As most Gulf markets experience an upward trend, with Dubai's main index reaching its highest level in over 17 years and Abu Dhabi's benchmark index also showing gains, investors are increasingly attentive to the potential of small-cap stocks in the Middle East. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems that may benefit from the region's positive market momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Altinay Savunma Teknolojileri Anonim Sirketi (IBSE:ALTNY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Altinay Savunma Teknolojileri Anonim Sirketi specializes in motion control, unmanned systems, stealth technology, weaponry, and ammunition destruction and production systems with a market capitalization of TRY18.12 billion.

Operations: Altinay generates its revenue primarily from the Defense Industry Systems segment, which brought in TRY1.96 billion. The company's financial performance is characterized by a net profit margin that reflects its operational efficiency and cost management within this segment.

Altinay Savunma Teknolojileri, a player in the Aerospace & Defense sector, has shown impressive earnings growth of 86.7% over the past year, outpacing industry averages. The company's price-to-earnings ratio stands at 25.5x, which is below the industry average of 49.2x, suggesting potential value for investors. Despite a net debt to equity ratio of 3.5%, considered satisfactory within its sector, Altinay's levered free cash flow remains negative at TRY -659 million as of March 2025. Recent quarterly results highlight significant progress with sales reaching TRY 637 million and a net income turnaround to TRY 62 million from a loss last year.

Is Yatirim Menkul Degerler Anonim Sirketi (IBSE:ISMEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Is Yatirim Menkul Degerler Anonim Sirketi offers capital market services to both individual and corporate investors in Turkey and abroad, with a market capitalization of TRY51.60 billion.

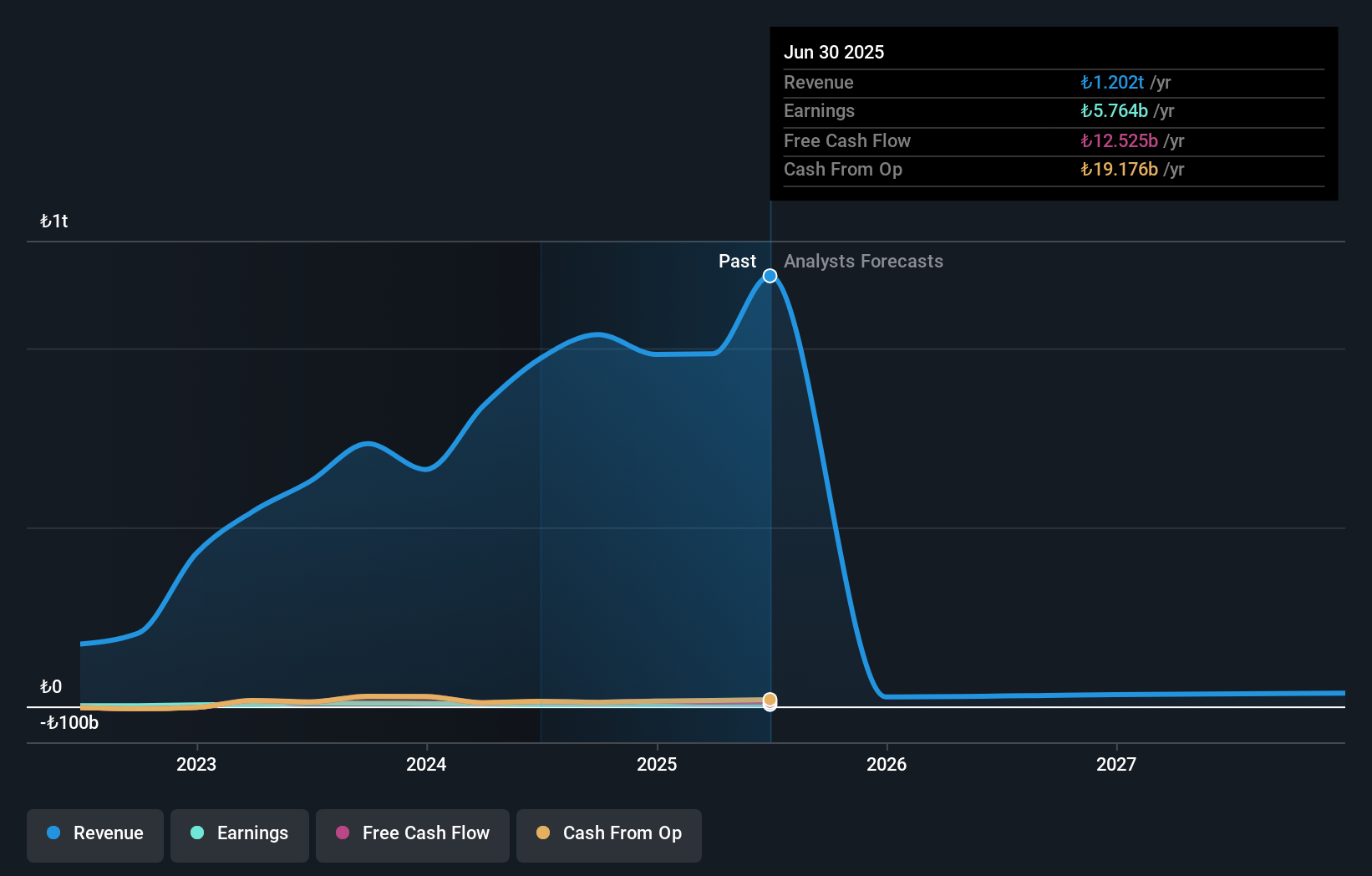

Operations: The company's primary revenue streams include Asset Management/Asset Leasing at TRY975.03 billion and Enterprise Capital at TRY3.52 billion. Portfolio Management contributes TRY2.61 billion, while Trust Company services add TRY2.07 billion to the revenue mix.

With a debt-to-equity ratio dropping from 188.6% to 52% over five years, Is Yatirim Menkul Degerler Anonim Sirketi has shown significant financial improvement. It holds more cash than its total debt, suggesting strong liquidity. The company's price-to-earnings ratio of 8.2x is notably lower than the market average of 17.6x, indicating potential undervaluation. Despite a challenging year with earnings growth at -14%, recent earnings reports show net income surged to TRY 1,139 million from TRY 366.5 million the previous year, reflecting resilience in operations amidst industry pressures.

- Take a closer look at Is Yatirim Menkul Degerler Anonim Sirketi's potential here in our health report.

Learn about Is Yatirim Menkul Degerler Anonim Sirketi's historical performance.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is engaged in the production, sale, and distribution of beer and malt both within Turkey and internationally, with a market cap of TRY58.05 billion.

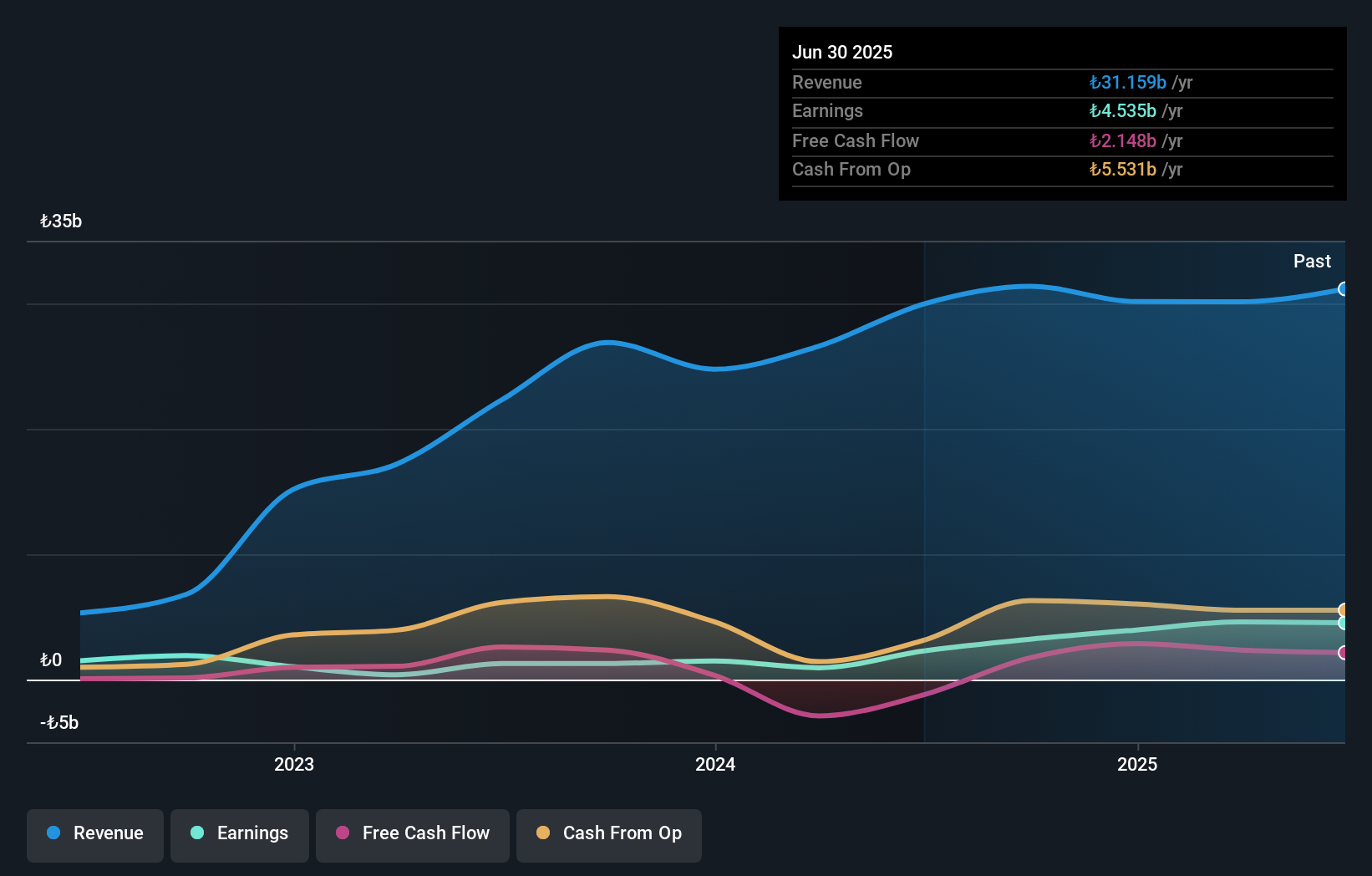

Operations: The company's primary revenue stream is from alcoholic beverages, totaling TRY30.14 billion. The focus on this segment highlights its significance in the overall financial structure.

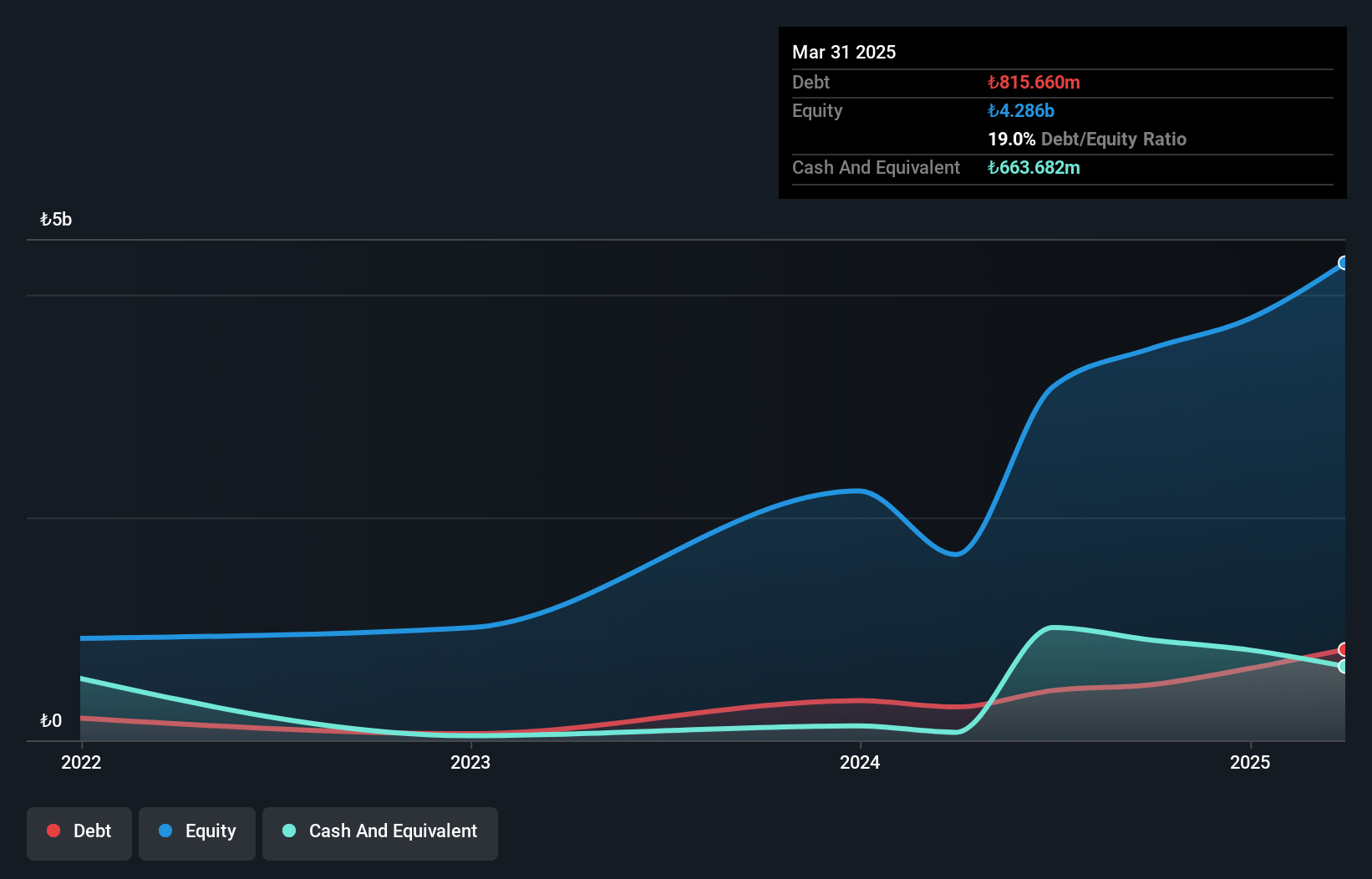

Türk Tuborg, a notable player in the beverage industry, has shown impressive growth with earnings surging by 358% over the past year, outpacing the industry average. The company has shed its debt from a debt-to-equity ratio of 50.6% five years ago to become completely debt-free today. Its price-to-earnings ratio stands at 12.7x, which is favorable compared to the TR market's 17.6x, indicating potential value for investors. Despite reporting a net loss of TRY 308 million for Q1 2025, this is an improvement from TRY 914 million last year, reflecting better financial management and cost control strategies.

Make It Happen

- Embark on your investment journey to our 227 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Türk Tuborg Bira ve Malt Sanayii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TBORG

Türk Tuborg Bira ve Malt Sanayii

Produces, sells, and distributes beer and malt in Turkey and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives