Undiscovered Gems In Middle East And 2 More Promising Stocks To Consider

Reviewed by Simply Wall St

As most Gulf markets experience gains fueled by hopes of U.S. interest rate cuts and a recent Gaza ceasefire, the Middle East is poised for potential economic transitions that could redirect capital towards growth. In this evolving landscape, identifying stocks with strong fundamentals and resilience to geopolitical shifts can present valuable opportunities for investors seeking to navigate these promising yet complex markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sector mainly in Turkey, with a market capitalization of TRY34.84 billion.

Operations: AgeSA generates revenue primarily through its segments in life insurance and retirement, with significant contributions from the Life Insurance - Retirement segment at TRY9.52 billion and the Life Insurance - Personal Accident segment at TRY3.55 billion.

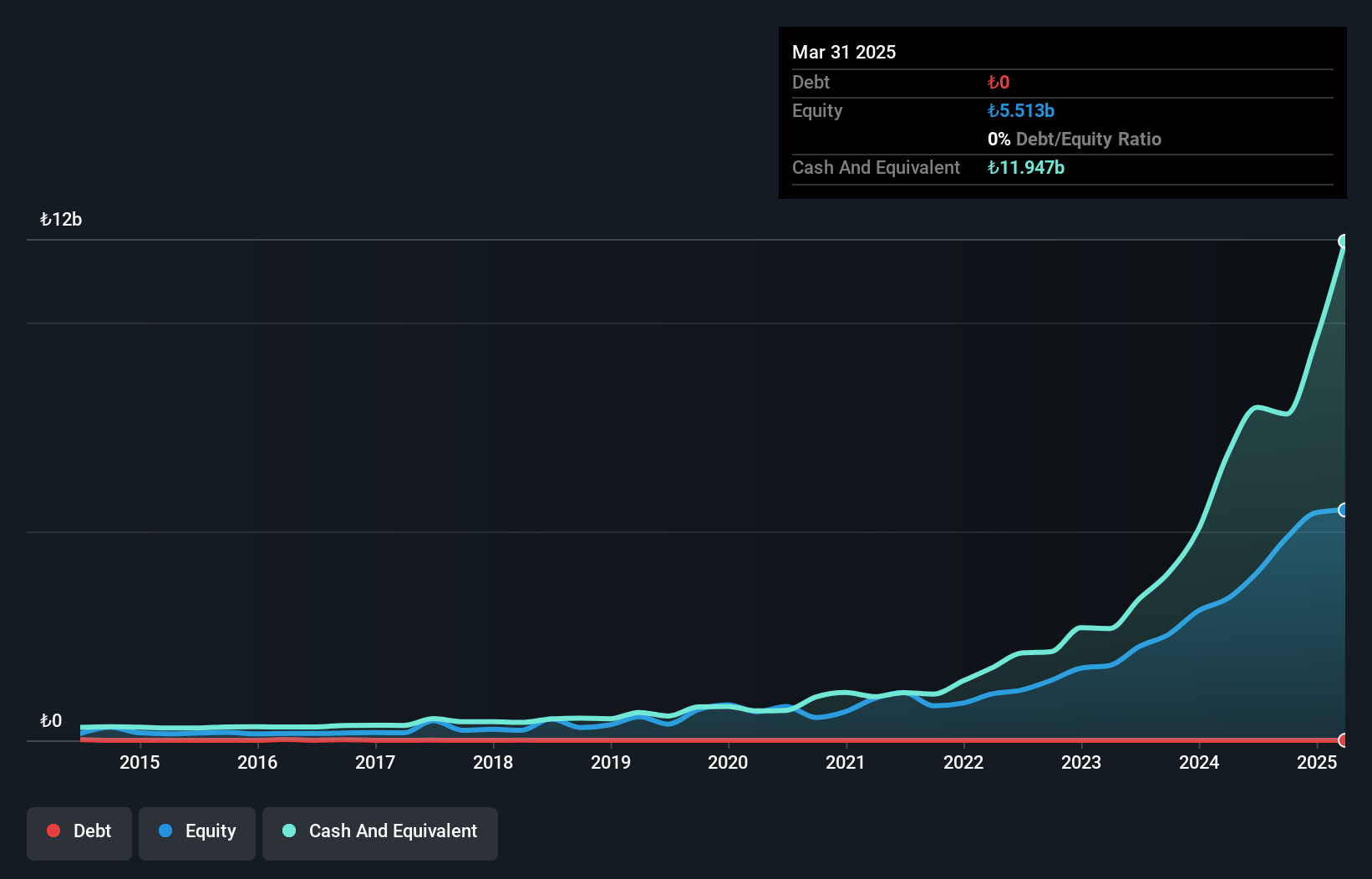

AgeSA Hayat ve Emeklilik Anonim Sirketi, a nimble player in the insurance sector, has shown impressive earnings growth of 122.8% over the past year, outpacing the industry's 79.5%. The firm is debt-free, which removes concerns about interest payment coverage and reflects disciplined financial management. Its price-to-earnings ratio stands at 8.3x, significantly below Turkey's market average of 21.8x, suggesting potential undervaluation. Recent earnings reports highlight a net income surge to TRY 1,424 million for Q2 compared to TRY 621 million last year and basic EPS from continuing operations rose to TRY 7.91 from TRY 3.45 previously.

Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi (IBSE:GIPTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gipta Ofis Kirtasiye ve Promosyon Ürünleri Imalat Sanayi A.S. is engaged in the manufacturing and distribution of office stationery and promotional products, with a market capitalization of TRY18.22 billion.

Operations: Gipta generates revenue primarily from its Paper & Paper Products segment, amounting to TRY1.80 billion.

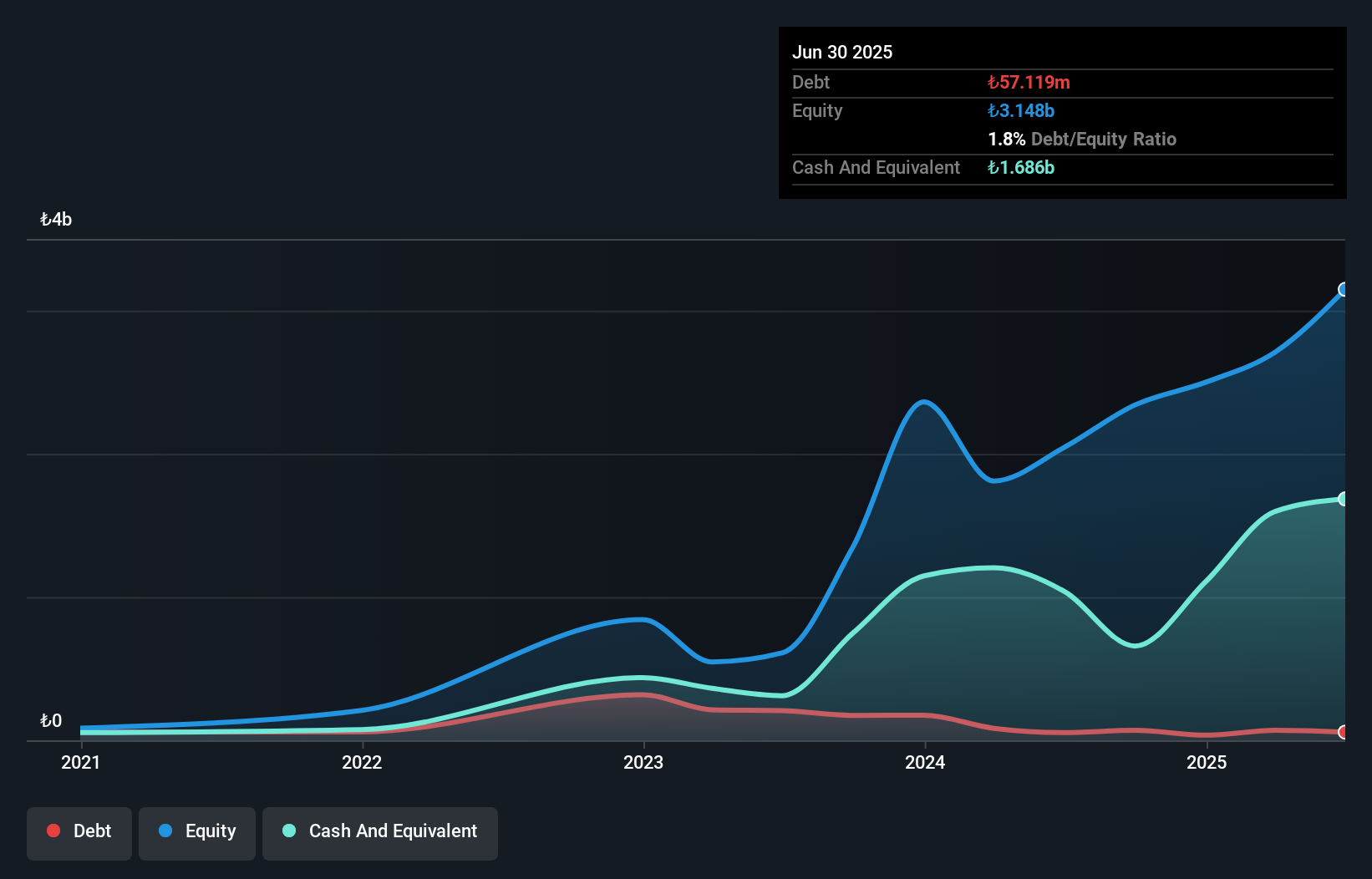

Gipta Ofis Kirtasiye, a modest player in the office supplies sector, has shown remarkable earnings growth of 2024.3% over the past year, far outpacing the industry's 10.6%. Despite a dip in sales to TRY 211.7 million from TRY 290.22 million year-on-year for Q2, net income surged to TRY 417.5 million from TRY 116.47 million previously, reflecting strong profitability with basic earnings per share rising to TRY 3.16 from TRY 0.88 last year. The company enjoys more cash than its total debt and efficiently covers interest payments without concern while maintaining high-quality non-cash earnings despite recent volatility in share price and negative free cash flow trends.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi operates in Turkey, offering savings finance solutions for purchasing houses and cars, with a market capitalization of TRY27.78 billion.

Operations: Katilimevim generates revenue primarily from its financial services in the consumer segment, amounting to TRY8.95 billion. The company's market capitalization stands at TRY27.78 billion.

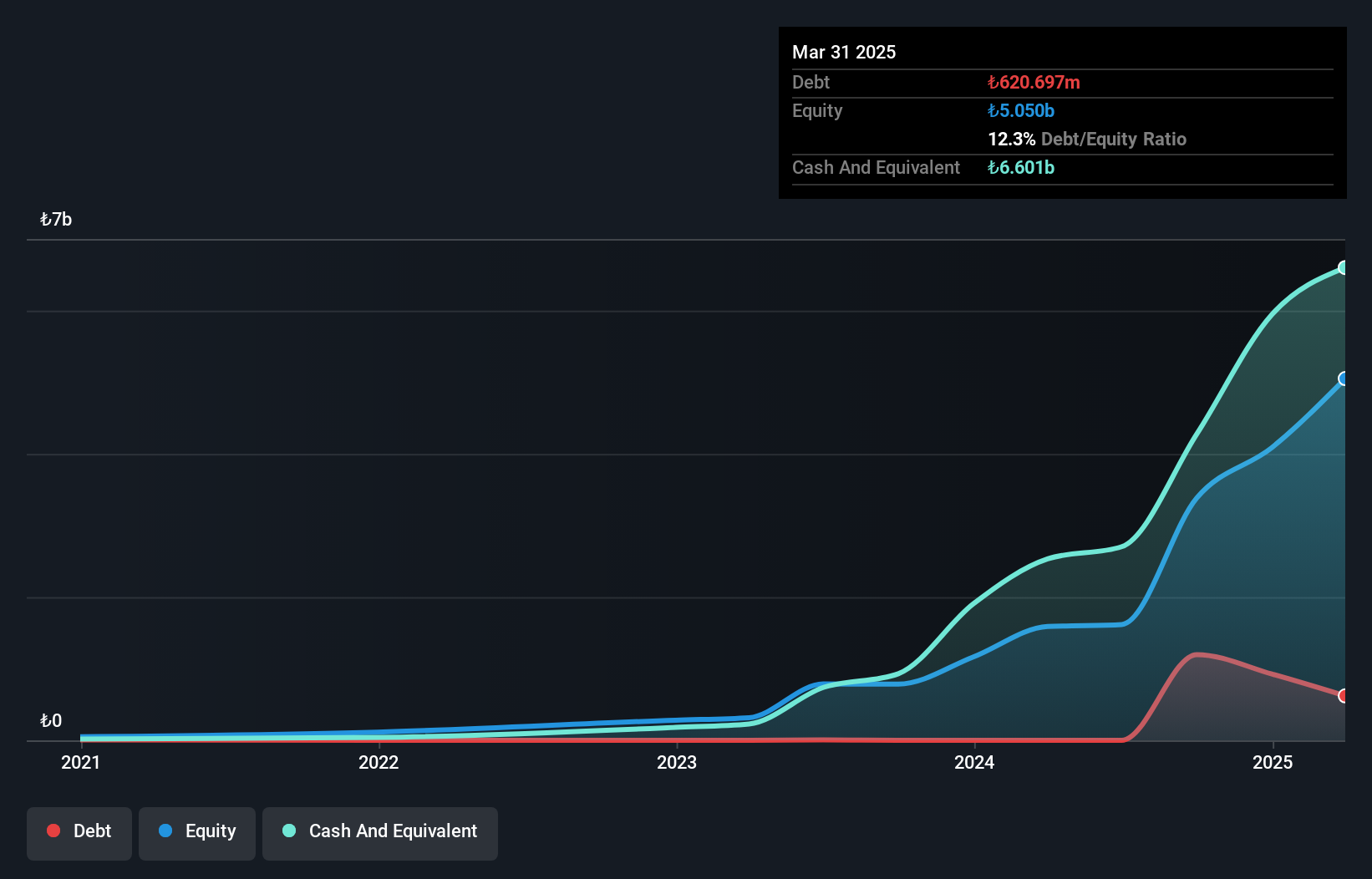

Katilimevim Tasarruf Finansman Anonim Sirketi has shown impressive financial performance, with earnings skyrocketing by 210.7% over the last year, outpacing the Consumer Finance industry's growth of 10.7%. Its net income for Q2 reached TRY 1,710 million, a significant leap from TRY 26 million in the previous year. The price-to-earnings ratio stands at a favorable 6.5x compared to the TR market's average of 21.8x, suggesting potential undervaluation. Despite high share price volatility recently, KTLEV's inclusion in the S&P Global BMI Index highlights its growing recognition and potential within the market landscape.

Taking Advantage

- Delve into our full catalog of 207 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AGESA

AgeSA Hayat ve Emeklilik Anonim Sirketi

Engages in the pension and life insurance business primarily in Turkey.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives