As global markets navigate a period of mixed economic signals, with U.S. consumer confidence dipping and European stocks experiencing modest gains, investors are increasingly turning their attention to stable income-generating opportunities. In such an environment, dividend stocks that offer attractive yields can provide a reliable source of income while potentially benefiting from market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

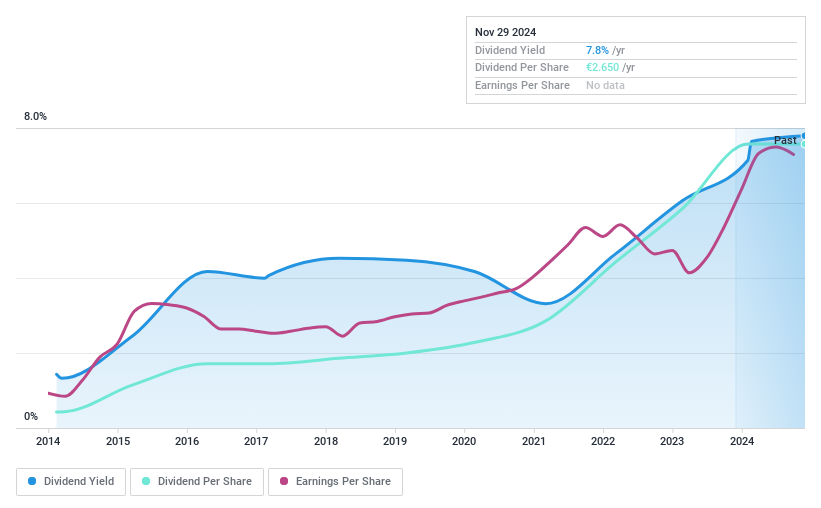

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ålandsbanken Abp operates as a commercial bank serving private individuals and companies in Finland and Sweden, with a market cap of €510.27 million.

Operations: Ålandsbanken Abp generates its revenue from various segments, including IT (€52.97 million), Premium Banking (€73.37 million), Corporate and Other (€8.42 million), and Private Banking (Including Asset Management) (€100.64 million).

Dividend Yield: 7.6%

Ålandsbanken Abp offers an attractive dividend yield of 7.57%, ranking in the top 25% among Finnish dividend payers. The bank's dividends have been stable and reliable over the past decade, supported by a reasonable payout ratio of 65.8%. However, concerns arise from its high level of bad loans at 2% and a low allowance for bad loans at 24%. Recent earnings growth of €39.9 million for nine months indicates potential for continued dividend support.

- Take a closer look at Ålandsbanken Abp's potential here in our dividend report.

- Our valuation report unveils the possibility Ålandsbanken Abp's shares may be trading at a premium.

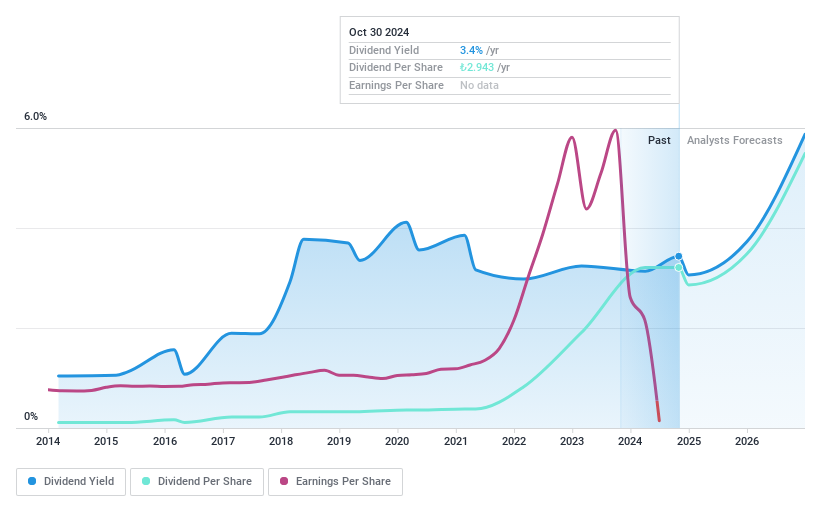

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haci Ömer Sabanci Holding A.S. operates primarily in the finance, manufacturing, and trading sectors worldwide with a market cap of TRY210.46 billion.

Operations: Haci Ömer Sabanci Holding A.S. generates revenue primarily from its banking segment at TRY465.63 billion, followed by energy at TRY156.09 billion, digital services at TRY52.14 billion, and financial services at TRY42.20 billion.

Dividend Yield: 3%

Haci Ömer Sabanci Holding's dividend yield of 3% ranks in the top 25% of Turkish payers, yet its dividends have been volatile and unreliable over the past decade. The current high payout ratio of 392.4% suggests dividends are not well covered by earnings, although forecasts indicate improved coverage in three years. Recent financial performance shows a net loss for nine months ending September 2024, with significant declines in net interest income and profit margins compared to the previous year.

- Unlock comprehensive insights into our analysis of Haci Ömer Sabanci Holding stock in this dividend report.

- Our expertly prepared valuation report Haci Ömer Sabanci Holding implies its share price may be too high.

Meiwa (TSE:8103)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Meiwa Corporation operates in the chemicals, lubricants, battery materials, automotive and mineral resource, and environmental sectors both in Japan and internationally, with a market cap of ¥26.12 billion.

Operations: Meiwa Corporation's revenue segments include First Business at ¥42.86 billion, Third Business at ¥59.98 billion, Second Business at ¥47.67 billion, and Automobile/Battery Materials Business at ¥11.34 billion.

Dividend Yield: 4.9%

Meiwa's dividend yield of 4.92% places it among the top 25% of dividend payers in Japan, though its dividends have been volatile and unreliable over the past decade. Despite this instability, dividends are well covered by earnings with a payout ratio of 45.2% and cash flows with a cash payout ratio of 25.9%. Additionally, Meiwa's earnings grew significantly by 94.6% last year, supporting its ability to maintain current dividend levels despite past volatility.

- Click here to discover the nuances of Meiwa with our detailed analytical dividend report.

- Our expertly prepared valuation report Meiwa implies its share price may be lower than expected.

Taking Advantage

- Navigate through the entire inventory of 1943 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ALBAV

Ålandsbanken Abp

Operates as a commercial bank for private individuals and companies in Finland and Sweden.

Solid track record established dividend payer.

Market Insights

Community Narratives