- Israel

- /

- Hospitality

- /

- TASE:TRA

Middle Eastern Penny Stocks With Market Caps Larger Than US$30M

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently exhibited mixed performance, influenced by weak corporate earnings and geopolitical tensions such as U.S. investment curbs on China. Despite these challenges, the region continues to offer unique opportunities for investors willing to explore beyond traditional large-cap stocks. While the term "penny stocks" might seem outdated, it still captures the essence of investing in smaller or newer companies that can offer both affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.546 | ₪176.54M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.058 | ₪3.29B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.11 | SAR1.65B | ★★★★★★ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.43 | TRY1.22B | ★★★★★☆ |

| Tgi Infrastructures (TASE:TGI) | ₪2.37 | ₪176.19M | ★★★★★☆ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY2.04 | TRY571.2M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.29 | AED9.74B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.328 | ₪517.77M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.762 | ₪71.1M | ★★★★★★ |

| Gilat Telecom Global (TASE:GLTL) | ₪0.68 | ₪46.67M | ★★★★☆☆ |

Click here to see the full list of 90 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ihlas Gazetecilik A.S. engages in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines both in Turkey and internationally with a market cap of TRY1.25 billion.

Operations: The company's revenue is primarily derived from its publishing segment, specifically newspapers, which generated TRY1.26 billion.

Market Cap: TRY1.25B

Ihlas Gazetecilik has a market cap of TRY1.25 billion, with revenues primarily from its newspaper publishing segment, generating TRY1.26 billion. Despite being unprofitable and experiencing a significant decline in earnings over the past five years, it maintains a strong cash position exceeding its debt and liabilities. The company has not diluted shareholders recently and boasts an experienced board with an average tenure of 7.7 years. However, its share price remains highly volatile, and it faces challenges in achieving profitability despite having sufficient cash runway for over three years under current conditions.

- Unlock comprehensive insights into our analysis of Ihlas Gazetecilik stock in this financial health report.

- Learn about Ihlas Gazetecilik's historical performance here.

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. operates in the manufacturing sector, specializing in vehicle-mounted equipment, with a market cap of TRY2.22 billion.

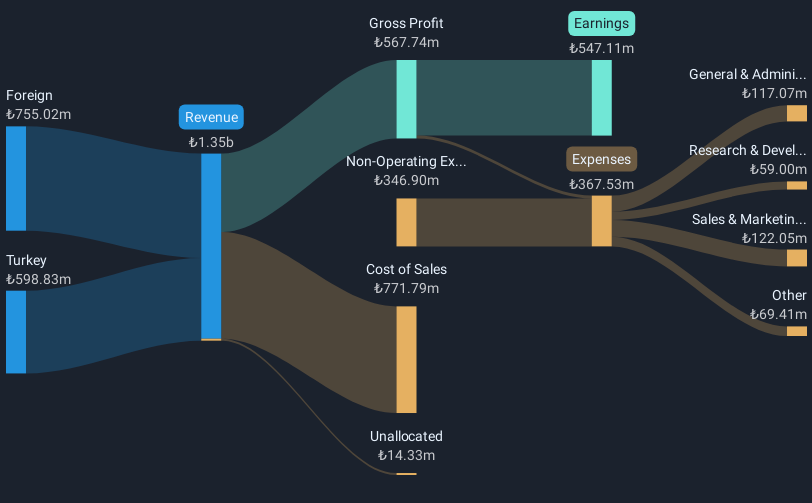

Operations: The company generates revenue of TRY1.34 billion from its vehicle equipment manufacturing segment.

Market Cap: TRY2.22B

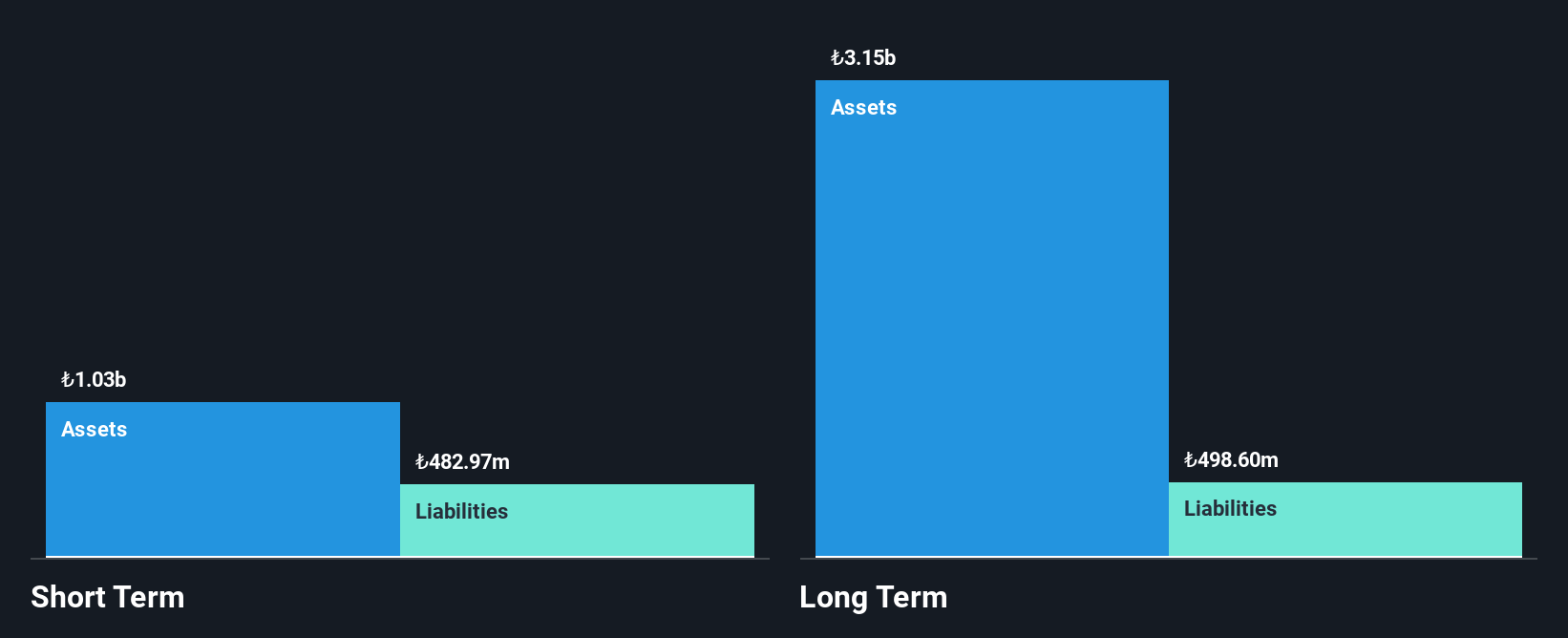

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. has demonstrated financial resilience with a market cap of TRY2.22 billion and revenue of TRY1.34 billion in vehicle equipment manufacturing. The company has transitioned to profitability, reporting a net income of TRY547.11 million for 2024, compared to a loss the previous year, despite declining sales figures. Its debt is well covered by operating cash flow, and both short-term and long-term liabilities are adequately managed with assets exceeding obligations significantly. However, interest coverage remains weak at 1.4 times EBIT, which may warrant attention for future financial planning.

- Click here to discover the nuances of Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret with our detailed analytical financial health report.

- Understand Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's track record by examining our performance history report.

Tarya Israel (TASE:TRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tarya Israel Ltd, with a market cap of ₪135.07 million, operates an internet platform in Israel through its subsidiaries.

Operations: The company generates revenue through two main segments: Credit Brokerage, contributing ₪25.49 million, and Credit Provision, accounting for ₪1.25 million.

Market Cap: ₪135.07M

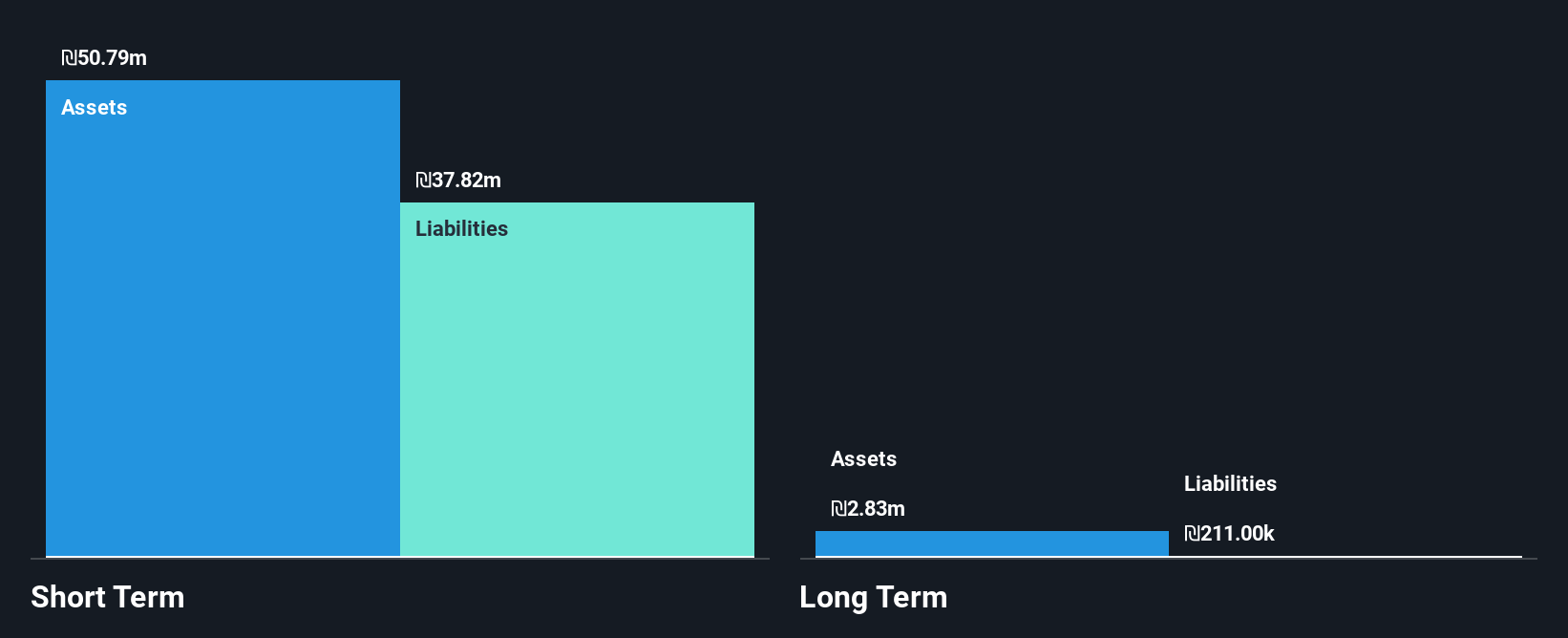

Tarya Israel Ltd, with a market cap of ₪135.07 million, operates an internet platform and generates revenue primarily through Credit Brokerage (₪25.49 million) and Credit Provision (₪1.25 million). Despite being unprofitable with increasing losses over the past five years, Tarya maintains a stable cash runway exceeding three years due to positive free cash flow. The company's short-term assets significantly cover both short-term and long-term liabilities, indicating strong liquidity management. However, its share price has been highly volatile recently, and the board's average tenure suggests limited experience in navigating complex market conditions.

- Jump into the full analysis health report here for a deeper understanding of Tarya Israel.

- Review our historical performance report to gain insights into Tarya Israel's track record.

Turning Ideas Into Actions

- Dive into all 90 of the Middle Eastern Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarya Israel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TRA

Excellent balance sheet low.

Market Insights

Community Narratives