- Turkey

- /

- Diversified Financial

- /

- IBSE:BRYAT

Undiscovered Gems in Middle East Stocks to Explore This April 2025

Reviewed by Simply Wall St

As the Middle East stock markets experience gains fueled by rising oil prices, strong corporate earnings, and optimism surrounding a potential U.S.-China trade agreement, investors are increasingly looking for opportunities in this dynamic region. In such a promising environment, identifying stocks with solid fundamentals and growth potential becomes crucial for those seeking to capitalize on these favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S., with a market cap of TRY56.36 billion, operates by investing in companies across the industrial, commercial, and service sectors through its subsidiaries.

Operations: BRYAT generates revenue by investing in companies within the industrial, commercial, and service sectors through its subsidiaries. The company's market capitalization stands at TRY56.36 billion.

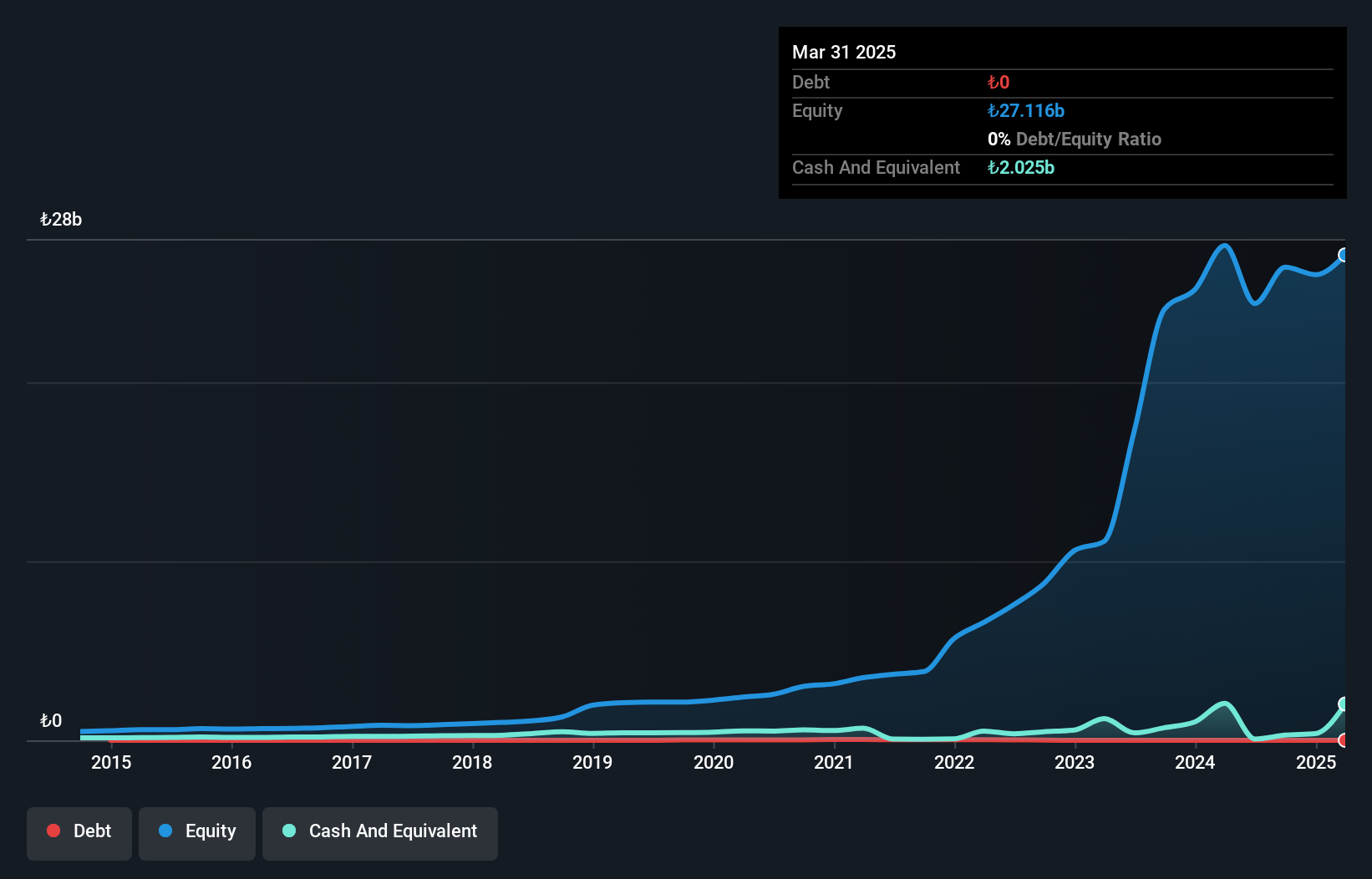

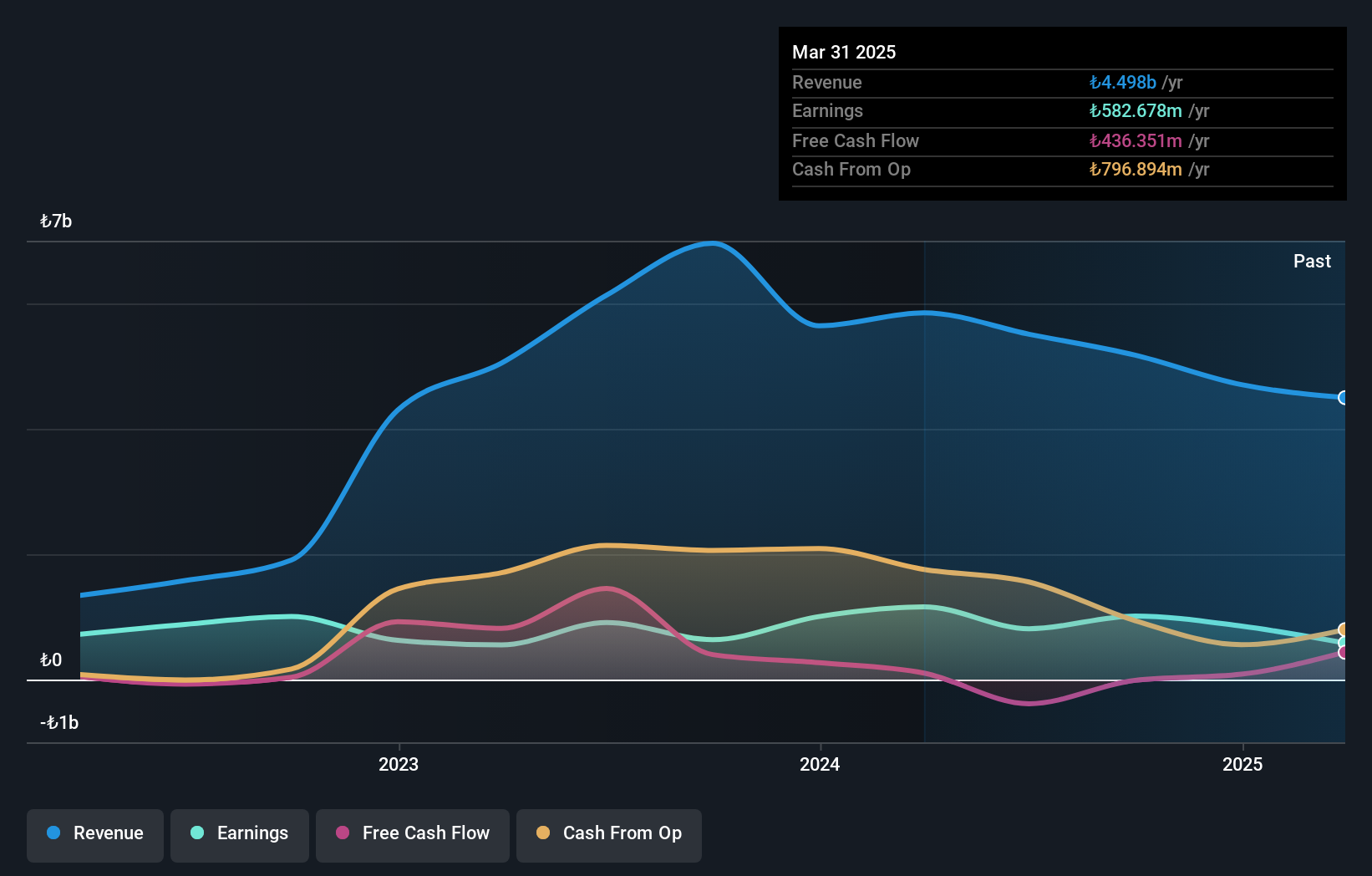

Borusan Yatirim ve Pazarlama, a small player in the financial sector, showcases its potential despite some hurdles. The firm is debt-free, contrasting with a 1% debt to equity ratio five years ago. However, its revenue of TRY 79 million doesn't stand out as significant. Earnings growth took a hit with a negative 10.4%, lagging behind the industry average of 37.6%. Despite this, high-quality past earnings and profitability remain strengths for Borusan Yatirim. Recently, it announced an annual dividend of TRY 58.57 per share and reported net income of TRY 2 billion for the past year.

Ege Endüstri ve Ticaret (IBSE:EGEEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ege Endüstri ve Ticaret A.S. specializes in the development, manufacturing, and sale of axle and suspension system components for commercial and special vehicles both in Turkey and internationally, with a market capitalization of TRY30.10 billion.

Operations: Ege Endüstri generates revenue primarily from the sale of motor vehicle parts and components, amounting to TRY4.70 billion. The company's financial performance can be evaluated through its net profit margin, which reflects its profitability after accounting for all expenses.

Ege Endüstri ve Ticaret, a compact player in the auto components sector, has seen its debt to equity ratio rise from 2.9% to 20% over five years. Despite this increase, the company holds more cash than total debt, indicating a strong liquidity position. However, earnings growth was negative at -15%, contrasting with the industry average of 7.6%. The price-to-earnings ratio is slightly below the industry norm at 35.3x versus 35.4x, suggesting potential undervaluation. Recent earnings revealed net income of TRY 0.85 million against TRY 1 million previously and a dividend reduction to TRY 53 per share reflects cautious financial management amidst these challenges.

- Click here and access our complete health analysis report to understand the dynamics of Ege Endüstri ve Ticaret.

Understand Ege Endüstri ve Ticaret's track record by examining our Past report.

Garanti Faktoring (IBSE:GARFA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Garanti Faktoring A.S. offers factoring services to industrial and commercial firms, with a market capitalization of TRY10.47 billion.

Operations: The company's primary revenue stream comes from its commercial financial services, generating TRY2.32 billion.

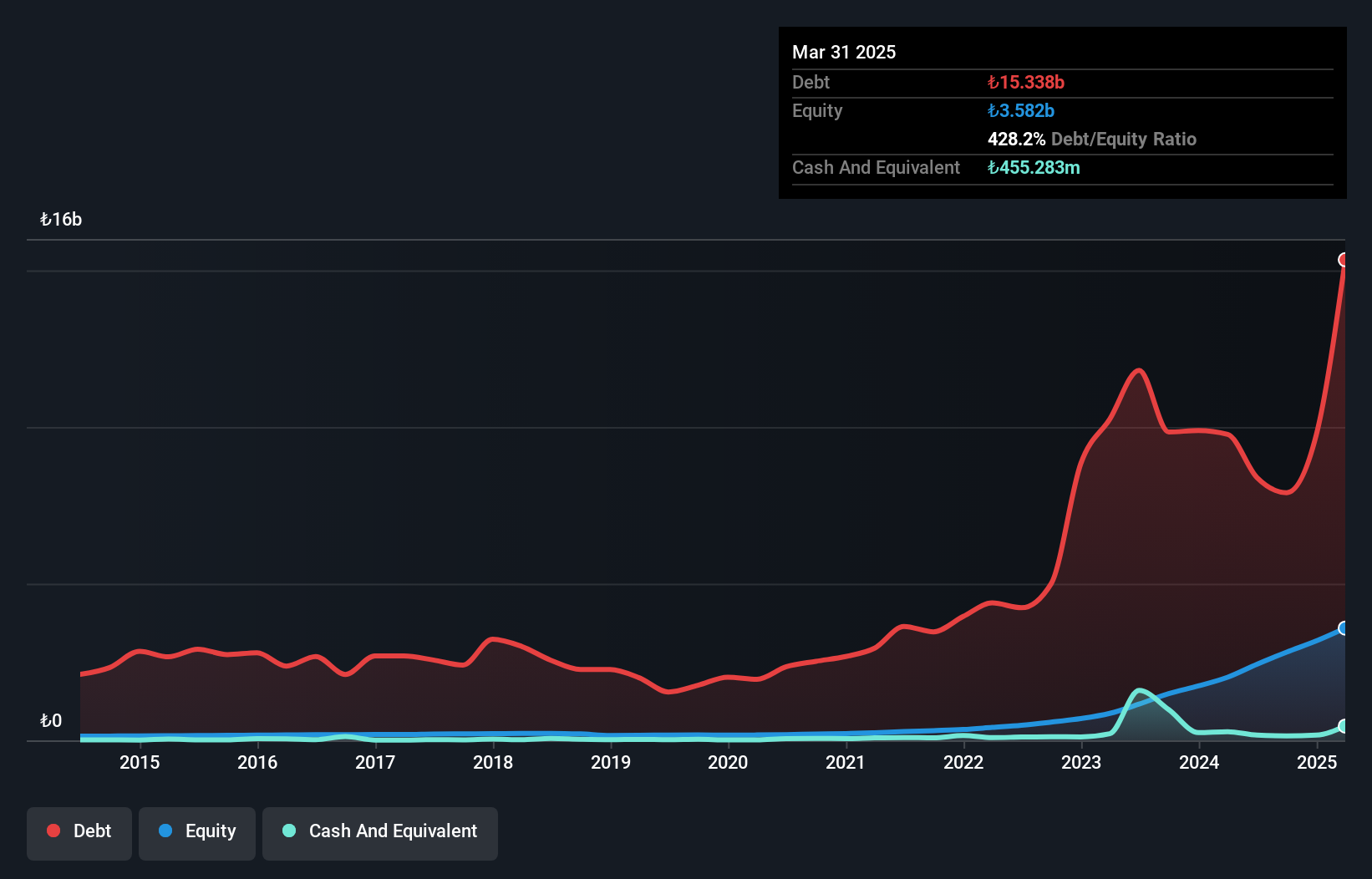

Garanti Faktoring, a financial player in the Middle East, is catching attention with its notable financial strides. Over the past five years, it has impressively reduced its debt to equity ratio from 1229.2% to 307.2%, although a net debt to equity ratio of 302% remains high by industry standards. The company's price-to-earnings ratio stands at an attractive 7.3x compared to the TR market's 17.6x, suggesting potential undervaluation. Its earnings have surged by an average of 64.7% annually over five years, reflecting robust growth despite not outpacing the broader Diversified Financial industry recently at 37.6%.

Next Steps

- Unlock our comprehensive list of 247 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borusan Yatirim ve Pazarlama might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BRYAT

Borusan Yatirim ve Pazarlama

Invests in companies in the industrial, commercial and service sectors.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives