79 billion.

Operations: The company generates revenue primarily from its Internet-Related Business, which amounted to ¥46.25 billion.

AnyMind Group, a promising player in the tech space, has shown impressive growth with earnings increasing by 178% over the past year, surpassing industry averages. The company is well-positioned financially, as it holds more cash than its total debt and maintains a strong interest coverage ratio of 6.2x. Despite some shareholder dilution recently, AnyMind continues to innovate with new product offerings like an enhanced analytics module on its influencer marketing platform and strategic partnerships such as those with TikTok in Thailand and FORENCOS in Vietnam. These moves highlight its focus on expanding digital marketing capabilities across Asia-Pacific markets.

- Unlock comprehensive insights into our analysis of AnyMind Group stock in this health report.

Explore historical data to track AnyMind Group's performance over time in our Past section.

Summing It All Up

- Delve into our full catalog of 4668 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LOGO

Logo Yazilim Sanayi ve Ticaret

Develops and markets software solutions in Turkey and Romania.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives