- Turkey

- /

- Household Products

- /

- IBSE:LILAK

Spotting Hidden Gems On None Exchange In November 2024

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks, driven by expectations of economic growth and regulatory changes following a political shift, small-cap indices like the Russell 2000 have shown strong gains, though they remain slightly below previous record highs. As investors navigate these dynamic market conditions, identifying undiscovered gems requires attention to companies with robust fundamentals and potential for growth within their respective niches.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 9.01% | 4.39% | 3.03% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi (IBSE:BTCIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi operates in the cement industry both in Turkey and internationally, with a market capitalization of TRY24.76 billion.

Operations: Batiçim generates revenue primarily from Stone and Soil Based Products, contributing TRY5.12 billion, followed by Ready Mixed Concrete at TRY2.90 billion. Electricity Production and Port Services add TRY1.46 billion and TRY799 million respectively to its revenue streams.

Batiçim, a player in the cement industry, showcases impressive earnings growth of 1326% over the past year, outpacing its industry peers. Despite a volatile share price recently, its net debt to equity ratio has improved significantly from 141.8% to 31.9% over five years, reflecting better financial health. The company reported a net income of TRY 284 million for Q2 2024 compared to a loss last year and maintains high-quality earnings with interest comfortably covered by profits. With a price-to-earnings ratio at 8.7x below market average, Batiçim seems undervalued given its robust performance metrics.

- Navigate through the intricacies of Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi with our comprehensive health report here.

Learn about Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi's historical performance.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY15.09 billion.

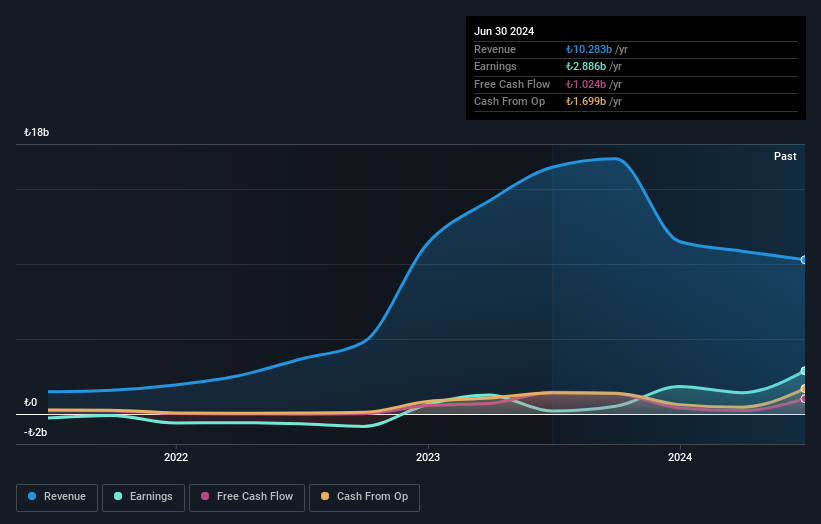

Operations: Lila Kagit generates revenue primarily from the sale of paper and paper products, amounting to TRY8.75 billion. The company's financial performance is influenced by its cost structure and market demand for its products.

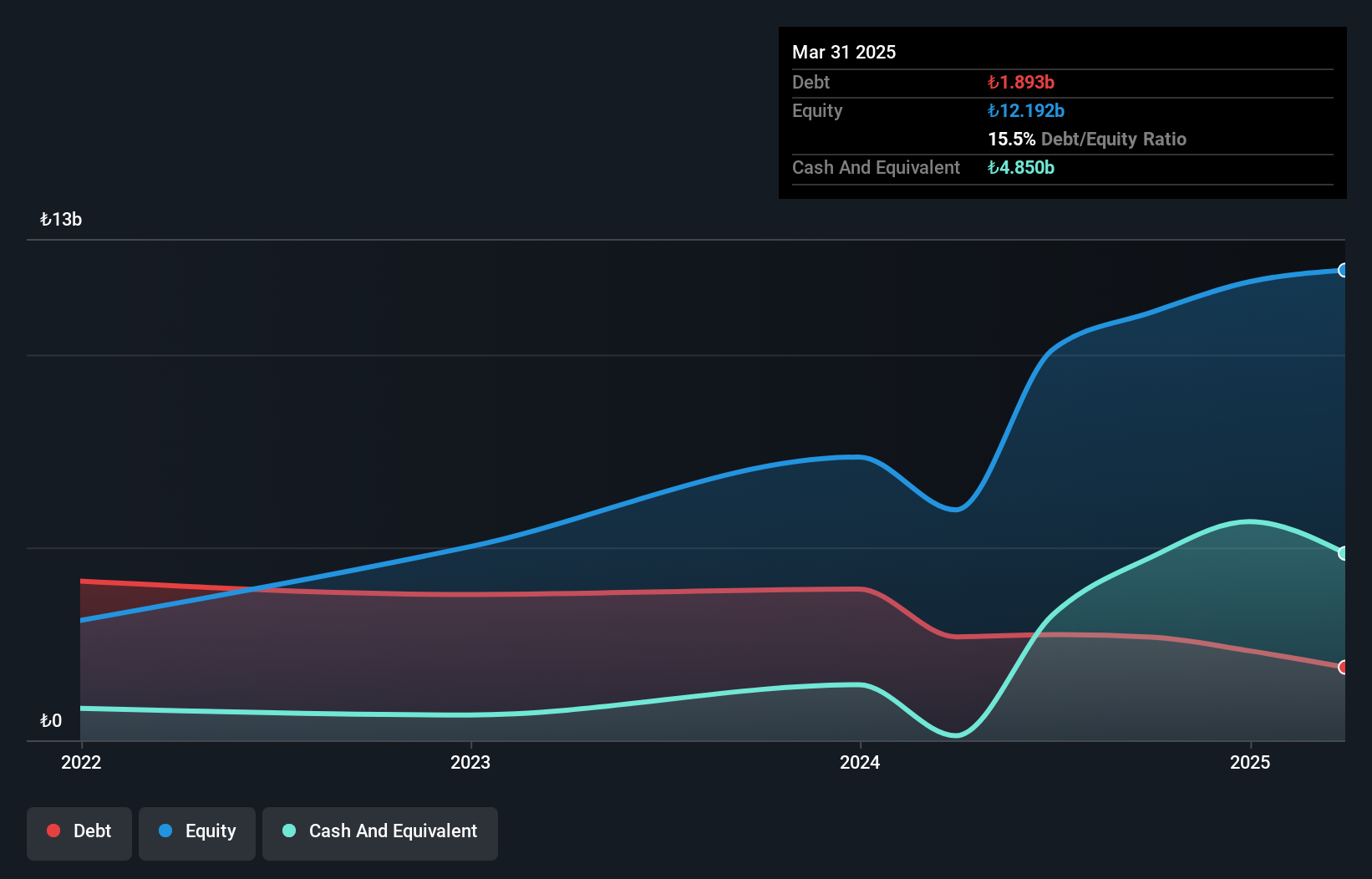

Lila Kagit, a player in the household products sector, has recently showcased robust earnings growth of 57%, outpacing the industry’s 34.5%. Despite a revenue dip of 14% over the past year, its net income for Q3 surged to TRY 351 million from a previous loss. The company maintains strong financial health with more cash than total debt and boasts high-quality earnings. Its price-to-earnings ratio stands at an attractive 15x compared to the industry average of 18.4x, suggesting potential value. Additionally, Lila Kagit was recently added to the S&P Global BMI Index, highlighting its growing market presence.

Boyaa Interactive International (SEHK:434)

Simply Wall St Value Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in China and internationally, with a market cap of HK$1.99 billion.

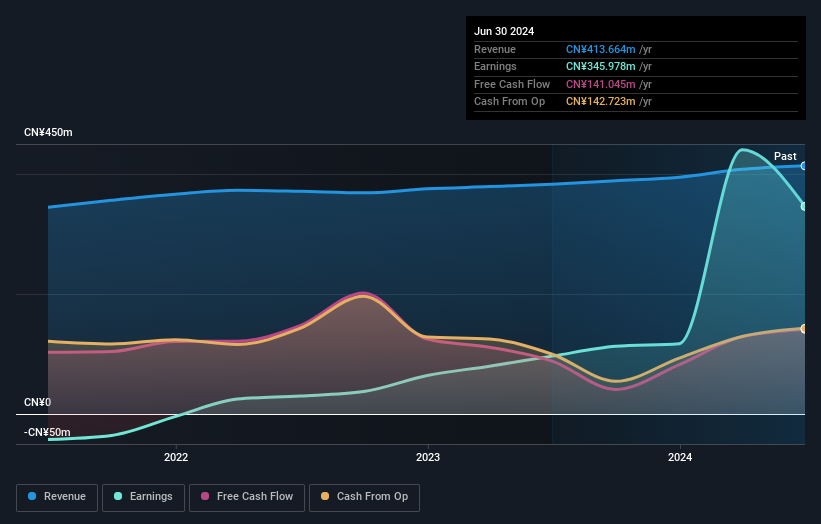

Operations: The company generates revenue primarily from online card and board games, focusing on user engagement and monetization strategies. It incurs costs related to game development, marketing, and platform operations. The net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

Boyaa Interactive, a smaller player in the tech world, is making waves with its impressive earnings growth of 258.6% over the past year, outpacing the entertainment industry's 10.1%. Despite a recent net loss of CNY 67.41 million for Q2 2024, its six-month net income soared to CNY 284.38 million compared to last year's CNY 55.58 million. The company trades at a compelling value, being priced at approximately 22.8% below estimated fair value and remains debt-free for five years now, highlighting financial prudence amidst market volatility and positioning it as an intriguing prospect in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Boyaa Interactive International.

Understand Boyaa Interactive International's track record by examining our Past report.

Key Takeaways

- Get an in-depth perspective on all 4643 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LILAK

Lila Kagit Sanayi Ve Ticaret

Produces and sells roll papers primarily in Turkey.

Excellent balance sheet with acceptable track record.