- New Zealand

- /

- Software

- /

- NZSE:GTK

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

Amid a busy earnings season and mixed economic signals, global markets have seen fluctuations with small-cap stocks holding up better than their larger counterparts, despite cautious earnings reports from major tech players. In this dynamic environment, identifying high-growth tech stocks involves looking for companies with strong fundamentals and innovative potential that can navigate the current market volatility and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.17% | 71.73% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1290 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Gentrack Group (NZSE:GTK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gentrack Group Limited develops, integrates, and supports enterprise billing and customer management software solutions for the energy, water utility, and airport industries with a market cap of NZ$1.04 billion.

Operations: Gentrack Group generates revenue primarily from its utility and airport segments, with the utility segment contributing NZ$160.52 million and the airport segment NZ$27.08 million. The company focuses on providing specialized software solutions tailored for billing and customer management in these sectors.

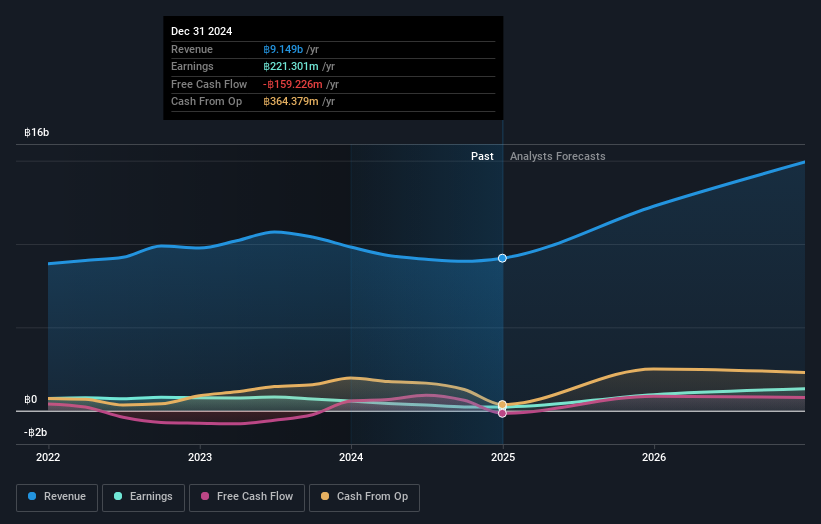

Gentrack Group, recently added to the S&P/ASX Small Ordinaries and 300 Indexes, showcases a promising trajectory with expected annual profit growth of 29.3%, outpacing the New Zealand market's 15.5%. Despite a challenging year with earnings contraction of 27.8%, forecasts indicate robust revenue expansion at 12.6% annually, significantly above the market average of 4.4%. This growth is underpinned by high-quality earnings and a positive free cash flow, although its return on equity in three years is anticipated to be modest at 12.3%. As Gentrack continues to navigate its sector, these dynamics suggest a resilient adaptability amid evolving market demands.

- Delve into the full analysis health report here for a deeper understanding of Gentrack Group.

Evaluate Gentrack Group's historical performance by accessing our past performance report.

Forth Corporation (SET:FORTH)

Simply Wall St Growth Rating: ★★★★★★

Overview: Forth Corporation Public Company Limited, along with its subsidiaries, is involved in the manufacture and distribution of electronic equipment both in Thailand and internationally, with a market capitalization of THB11.79 billion.

Operations: Forth Corporation generates revenue primarily from three segments: Smart Service Business (THB3.76 billion), Enterprise Solutions Business (THB2.58 billion), and Electronics Manufacturing Service Business (THB3.66 billion).

Amid a challenging landscape, Forth Corporation's commitment to innovation is evident with its R&D expenses reaching 15% of total revenue, signaling a robust pursuit of technological advancements. Despite recent dips in net income and earnings per share as reported in the latest semi-annual figures, the company is positioned for significant recovery with projected earnings growth of 45.9% annually. This optimism is bolstered by an expected revenue surge at 20.7% per year, outstripping the Thai market's average growth rate significantly. With such strategic financial management and aggressive growth targets, Forth Corporation remains a compelling entity within its sector, navigating through temporary setbacks towards potentially lucrative horizons.

Chengdu KSW TechnologiesLtd (SHSE:688283)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu KSW Technologies Co., Ltd. specializes in the R&D, manufacturing, and sales of wireless channel emulators and RF microwave signal generator products in China, with a market cap of CN¥3.09 billion.

Operations: KSW Technologies focuses on developing and producing wireless channel emulators and RF microwave signal generators, catering primarily to the Chinese market. The company derives its revenue from these specialized products, emphasizing innovation in telecommunications technology.

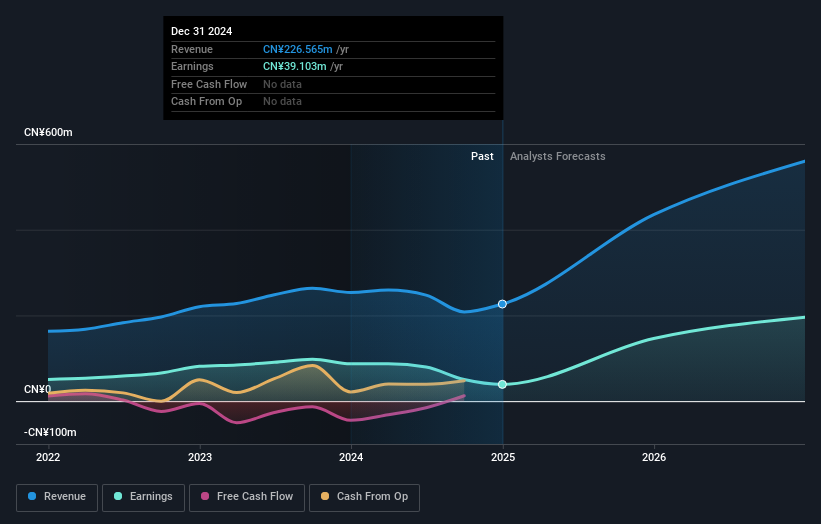

Chengdu KSW TechnologiesLtd has navigated a challenging period with a notable dip in sales and net income as recent earnings for the nine months ending September 30, 2024, show sales dropping to CNY 121.33 million from CNY 166.73 million year-over-year. Despite these hurdles, the company's commitment to growth is underscored by its aggressive share repurchase program, buying back shares worth CNY 16.3 million. Looking ahead, Chengdu KSW is poised for recovery with anticipated annual earnings growth of 44.4%, significantly outpacing the Chinese market forecast of 25.8%. This optimism is further bolstered by projected revenue growth at an impressive rate of 36.8% per year, highlighting its potential resilience and adaptability in the tech sector.

Key Takeaways

- Click this link to deep-dive into the 1290 companies within our High Growth Tech and AI Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GTK

Gentrack Group

Engages in the development, integration, and support of enterprise billing and customer management software solutions for the energy and water utility, and airport industries.

Flawless balance sheet with reasonable growth potential.