- Turkey

- /

- Real Estate

- /

- IBSE:DAPGM

Undiscovered Gems Three Promising Stocks For November 2024

Reviewed by Simply Wall St

As global markets experience a rally driven by election outcomes and economic policy shifts, small-cap stocks have captured investor attention, with the Russell 2000 Index notably leading gains despite not reaching record highs. In this dynamic environment, identifying promising stocks involves seeking companies that can capitalize on growth opportunities presented by favorable regulatory changes and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bank MNC Internasional | 11.85% | 4.80% | 43.63% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY 14 billion.

Operations: Albaraka Türk Katilim Bankasi A.S. generates revenue primarily from its Commercial and Corporate segment, contributing TRY 28.19 billion, followed by the Treasury segment with TRY 16.13 billion and Retail at TRY 6.25 billion.

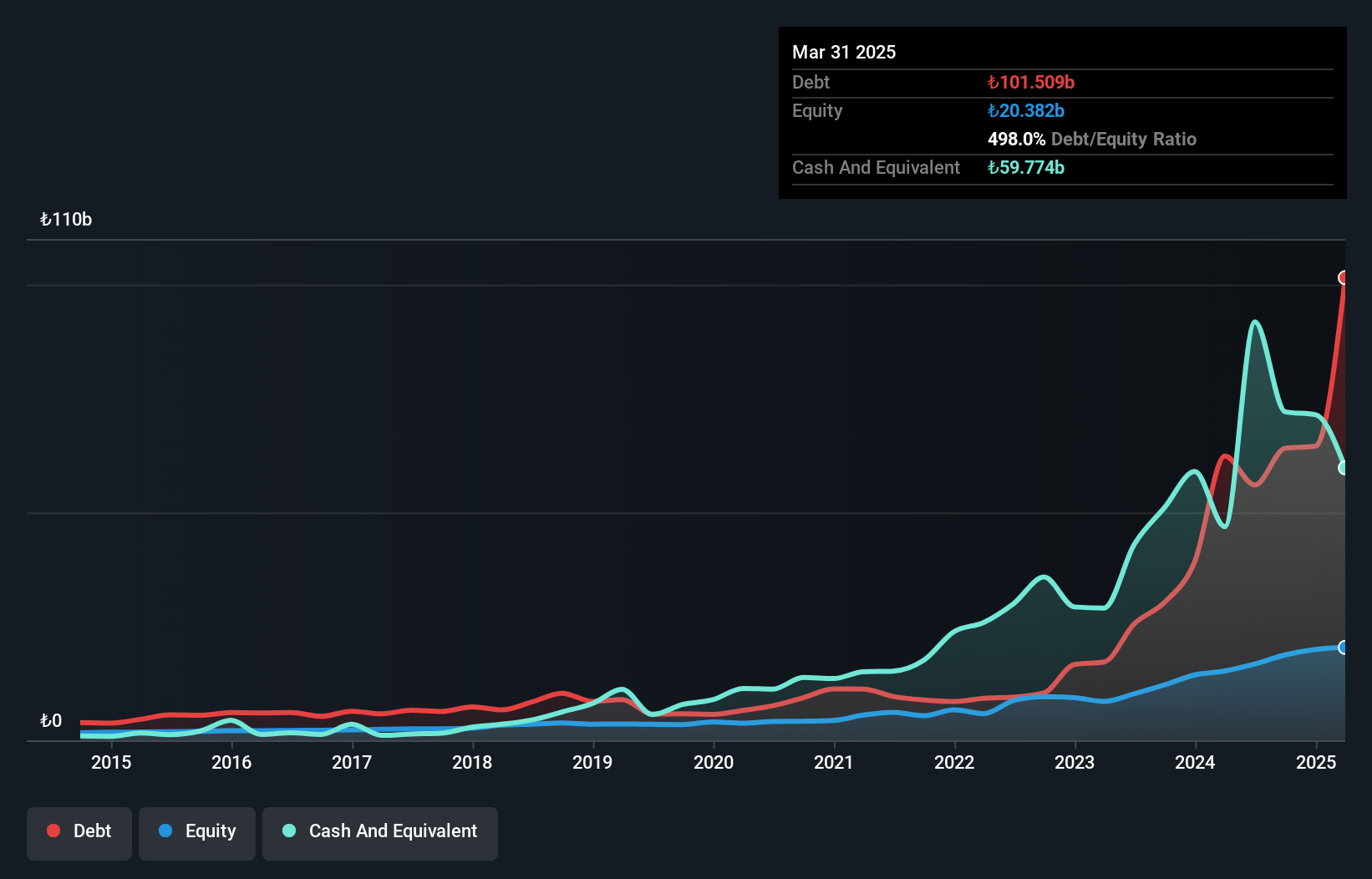

Albaraka Türk Katilim Bankasi, a smaller player in the banking sector, has shown impressive earnings growth of 124.5% over the past year, significantly outpacing the industry's 13.5%. This surge is partly due to a notable one-off gain of TRY3 billion impacting its recent financials. The bank's total assets stand at TRY269.7 billion with equity at TRY16.7 billion, and it holds deposits totaling TRY179.2 billion against loans of TRY115.7 billion. Despite lacking sufficient data on bad loan allowances, its price-to-earnings ratio of 2.7x suggests potential value compared to the broader market's 15x benchmark.

DAP Gayrimenkul Gelistirme (IBSE:DAPGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: DAP Gayrimenkul Gelistirme A.S. is involved in real estate development in Turkey and has a market capitalization of TRY12.06 billion.

Operations: DAP Gayrimenkul Gelistirme generates revenue primarily from its real estate operations and development, amounting to TRY6.37 billion.

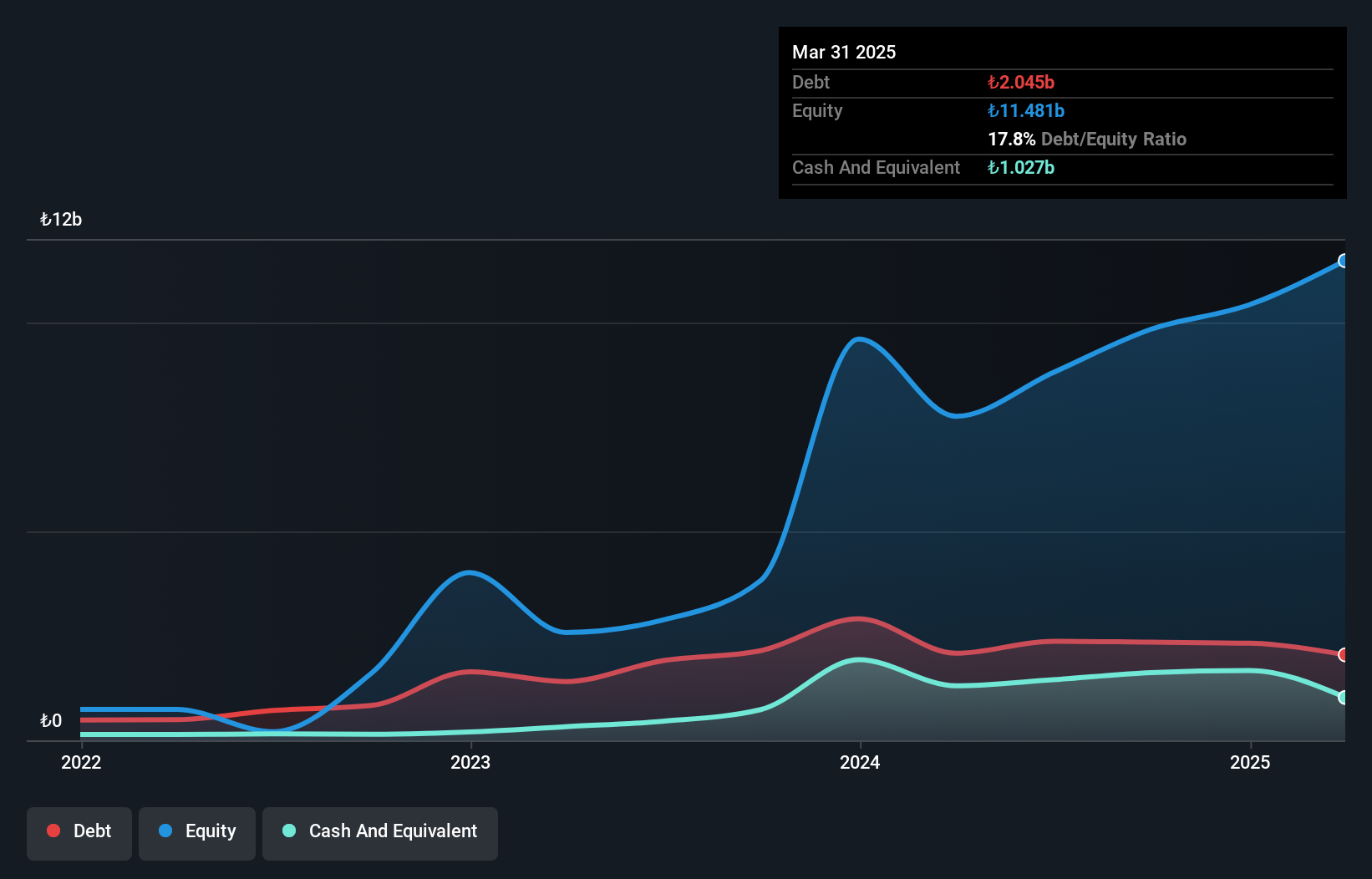

DAP Gayrimenkul Gelistirme shows a dynamic profile with earnings growth of 25.5% over the past year, outpacing the Real Estate industry's 7.5%. Despite a volatile share price recently, its net debt to equity ratio stands at a satisfactory 10.5%, indicating prudent financial management. The company also boasts high non-cash earnings and covers its interest payments comfortably, signaling robust fiscal health. However, revenue has taken a hit with a decline of 36.7% in the past year, which could be concerning for some investors. Its price-to-earnings ratio is attractive at 6.2x compared to the market's 15x average, suggesting potential value for discerning investors seeking opportunities in smaller companies within this sector.

- Click to explore a detailed breakdown of our findings in DAP Gayrimenkul Gelistirme's health report.

Understand DAP Gayrimenkul Gelistirme's track record by examining our Past report.

Mavi Giyim Sanayi ve Ticaret (IBSE:MAVI)

Simply Wall St Value Rating: ★★★★★★

Overview: Mavi Giyim Sanayi ve Ticaret A.S. is involved in the wholesale and retail sale of ready-to-wear denim apparel for men, women, and children, with a market cap of TRY31.58 billion.

Operations: Mavi generates revenue primarily from its apparel segment, amounting to TRY27.23 billion. The company's financial performance is influenced by its gross profit margin, which reflects the profitability of its core operations.

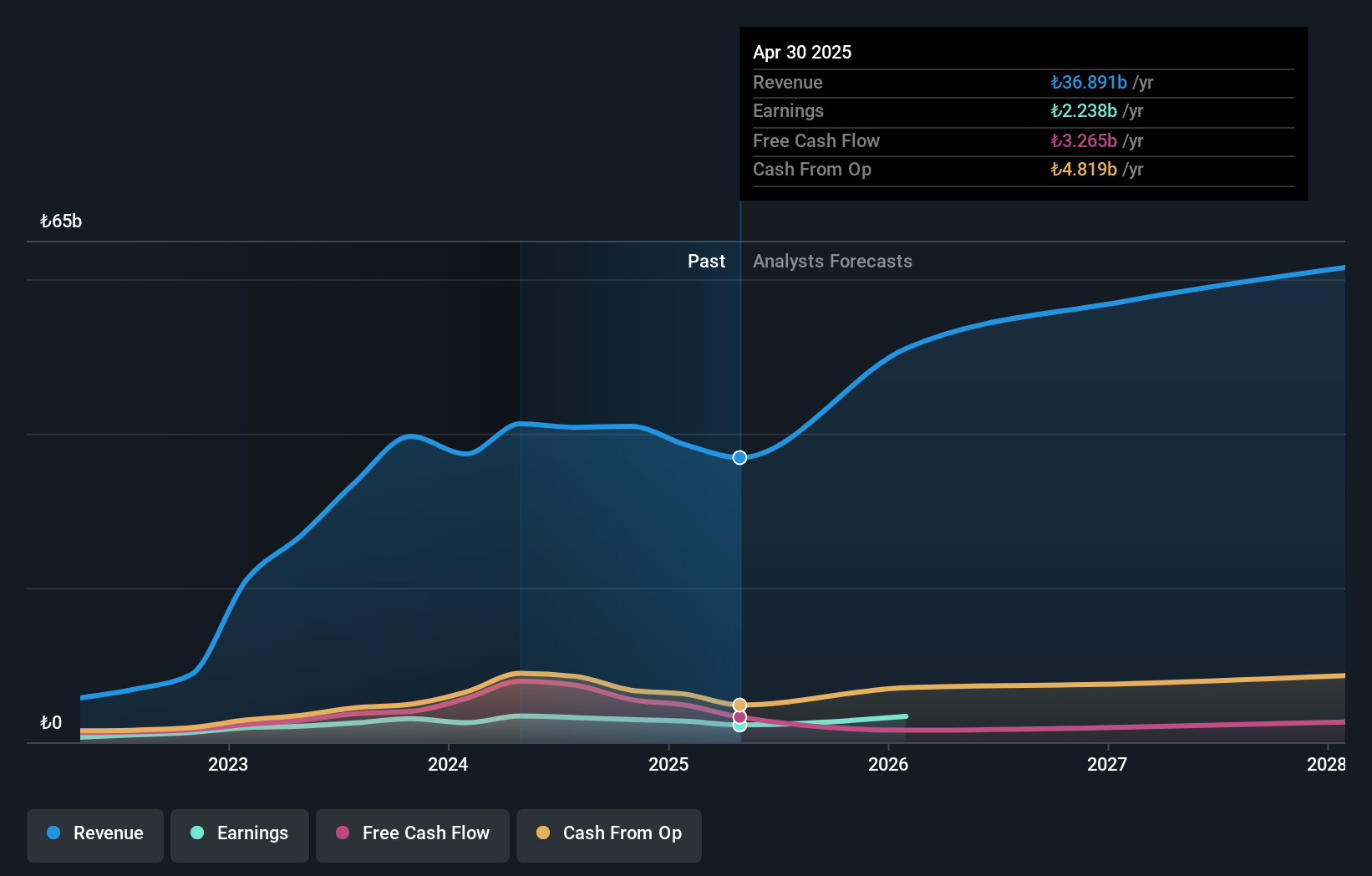

Mavi Giyim Sanayi ve Ticaret, a notable player in the fashion industry, has demonstrated financial resilience with its debt to equity ratio plummeting from 134.1% to 16.4% over five years. Despite recent negative earnings growth of 11%, it stands out for trading at 30.2% below estimated fair value and maintaining high-quality earnings. The company's net income for the first half of 2024 surged to TRY 1,552.98 million from TRY 1,195.36 million a year ago, suggesting robust operational performance even amidst challenges in the luxury sector where average growth was -4.4%.

Seize The Opportunity

- Unlock our comprehensive list of 4671 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:DAPGM

DAP Gayrimenkul Gelistirme

Operates in the real estate industry in Turkey.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives