- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Growth Companies With High Insider Ownership To Watch In January 2025

Reviewed by Simply Wall St

As global markets experience a boost from easing core U.S. inflation and strong bank earnings, investors are keenly observing the shifting dynamics between value and growth stocks, with recent trends favoring the former due to sector-specific performances. Amidst this backdrop, identifying growth companies with high insider ownership can be particularly appealing, as such ownership often signals confidence in a company's long-term prospects, aligning well with current market optimism.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.1% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 108.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 22.5% |

Let's explore several standout options from the results in the screener.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Haci Ömer Sabanci Holding A.S. is a diversified conglomerate operating primarily in the finance, manufacturing, and trading sectors worldwide, with a market cap of TRY215.50 billion.

Operations: The company's revenue is primarily derived from its banking segment at TRY465.63 billion, followed by energy at TRY156.09 billion, digital services at TRY52.14 billion, and financial services contributing TRY42.20 billion.

Insider Ownership: 20.7%

Revenue Growth Forecast: 82.5% p.a.

Haci Ömer Sabanci Holding demonstrates potential for growth with forecasted revenue and earnings expansion of 82.5% and 107.21% per year, respectively, outpacing the Turkish market averages. Despite this, recent financials show a net loss of TRY 11.13 billion over nine months in 2024, highlighting challenges in profitability and a decline in profit margins to 1.1%. The company's Return on Equity is projected to remain low at 14.1%, while insider trading activity shows no significant changes recently.

- Dive into the specifics of Haci Ömer Sabanci Holding here with our thorough growth forecast report.

- The analysis detailed in our Haci Ömer Sabanci Holding valuation report hints at an inflated share price compared to its estimated value.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EQT AB (publ) is a global private equity firm focusing on private capital and real asset segments, with a market cap of approximately SEK445.95 billion.

Operations: The company's revenue segments include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

Insider Ownership: 12.2%

Revenue Growth Forecast: 15.4% p.a.

EQT AB's recent financial performance showcases robust growth, with revenue reaching EUR 2.65 billion and net income soaring to EUR 776 million for 2024. Despite significant insider selling recently, the company's earnings are projected to grow at an impressive rate of 34.25% annually over the next three years, surpassing Swedish market averages. However, Return on Equity is expected to remain modest at 19.6%. Active in M&A discussions, EQT seeks strategic expansion opportunities.

- Delve into the full analysis future growth report here for a deeper understanding of EQT.

- Upon reviewing our latest valuation report, EQT's share price might be too optimistic.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF36.66 billion.

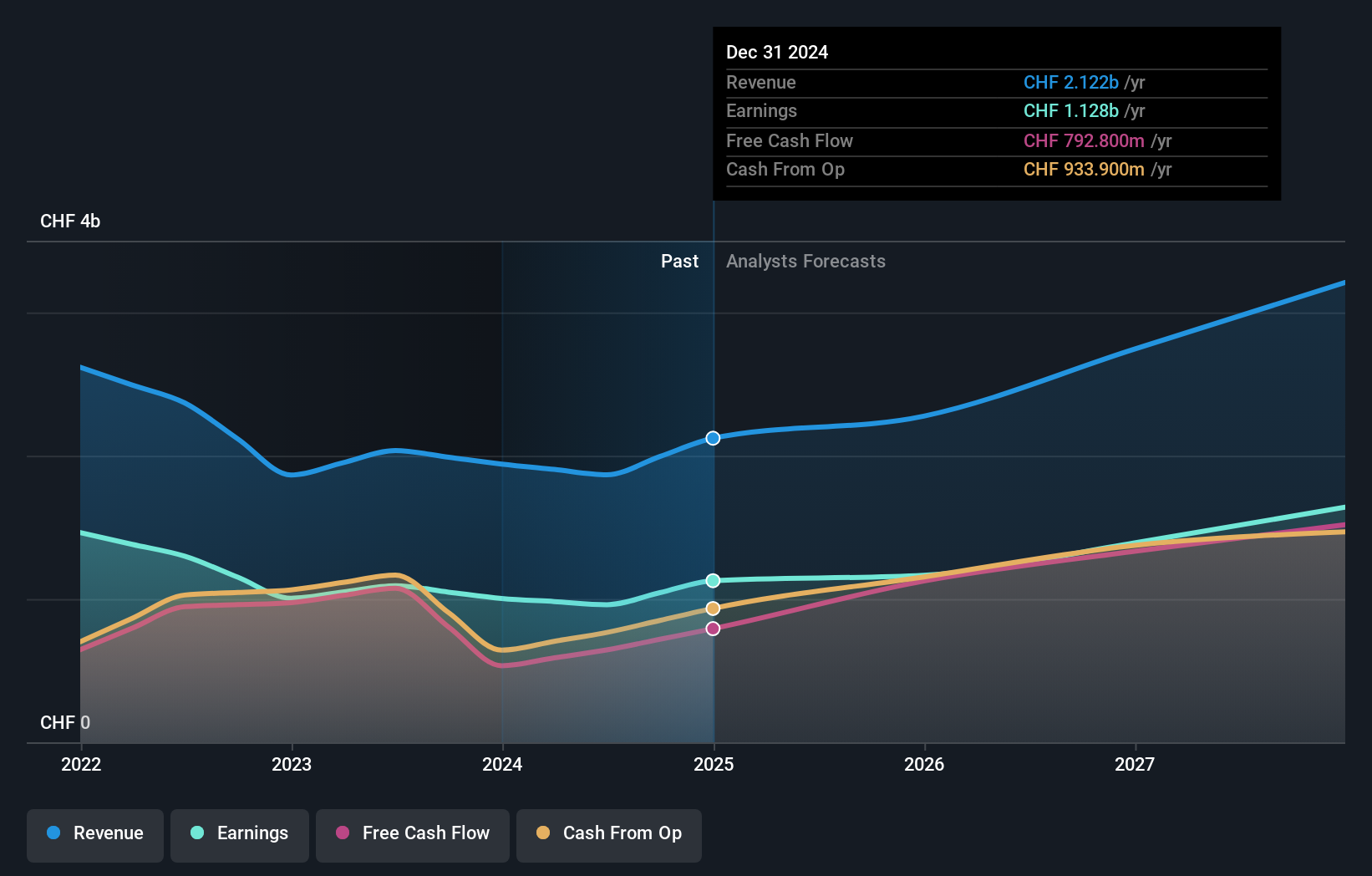

Operations: The company's revenue segments include CHF1.19 billion from Private Equity, CHF254.90 million from Infrastructure, CHF218.90 million from Private Credit, and CHF190.90 million from Real Estate.

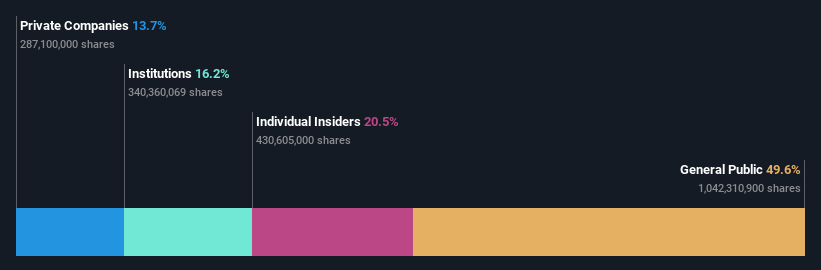

Insider Ownership: 17%

Revenue Growth Forecast: 14.6% p.a.

Partners Group Holding is actively seeking strategic acquisitions to enhance its real estate vertical, aligning with its growth strategy. The company's revenue is forecasted to grow at 14.6% annually, outpacing the Swiss market average. Despite high debt levels, Partners Group maintains a strong return on equity projection of 53.2%. Its earnings are expected to increase by 14.2% annually, driven by substantial client asset growth and strategic collaborations in private wealth and insurance sectors for 2025.

- Click to explore a detailed breakdown of our findings in Partners Group Holding's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Partners Group Holding shares in the market.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1462 Fast Growing Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Reasonable growth potential with adequate balance sheet.