- Turkey

- /

- Construction

- /

- IBSE:RALYH

Undiscovered Gems in the Middle East for April 2025

Reviewed by Simply Wall St

As Middle Eastern markets grapple with recession fears fueled by U.S. tariffs and a potential global trade war, key indices across the region have seen significant declines, highlighting the volatility in Gulf bourses. Despite these challenges, opportunities remain for discerning investors who can identify stocks with strong fundamentals and resilience in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.06% | 49.99% | 57.15% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 13.42% | 32.03% | 47.24% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Meditera Tibbi Malzeme Sanayi ve Ticaret Anonim Sirketi | 2.10% | 33.53% | -19.97% | ★★★★★☆ |

| Ege Endüstri ve Ticaret | 19.99% | 43.25% | 22.60% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.68% | 12.49% | 49.63% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 91.93% | 46.59% | 3.35% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY14.97 billion.

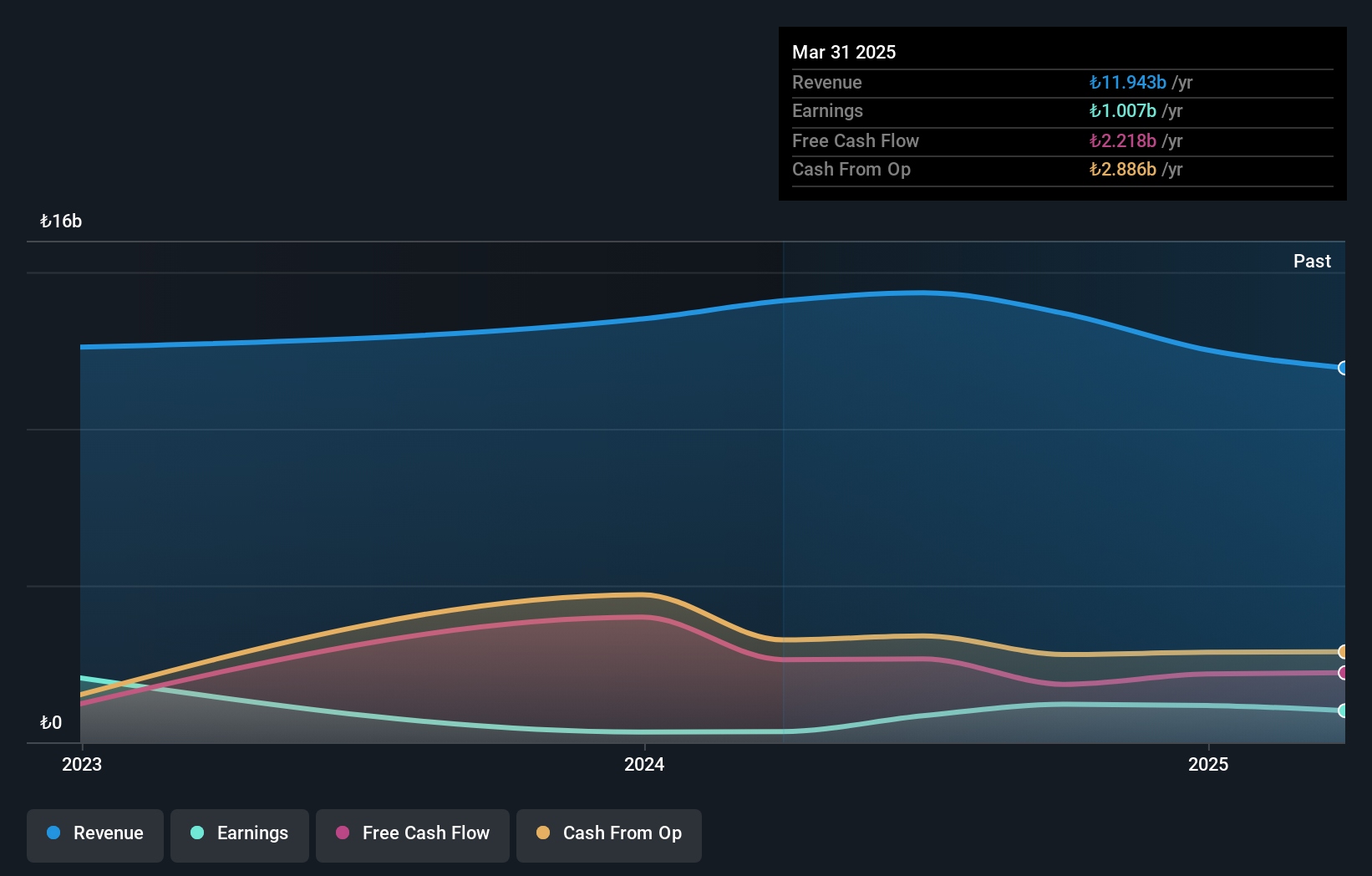

Operations: Lila Kagit generates revenue primarily from its Paper & Paper Products segment, amounting to TRY12.52 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of converting revenue into profit after accounting for all expenses.

Lila Kagit Sanayi Ve Ticaret, a nimble player in the Middle East market, has shown impressive earnings growth of 262.7% over the past year, outpacing its industry peers. Despite a revenue drop of 7.3%, the company remains profitable with a price-to-earnings ratio of 12.7x, which is attractive compared to Turkey's market average of 17.5x. With more cash than total debt and positive free cash flow throughout recent periods, Lila Kagit appears financially robust despite challenges in sales figures from TRY 13,507 million to TRY 12,518 million over the last year.

Ral Yatirim Holding (IBSE:RALYH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ral Yatirim Holding A.S. operates in the construction, energy, and education sectors with a market capitalization of TRY32.47 billion.

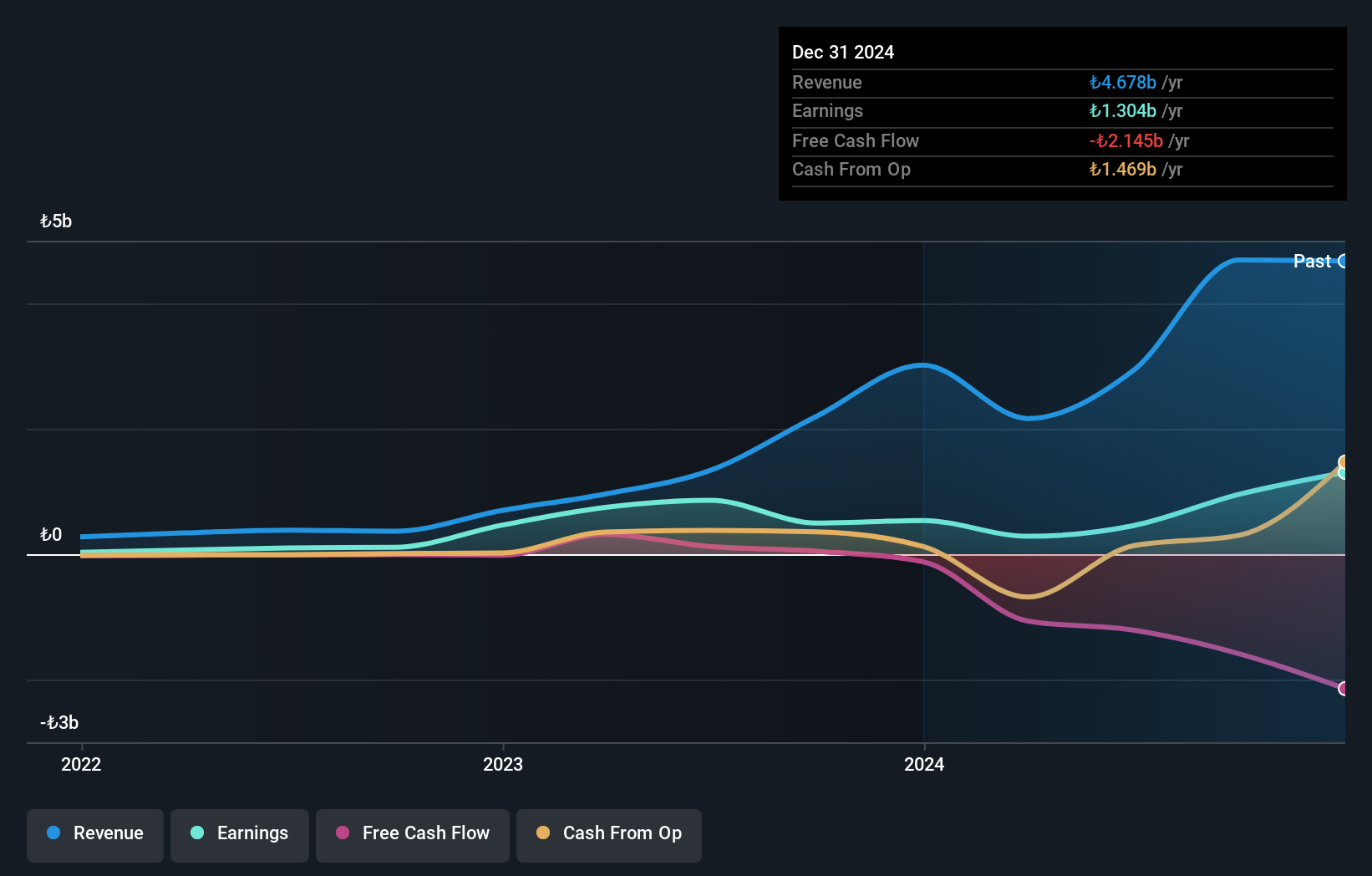

Operations: Ral Yatirim Holding generates revenue primarily from its construction segment, which accounts for TRY4.61 billion, with additional contributions from investment holding activities at TRY76.89 million. The energy segment contributes minimally to the overall revenue stream.

Ral Yatirim Holding's financial landscape is intriguing, with a notable earnings surge of 142.7% over the past year, outpacing the construction industry's growth. Despite its profitability and ability to cover interest payments comfortably, the company's net debt to equity ratio stands at a high 63.1%, having risen from 20.8% over five years, indicating increased leverage. The firm reported robust sales of TRY 4.68 billion for the year ending December 2024, up from TRY 3.02 billion previously, while net income soared to TRY 1.30 billion from TRY 537 million last year, underscoring strong operational performance amidst rising debt levels and non-cash earnings complexities.

- Click here and access our complete health analysis report to understand the dynamics of Ral Yatirim Holding.

Explore historical data to track Ral Yatirim Holding's performance over time in our Past section.

Villar International (TASE:VILR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Villar International Ltd., with a market cap of ₪3.24 billion, operates in the development and construction of properties both within Israel and on an international scale through its subsidiaries.

Operations: Villar International generates revenue primarily from its property development and construction activities. The company reported a market cap of ₪3.24 billion, indicating its substantial presence in the industry.

Villar International, a promising player in the Middle East real estate sector, showcases a compelling financial profile. The company's P/E ratio of 9.1x is attractive compared to the IL market's 13.4x, suggesting potential undervaluation. Over five years, Villar has improved its debt-to-equity from 30.7% to 19.9%, indicating prudent financial management. Earnings surged by 43.8% last year, outpacing industry growth of 36.2%. Despite a significant one-off gain of ₪239M affecting recent results, the net debt-to-equity remains satisfactory at 14.3%. With strong EBIT covering interest payments by 6.7x, Villar seems well-positioned financially for future endeavors.

Where To Now?

- Investigate our full lineup of 241 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:RALYH

Ral Yatirim Holding

Engages in the construction, energy, and education activities.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives