Exploring Three Promising Middle East Stocks with Untapped Potential

Reviewed by Simply Wall St

As the Middle East grapples with market volatility amid looming tariff concerns and geopolitical tensions, investors are keenly observing the region's indices, which have shown mixed performances recently. In this climate of uncertainty, identifying stocks with untapped potential requires a focus on companies that demonstrate resilience and adaptability in challenging conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★☆☆

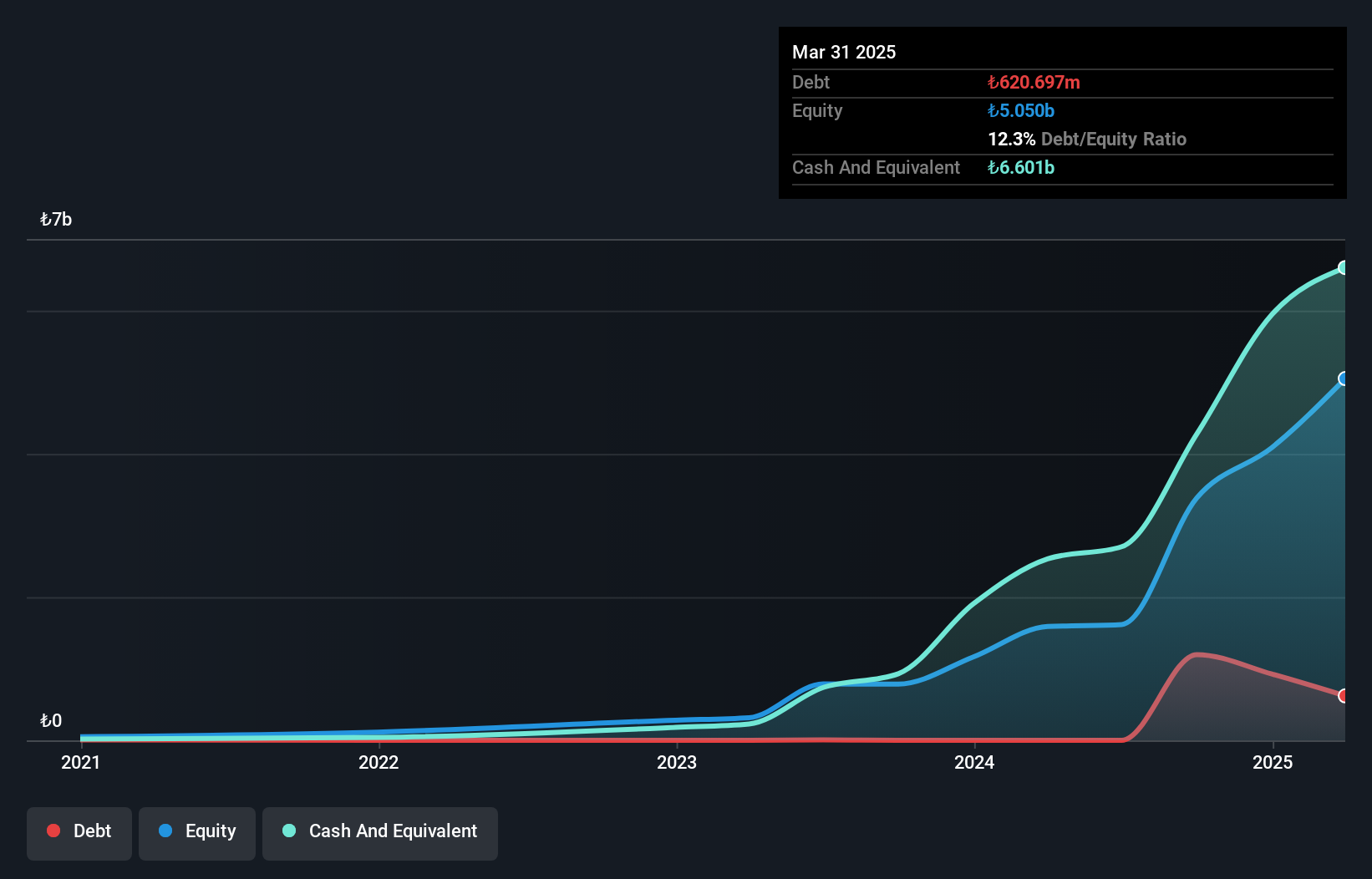

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi operates in Turkey, offering savings finance solutions for purchasing houses and cars, with a market cap of TRY17.69 billion.

Operations: Katilimevim generates revenue primarily through its savings finance services for housing and automobile purchases. The company focuses on facilitating customer savings plans, which contribute to its financial performance.

Katilimevim Tasarruf Finansman Anonim Sirketi showcases a compelling narrative with earnings growth of 80.2% over the past year, outpacing the Consumer Finance industry's 10.4%. Despite a dip in profit margins from 77.4% to 36.5%, its price-to-earnings ratio of 6.9x remains attractive compared to the TR market's 17.9x, suggesting potential value for investors seeking opportunities in smaller companies. The company reported net income of TRY1,108 million for Q1 2025, up from TRY706 million year-on-year, reflecting robust performance despite recent dividend decreases to TRY1.10 per share—highlighting both growth prospects and areas needing attention in financial management.

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Value Rating: ★★★★★★

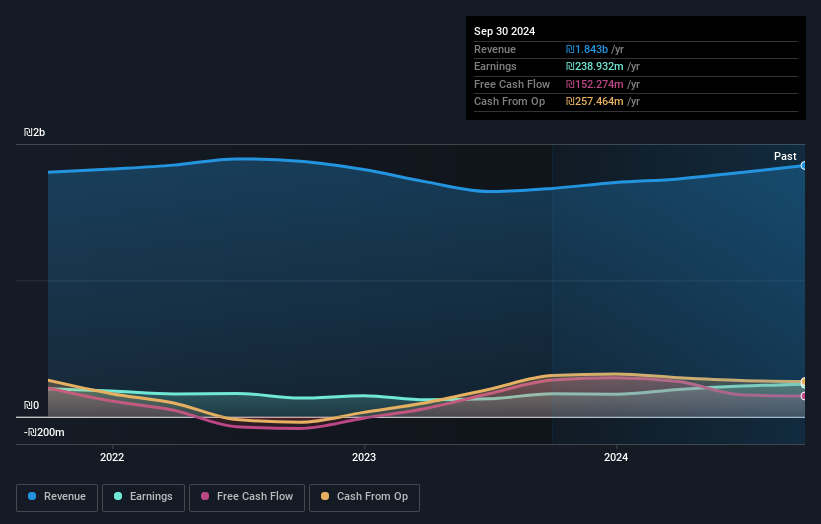

Overview: Palram Industries (1990) Ltd is a company that manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪2.14 billion.

Operations: Palram generates revenue primarily from the Polycarbonate Sector, contributing ₪984.33 million, followed by the PVC Sector with ₪445.89 million. The Home Finished Products and Sales and Display Stands sectors add ₪263.28 million and ₪197.96 million, respectively.

With a promising profile in the Middle East, Palram Industries has shown impressive financial health and growth. The company's debt-to-equity ratio dropped significantly from 20.6% to 0.08% over five years, reflecting strong financial management. Its earnings grew by 41%, outpacing the Chemicals industry average of 14.6%. The price-to-earnings ratio stands at a favorable 9.3x against the IL market's 13.9x, suggesting potential value for investors. Additionally, Palram's interest payments are well covered with an EBIT coverage of 87 times, indicating robust earnings quality and profitability without cash runway concerns.

Plasson Industries (TASE:PLSN)

Simply Wall St Value Rating: ★★★★★★

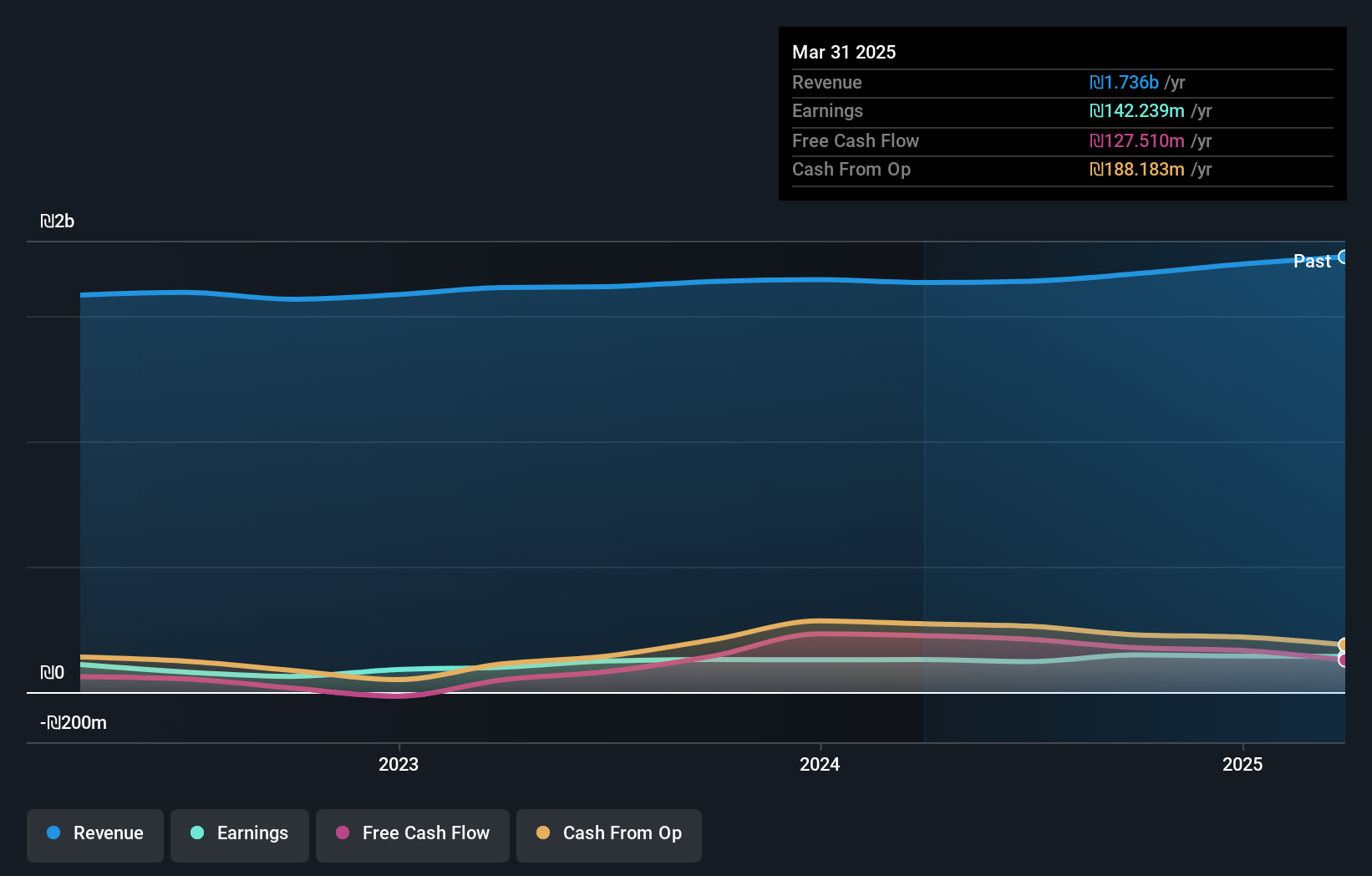

Overview: Plasson Industries Ltd is a company that develops, manufactures, and markets technical products across various regions including Israel, Europe, Brazil, Oceania, the United States, Asia, Africa, and the rest of the Americas with a market cap of ₪2.08 billion.

Operations: Plasson Industries generates revenue primarily from three segments: connection accessories for plumbing (₪883.29 million), products for animals (₪564.07 million), and other activities (₪259.52 million).

Plasson Industries, a small player in the machinery sector, is punching above its weight with earnings growth of 11.4% over the past year, outpacing the industry average of 7.2%. The company's debt to equity ratio has improved significantly from 64% to 39.8% over five years, indicating solid financial management. With a price-to-earnings ratio of 14.5x, it offers better value than the industry average of 23.5x. Plasson also boasts high-quality earnings and robust interest coverage at eight times EBIT, suggesting strong operational performance and financial health that investors might find appealing in this niche market segment.

- Click here to discover the nuances of Plasson Industries with our detailed analytical health report.

Assess Plasson Industries' past performance with our detailed historical performance reports.

Key Takeaways

- Unlock our comprehensive list of 228 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLSN

Plasson Industries

Develops, manufactures, and markets technical products in Israel, Europe, Brazil, Oceania, the United States, Asia, Africa, and rest of the Americas.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives