- Turkey

- /

- Electronic Equipment and Components

- /

- IBSE:INDES

November 2024's Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices reaching record highs and a notable rally in U.S. stocks driven by growth and tax optimism, investors are closely watching how these developments might impact economic policies and inflation expectations. In this dynamic environment, dividend stocks remain an attractive option for those seeking steady income streams, particularly as interest rates fluctuate and economic uncertainties persist.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

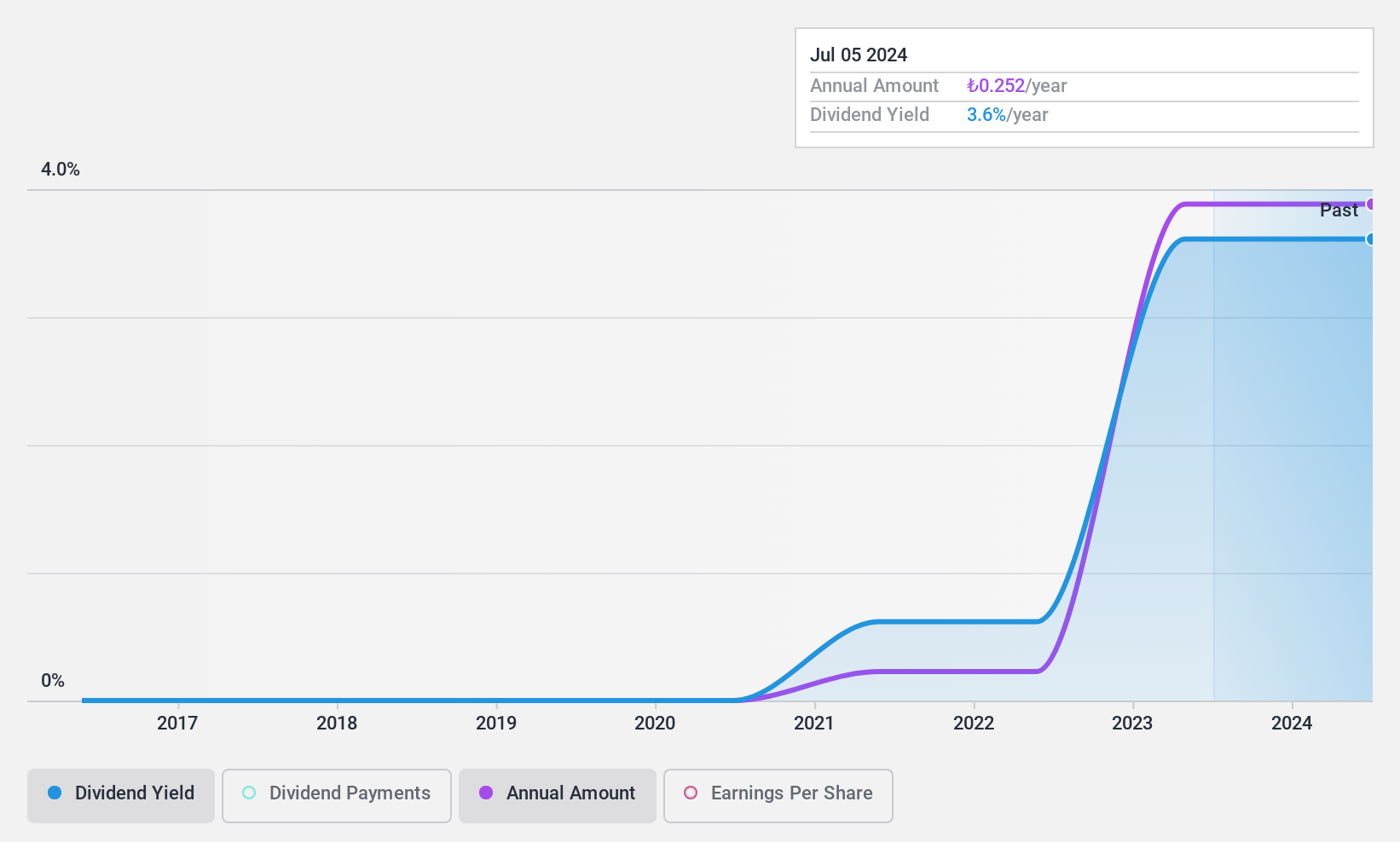

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi (IBSE:INDES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi is a company that distributes IT products in Turkey, with a market cap of TRY4.99 billion.

Operations: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi generates revenue through the distribution of IT products in Turkey.

Dividend Yield: 5.3%

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi has demonstrated robust earnings growth, with a 106% increase over the past year, supporting its relatively new dividend program. Despite only three years of dividend payments, the company maintains a low payout ratio of 45.3%, ensuring dividends are well-covered by both earnings and cash flows. With its dividend yield in the top 25% of the Turkish market, it offers attractive income potential for investors.

- Dive into the specifics of Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi here with our thorough dividend report.

- Our valuation report here indicates Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi may be undervalued.

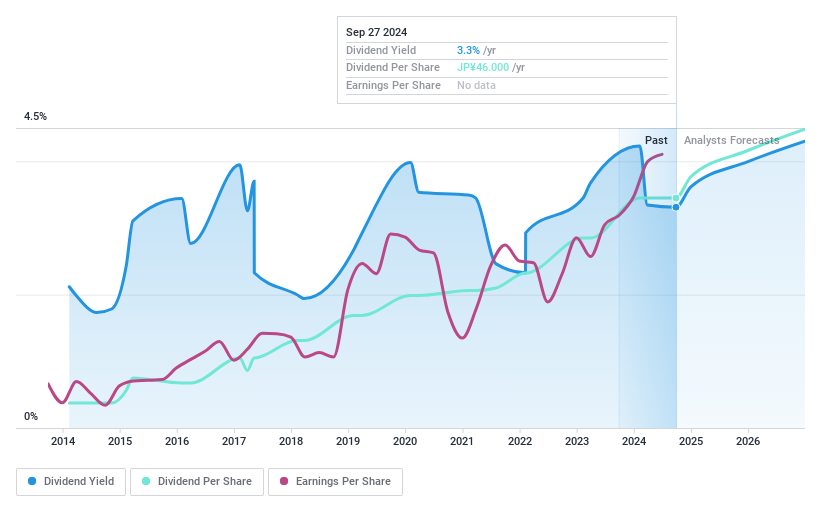

Aoyama Zaisan Networks CompanyLimited (TSE:8929)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aoyama Zaisan Networks Company, Limited offers property consulting solutions to individual asset owners and business owners in Japan, with a market cap of ¥34.60 billion.

Operations: Aoyama Zaisan Networks Company, Limited generates its revenue primarily from the Property Consulting Business, which accounts for ¥43.05 billion.

Dividend Yield: 3.2%

Aoyama Zaisan Networks Company Limited offers a stable dividend profile, with dividends consistently paid and increased over the past decade. The company's dividends are well-supported by both earnings, with a payout ratio of 43.9%, and cash flows, reflected in a low cash payout ratio of 15.6%. Although its dividend yield of 3.25% is below Japan's top quartile, it trades at a discount to its estimated fair value, suggesting potential for capital appreciation alongside reliable income.

- Take a closer look at Aoyama Zaisan Networks CompanyLimited's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Aoyama Zaisan Networks CompanyLimited is trading behind its estimated value.

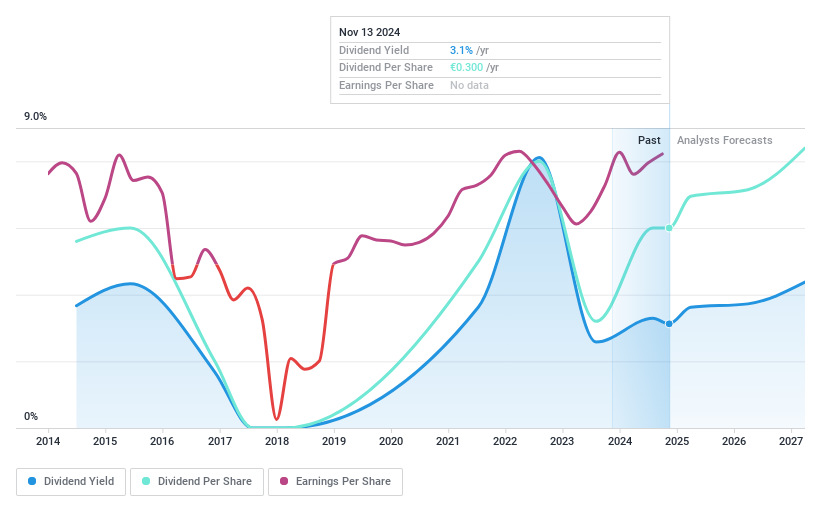

Bastei Lübbe (XTRA:BST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bastei Lübbe AG is a media company that publishes books, audio books, e-books, and other digital products in fiction and popular science genres across Germany, Austria, Luxembourg, and Switzerland with a market cap of €128.04 million.

Operations: Bastei Lübbe AG generates revenue through its diverse portfolio of books, audio books, e-books, and digital products in the fiction and popular science genres across several European countries.

Dividend Yield: 3.1%

Bastei Lübbe's dividend history shows volatility and unreliability, with past payments experiencing significant drops. Despite this, the current payout ratio of 37% indicates dividends are well-covered by earnings and cash flows (cash payout ratio at 80.2%). Recent financial performance is strong, with notable earnings growth; however, the dividend yield of 3.08% remains below the German market's top quartile. The stock trades significantly below its estimated fair value, presenting a potential opportunity for investors seeking discounted assets.

- Delve into the full analysis dividend report here for a deeper understanding of Bastei Lübbe.

- The analysis detailed in our Bastei Lübbe valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1939 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:INDES

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi

Distributes IT products in Turkey.

Flawless balance sheet with solid track record and pays a dividend.