- France

- /

- Specialty Stores

- /

- ENXTPA:SAMS

Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are navigating a complex landscape marked by mixed performances and economic uncertainties. Despite recent fluctuations, such as the S&P 500's year-end slump and ongoing challenges in manufacturing sectors, dividend stocks remain an attractive option for investors seeking steady income amidst volatility. In this environment, a good dividend stock is characterized by its ability to offer consistent payouts while maintaining financial stability even when broader market conditions are less predictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.57% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

FinecoBank Banca Fineco (BIT:FBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinecoBank Banca Fineco S.p.A. offers a range of banking and investment products and services, with a market cap of approximately €10.45 billion.

Operations: FinecoBank Banca Fineco S.p.A. generates revenue primarily from its banking segment, which accounts for €1.30 billion.

Dividend Yield: 4%

FinecoBank Banca Fineco's dividend payments have been volatile over the past decade, with significant annual drops, making them unreliable. Despite this, current dividends are covered by earnings at a 67.9% payout ratio and expected to remain covered in three years at 76%. Although its dividend yield of 4.04% is low compared to top Italian market payers, recent earnings growth suggests potential stability improvements. Recent net income increased to €169.68 million for Q3 2024 from €145.32 million the previous year.

- Unlock comprehensive insights into our analysis of FinecoBank Banca Fineco stock in this dividend report.

- Our valuation report unveils the possibility FinecoBank Banca Fineco's shares may be trading at a premium.

Samse (ENXTPA:SAMS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA is a French company that distributes building materials and tools, with a market cap of €505.55 million.

Operations: Samse SA generates revenue from its Trading segment, which accounts for €1.69 billion, and its Do-It-Yourself segment, contributing €429.36 million.

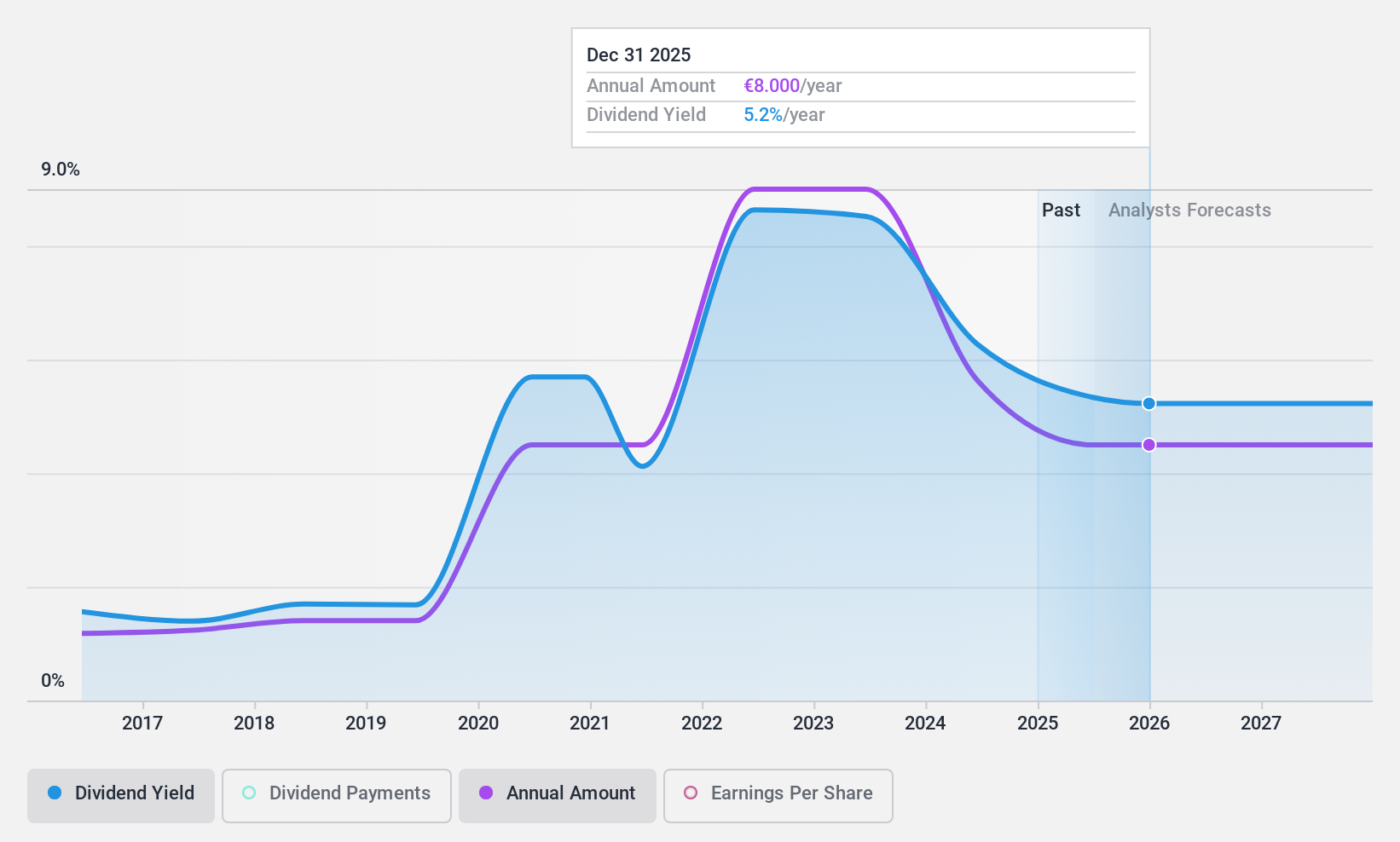

Dividend Yield: 6.8%

Samse's dividend yield of 6.78% ranks in the top 25% of French market payers, though its dividend history is unstable with volatility over the past decade. Current dividends are covered by earnings at a payout ratio of 79.7% and strongly supported by cash flows with a cash payout ratio of 28%. Despite declining profit margins from last year and forecasted earnings decreases, its price-to-earnings ratio suggests it trades at a good value compared to the broader market.

- Click to explore a detailed breakdown of our findings in Samse's dividend report.

- Our expertly prepared valuation report Samse implies its share price may be lower than expected.

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers a range of banking products and services both in Turkey and internationally, with a market capitalization of TRY263.38 billion.

Operations: Yapi ve Kredi Bankasi A.S. generates revenue through several segments, including Retail Banking (Incl. Private Banking and Wealth Management) at TRY80.12 billion, Commercial and SME Banking at TRY51.26 billion, Corporate Banking at TRY13.81 billion, Other Domestic Operations at TRY12.60 billion, and Other Foreign Operations at TRY4.95 billion.

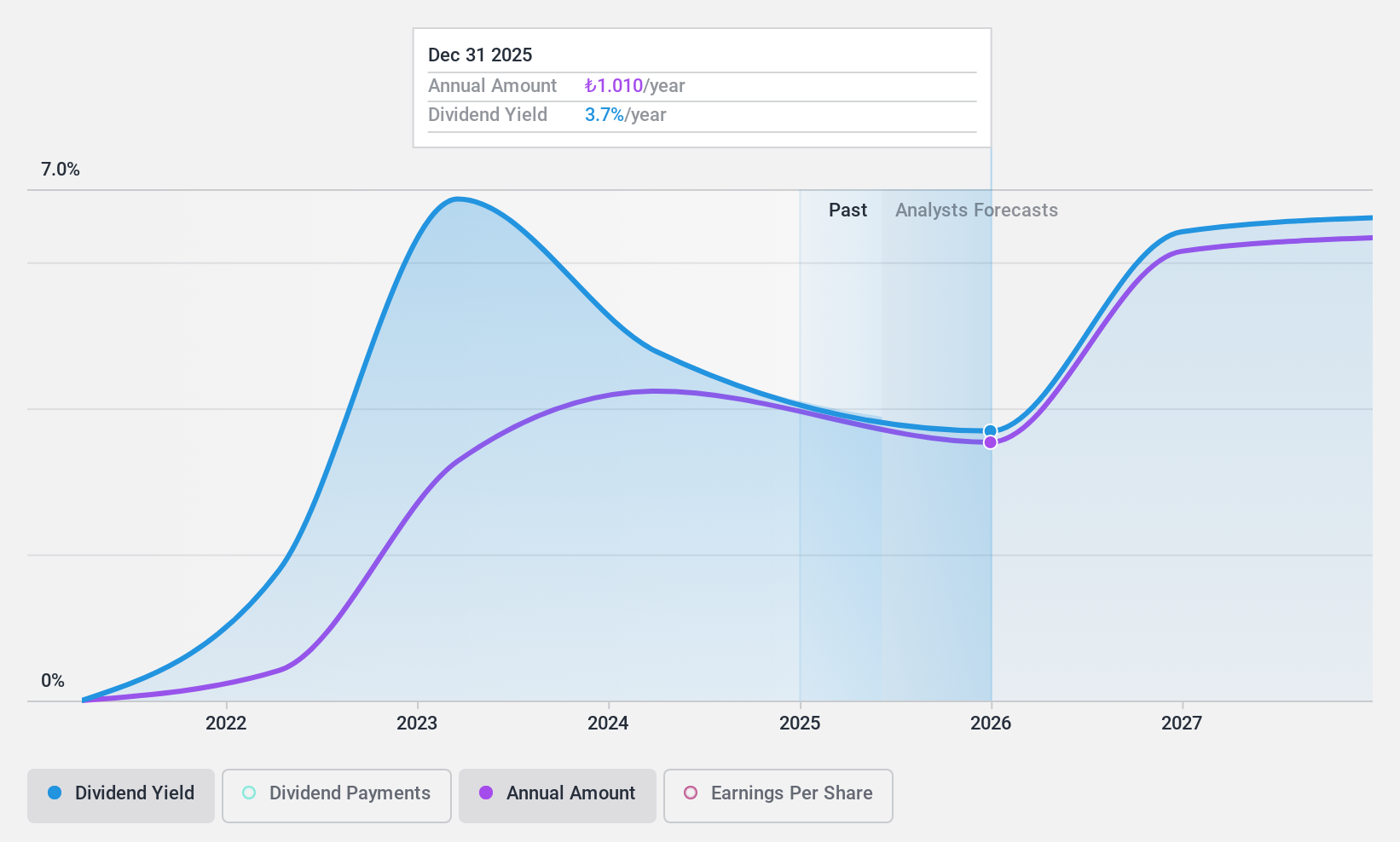

Dividend Yield: 3.9%

Yapi ve Kredi Bankasi's dividend yield of 3.88% is among the top 25% in Turkey, supported by a low payout ratio of 24.5%, indicating strong coverage by earnings. However, its dividend history is marked by volatility and unreliability over the past decade. Despite recent declines in net income to TRY 22.41 billion for nine months ending September 2024, dividends remain sustainable with future coverage expected to improve further to a payout ratio of 16.3%.

- Delve into the full analysis dividend report here for a deeper understanding of Yapi ve Kredi Bankasi.

- Our valuation report unveils the possibility Yapi ve Kredi Bankasi's shares may be trading at a discount.

Taking Advantage

- Unlock our comprehensive list of 1979 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAMS

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives