- Thailand

- /

- Healthcare Services

- /

- SET:BIS

AyalaLand Logistics Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, marked by cautious Federal Reserve commentary and political uncertainties, which have contributed to broad-based declines in major indices. Amid these fluctuations, investors are increasingly looking at smaller or newer companies for potential growth opportunities. Despite the somewhat outdated term "penny stocks," these investments can still offer surprising value when backed by strong financial health and stability.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,850 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AyalaLand Logistics Holdings (PSE:ALLHC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AyalaLand Logistics Holdings Corp.,

Operations: The company's revenue is primarily derived from Real Estate and Property Development, contributing ₱4.92 billion, and Cold Storage Operations, which add ₱200.64 million.

Market Cap: ₱10.38B

AyalaLand Logistics Holdings has demonstrated significant revenue growth, with recent third-quarter sales reaching ₱1.36 billion, up from ₱601.13 million the previous year. The company reported a net income of ₱204.33 million for the same period, showcasing improved profitability despite a high net debt to equity ratio of 43.5%. While earnings have grown at an annual rate of 7% over five years, recent growth accelerated to 11.7%, surpassing industry averages slightly and indicating robust operational performance. However, its management team is relatively new with an average tenure of 1.6 years, suggesting potential leadership challenges ahead.

- Click to explore a detailed breakdown of our findings in AyalaLand Logistics Holdings' financial health report.

- Gain insights into AyalaLand Logistics Holdings' outlook and expected performance with our report on the company's earnings estimates.

Bioscience Animal Health (SET:BIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bioscience Animal Health Public Company Limited operates in Thailand, focusing on the manufacture and distribution of pharmaceutical supplies, medical devices, and equipment, with a market cap of THB967.12 million.

Operations: The company's revenue is derived from several segments, including Nutrition (THB555.8 million), Diagnostic (THB562.7 million), Ingredient (THB516.5 million), Animal Health (THB451.2 million), and Complete Feed (THB376.3 million).

Market Cap: THB967.12M

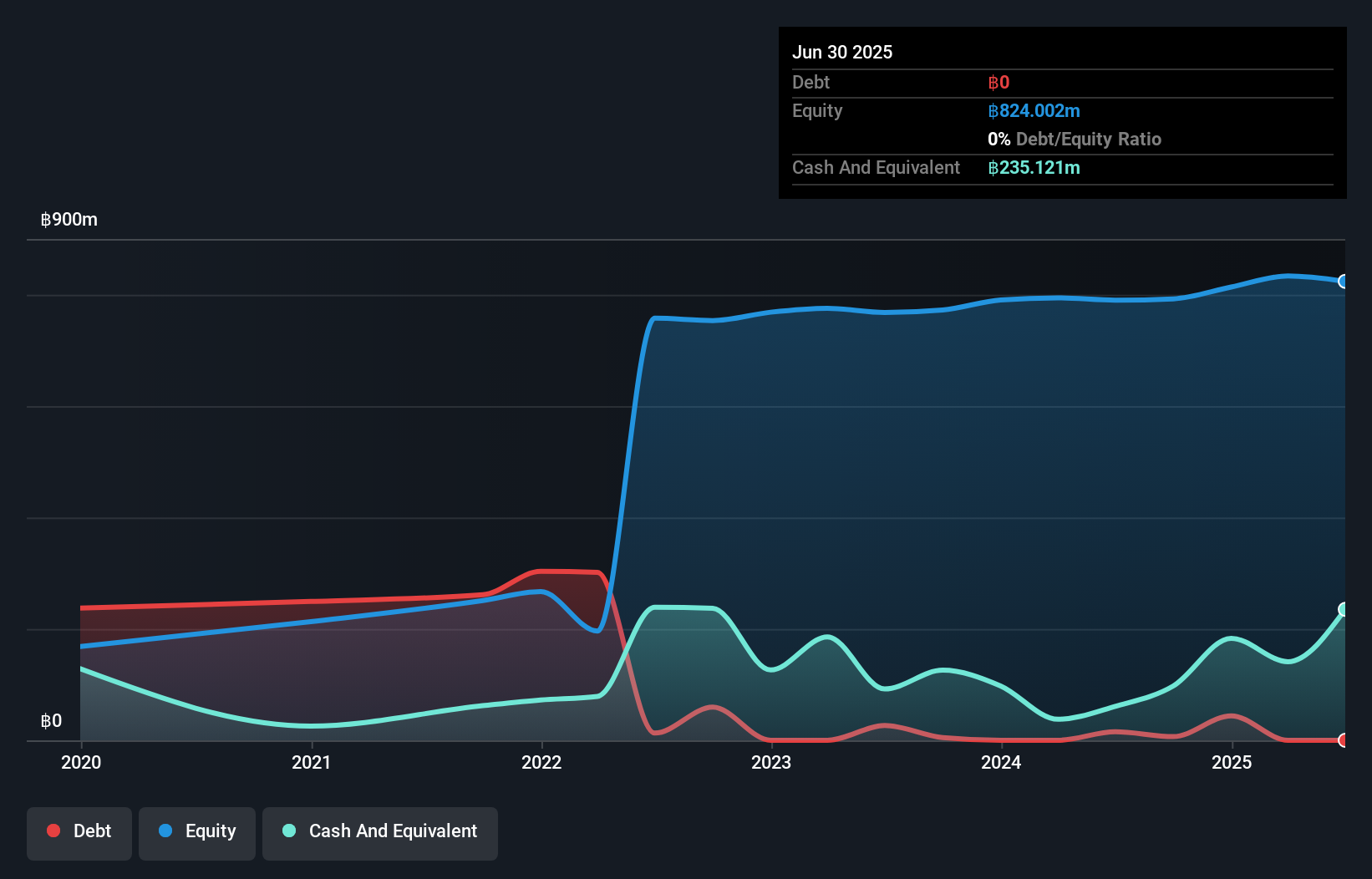

Bioscience Animal Health reported a third-quarter revenue of THB570.85 million, slightly down from THB646.09 million the previous year, yet net income improved to THB17.21 million from THB16.5 million. The company benefits from strong financial positioning with short-term assets exceeding both long-term and short-term liabilities significantly, and its debt is well-covered by operating cash flow. Earnings growth has accelerated recently at 31.6%, outpacing industry averages, although return on equity remains low at 8.8%. Despite stable weekly volatility and high-quality earnings, dividend sustainability is questionable due to insufficient free cash flow coverage.

- Get an in-depth perspective on Bioscience Animal Health's performance by reading our balance sheet health report here.

- Gain insights into Bioscience Animal Health's historical outcomes by reviewing our past performance report.

MDX (SET:MDX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MDX Public Company Limited, along with its subsidiaries, focuses on investing in and developing real estate and infrastructure projects, with a market cap of THB1.54 billion.

Operations: The company's revenue is primarily derived from real estate activities, including THB156.61 million from rental and utility services and THB46.93 million from land sales, as well as THB33.84 million from electricity generation and distribution.

Market Cap: THB1.54B

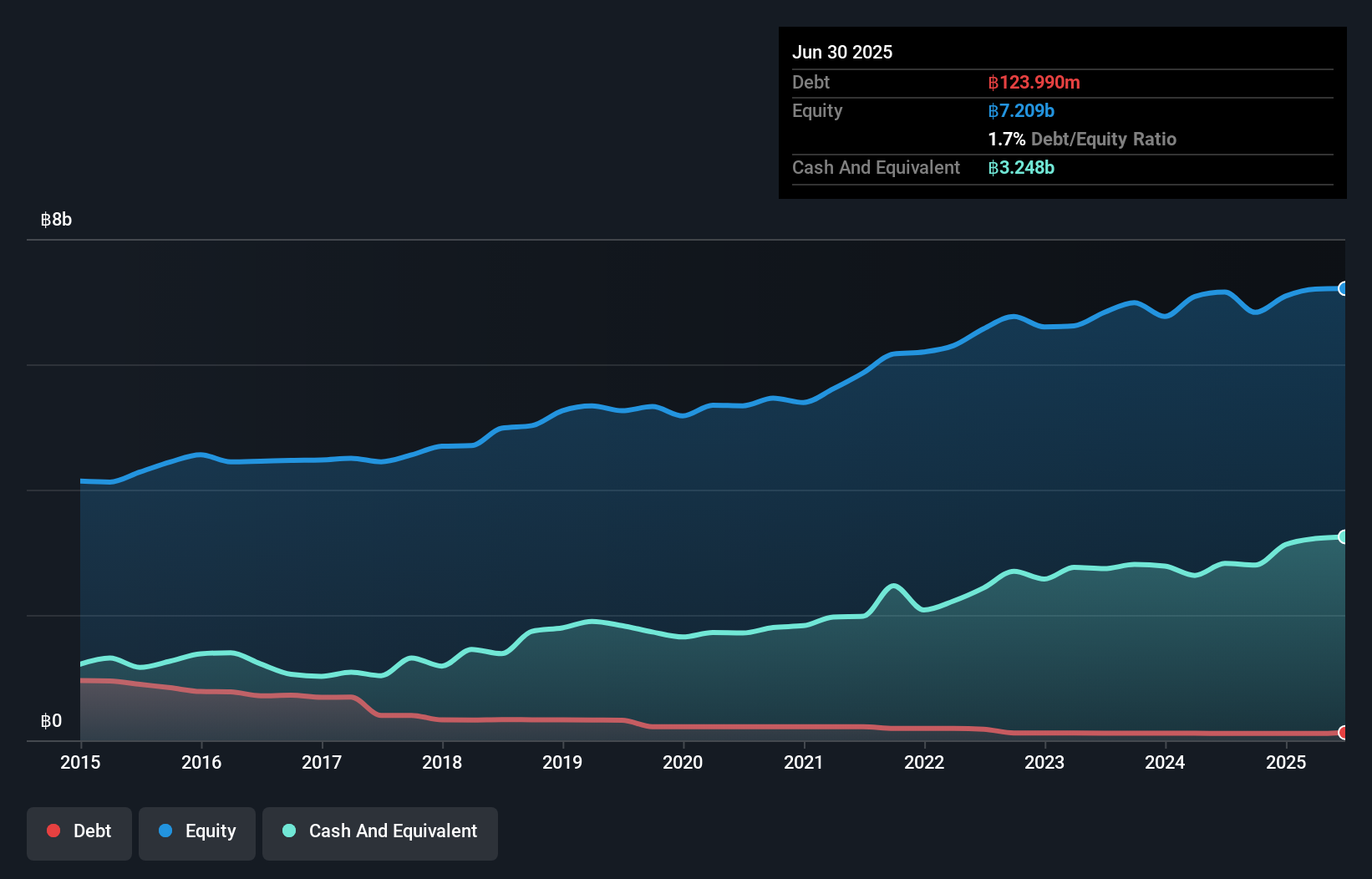

MDX Public Company Limited has shown significant earnings growth over the past year, with net income rising to THB106.76 million from THB33.22 million a year ago, despite a decline in five-year earnings growth. The company's financial health is supported by short-term assets of THB3.4 billion exceeding both short- and long-term liabilities, and more cash than total debt, although operating cash flow remains negative. The appointment of a new CEO in January 2025 may influence future strategic directions. MDX's price-to-earnings ratio is favorable compared to the market average, but return on equity is low at 5%.

- Click here to discover the nuances of MDX with our detailed analytical financial health report.

- Gain insights into MDX's past trends and performance with our report on the company's historical track record.

Make It Happen

- Gain an insight into the universe of 5,850 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bioscience Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:BIS

Bioscience Animal Health

Manufactures and distributes pharmaceutical supplies, devices, and equipment in Thailand.

Flawless balance sheet and good value.

Market Insights

Community Narratives