Undiscovered Gems And 2 Other Small Cap Finds With Promising Metrics

Reviewed by Simply Wall St

Amidst a backdrop of market optimism fueled by expectations of economic growth and tax reforms following the recent U.S. elections, small-cap stocks have shown significant movement. The Russell 2000 Index, although not yet at record highs, led gains with an impressive weekly surge, reflecting renewed investor confidence in the potential for earnings growth and regulatory changes. In such an environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and metrics that suggest resilience and growth potential despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Wanguo Gold Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

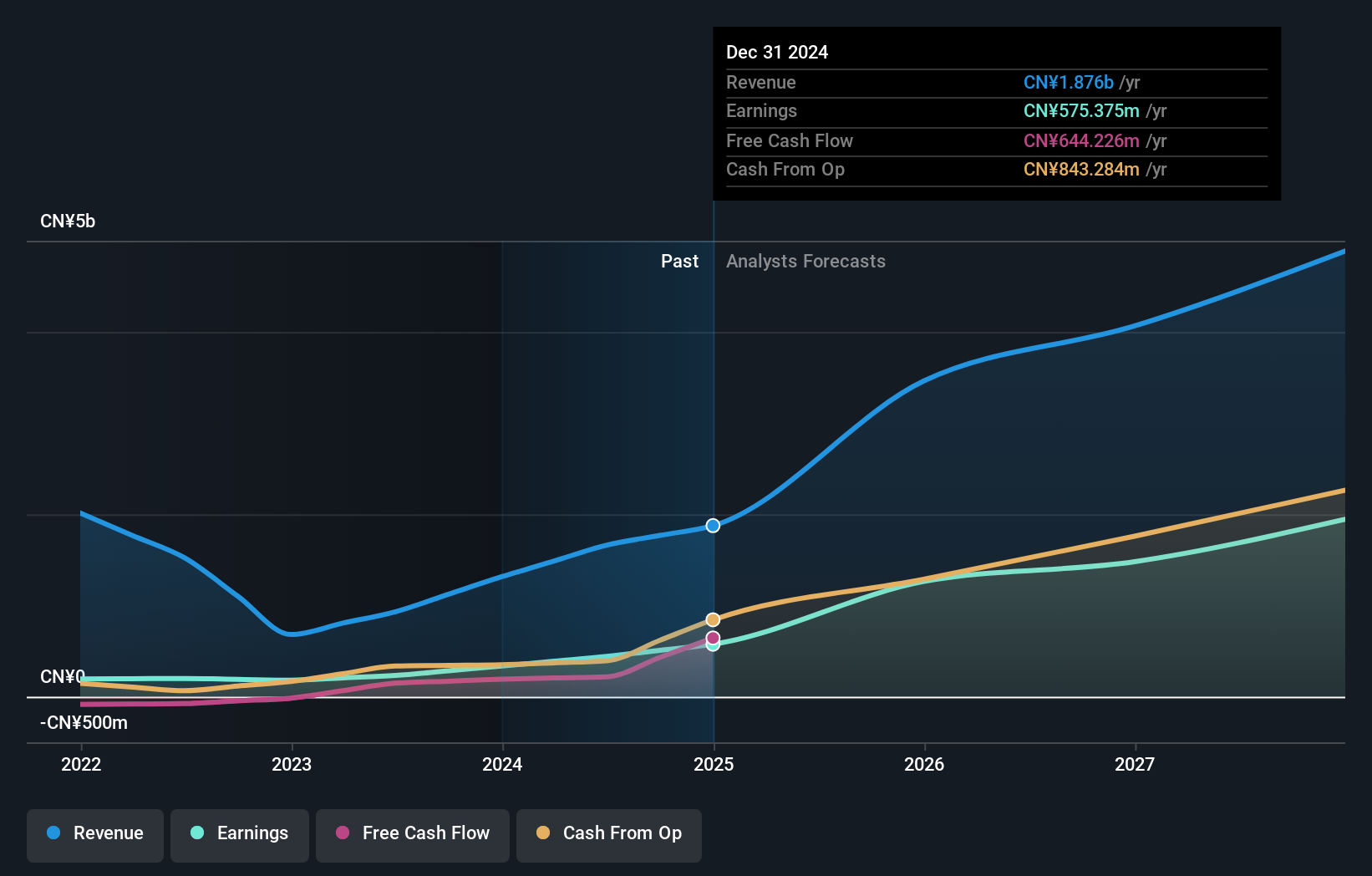

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market capitalization of HK$10.64 billion.

Operations: Wanguo Gold Group generates revenue primarily from its Yifeng Project and Solomon Project, contributing CN¥749.25 million and CN¥912.63 million respectively.

Wanguo Gold Group, a smaller player in the mining industry, has shown impressive earnings growth of 89.9% over the past year, outpacing its industry peers. The company's financial health seems solid with interest payments well covered by EBIT at 91.7x coverage and positive free cash flow of HKD 217.13 million as of June 2024. However, shareholders experienced dilution due to a recent follow-on equity offering amounting to HKD 1.38 billion at HKD 8.33 per share for additional capital expansion and acquisitions, which might enhance future growth prospects despite increasing shares outstanding.

- Take a closer look at Wanguo Gold Group's potential here in our health report.

Explore historical data to track Wanguo Gold Group's performance over time in our Past section.

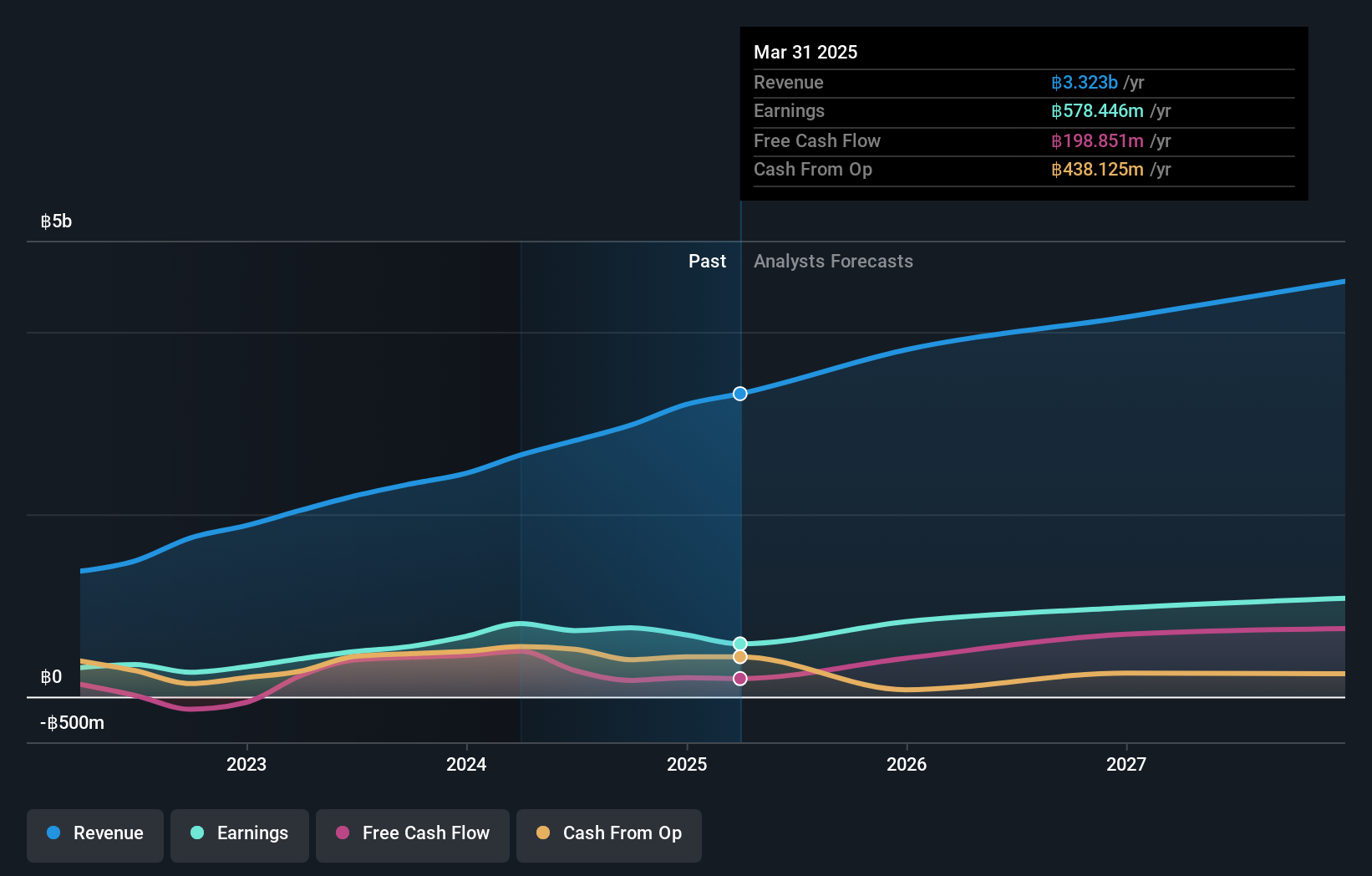

Karmarts (SET:KAMART)

Simply Wall St Value Rating: ★★★★★★

Overview: Karmarts Public Company Limited, along with its subsidiary, operates in Thailand focusing on the manufacturing, packaging, import, and distribution of cosmetics and consumer products with a market capitalization of THB13.86 billion.

Operations: Karmarts generates revenue primarily from the manufacture and distribution of consumer products, contributing THB2.77 billion, with a smaller segment from warehouse rental at THB26.15 million. The company also reports a minor negative figure in investment properties and by-products distribution at -THB1.33 million.

Karmarts, a promising player in the personal products sector, has shown impressive growth with earnings increasing by 46% over the past year, outpacing its industry peers. Despite this surge, recent financials reveal mixed results; second-quarter sales hit THB 746 million compared to THB 576 million last year, yet net income dipped to THB 52 million from THB 129 million. The company's debt-to-equity ratio improved significantly from 27% to nearly 16% over five years. With an interim dividend of THB 0.10 per share approved recently, Karmarts continues to display robust cash flow and strategic financial management.

- Unlock comprehensive insights into our analysis of Karmarts stock in this health report.

Review our historical performance report to gain insights into Karmarts''s past performance.

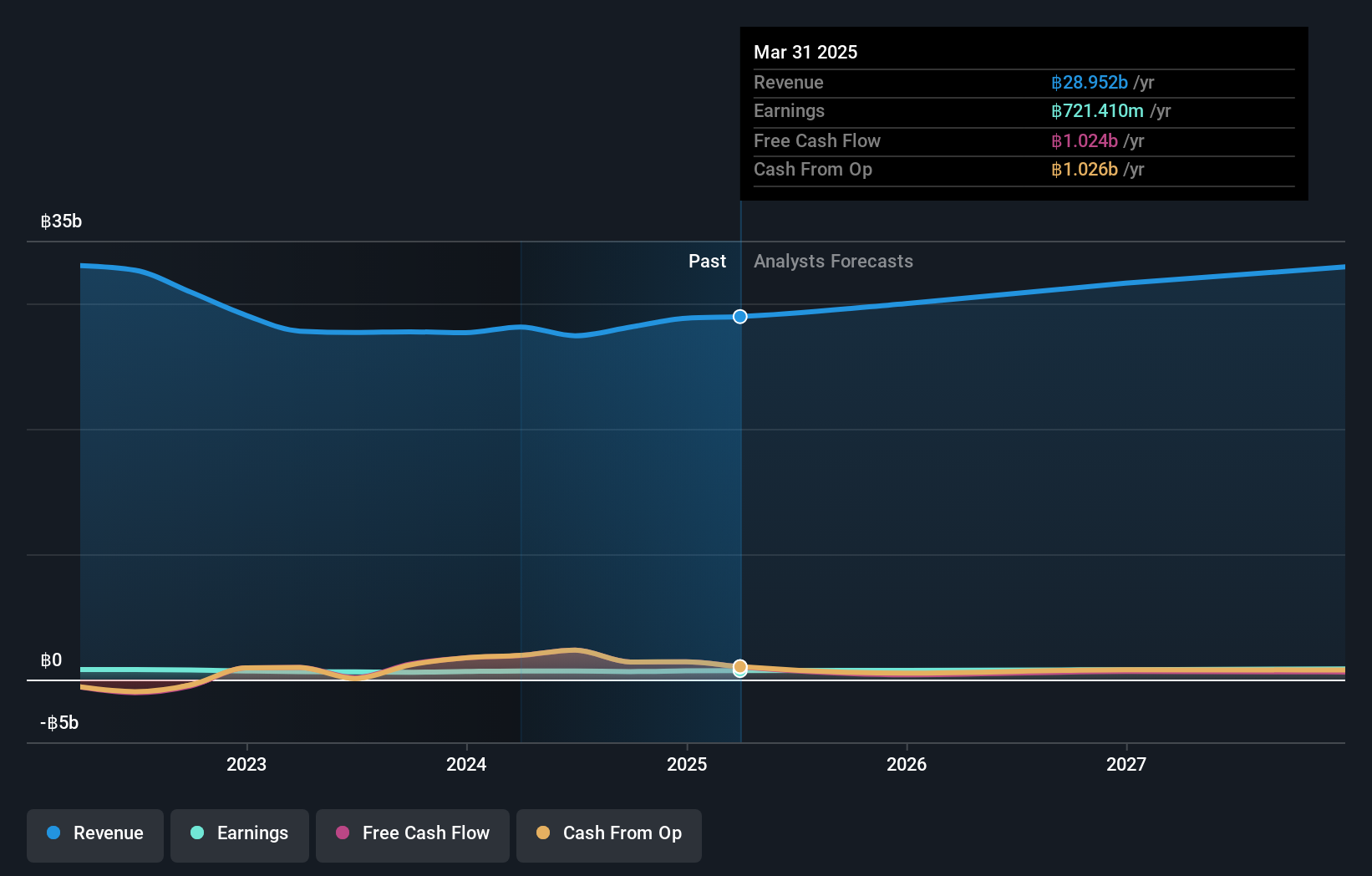

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Value Rating: ★★★★★☆

Overview: SiS Distribution (Thailand) Public Company Limited, along with its subsidiaries, operates in the Thai market distributing computer components, smartphones, and office automation equipment with a market capitalization of THB9.28 billion.

Operations: SiS Distribution (Thailand) generates revenue primarily from distributing computer components, smartphones, and office automation equipment. The company's financial performance is characterized by a focus on efficient cost management, which influences its net profit margin.

SiS Distribution (Thailand) has shown consistent growth, with earnings increasing 5.8% annually over the past five years, though recent figures reveal a net income of THB 119 million for the third quarter, down from THB 161 million last year. The company trades at nearly 60% below its estimated fair value and maintains high-quality earnings with EBIT covering interest payments 14.6 times over. Despite a high net debt to equity ratio of 53%, SiS has reduced its debt to equity from 88% to around 69% in five years, indicating improved financial health amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of SiS Distribution (Thailand).

Gain insights into SiS Distribution (Thailand)'s past trends and performance with our Past report.

Key Takeaways

- Gain an insight into the universe of 4643 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SIS

SiS Distribution (Thailand)

Engages in the distribution of computer components, smartphones, and office automation equipment in Thailand.

Solid track record with excellent balance sheet and pays a dividend.