- New Zealand

- /

- Biotech

- /

- NZSE:PEB

3 Promising Penny Stocks With Market Caps Of US$50M

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, including rate cuts by the ECB and SNB and expectations for a Fed rate cut, investors are keenly observing how these shifts might impact different sectors. Despite the underperformance of smaller-cap stocks compared to their larger counterparts, penny stocks continue to draw interest due to their unique potential. While the term "penny stocks" may seem outdated, these smaller or newer companies can still offer significant opportunities when backed by strong financials. In this article, we explore three penny stocks that stand out for their balance sheet strength and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.02M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$45.15B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pacific Edge (NZSE:PEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pacific Edge Limited is a cancer diagnostics company that focuses on researching, developing, and commercializing diagnostic and prognostic tools for early cancer detection and management in New Zealand, the United States, and internationally, with a market cap of NZ$95.81 million.

Operations: The company's revenue is derived from two main segments: Research, which generated NZ$3.78 million, and Commercial activities, contributing NZ$22.57 million.

Market Cap: NZ$95.81M

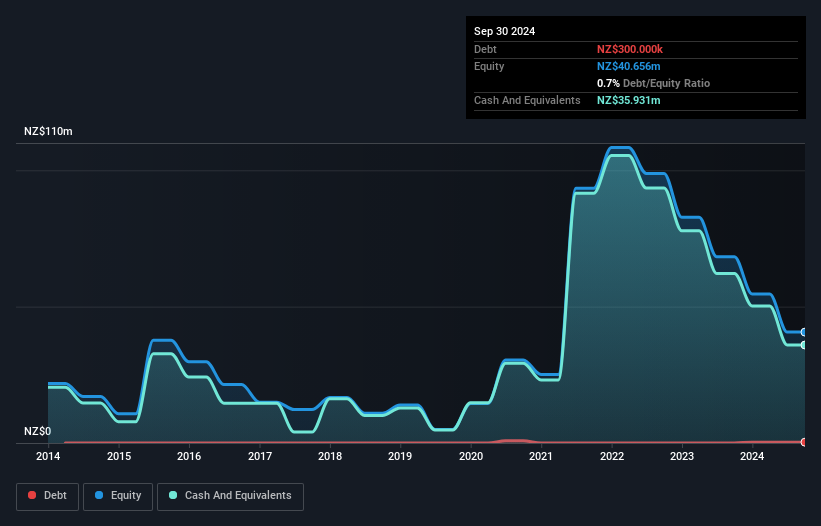

Pacific Edge Limited, with a market cap of NZ$95.81 million, operates in the cancer diagnostics sector and has faced financial challenges recently. For the half year ended September 2024, the company reported a decline in revenue to NZ$12.16 million from NZ$16.58 million the previous year, alongside a net loss of NZ$14.5 million. Despite being unprofitable, Pacific Edge maintains sufficient cash runway for over a year and holds more cash than debt. The management team is experienced with an average tenure of 3.2 years, and short-term assets exceed liabilities significantly, providing some financial stability amidst volatility concerns.

- Navigate through the intricacies of Pacific Edge with our comprehensive balance sheet health report here.

- Understand Pacific Edge's earnings outlook by examining our growth report.

Niraku GC Holdings (SEHK:1245)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Niraku GC Holdings, Inc. is an investment holding company that operates pachinko and pachislot halls in Japan, with a market capitalization of HK$284.61 million.

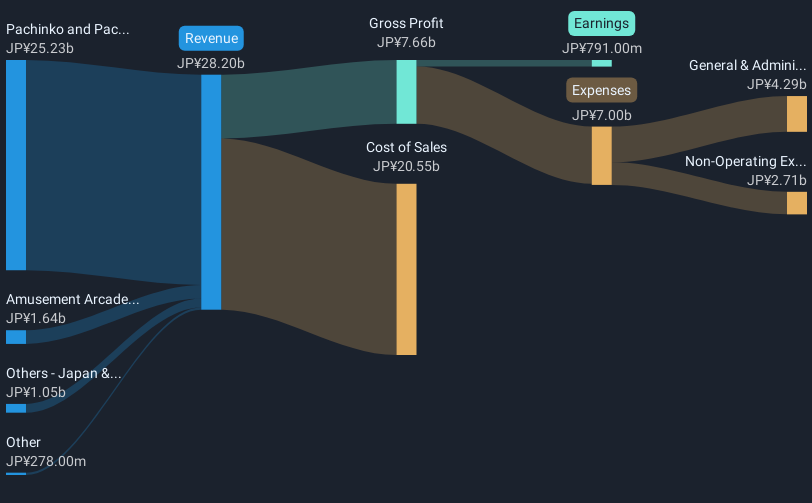

Operations: The company's revenue is primarily derived from its Pachinko and Pachislot Hall Operations in Japan, which generated ¥25.23 billion, followed by Amusement Arcade Operations in Southeast Asia at ¥1.64 billion, and other activities in Japan & Hong Kong contributing ¥1.05 billion.

Market Cap: HK$284.61M

Niraku GC Holdings, with a market cap of HK$284.61 million, generates significant revenue from its pachinko and pachislot operations in Japan, reporting ¥25.23 billion for the latest period. Despite earnings growth of 10.6% not surpassing industry averages, the company maintains stable profit margins and has reduced its debt-to-equity ratio over five years. Its management team is experienced with an average tenure of 10.3 years, providing stability amidst financial challenges such as short-term liabilities exceeding assets by ¥1.4 billion. Recent board changes include appointing Ms. Reiko Hachisuka as an independent non-executive director to strengthen governance.

- Get an in-depth perspective on Niraku GC Holdings' performance by reading our balance sheet health report here.

- Examine Niraku GC Holdings' past performance report to understand how it has performed in prior years.

Tianjin Jinran Public Utilities (SEHK:1265)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tianjin Jinran Public Utilities Company Limited is involved in the sale of piped natural gas in Mainland China and has a market cap of HK$358.67 million.

Operations: The company's revenue is primarily derived from the sales of piped gas, amounting to CN¥1.69 billion, followed by gas connection services at CN¥48.29 million and sales of gas appliances and others at CN¥3.37 million.

Market Cap: HK$358.67M

Tianjin Jinran Public Utilities, with a market cap of HK$358.67 million, primarily generates revenue from the sale of piped natural gas in Mainland China, amounting to CN¥1.69 billion. Despite being unprofitable and experiencing increased losses over the past five years, the company benefits from having no debt and possesses short-term assets (CN¥821.2M) that cover both its short-term (CN¥397.1M) and long-term liabilities (CN¥95.7M). While management is experienced with an average tenure of 3.2 years, the board is relatively new with a 2.3-year average tenure, indicating potential governance adjustments ahead.

- Dive into the specifics of Tianjin Jinran Public Utilities here with our thorough balance sheet health report.

- Gain insights into Tianjin Jinran Public Utilities' historical outcomes by reviewing our past performance report.

Key Takeaways

- Jump into our full catalog of 5,810 Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:PEB

Pacific Edge

A cancer diagnostics company, researches, develops, and commercializes diagnostic and prognostic tools for the early detection and management of cancers in New Zealand, the United States, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives