- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A179900

3 Growth Companies Backed By Insider Confidence

Reviewed by Simply Wall St

In recent weeks, global markets have been characterized by fluctuating indices and sector-specific movements, with notable advancements in the U.S. small-cap and mid-cap segments, while European markets responded to interest rate cuts with moderate gains. Amidst these shifting economic landscapes, growth companies with high insider ownership stand out as potentially attractive investment opportunities due to the confidence insiders demonstrate through their substantial holdings.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| KebNi (OM:KEBNI B) | 36.3% | 87.2% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

We're going to check out a few of the best picks from our screener tool.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Haci Ömer Sabanci Holding A.S. operates primarily in the finance, manufacturing, and trading sectors worldwide with a market cap of TRY174.75 billion.

Operations: The company's revenue is primarily derived from its banking segment at TRY438.35 billion, followed by the energy sector contributing TRY171.88 billion, digital services at TRY52.22 billion, and financial services generating TRY41.51 billion.

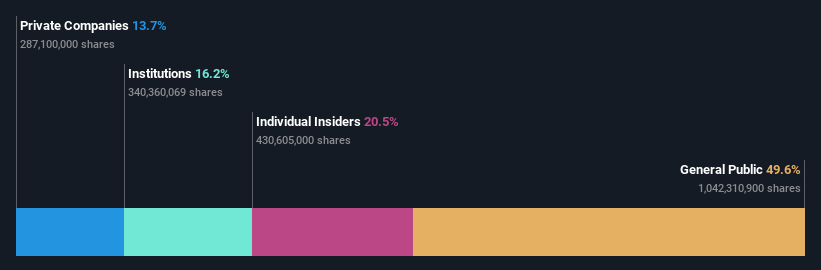

Insider Ownership: 20.5%

Haci Ömer Sabanci Holding is poised for significant growth, with revenue expected to increase by 75.5% annually, outpacing the market's 24.3%. Despite recent financial challenges, including a TRY 7.63 billion net loss over six months and shareholder dilution, the company is seeking strategic partnerships through an IPO of its joint venture Enerjisa Uretim Santralleri AS. Analysts forecast a potential stock price rise of 60.3%, reflecting optimism about future profitability and expansion initiatives.

- Click here to discover the nuances of Haci Ömer Sabanci Holding with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Haci Ömer Sabanci Holding's share price might be too pessimistic.

UTI (KOSDAQ:A179900)

Simply Wall St Growth Rating: ★★★★★★

Overview: UTI Inc. is involved in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses both in South Korea and internationally, with a market cap of ₩375.76 billion.

Operations: The company generates its revenue primarily from the Electronic Components & Parts segment, amounting to ₩19.97 billion.

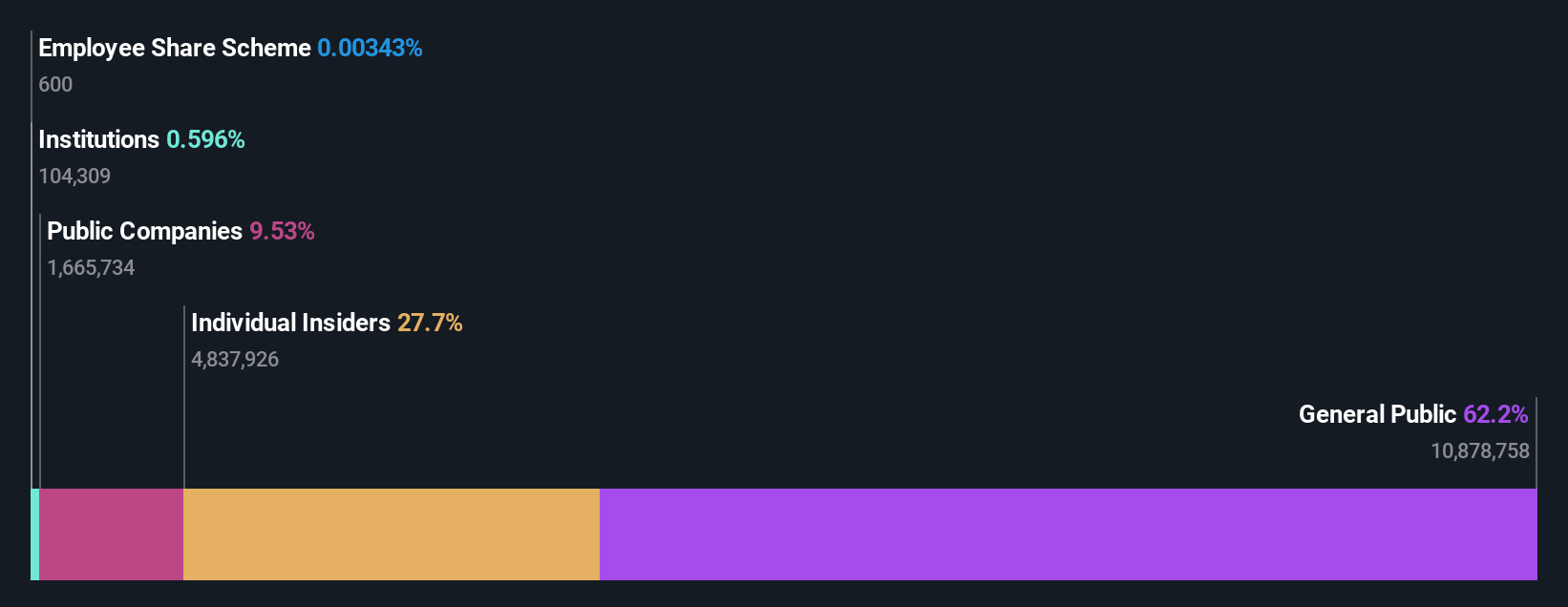

Insider Ownership: 33.1%

UTI is positioned for substantial growth, with revenue projected to rise by 115% annually, significantly outpacing the KR market's 10.3%. The company is expected to achieve profitability within three years, surpassing average market growth rates. Its Return on Equity is forecasted to be very high at 106.2% in three years. While there has been no significant insider trading activity recently, these projections indicate strong internal confidence in UTI's growth trajectory.

- Navigate through the intricacies of UTI with our comprehensive analyst estimates report here.

- Our valuation report here indicates UTI may be overvalued.

Qingdao Daneng Environmental Protection Equipment (SHSE:688501)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Daneng Environmental Protection Equipment Co., Ltd. operates in the environmental protection sector, focusing on manufacturing and supplying equipment for pollution control, with a market cap of CN¥1.83 billion.

Operations: Revenue Segments (in millions of CN¥): null

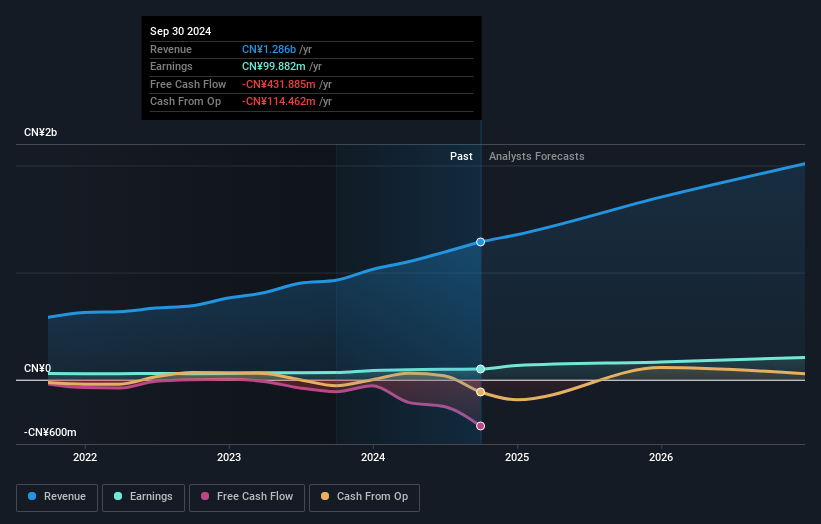

Insider Ownership: 27.2%

Qingdao Daneng Environmental Protection Equipment is experiencing robust growth, with revenue up from CNY 352.46 million to CNY 513.93 million year-on-year and net income increasing from CNY 12.89 million to CNY 23.98 million. The company's earnings are forecasted to grow at a significant rate of 27.8% annually, outpacing the CN market's average growth rate of 23.8%. Recent private placements indicate strong insider commitment despite no recent insider trading activity.

- Unlock comprehensive insights into our analysis of Qingdao Daneng Environmental Protection Equipment stock in this growth report.

- The analysis detailed in our Qingdao Daneng Environmental Protection Equipment valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Discover the full array of 1495 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade UTI, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A179900

UTI

Engages in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses in South Korea and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives