As global markets navigate mixed performances and economic indicators show a resilient U.S. consumer, investors are increasingly looking for opportunities in the small-cap space. With inflation near central bank targets and value stocks outperforming growth shares, now is an opportune time to explore undiscovered gems that have strong potential for September 2024. In this climate, a good stock often combines solid fundamentals with the ability to thrive amidst broader market conditions. These characteristics can help identify promising investments that may be overlooked by mainstream analysts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 2.25% | 10.54% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Zona Franca de Iquique | NA | 6.56% | 10.86% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Banco Hipotecario (BASE:BHIP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Banco Hipotecario S.A. offers wholesale and retail banking services in Argentina, with a market cap of ARS621.15 billion.

Operations: Banco Hipotecario S.A. generates revenue primarily through its wholesale and retail banking services in Argentina. The company has a market cap of ARS621.15 billion.

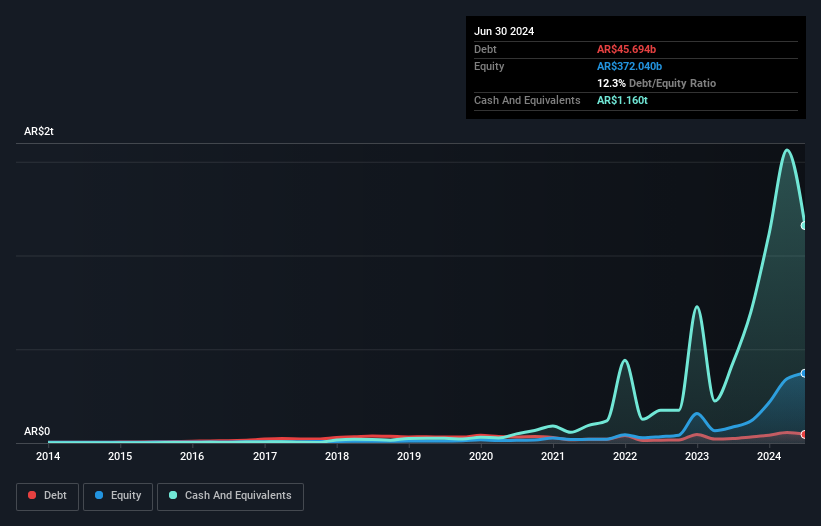

Banco Hipotecario, with total assets of ARS2,281.9B and equity of ARS372.0B, has a price-to-earnings ratio of 12x compared to the AR market's 19.6x. It holds total deposits worth ARS1,587.2B and loans totaling ARS392.4B while maintaining a net interest margin of 22.3%. Despite earnings growth averaging 76% annually over five years, it faces challenges with high non-performing loans at 2.2% and recent shareholder dilution.

- Get an in-depth perspective on Banco Hipotecario's performance by reading our health report here.

Gain insights into Banco Hipotecario's past trends and performance with our Past report.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sectors primarily in Turkey, with a market cap of TRY19.40 billion.

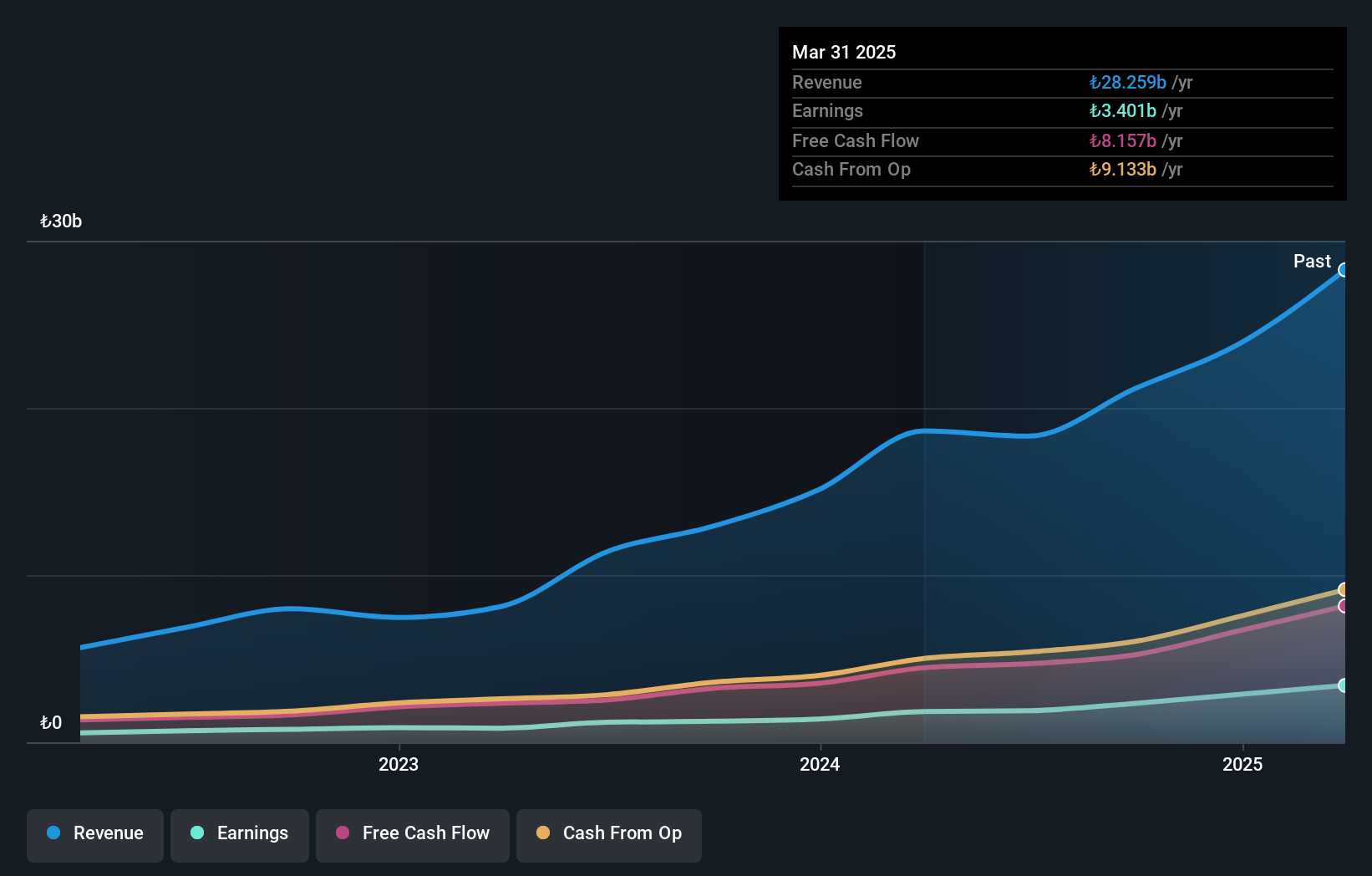

Operations: AgeSA generates revenue from various life insurance and pension segments, with Life Insurance - Pension contributing TRY4.62 billion and Life Insurance - Retirement adding TRY4.48 billion. The company shows a net profit margin of 12% in the most recent period.

With no debt over the past five years, AgeSA Hayat ve Emeklilik Anonim Sirketi has demonstrated solid financial health. The company's earnings have grown 44.6% annually, showcasing robust performance. Recent results for Q2 2024 reported net income of TRY 621.49 million, up from TRY 566.79 million last year, with basic EPS rising to TRY 3.45 from TRY 3.15 a year ago. The P/E ratio stands at a favorable 10.3x compared to the TR market's 16.6x.

Equity Group Holdings (NASE:EQTY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equity Group Holdings Plc offers a range of financial products and services to individuals, small and medium-sized enterprises, and large enterprises, with a market cap of KES162.27 billion.

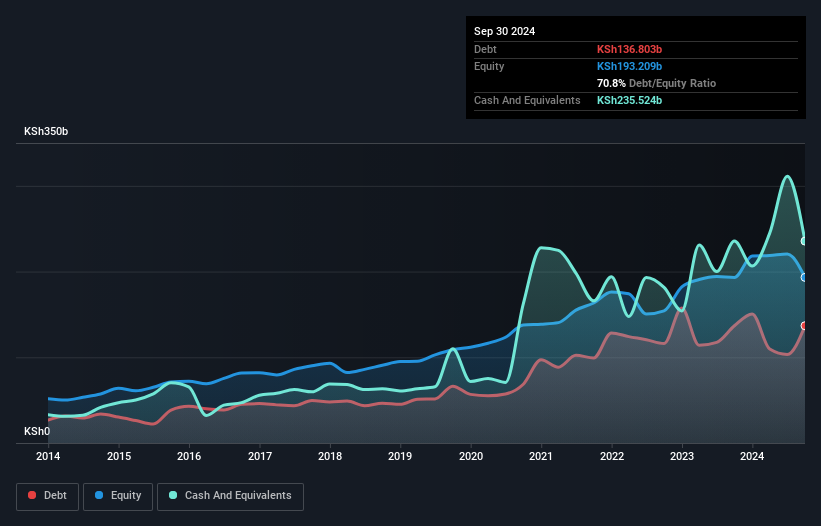

Operations: The primary revenue stream for Equity Group Holdings Plc is derived from its banking operations, generating KES145.29 billion.

Equity Group Holdings, with total assets of KES1.75 trillion and equity of KES220.5 billion, showcases a mixed bag for investors. Total deposits stand at KES1.31 trillion while loans amount to KES791.1 billion. The company faces challenges with high non-performing loans at 15.2% and an allowance for bad loans at 65%. Despite these hurdles, it trades 42% below its estimated fair value and has primarily low-risk funding sources comprising 86% customer deposits.

Summing It All Up

- Gain an insight into the universe of 4870 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AGESA

AgeSA Hayat ve Emeklilik Anonim Sirketi

Engages in the pension and life insurance business primarily in Turkey.

Excellent balance sheet with proven track record and pays a dividend.