- Turkey

- /

- Retail REITs

- /

- IBSE:YGGYO

Exploring 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with small-cap stocks like those in the Russell 2000 Index showing notable gains yet remaining below their record highs. As investors navigate these dynamic conditions marked by changes in fiscal policy and interest rates, identifying promising opportunities becomes crucial. A good stock often combines strong fundamentals with resilience to macroeconomic shifts, making it well-positioned to benefit from current market trends and economic developments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector with a market capitalization of TRY14.35 billion.

Operations: YGGYO generates revenue primarily from its real estate investments, focusing on rental income and property sales. The company's cost structure includes expenses related to property management and maintenance, which influence its profitability. Notably, the net profit margin has shown variability over recent periods.

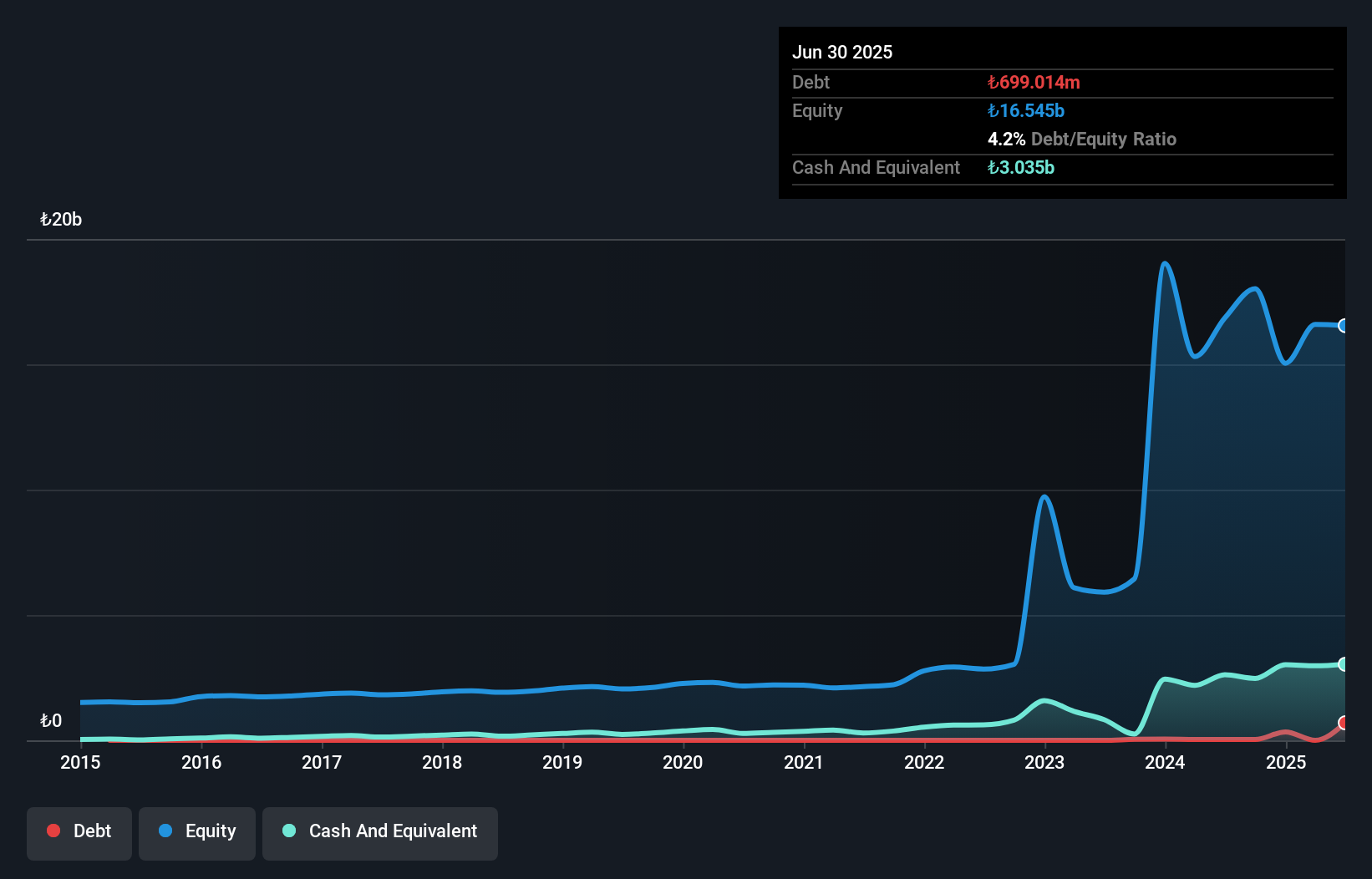

Yeni Gimat Gayrimenkul Yatirim Ortakligi, a noteworthy player in the real estate sector, has shown a significant earnings growth of 48.9% over the past year, surpassing the Retail REITs industry average of 43.6%. The company trades at an attractive valuation, being 88.6% below its estimated fair value. Despite an increase in its debt-to-equity ratio from 0% to 0.2% over five years, it maintains more cash than total debt and reports positive free cash flow. Recent earnings highlight robust sales growth to TRY 904 million for Q3 but a drop in net income to TRY 564 million compared to last year’s figures.

VITZROCELLLtd (KOSDAQ:A082920)

Simply Wall St Value Rating: ★★★★★★

Overview: VITZROCELL Co., Ltd. is a South Korean company specializing in the production and sale of lithium batteries, with a market capitalization of ₩465.97 billion.

Operations: VITZROCELL Co., Ltd. generates its revenue primarily from the production and sale of lithium batteries. The company has reported a market capitalization of ₩465.97 billion, reflecting its position in the industry.

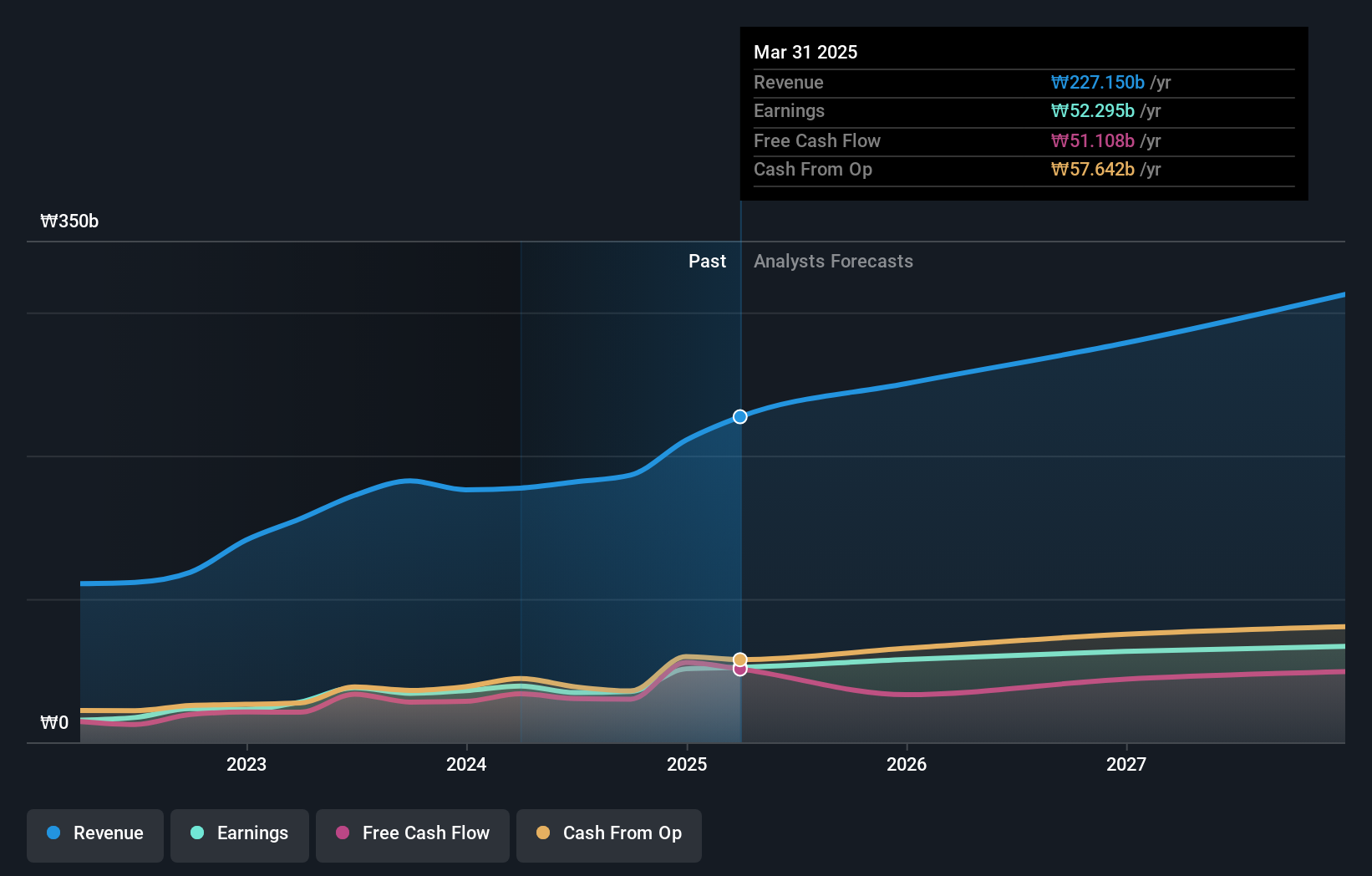

Vitzrocell Ltd., a smaller player in the market, has shown solid financial metrics despite some challenges. Over the past five years, earnings have grown at an annual rate of 18.1%, though recent growth of 3.6% lagged behind the electrical industry’s 11.6%. The company is trading at about 10% below its estimated fair value, suggesting potential for appreciation. Its debt-to-equity ratio has impressively decreased from 0.7 to 0.2 over five years, indicating stronger financial health. Recent quarterly results highlight sales of ₩48 billion and net income of ₩8 billion, reflecting steady year-on-year growth in both areas.

- Click here to discover the nuances of VITZROCELLLtd with our detailed analytical health report.

Explore historical data to track VITZROCELLLtd's performance over time in our Past section.

Hung Ching Development & Construction (TWSE:2527)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hung Ching Development & Construction Co. engages in the development and construction of real estate projects, with a market capitalization of NT$8.94 billion.

Operations: Hung Ching Development & Construction derives its revenue primarily from construction and property development, with NT$2.92 billion and NT$2.54 billion respectively.

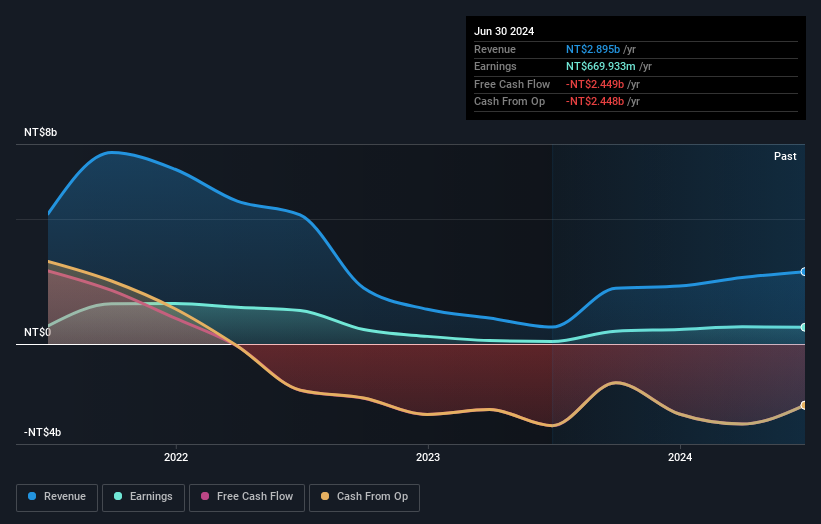

Hung Ching Development & Construction has shown a remarkable earnings growth of 583% over the past year, outpacing the Real Estate industry average of 63%. Despite this impressive performance, its net income for the second quarter was TWD 8.28 million, down from TWD 29.03 million a year ago. The company's price-to-earnings ratio stands at 13.8x, which is attractive compared to the TW market's 21.2x. However, Hung Ching's net debt to equity ratio remains high at 122.9%, although it has improved from previous levels over five years, indicating some progress in financial management efforts despite challenges in operating cash flow coverage of debt obligations.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4663 more companies for you to explore.Click here to unveil our expertly curated list of 4666 Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YGGYO

Yeni Gimat Gayrimenkul Yatirim Ortakligi

Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S.

Excellent balance sheet, good value and pays a dividend.