- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Uncovering Three Promising Small Caps For Savvy Investors

Reviewed by Simply Wall St

In a week marked by volatility and global market shifts, small-cap stocks have been under the microscope as investors assess the impacts of AI competition fears and fluctuating economic indicators. With the S&P 600 experiencing mixed performance amid these broader market sentiments, identifying promising opportunities requires a keen eye for companies that demonstrate resilience and potential in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Ningbo United GroupLtd | 11.97% | -19.47% | -30.66% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 36.20% | 2.98% | 3.98% | ★★★★★☆ |

| Guangdong Kingstrong Technology | 3.20% | 18.82% | 39.73% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics with a market capitalization of €541.95 million.

Operations: Clínica Baviera generates revenue primarily from its ophthalmology services, totaling €252.47 million. The company's financial performance includes a net profit margin trend worth noting for further analysis.

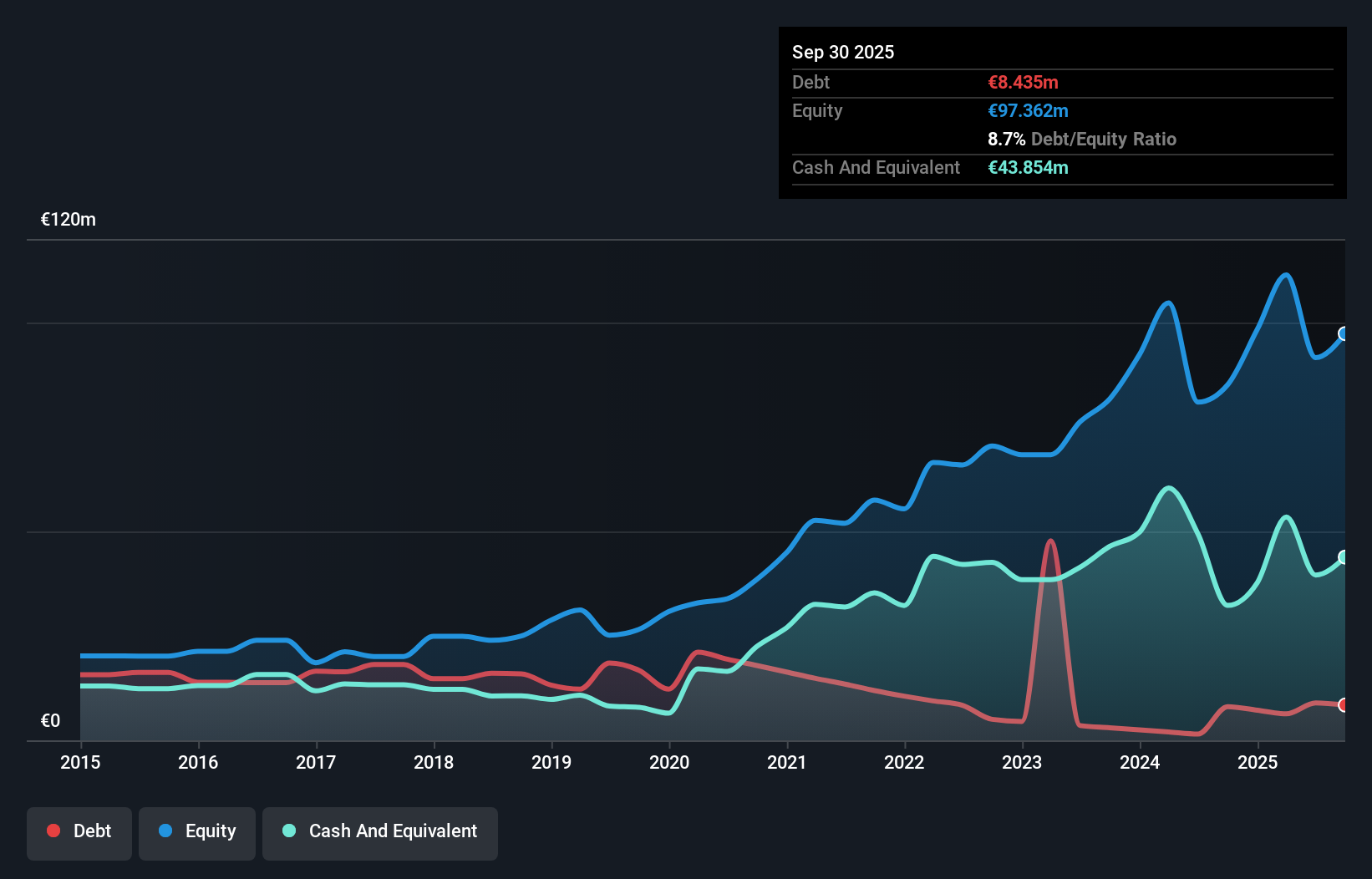

In the healthcare space, Clínica Baviera stands out with its recent earnings growth of 14.9%, which surpasses the industry average. Over the past five years, their debt-to-equity ratio has impressively dropped from 63.2% to just 9.5%, indicating strong financial management. The company reported sales of €189 million for the first nine months of 2024, up from €163.59 million in the previous year, while net income increased slightly to €28.02 million from €26.92 million last year, underscoring its solid performance and potential value as it trades at a significant discount to estimated fair value by 41%.

- Delve into the full analysis health report here for a deeper understanding of Clínica Baviera.

Explore historical data to track Clínica Baviera's performance over time in our Past section.

Mopas Marketcilik Gida Sanayi ve Ticaret Anonim Sirketi (IBSE:MOPAS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mopas Marketcilik Gida Sanayi ve Ticaret Anonim Sirketi operates by selling a range of consumer products through both physical and online retail channels, with a market capitalization of TRY9.61 billion.

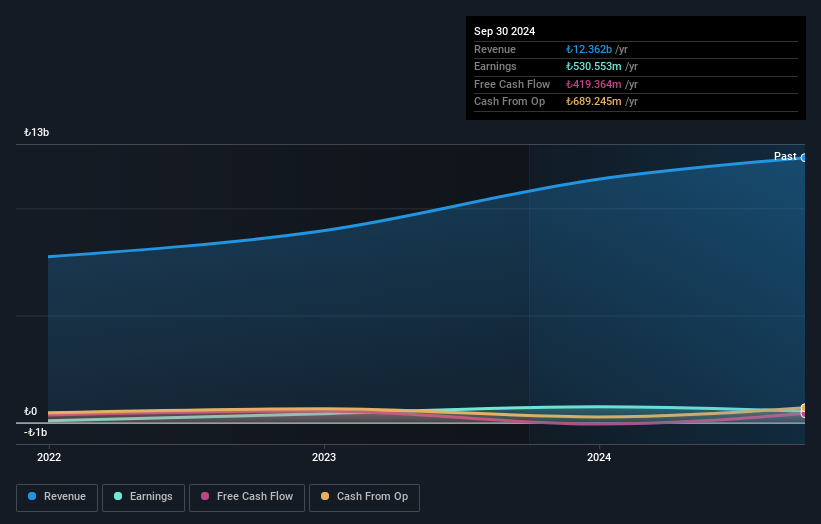

Operations: Mopas generates revenue primarily from marketing activities, amounting to TRY11.36 billion. The company's financial performance is highlighted by its net profit margin trend, which provides insight into profitability relative to total revenue.

Mopas has recently completed an IPO, raising TRY 2.01 billion, highlighting its potential as a growing player in the market. This company showcases strong earnings growth of 79% over the past year, outpacing the Consumer Retailing industry's growth of 51.7%, and its price-to-earnings ratio stands at a favorable 13x compared to the TR market's 15.4x. Despite having more cash than total debt, Mopas faces challenges with interest payments not well covered by EBIT at only 1.2x coverage; however, its high level of non-cash earnings suggests robust operational performance amidst these financial dynamics.

Changhua Holding Group (SHSE:605018)

Simply Wall St Value Rating: ★★★★★★

Overview: Changhua Holding Group Co., Ltd. operates in the research, development, production, and sale of automotive metal parts both in China and internationally, with a market capitalization of CN¥5.88 billion.

Operations: The company generates revenue primarily from the sale of automotive metal parts. Its cost structure includes expenses related to research, development, and production. The net profit margin stands at 8.5%, reflecting its efficiency in converting revenue into actual profit after all expenses are accounted for.

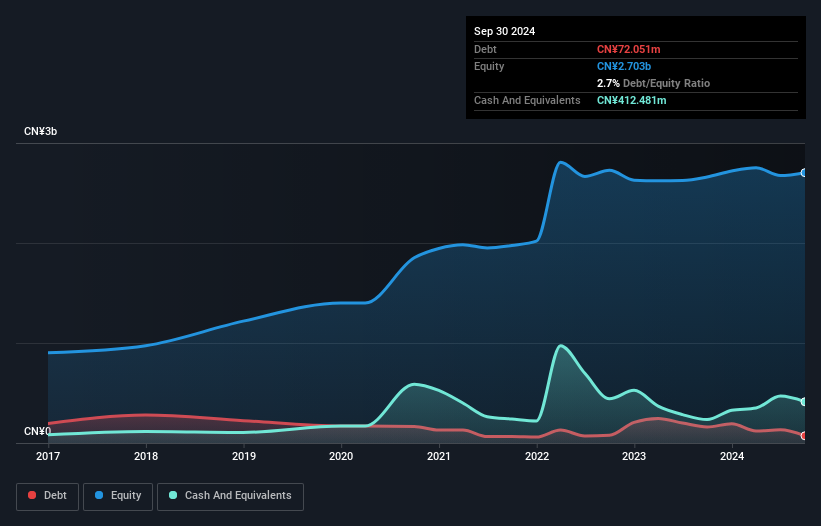

Changhua Holding Group, a smaller player in the auto components industry, has shown impressive earnings growth of 42% over the past year, outpacing the industry's 10.5%. Despite this growth, its earnings have declined by 14% annually over five years. The company has effectively managed its debt, reducing its debt-to-equity ratio from 13.5 to 2.7 in five years and boasts high-quality earnings with sufficient interest coverage. However, recent volatility in share price and removal from the S&P Global BMI Index could be concerns for investors eyeing stability amidst potential opportunities for future growth.

Seize The Opportunity

- Delve into our full catalog of 4688 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives