Undiscovered Gems And These 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding the incoming Trump administration's policies has led to fluctuations in key indices and sector performances, with small-cap stocks experiencing notable volatility. Despite these challenges, economic indicators such as inflation data and interest rate expectations continue to shape investor sentiment across various markets. In this environment, identifying promising small-cap stocks requires a focus on companies with robust fundamentals that can navigate policy shifts and economic changes effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.20% | 7.84% | 27.00% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

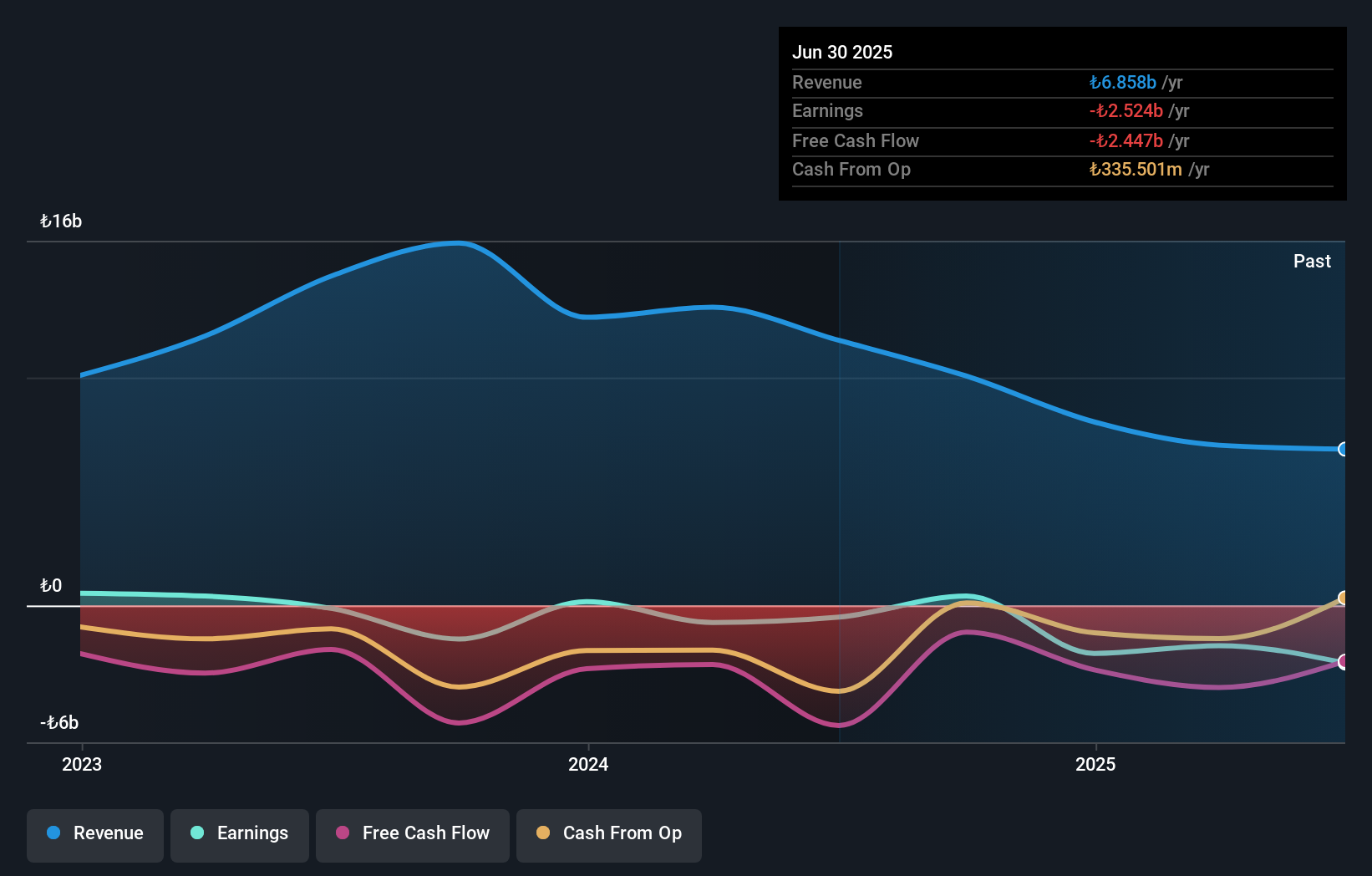

Bien Yapi Urunleri Sanayi Turizm ve Ticaret (IBSE:BIENY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bien Yapi Urunleri Sanayi Turizm ve Ticaret A.S. operates in the construction materials industry and has a market capitalization of TRY11.48 billion.

Operations: Bien Yapi's revenue streams primarily stem from its operations in the construction materials sector. The company has a market capitalization of TRY11.48 billion, reflecting its significant presence in this industry.

Bien Yapi's recent performance paints a complex picture, with earnings soaring by 239% over the past year, outpacing the building industry's growth of 18.6%. Despite this impressive surge, the company faces challenges such as a significant one-off loss of TRY230.7M impacting its recent financial results and an unsatisfactory EBIT coverage for interest payments at just 0.3x. Sales figures reveal a downward trend, with third-quarter sales dropping to TRY1.24 billion from TRY2.81 billion last year, while net losses narrowed to TRY304.79 million from TRY1.23 billion in the same period last year, reflecting some recovery efforts amidst turbulent times.

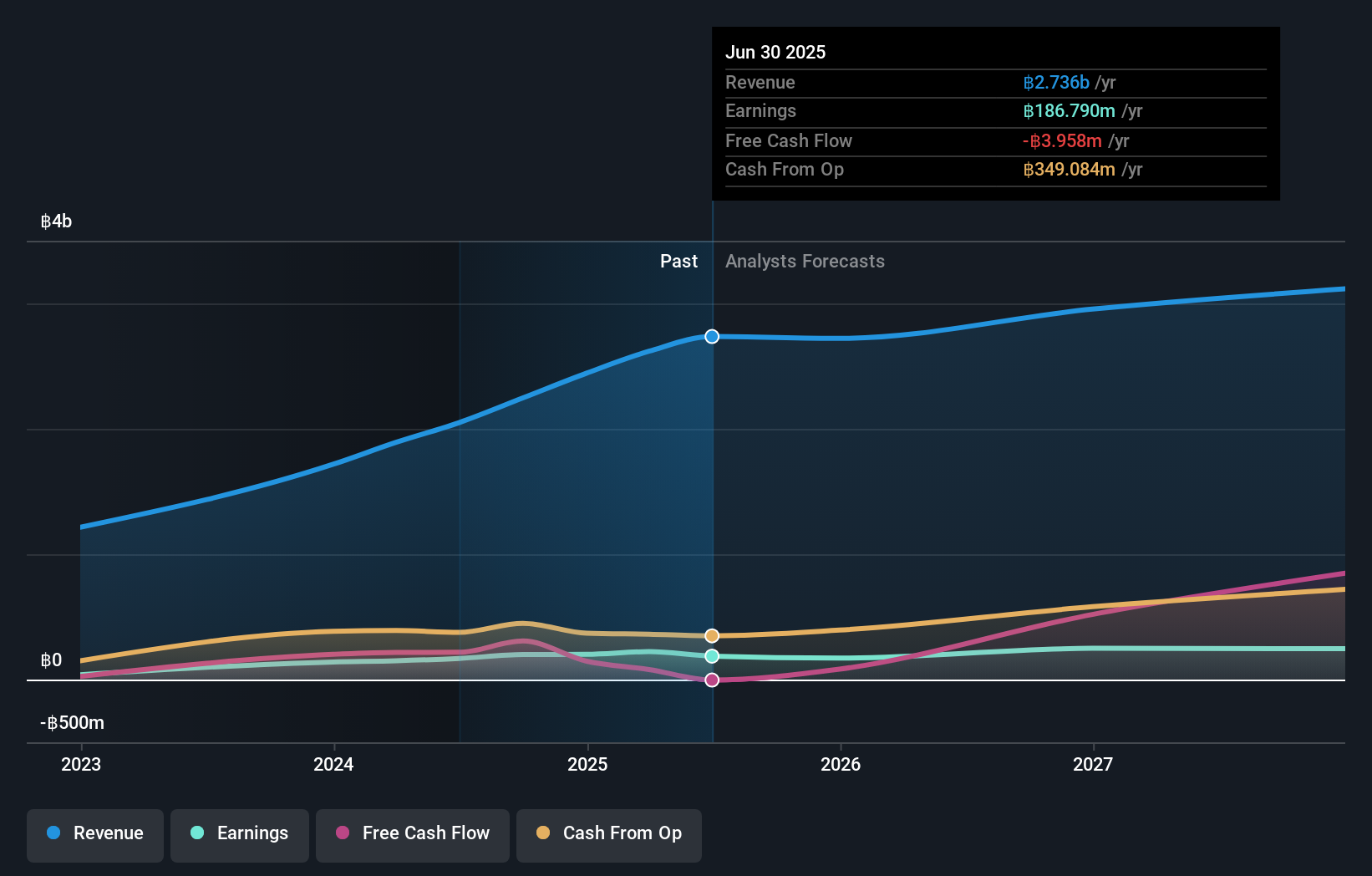

Pluk Phak Praw Rak Mae (SET:OKJ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pluk Phak Praw Rak Mae Public Company Limited is engaged in cultivating organic vegetables and fruits in Thailand, with a market cap of THB9.38 billion.

Operations: Pluk Phak Praw Rak Mae generates revenue primarily from its restaurant business, amounting to THB2.25 billion.

Pluk Phak Praw Rak Mae has recently made waves with its IPO, raising THB 1.07 billion by offering 159 million ordinary shares at THB 6.7 each. This company stands out in the food industry, boasting a robust earnings growth of 73% over the past year, significantly outpacing the sector's average of 34%. Its financial health is underscored by free cash flow turning positive at THB 307.62 million as of September 2024, alongside capital expenditures decreasing to THB -136.72 million in the same period. Trading at a substantial discount to fair value suggests potential upside for investors seeking opportunities in this space.

- Click here and access our complete health analysis report to understand the dynamics of Pluk Phak Praw Rak Mae.

Gain insights into Pluk Phak Praw Rak Mae's past trends and performance with our Past report.

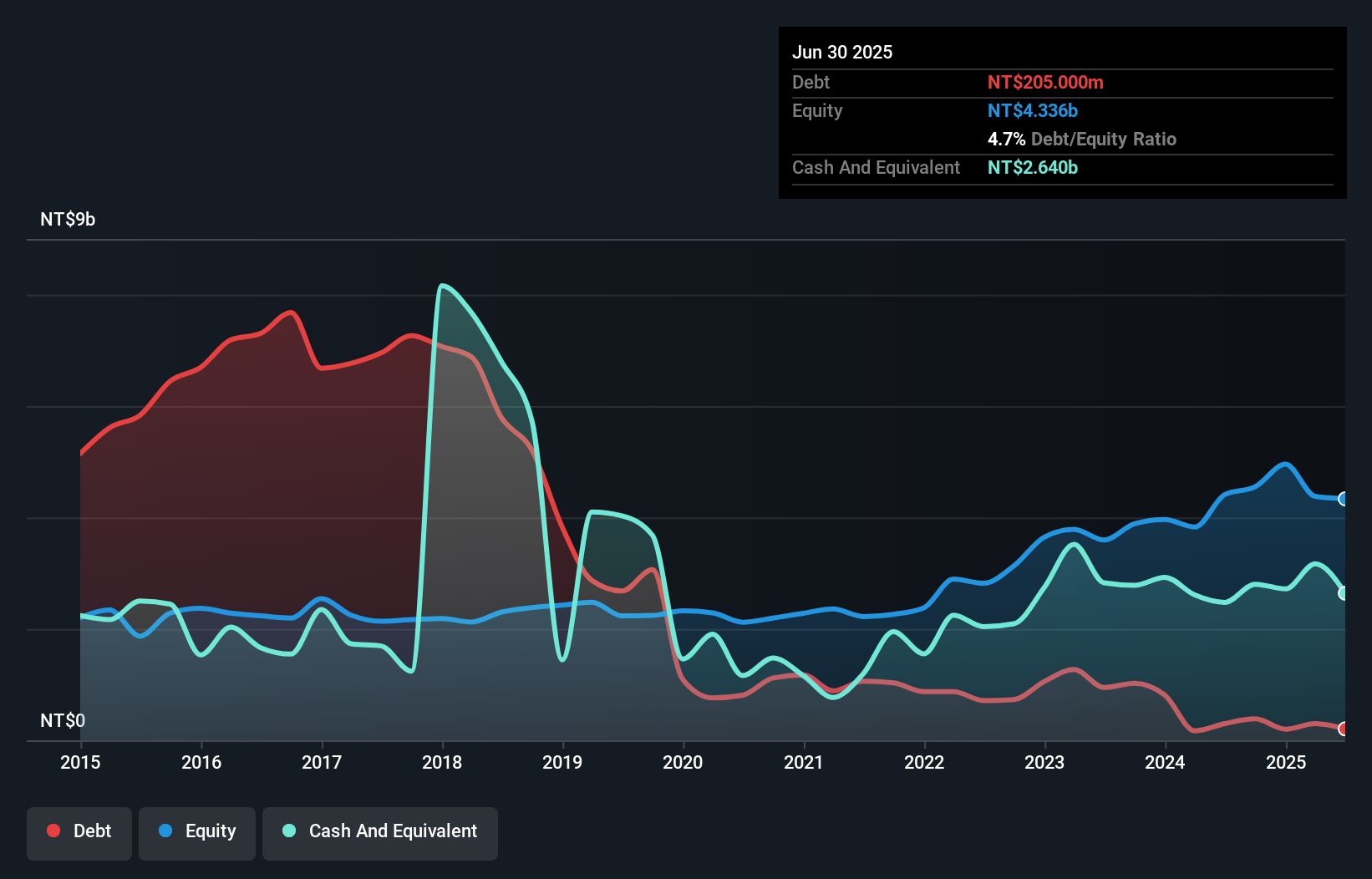

Netronix (TPEX:6143)

Simply Wall St Value Rating: ★★★★★★

Overview: Netronix, Inc. designs and manufactures network and e-Reader products in Taiwan and internationally, with a market capitalization of NT$10.20 billion.

Operations: Netronix generates revenue primarily from network and e-Reader products. The company's gross profit margin is 17.24%.

Netronix, a promising player in the tech space, has shown notable financial resilience. The company's earnings growth of 37% over the past year surpasses the industry average of 11%, indicating strong momentum. Trading at 70% below its estimated fair value suggests potential undervaluation, offering an intriguing opportunity for investors. Despite a volatile share price recently, Netronix's debt-to-equity ratio impressively dropped from 137% to just 9% over five years, reflecting improved financial health. Recent earnings reveal sales of TWD 1.82 billion for Q3 and net income of TWD 115 million, highlighting steady performance amidst market challenges.

- Delve into the full analysis health report here for a deeper understanding of Netronix.

Evaluate Netronix's historical performance by accessing our past performance report.

Seize The Opportunity

- Click this link to deep-dive into the 4651 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bien Yapi Urunleri Sanayi Turizm ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BIENY

Bien Yapi Urunleri Sanayi Turizm ve Ticaret

Bien Yapi Urunleri Sanayi Turizm ve Ticaret A.S.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives