December 2024's Top Stock Selections Estimably Priced Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and shifting economic indicators, major indices like the Nasdaq Composite and S&P 500 have shown mixed performance in recent weeks. Amidst this backdrop, identifying stocks that are potentially undervalued can offer investors a strategic opportunity to capitalize on market inefficiencies. A good stock in such conditions is often characterized by strong fundamentals and a price that does not fully reflect its intrinsic value, providing potential for growth as market perceptions adjust.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$631.28 | MX$1257.07 | 49.8% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.85 | 49.7% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.45 | CN¥30.82 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1130.65 | ₹2253.01 | 49.8% |

| Lindab International (OM:LIAB) | SEK228.20 | SEK452.08 | 49.5% |

| S Foods (TSE:2292) | ¥2757.00 | ¥5472.35 | 49.6% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Infomart (TSE:2492) | ¥290.00 | ¥574.47 | 49.5% |

| Surgical Science Sweden (OM:SUS) | SEK159.60 | SEK317.20 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

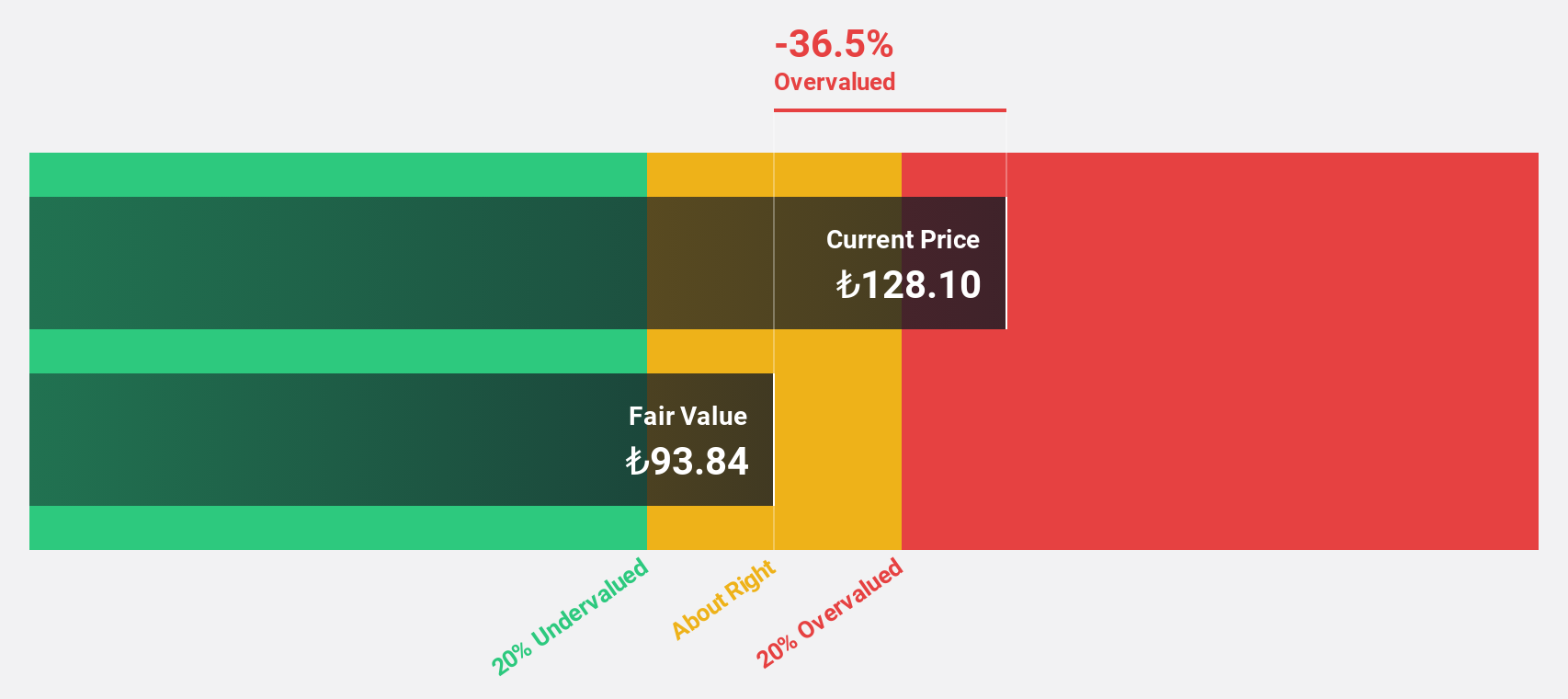

Arçelik Anonim Sirketi (IBSE:ARCLK)

Overview: Arçelik Anonim Sirketi, along with its subsidiaries, is involved in the production, marketing, sales, after-sales services, import and export of consumer durable goods and electronics across Turkey, Europe, the Asia Pacific, Africa and globally; it has a market cap of TRY86.72 billion.

Operations: The company's revenue is primarily derived from White Goods, contributing TRY224.10 billion, followed by Consumer Electronics at TRY16.95 billion.

Estimated Discount To Fair Value: 32.7%

Arçelik Anonim Sirketi trades at TRY 142.9, significantly below its estimated fair value of TRY 212.19, indicating potential undervaluation based on cash flows. Despite a challenging financial position with interest payments not well covered by earnings and a net loss reported for the recent quarter, the company is expected to achieve above-average market profit growth over the next three years, supported by strong forecasted revenue growth of 25.9% annually.

- Our growth report here indicates Arçelik Anonim Sirketi may be poised for an improving outlook.

- Click here to discover the nuances of Arçelik Anonim Sirketi with our detailed financial health report.

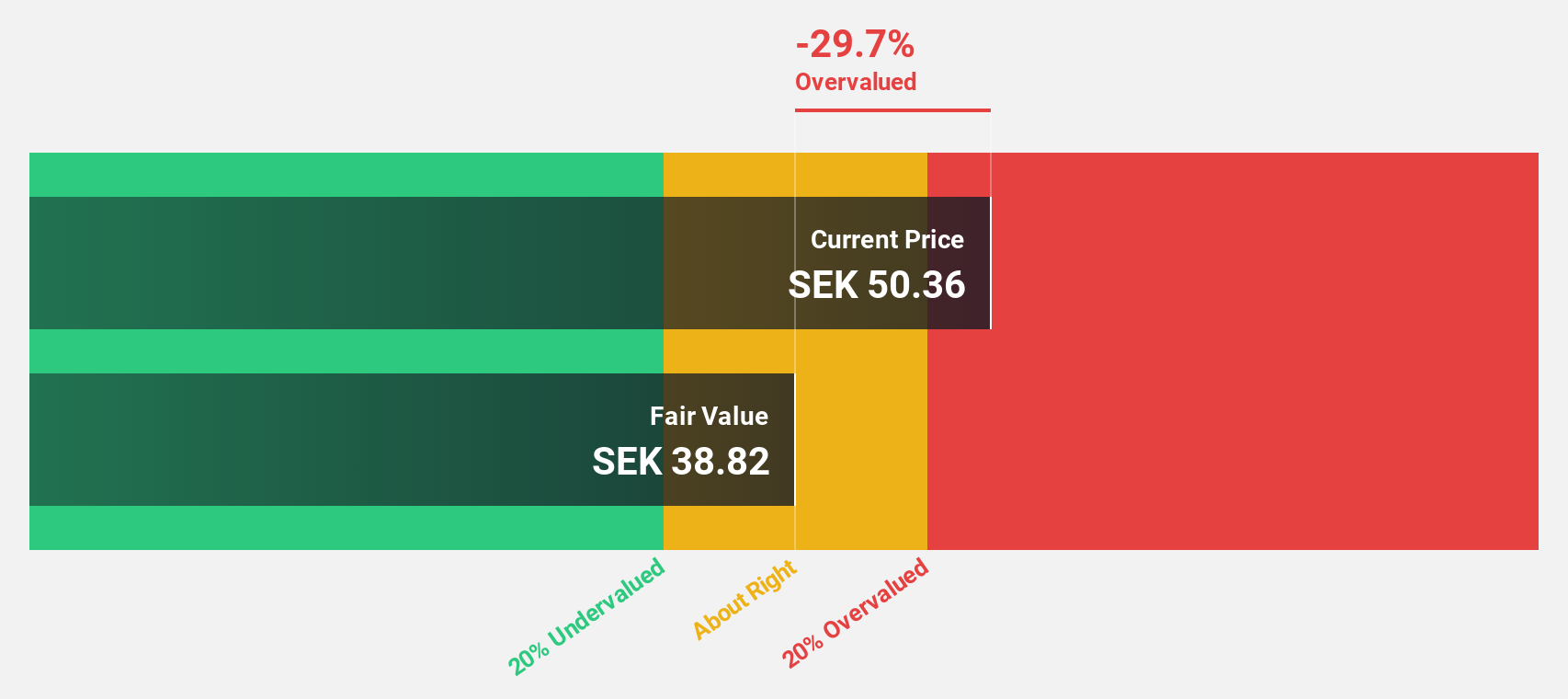

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB (publ) is a company that produces and sells outdoor power products, watering products, and lawn care power equipment, with a market cap of approximately SEK33.17 billion.

Operations: The company's revenue segments include Gardena at SEK12.34 billion, Husqvarna Construction at SEK7.91 billion, and Husqvarna Forest & Garden at SEK28.08 billion.

Estimated Discount To Fair Value: 12.8%

Husqvarna, trading at SEK 57.96, is undervalued relative to its estimated fair value of SEK 66.46 based on discounted cash flow analysis. Despite recent challenges such as a net loss in Q3 and anticipated sales decline in Q4 due to market conditions and inventory adjustments, the company is poised for significant earnings growth of 38.3% annually over the next three years, outpacing Swedish market averages.

- Our comprehensive growth report raises the possibility that Husqvarna is poised for substantial financial growth.

- Navigate through the intricacies of Husqvarna with our comprehensive financial health report here.

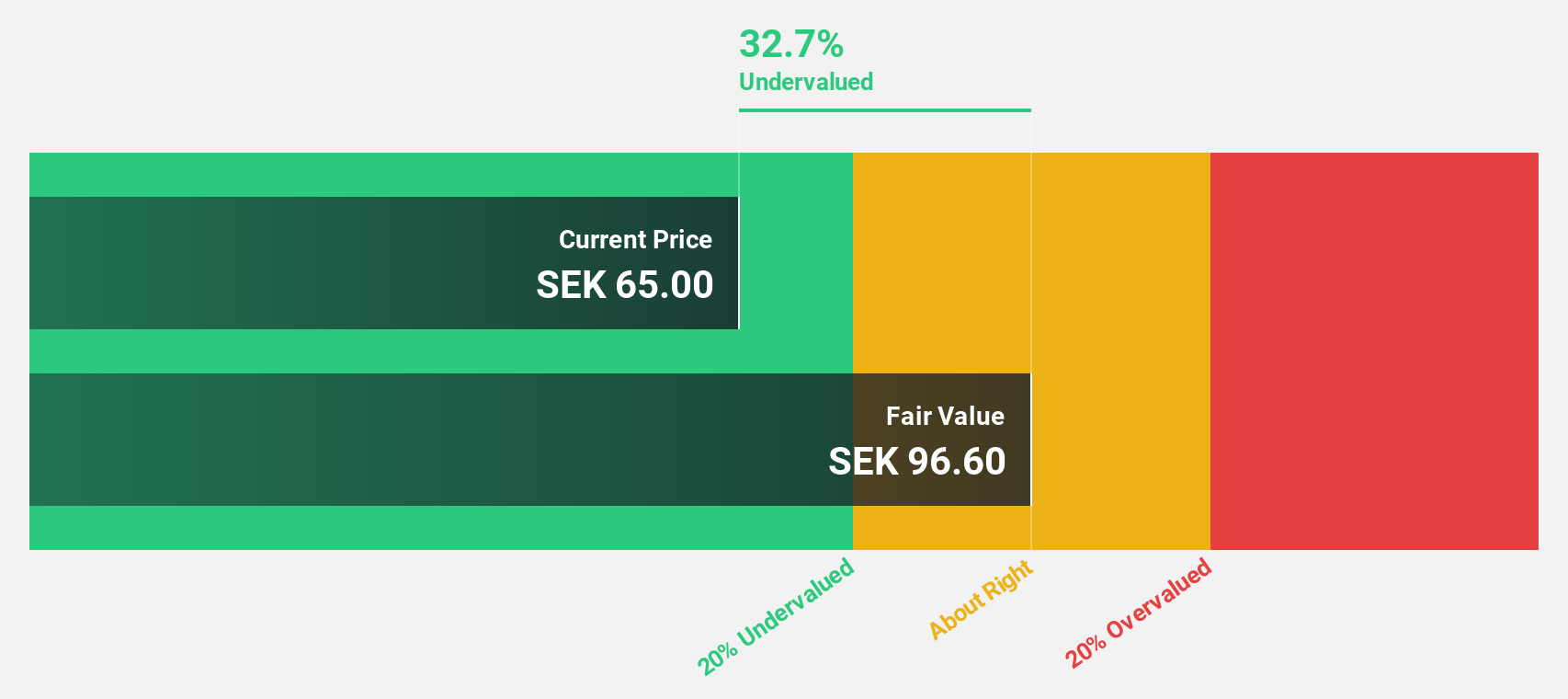

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK17.84 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to approximately SEK1.78 billion.

Estimated Discount To Fair Value: 41.3%

Truecaller, trading at SEK 52, is significantly undervalued with an estimated fair value of SEK 88.62 based on discounted cash flow analysis. Despite a modest increase in Q3 net income to SEK 117.83 million, the company is poised for substantial earnings growth of 23.6% annually over the next three years, surpassing Swedish market averages. Recent partnerships with major financial institutions enhance its business communication solutions and strengthen its market position globally.

- The growth report we've compiled suggests that Truecaller's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Truecaller's balance sheet health report.

Key Takeaways

- Access the full spectrum of 871 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives