- United Arab Emirates

- /

- Basic Materials

- /

- DFM:NCC

Discovering Middle East's Undiscovered Gems This April 2025

Reviewed by Simply Wall St

As the Middle East stock markets navigate the turbulence caused by recent U.S. tariff announcements and fluctuating oil prices, investors are keenly observing how these factors impact regional indices like Saudi Arabia's benchmark index and Dubai's main share index. Amidst this backdrop of market volatility, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and resilience to external economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★★

Overview: National Cement Company (Public Shareholding Co.) operates in the manufacture and sale of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED1.59 billion.

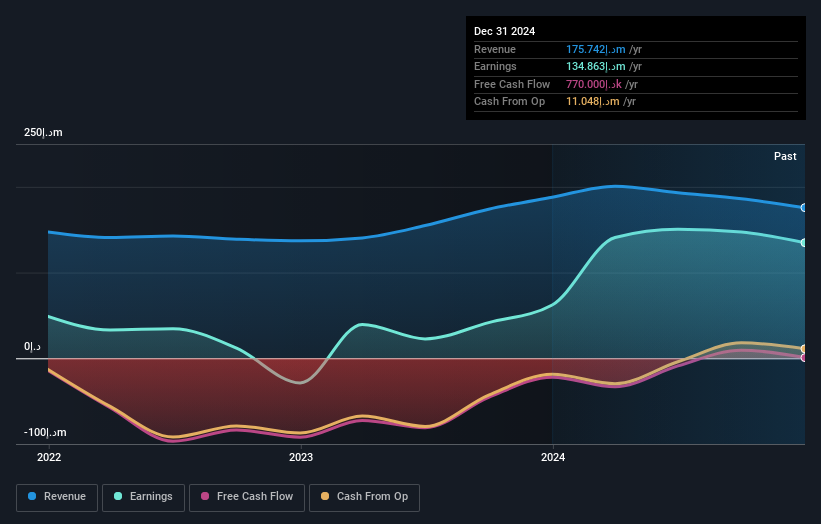

Operations: NCC generates revenue primarily from the sale of cement, amounting to AED175.74 million. The company's financial performance can be analyzed through its net profit margin trends over recent periods.

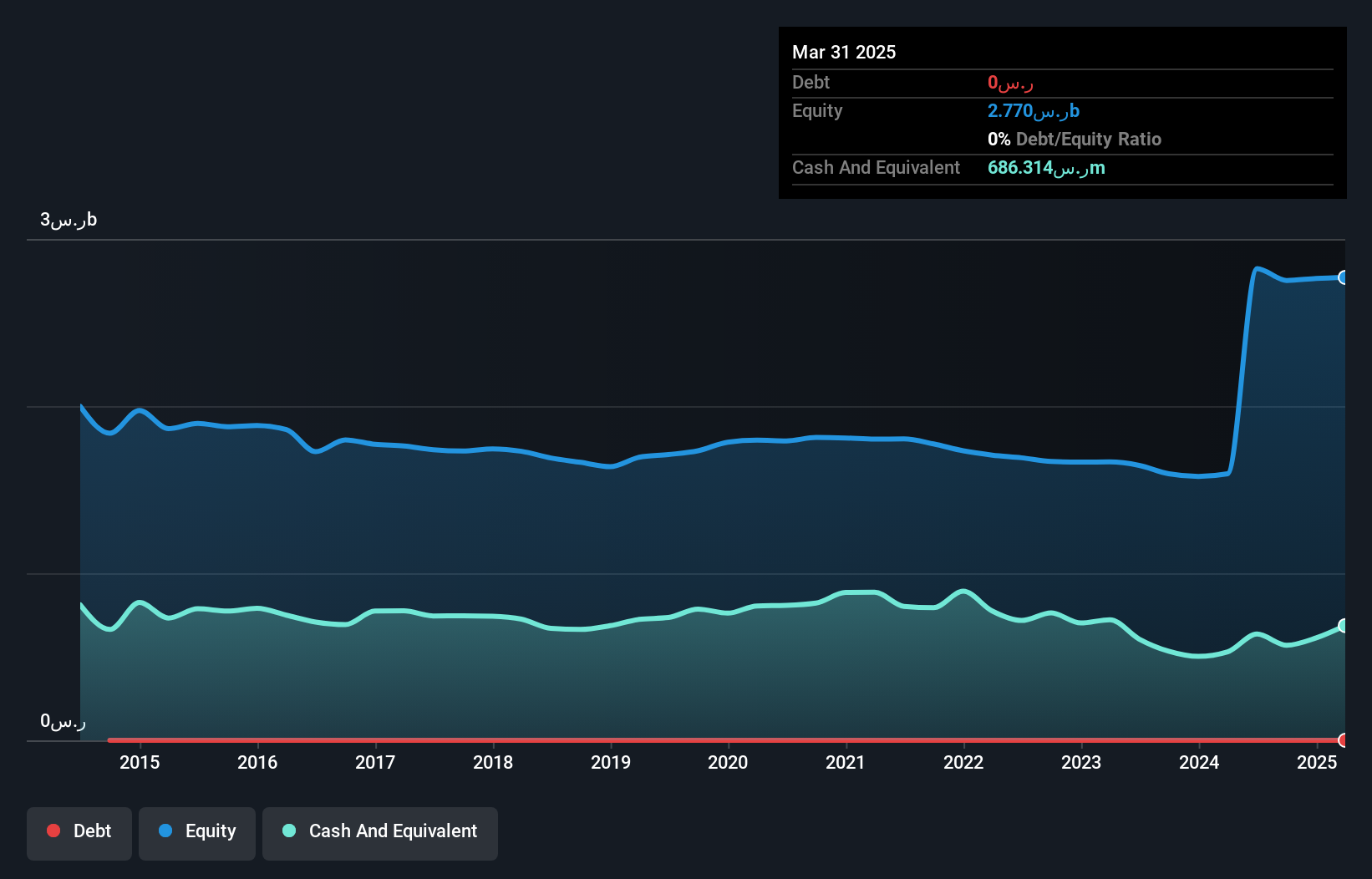

National Cement Company, a nimble player in the Middle East's building materials sector, showcases impressive financial health with no debt and a notable earnings growth of 116.7% over the past year, outpacing the industry's 85%. Its price-to-earnings ratio stands at an attractive 11.8x against the market's 12.8x, hinting at potential undervaluation. Despite recent sales dipping to AED 175.74 million from AED 187.92 million, net income surged to AED 134.86 million from AED 62.23 million last year, reflecting high-quality earnings and robust profitability that support its promising outlook amidst share price volatility.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi (IBSE:BANVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi is a food company based in Turkey with a market capitalization of TRY26.51 billion.

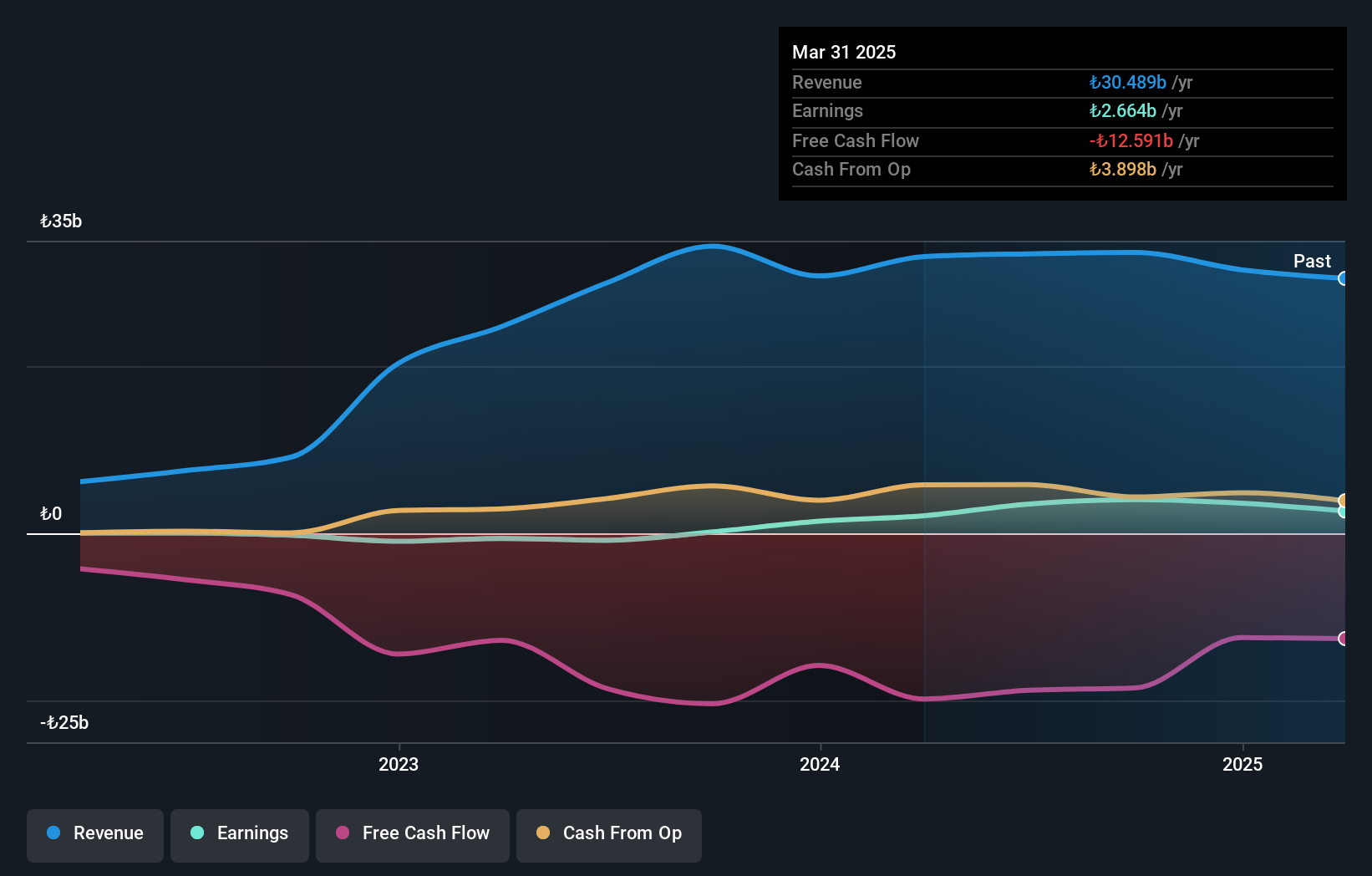

Operations: Banvit generates revenue primarily through its food operations in Turkey. The company's net profit margin is 4.5%, reflecting its profitability after accounting for all expenses.

Banvit, a notable player in the food industry, has demonstrated impressive growth with earnings skyrocketing by 259% over the past year, significantly outpacing the sector's -22.5%. The company appears financially sound with cash exceeding its total debt and a reduced debt-to-equity ratio from 25.9% to 19% over five years. Its price-to-earnings ratio of 7.4x is below the market average of 17.4x, suggesting potential undervaluation. Recent results show net income rising to TRY 3.60 billion from TRY 1.37 billion last year on sales of TRY 31.53 billion, indicating strong operational performance and financial stability moving forward.

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★★

Overview: Qassim Cement Company operates in the Kingdom of Saudi Arabia, focusing on the manufacture and sale of cement, with a market capitalization of SAR5.94 billion.

Operations: The company's revenue primarily stems from the manufacturing and selling of cement, amounting to SAR967.58 million.

Qassim Cement has shown impressive financial performance with sales reaching SAR 967.58 million, up from SAR 583.56 million last year, and net income climbing to SAR 301.35 million from SAR 141.97 million. Their earnings per share rose to SAR 2.98 compared to the previous year's SAR 1.58, indicating strong profitability growth of over double at 112%. Despite shareholder dilution in the past year, Qassim remains debt-free for five years and boasts high-quality earnings with a price-to-earnings ratio of 19.7x below the SA market's average of 22.7x, suggesting good value potential within its industry context.

- Click here to discover the nuances of Qassim Cement with our detailed analytical health report.

Understand Qassim Cement's track record by examining our Past report.

Next Steps

- Click here to access our complete index of 240 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Cement Company (Public Shareholding) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:NCC

National Cement Company (Public Shareholding)

Engages in the manufacture and sale of cement and related products in the United Arab Emirates and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives