- United Arab Emirates

- /

- Banks

- /

- ADX:UAB

Undiscovered Gems in Middle East Stocks for December 2025

Reviewed by Simply Wall St

The Middle East stock markets have recently shown mixed performance, with Dubai experiencing a rebound as oil prices tick up and investors keep a close watch on the Federal Reserve's rate path. As steady oil prices continue to influence the region's financial markets, identifying promising stocks in this dynamic environment requires an understanding of local economic fundamentals and market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Arab Bank P.J.S.C. operates as a provider of commercial banking products and services for both individual and corporate clients in the United Arab Emirates, with a market capitalization of AED4.08 billion.

Operations: United Arab Bank generates revenue primarily from Wholesale Banking (AED497.67 million), followed by Treasury and Capital Markets (AED225.58 million), and Retail Banking (AED83.69 million).

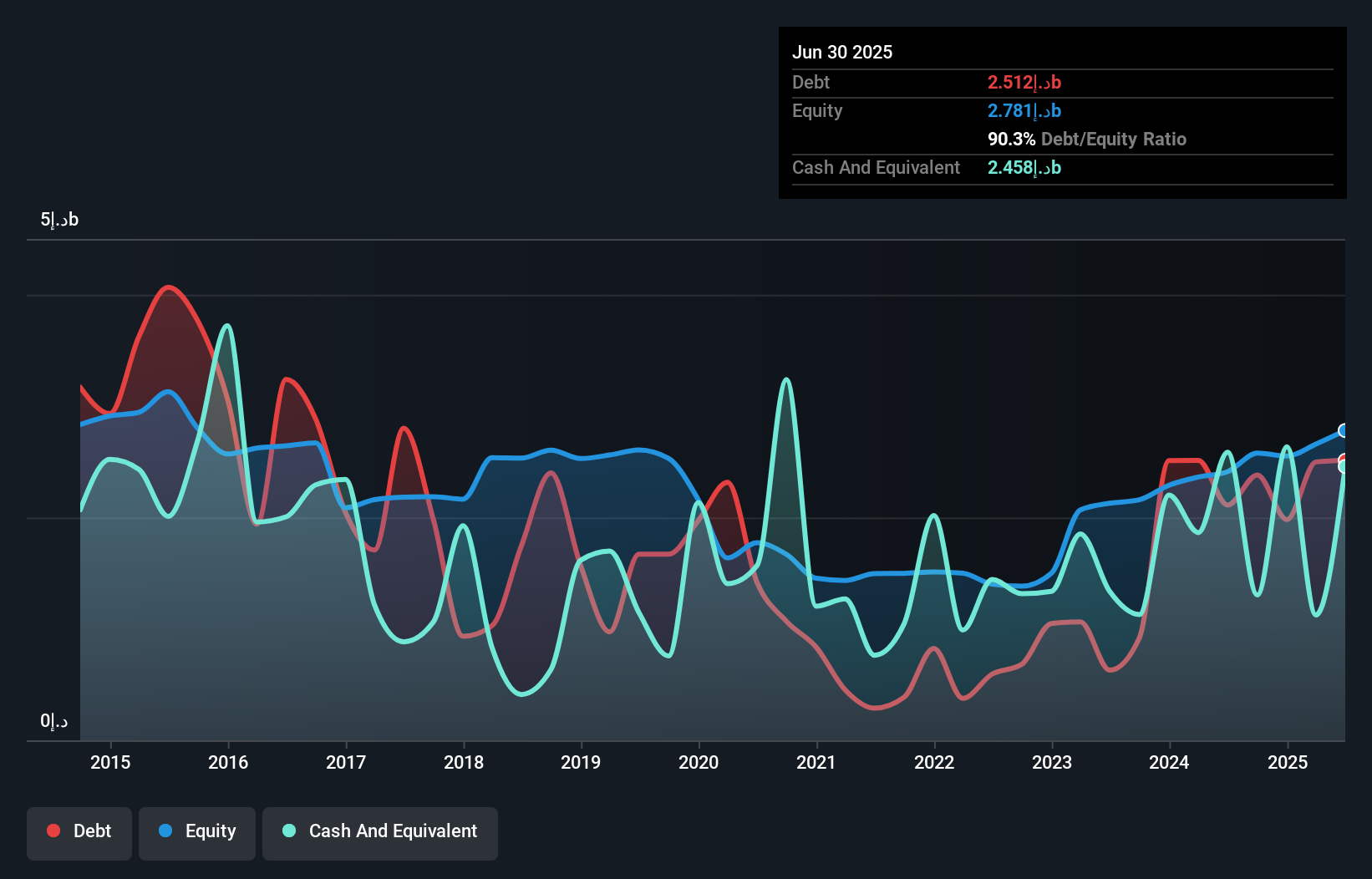

United Arab Bank, with total assets of AED24.5 billion and equity of AED4 billion, presents a mixed financial picture. Despite a high bad loans ratio of 3.1%, the bank's earnings growth over the past year reached an impressive 56.4%, outpacing the industry average of 15%. However, its allowance for bad loans remains low at 82%. The price-to-earnings ratio stands at 10.1x, suggesting good value compared to the AE market's average of 11.7x. While primarily funded through low-risk customer deposits (82% of liabilities), shareholders faced substantial dilution recently, reflecting some volatility in share structure and performance stability concerns.

- Click here to discover the nuances of United Arab Bank P.J.S.C with our detailed analytical health report.

Evaluate United Arab Bank P.J.S.C's historical performance by accessing our past performance report.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Aksigorta A.S. offers a range of life and non-life insurance products and services to both retail and corporate clients in Turkey, with a market capitalization of TRY11.82 billion.

Operations: Aksigorta generates revenue primarily from its life and non-life insurance offerings to retail and corporate clients in Turkey. The company's financial performance is influenced by the dynamics of the Turkish insurance market, with a focus on managing costs associated with underwriting and claims. Its net profit margin reflects the efficiency of its operations in relation to revenue generated from premiums.

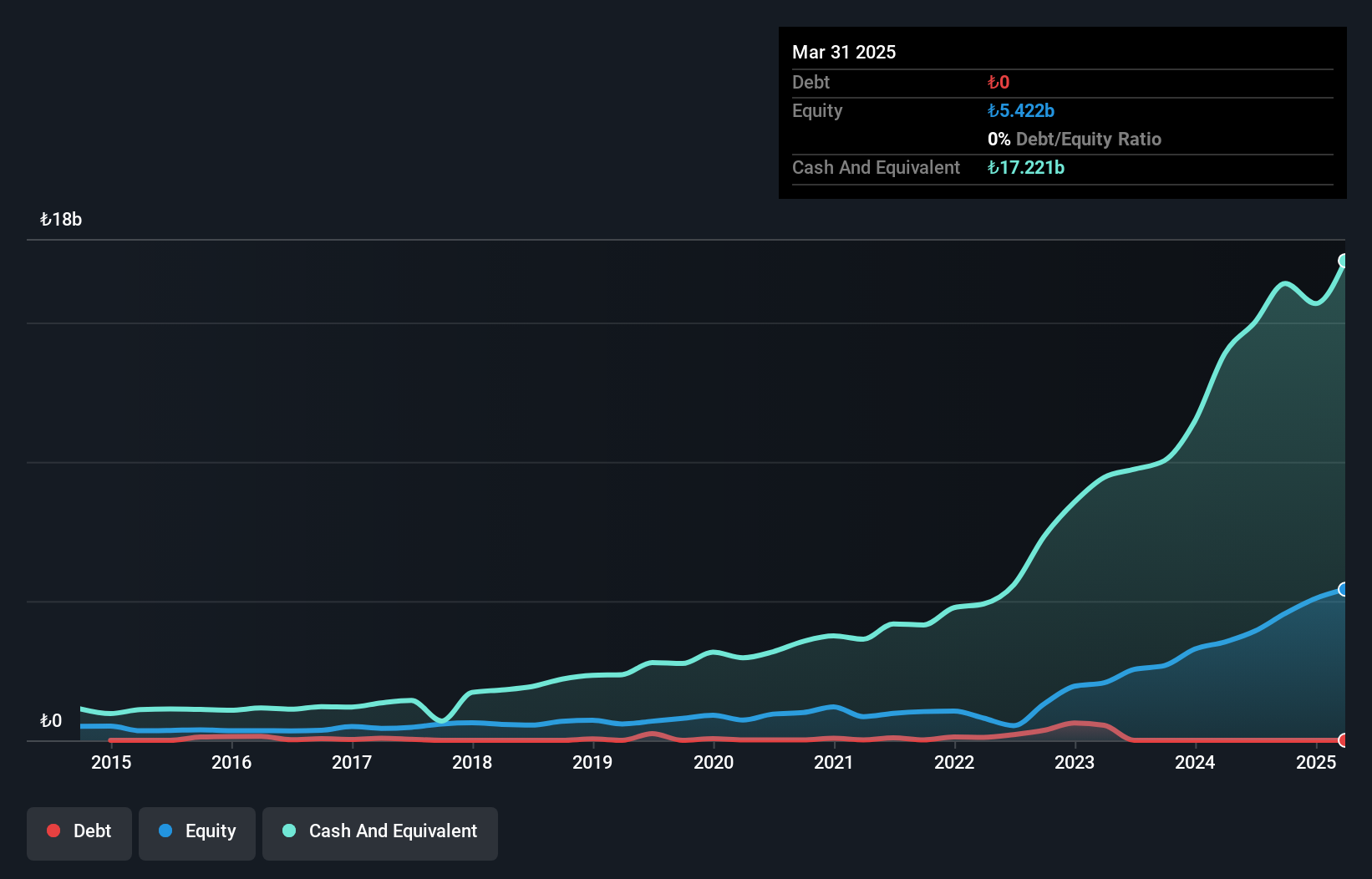

Aksigorta, a nimble player in the insurance sector, showcases impressive financial health with no debt, a sharp contrast to its 1.3% debt-to-equity ratio five years ago. Its price-to-earnings ratio of 4.4x is notably lower than the TR market's 18.5x, indicating potential undervaluation. Over the past year, earnings surged by 55.8%, though still trailing behind the industry’s growth of 83.8%. With high-quality earnings and free cash flow positivity confirmed at TRY 4,674 million as of September 2025, Aksigorta seems well-positioned for sustained profitability amidst competitive pressures in the insurance landscape.

- Delve into the full analysis health report here for a deeper understanding of Aksigorta.

Review our historical performance report to gain insights into Aksigorta's's past performance.

Terminal X Online (TASE:TRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Terminal X Online Ltd. is an online retailer providing clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenagers under various brands with a market cap of ₪841.03 million.

Operations: Terminal X generates revenue primarily from its Terminal X segment, contributing ₪452.06 million, and independent websites, adding ₪87.85 million. Adjustments account for a deduction of ₪2.12 million from total revenue.

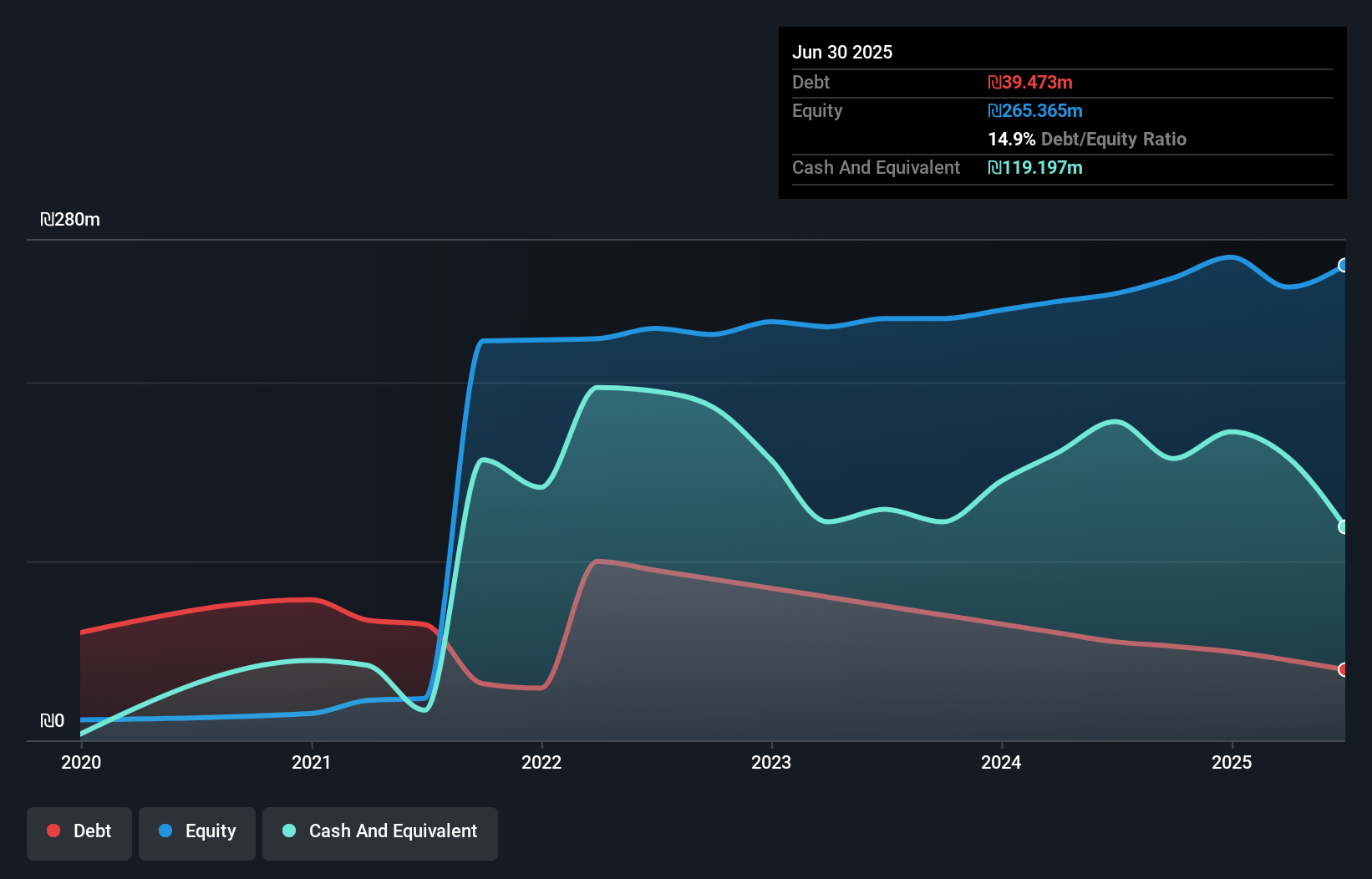

Terminal X Online, a dynamic player in the Middle Eastern market, has caught attention with its impressive financial strides. Over the past year, earnings surged by 85.6%, far outpacing the industry average of 2.3%. Its debt to equity ratio dramatically improved from 527.4% to just 12.9% over five years, signaling robust financial health. The company reported third-quarter sales of ILS 133.78 million and net income of ILS 4.91 million, showing solid growth compared to last year’s figures of ILS 109.09 million and ILS 3.38 million respectively, underscoring its potential as an emerging market contender in online retailing.

- Click to explore a detailed breakdown of our findings in Terminal X Online's health report.

Assess Terminal X Online's past performance with our detailed historical performance reports.

Where To Now?

- Explore the 182 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:UAB

United Arab Bank P.J.S.C

Together with its subsidiary, provides commercial banking products and services for individual and corporate customers in the United Arab Emirates.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion