Three Undiscovered Gems In The Middle East To Enhance Your Portfolio

Reviewed by Simply Wall St

As Gulf markets continue to rise, with Dubai's main index reaching a 17-year high and Abu Dhabi's benchmark following suit, investors are increasingly turning their attention to the Middle East for promising opportunities. In such a dynamic market environment, identifying stocks with strong fundamentals and growth potential can be key to enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Mackolik Internet Hizmetleri Ticaret | 0.14% | 25.61% | 36.34% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 12.49% | -23.32% | 41.51% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 20.07% | 44.84% | 6.75% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Kayseri Seker Fabrikasi Anonim Sirketi (IBSE:KAYSE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kayseri Seker Fabrikasi Anonim Sirketi is engaged in the manufacturing and selling of sugar both within Turkey and internationally, with a market capitalization of TRY14.53 billion.

Operations: Kayseri Seker generates revenue primarily from sugar production activities, contributing TRY16.39 billion. The company's financial performance is significantly driven by this core segment, impacting its overall profitability and market presence.

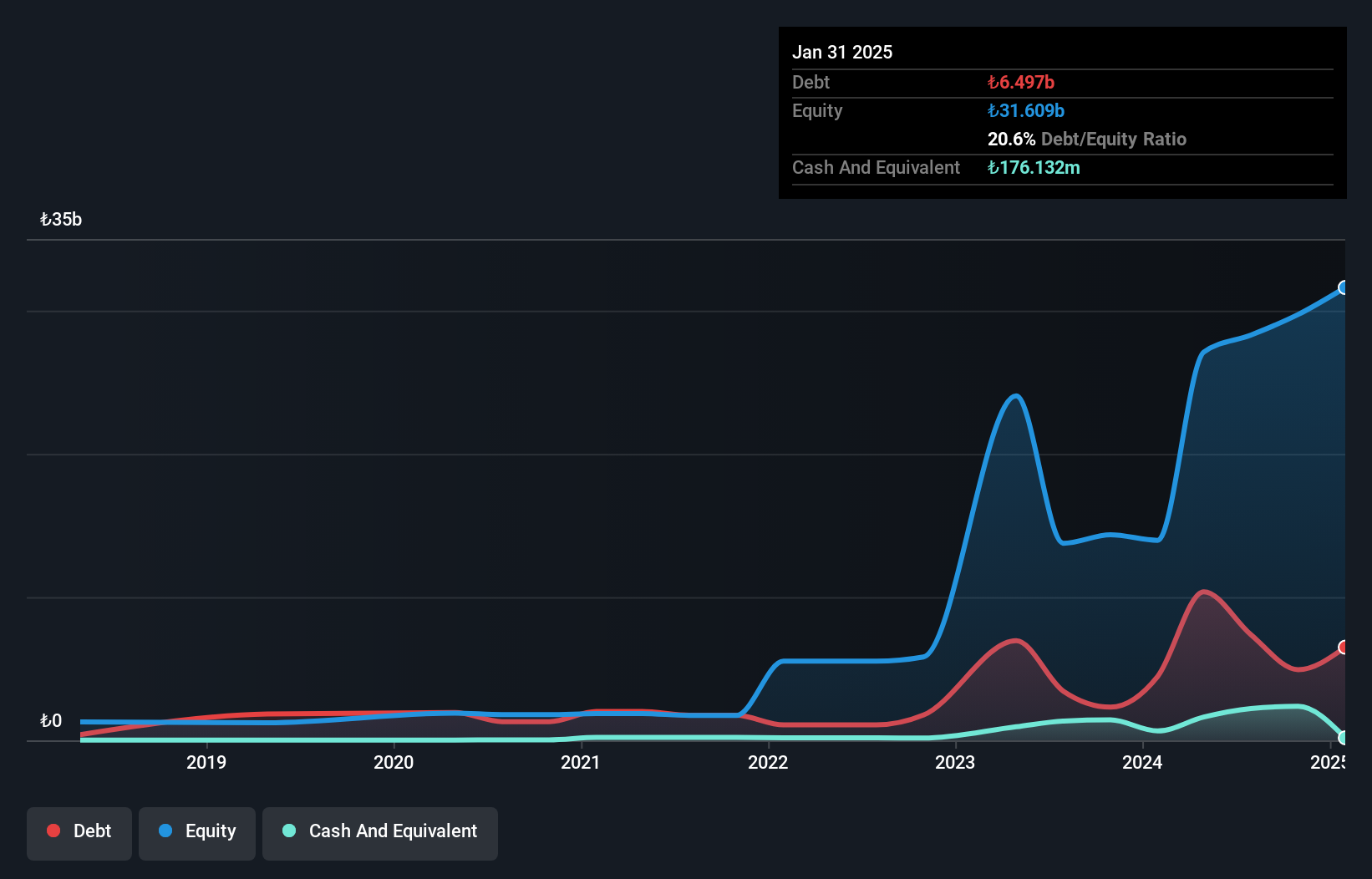

Kayseri Seker Fabrikasi, a notable player in the Middle East's sugar industry, has shown resilience despite recent challenges. Over the past five years, its debt to equity ratio impressively decreased from 110% to 20.6%, indicating improved financial stability. The company experienced a significant one-off gain of TRY1.5 billion impacting its latest results, yet it still reported a net loss of TRY579 million for Q3 2025 compared to TRY451 million the previous year. Although earnings grew by 1.8% last year, interest payments remain poorly covered by EBIT at zero times coverage, highlighting areas for improvement in operational efficiency and profitability management.

Mavi Giyim Sanayi ve Ticaret (IBSE:MAVI)

Simply Wall St Value Rating: ★★★★★★

Overview: Mavi Giyim Sanayi ve Ticaret A.S. is involved in the wholesale and retail sale of ready-to-wear denim apparel both in Turkey and internationally, with a market capitalization of TRY25.41 billion.

Operations: Mavi generates revenue primarily from the sale of apparel, amounting to TRY38.52 billion.

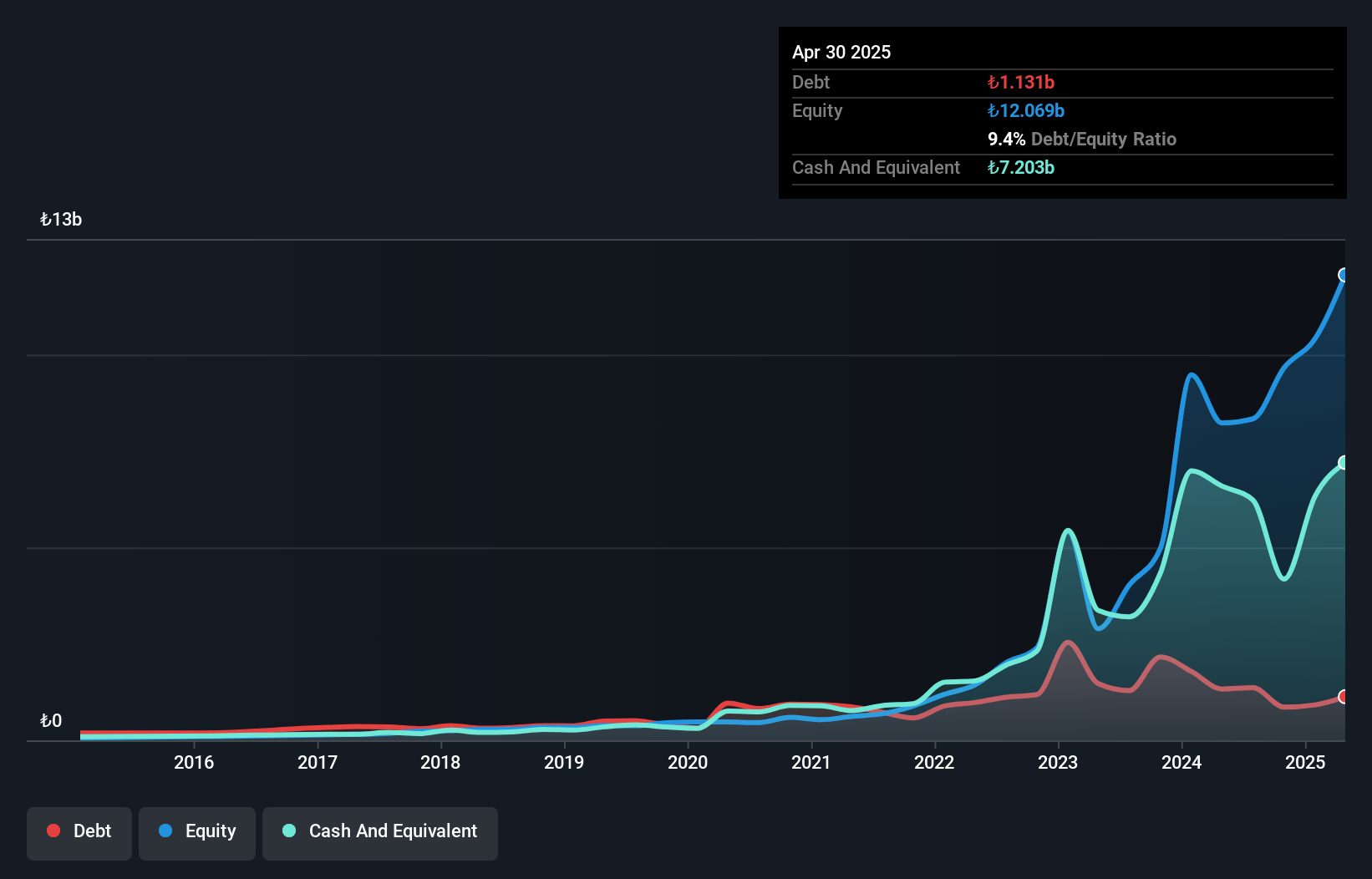

Mavi Giyim is making strides with a focus on North America and Turkey, enhancing its market presence through strategic store openings and infrastructure investments. The company's earnings grew by 7% last year, outpacing the luxury sector's downturn of 43%. Mavi's debt to equity ratio has impressively dropped from 67% to just under 9% in five years, indicating disciplined financial management. With a price-to-earnings ratio of 9x against the TR market's average of nearly 18x, it appears undervalued. Despite robust plans for expansion, Mavi faces challenges like rising costs and softer demand in Turkey that could impact profitability.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ayalon Insurance Company Ltd operates in Israel, offering a range of insurance products through its subsidiaries, with a market capitalization of ₪1.39 billion.

Operations: Ayalon Insurance generates revenue primarily from its life insurance and long-term savings segment, contributing ₪1.19 billion, and general insurance categories such as automobile property insurance at ₪685.27 million. The company also derives significant income from compulsory vehicle insurance and health insurance, with revenues of ₪305.75 million and ₪615.83 million respectively.

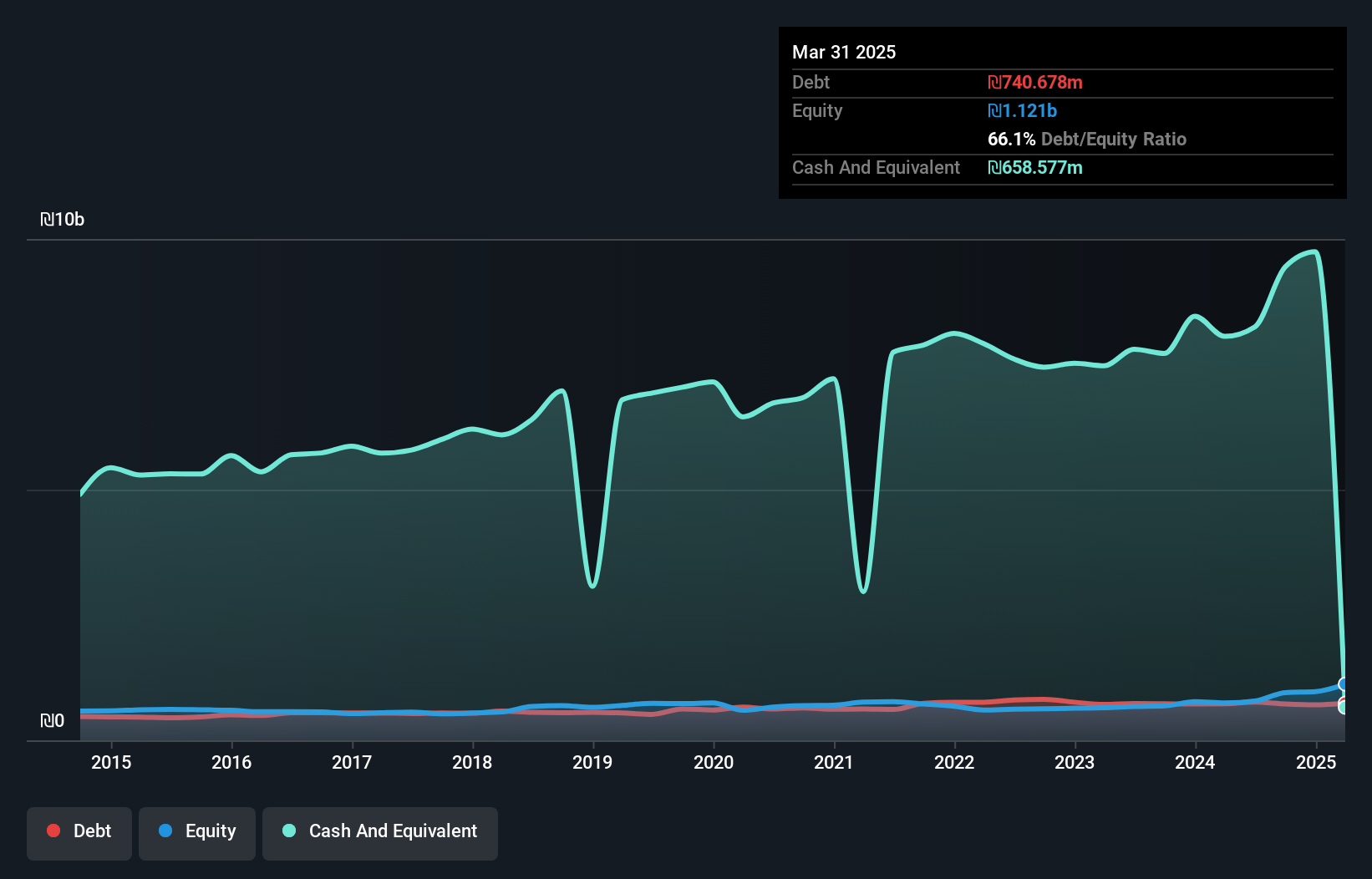

Ayalon Insurance stands out with a robust earnings growth of 70.1% over the past year, surpassing the insurance industry's average of 63%. Trading at 27.8% below its estimated fair value, it offers potential for undervalued investment opportunities. The company has successfully reduced its debt-to-equity ratio from 81.3% to 72.6% over five years and maintains high-quality earnings, indicating sound financial management. Despite substantial shareholder dilution recently, Ayalon’s interest payments are well-covered by EBIT at four times coverage, suggesting strong operational performance and effective debt management strategies in place for future growth prospects.

- Click to explore a detailed breakdown of our findings in Ayalon Insurance's health report.

Assess Ayalon Insurance's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Navigate through the entire inventory of 228 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MAVI

Mavi Giyim Sanayi ve Ticaret

Engages in the wholesale and retail sale of ready-to-wear denim apparel in Turkey and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)