The Middle Eastern stock markets have shown mixed performances recently, with UAE bourses experiencing fluctuations as investors anticipate insights from Federal Reserve Chair Jerome Powell's speech, which could influence future U.S. monetary policy. In this context of market uncertainty and geopolitical factors affecting oil prices, dividend stocks in the region can offer a degree of stability and income potential for investors seeking reliable returns amidst fluctuating indices.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.81% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.56% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.47% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.03% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.21% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.85% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.80% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.09% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.81% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.84% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

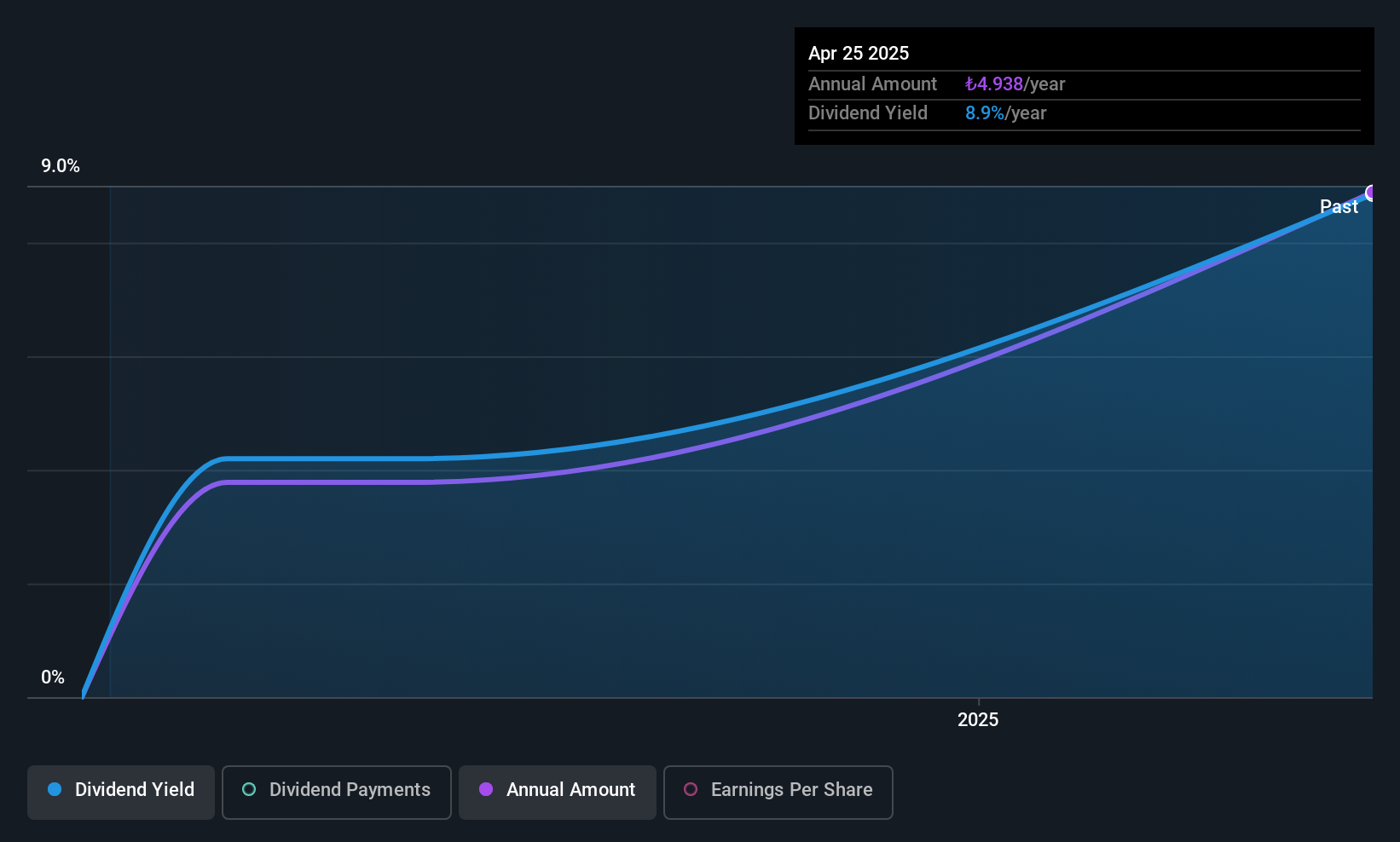

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates in real estate development, leasing, and business administration in Turkey with a market cap of TRY25.62 billion.

Operations: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi generates its revenue from two main segments: Residential and Office Project, contributing TRY1.47 billion, and Office and Shopping Centers for Rent, contributing TRY1.97 billion.

Dividend Yield: 7.7%

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi's dividend yield of 7.71% places it in the top 25% of dividend payers in Turkey, significantly higher than the market average of 2.92%. Despite being new to dividends, its low payout ratio (16.2%) and cash payout ratio (32.9%) suggest sustainability, as they are well covered by earnings and cash flows. However, large one-off items have impacted financial results, making long-term reliability uncertain at this stage.

- Take a closer look at Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi shares in the market.

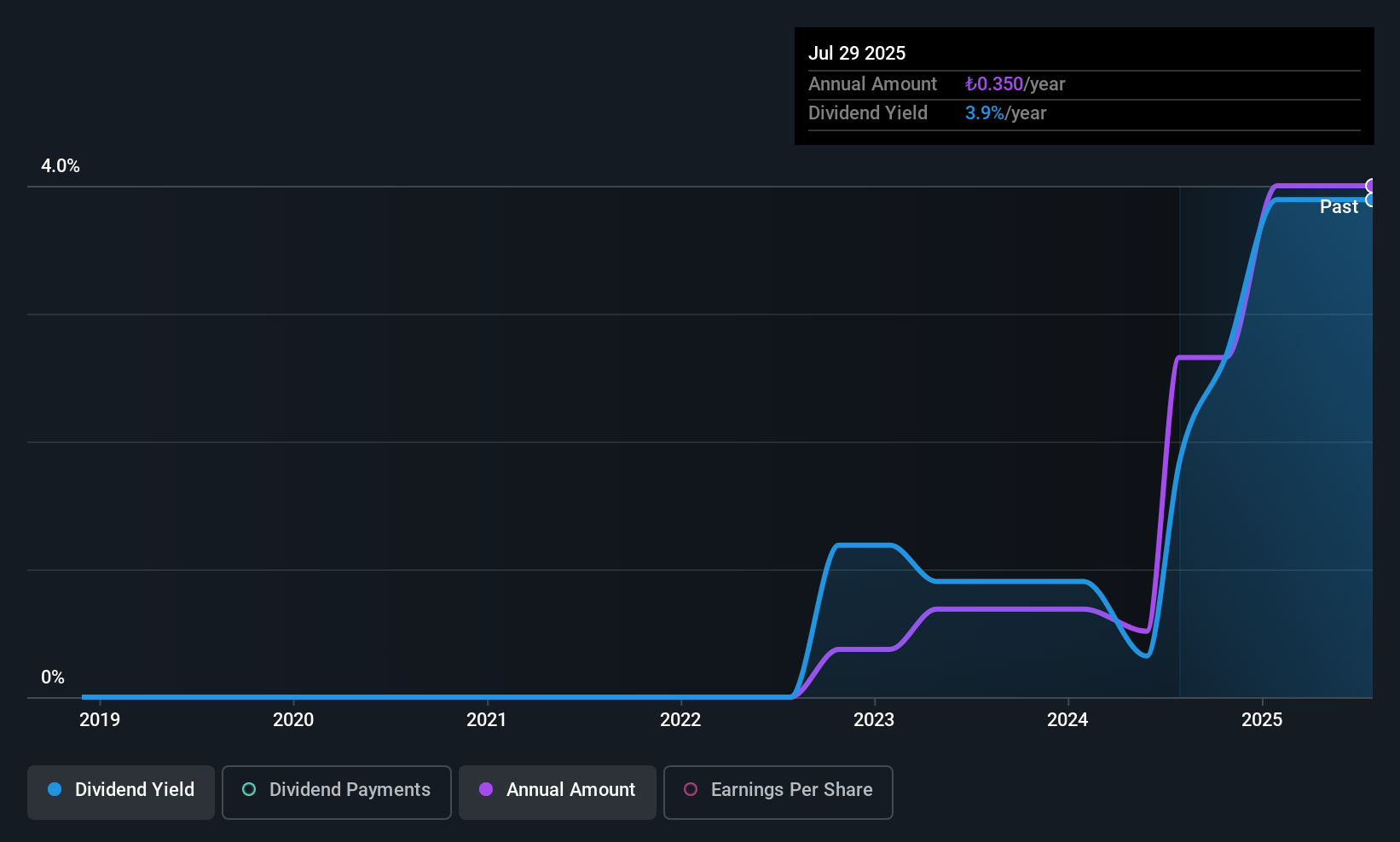

Osmanli Yatirim Menkul Degerler (IBSE:OSMEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Osmanli Yatirim Menkul Degerler A.S. operates in Turkey, offering asset management, custody services, investment consultancy, and online capital market trading platforms with a market cap of TRY4.14 billion.

Operations: Osmanli Yatirim Menkul Degerler A.S. generates revenue primarily through its brokerage services, amounting to TRY7.76 billion.

Dividend Yield: 3.4%

Osmanli Yatirim Menkul Degerler's dividend yield of 3.38% ranks it in the top 25% of Turkish dividend payers, surpassing the market average. The dividends are well-supported by earnings and cash flows, with payout ratios at 57.2% and 21.3%, respectively. However, its short dividend history of three years shows volatility and unreliability in payments, compounded by a recent decline in profit margins from 5% to 2.4%.

- Unlock comprehensive insights into our analysis of Osmanli Yatirim Menkul Degerler stock in this dividend report.

- The analysis detailed in our Osmanli Yatirim Menkul Degerler valuation report hints at an inflated share price compared to its estimated value.

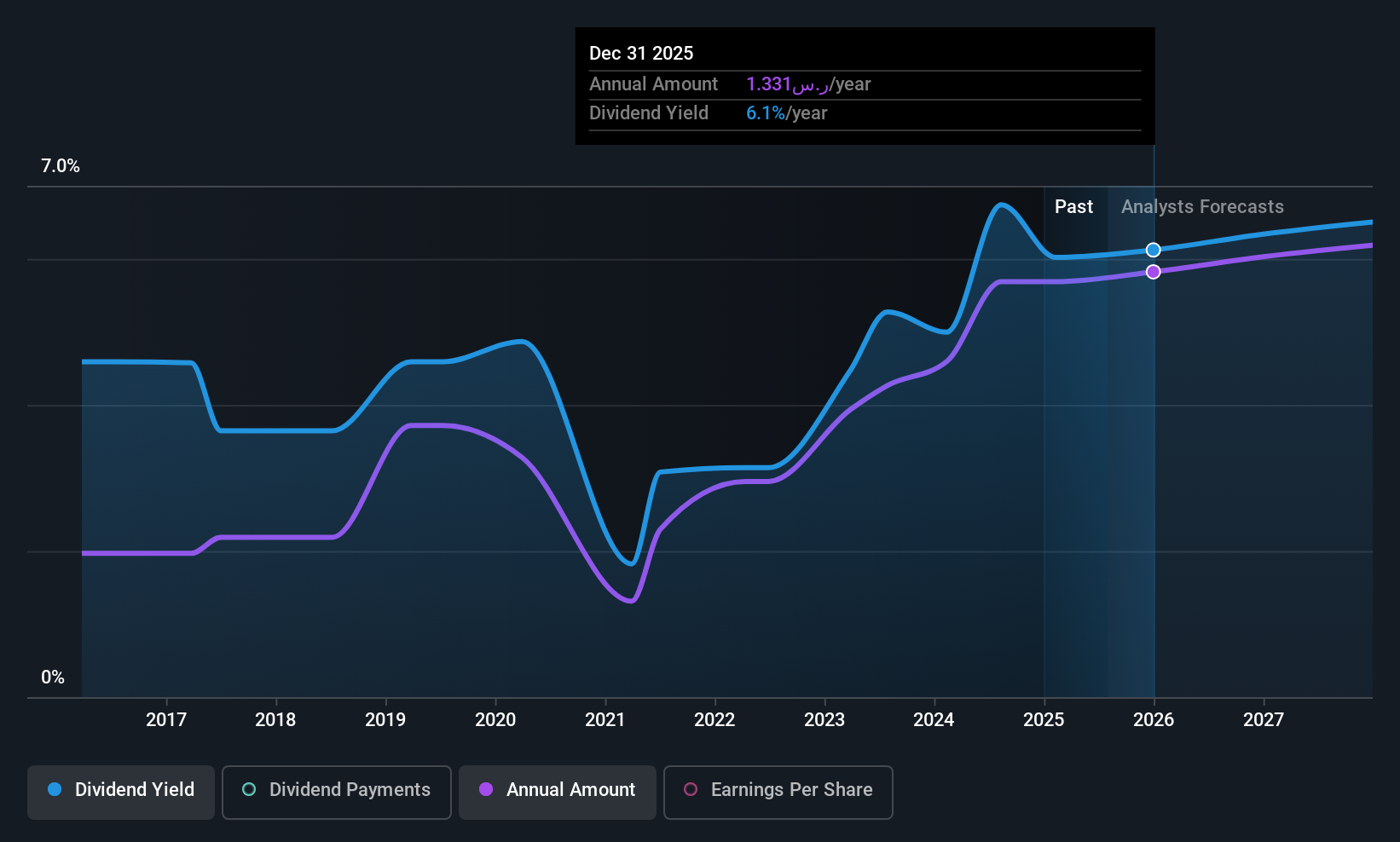

Arab National Bank (SASE:1080)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arab National Bank offers a range of banking products and services across Saudi Arabia, the GCC, the Middle East, Europe, North America, Latin America, Southeast Asia, and internationally with a market cap of SAR44.76 billion.

Operations: Arab National Bank's revenue is primarily derived from Corporate Banking (SAR6.95 billion), followed by Retail Banking (SAR1.61 billion), Treasury (SAR721.47 million), and Investment and Brokerage Services (SAR522.52 million).

Dividend Yield: 5.8%

Arab National Bank's dividend yield of 5.81% places it among the top 25% of Saudi Arabian dividend payers, supported by a sustainable payout ratio around 50%. Despite earnings growth and recent dividends, its track record shows volatility over the past decade. The bank recently declared a cash dividend of SAR 0.65 for H1-2025, with net income rising to SAR 2.64 billion for the first half of the year. Its P/E ratio at 8.7x suggests good value relative to peers.

- Click to explore a detailed breakdown of our findings in Arab National Bank's dividend report.

- Our expertly prepared valuation report Arab National Bank implies its share price may be lower than expected.

Where To Now?

- Discover the full array of 69 Top Middle Eastern Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AVPGY

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi

Engages in the real estate development, leasing, and business administration activities in Turkey.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives