Undervalued Opportunities: Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

Global markets have been buzzing with activity following a significant political shift in the U.S., where expectations of policy changes have propelled major stock indices to new heights. Amidst this backdrop, the search for undervalued opportunities has intensified, leading many investors to consider penny stocks as a viable option. Although often seen as relics from past market eras, penny stocks—typically representing smaller or newer companies—continue to offer potential growth at accessible price points when coupled with strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$139.45M | ★★★★☆☆ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.12 | THB1.72B | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.96 | MYR2.04B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,741 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★★★

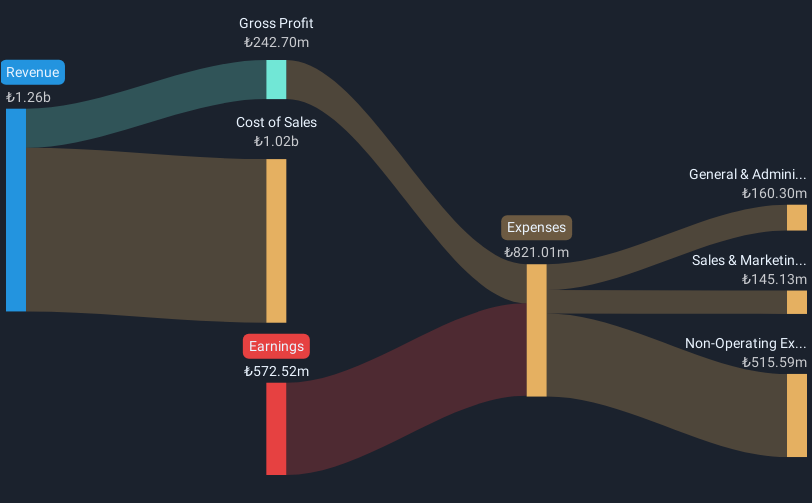

Overview: Ihlas Gazetecilik A.S. is involved in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines in Turkey and internationally with a market cap of TRY1.11 billion.

Operations: Ihlas Gazetecilik A.S. does not have any reported revenue segments.

Market Cap: TRY1.11B

Ihlas Gazetecilik A.S. has demonstrated resilience despite its unprofitability, with short-term assets of TRY964.9 million exceeding both long-term liabilities and short-term liabilities, indicating strong liquidity. The company has reduced its debt-to-equity ratio significantly over the past five years and maintains a cash position that surpasses total debt, providing financial stability. Although it reported a net loss of TRY151.77 million for the first half of 2024, this was an improvement from the previous year’s loss. Despite declining profits over five years, Ihlas Gazetecilik's stable weekly volatility suggests consistent market performance amidst challenges.

- Dive into the specifics of Ihlas Gazetecilik here with our thorough balance sheet health report.

- Evaluate Ihlas Gazetecilik's historical performance by accessing our past performance report.

CDL Investments New Zealand (NZSE:CDI)

Simply Wall St Financial Health Rating: ★★★★★★

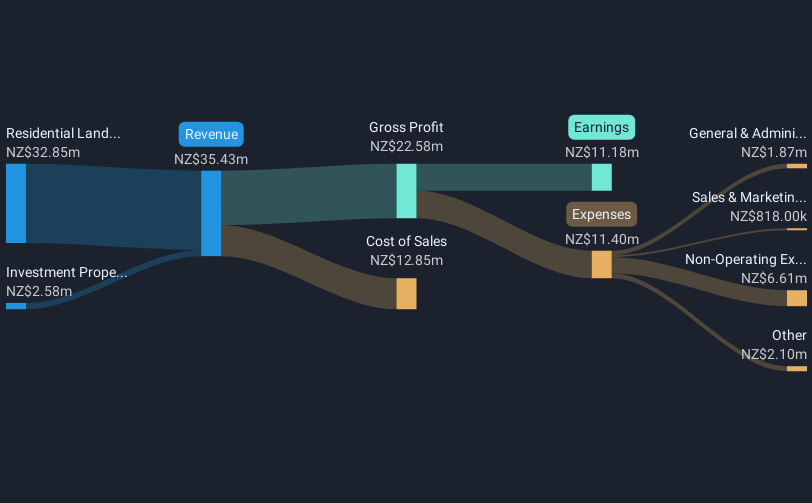

Overview: CDL Investments New Zealand Limited, along with its subsidiary CDL Land New Zealand Limited, focuses on the investment, development, management, and sale of residential land properties in New Zealand and has a market capitalization of NZ$220.33 million.

Operations: The company generates revenue from two main segments: Residential Land Development, which contributes NZ$32.85 million, and Investment Property, accounting for NZ$2.58 million.

Market Cap: NZ$220.33M

CDL Investments New Zealand Limited, with a market cap of NZ$220.33 million, operates debt-free and maintains strong liquidity, as its short-term assets of NZ$54.3 million exceed both long-term and short-term liabilities. Despite high-quality earnings, the company faces challenges with declining profits over the past five years at an annual rate of 14.4% and reduced net profit margins from 42.4% to 31.6%. The dividend yield of 4.64% lacks coverage by earnings or free cash flows, raising sustainability concerns. Recent board changes include Janie Elrick's appointment, bringing extensive financial expertise to the team.

- Unlock comprehensive insights into our analysis of CDL Investments New Zealand stock in this financial health report.

- Learn about CDL Investments New Zealand's historical performance here.

Cornerstone Technologies Holdings (SEHK:8391)

Simply Wall St Financial Health Rating: ★★★★☆☆

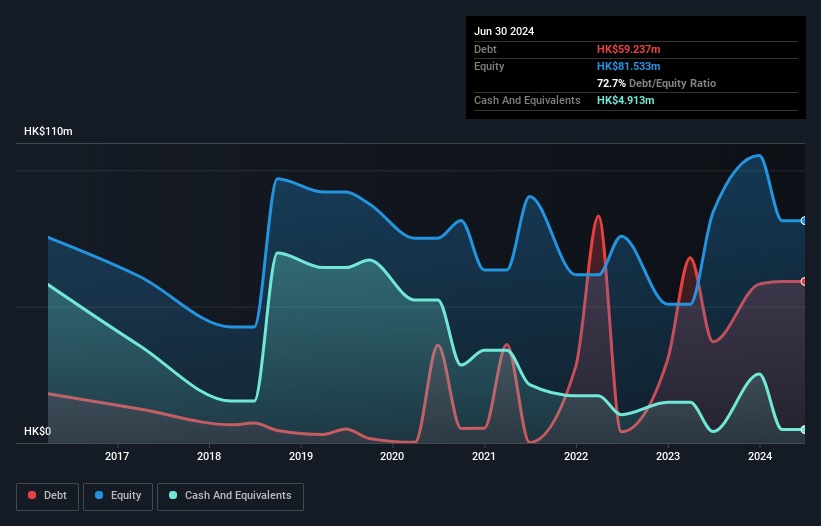

Overview: Cornerstone Technologies Holdings Limited, with a market cap of HK$600.75 million, is an investment holding company focused on providing electric vehicle charging solutions primarily in Hong Kong.

Operations: The company generates revenue from its Electric Vehicle Charging Business, amounting to HK$104.68 million.

Market Cap: HK$600.75M

Cornerstone Technologies Holdings Limited, with a market cap of HK$600.75 million, focuses on electric vehicle charging solutions in Hong Kong. The company reported sales of HK$52.08 million for the first half of 2024, showing growth from the previous year despite remaining unprofitable with a net loss of HK$39.9 million. Its short-term assets exceed both short and long-term liabilities, indicating some financial stability amidst challenges like high debt levels and shareholder dilution over the past year. Recent capital raising efforts include convertible notes totaling HK$200 million to support its operations and strategic investments in Spark EV Company Limited.

- Click here and access our complete financial health analysis report to understand the dynamics of Cornerstone Technologies Holdings.

- Understand Cornerstone Technologies Holdings' track record by examining our performance history report.

Where To Now?

- Unlock more gems! Our Penny Stocks screener has unearthed 5,738 more companies for you to explore.Click here to unveil our expertly curated list of 5,741 Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHGZT

Ihlas Gazetecilik

Ihlas Gazetecilik A.S. publishes, sells, distributes, and markets newspapers, books, encyclopedias, brochures, and magazines in Turkey and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives