In the wake of recent U.S. elections, global markets have experienced significant shifts, with small-cap stocks like those in the Russell 2000 Index showing notable gains amid expectations of economic growth and regulatory changes. As investors navigate these dynamic conditions, identifying promising small-cap stocks can offer unique opportunities for diversification and potential growth within a portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

ATP Yazilim ve Teknoloji Anonim Sirketi (IBSE:ATATP)

Simply Wall St Value Rating: ★★★★★☆

Overview: ATP Yazilim ve Teknoloji Anonim Sirketi provides software and infrastructure solutions across finance, hospitality, and various other industries both in Turkey and internationally, with a market cap of TRY9.25 billion.

Operations: ATP Yazilim ve Teknoloji Anonim Sirketi generates revenue through its software and infrastructure solutions tailored for finance, hospitality, and other sectors. The company's financial performance is marked by a net profit margin of 15.3%, indicating efficient cost management relative to its revenue generation.

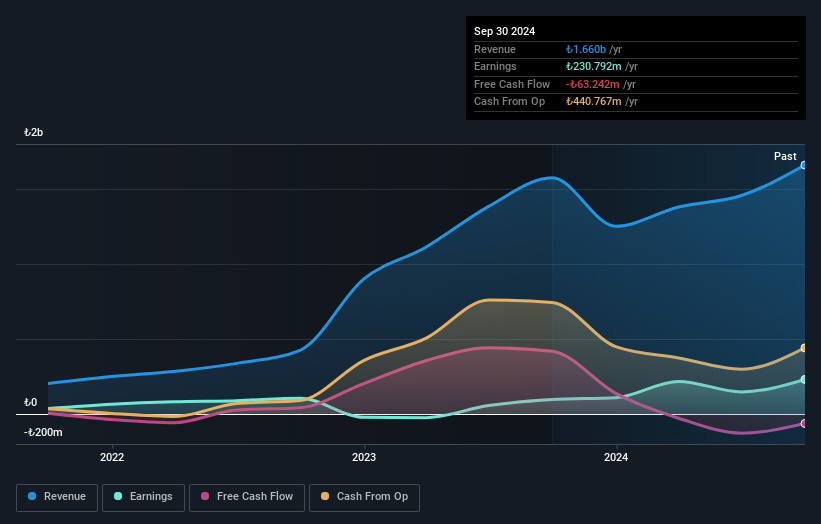

ATP Yazilim ve Teknoloji Anonim Sirketi, a nimble player in the software industry, has demonstrated robust earnings growth of 139.7% over the past year, outpacing the industry average of 10.6%. With sales reaching TRY 455.75 million in Q3 2024 compared to TRY 424.9 million a year prior, and net income soaring to TRY 142.13 million from TRY 4.24 million, it seems their financial performance is on an upward trajectory despite a rise in debt-to-equity ratio from 2.5 to 4.8 over five years and recent negative free cash flow trends such as -TRY127.66 million in June 2024.

- Take a closer look at ATP Yazilim ve Teknoloji Anonim Sirketi's potential here in our health report.

Raoom trading (SASE:9529)

Simply Wall St Value Rating: ★★★★★★

Overview: Raoom Trading Company is engaged in the manufacturing, processing, and trading of glass, mirrors, and aluminum decorations across Saudi Arabia and Gulf countries with a market capitalization of SAR1.20 billion.

Operations: Raoom generates revenue primarily from the manufacturing, processing, and trading of glass, mirrors, and aluminum decorations. It operates within Saudi Arabia and Gulf countries with a market cap of SAR1.20 billion. The company's financial performance is characterized by its gross profit margin trends.

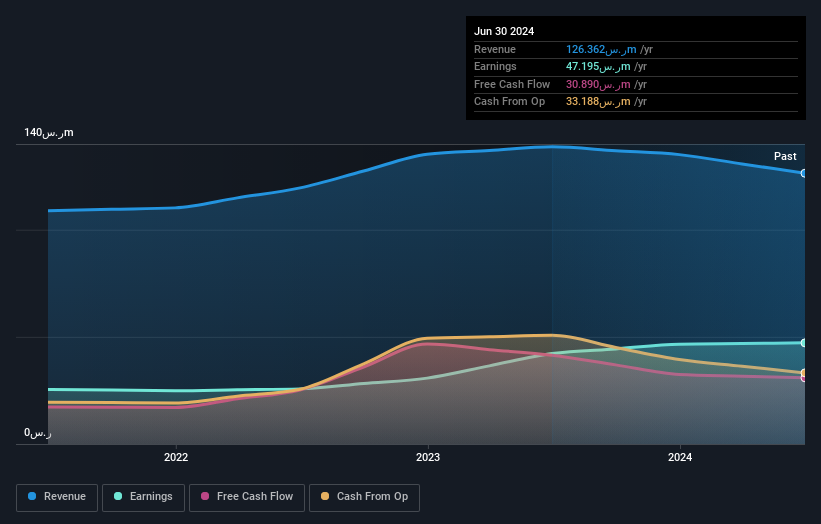

Raoom Trading, a small player in its sector, has shown promising financial health with positive free cash flow and high-quality earnings. The company operates debt-free, which eliminates concerns over interest payments. Its earnings growth of 11.8% last year outpaced the building industry's -11.6%, highlighting its potential in a challenging market environment. However, Raoom's share price has been highly volatile over the past three months, possibly affecting investor sentiment. Despite this volatility, its profitability suggests a solid cash runway for future operations and growth opportunities within the industry context seem favorable given these metrics.

- Navigate through the intricacies of Raoom trading with our comprehensive health report here.

Explore historical data to track Raoom trading's performance over time in our Past section.

Earth (TSE:4985)

Simply Wall St Value Rating: ★★★★★★

Overview: Earth Corporation is involved in the manufacture, marketing, import, and export of pharmaceutical products, quasi-drug products, medical tools, and household products both in Japan and internationally with a market cap of ¥120.21 billion.

Operations: Earth Corporation generates revenue primarily from its Household Products Business, contributing ¥145.71 billion, and the Comprehensive Environment Hygiene Business, adding ¥30.61 billion. The company's financial structure is impacted by various cost factors associated with these segments.

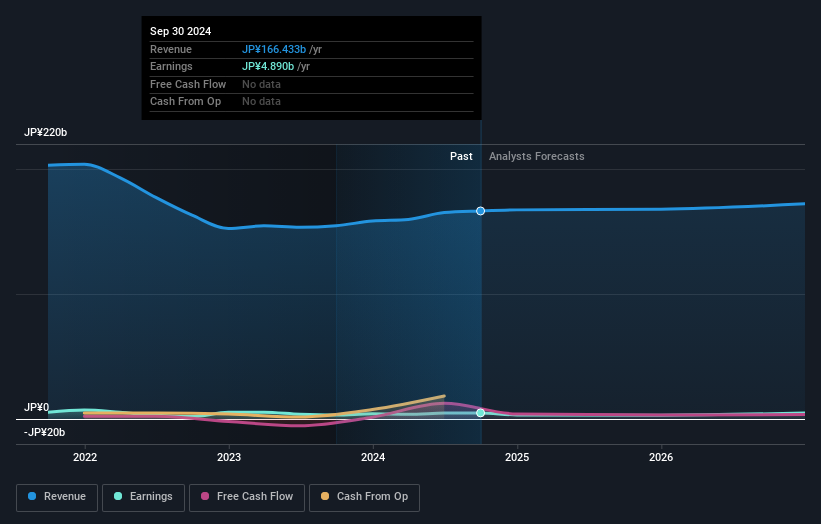

Earth Corporation, a promising player in its industry, has shown significant financial improvements. Over the past year, earnings have surged by 25%, outpacing the Household Products sector's growth of 21%. The company's debt to equity ratio impressively decreased from 42% to just 9% over five years. Additionally, Earth Corporation holds more cash than its total debt and is trading at nearly 4% below its estimated fair value. With high-quality earnings and positive free cash flow, Earth seems well-positioned for continued growth with an expected annual earnings increase of approximately 11%.

- Unlock comprehensive insights into our analysis of Earth stock in this health report.

Assess Earth's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 4670 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ATATP

ATP Yazilim ve Teknoloji Anonim Sirketi

Develops software and infrastructure solutions for finance, hospitality, and other industries in Turkey and internationally.

Excellent balance sheet with proven track record.