Asian Market Insights: Best Mart 360 Holdings And 2 More Intriguing Penny Stocks

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating economic indicators and geopolitical tensions, Asian markets have been navigating a complex landscape. As investors seek opportunities in this evolving environment, penny stocks—though often considered niche—remain an intriguing area for potential growth. These smaller or newer companies can offer significant upside when supported by strong fundamentals and financial health, making them worth exploring for those looking to uncover hidden value.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.103 | SGD43.77M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.27 | HK$801.31M | ✅ 4 ⚠️ 1 View Analysis > |

| KPa-BM Holdings (SEHK:2663) | HK$0.335 | HK$186.57M | ✅ 2 ⚠️ 4 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.415 | SGD168.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.19 | SGD8.62B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.174 | SGD34.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.09 | SGD847.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.72 | HK$54.07B | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.50 | HK$12.92B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,020 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Best Mart 360 Holdings (SEHK:2360)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Best Mart 360 Holdings Limited operates chain retail stores under the Best Mart 360 and FoodVille brands, focusing on leisure food retailing in Hong Kong, Macau, and the People's Republic of China, with a market cap of HK$1.90 billion.

Operations: The company's revenue is primarily derived from retailing sales of food and beverage, as well as household and personal care products, totaling HK$2.81 billion.

Market Cap: HK$1.9B

Best Mart 360 Holdings, with a market cap of HK$1.90 billion, has demonstrated solid financial health, boasting more cash than total debt and strong coverage of interest payments by EBIT. The company's short-term assets exceed both its short- and long-term liabilities, indicating robust liquidity management. Despite a recent slowdown in earnings growth to 10.3%, it remains above the industry average and has shown significant profit growth over five years at 45% annually. However, the management team is relatively new with an average tenure of 1.8 years, which may pose challenges in strategic continuity. Recent dividend increases highlight shareholder returns amidst stable weekly volatility and high-quality earnings performance.

- Get an in-depth perspective on Best Mart 360 Holdings' performance by reading our balance sheet health report here.

- Assess Best Mart 360 Holdings' previous results with our detailed historical performance reports.

Vobile Group (SEHK:3738)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions in the United States, Mainland China, and internationally, with a market cap of HK$7.83 billion.

Operations: The company's revenue is derived entirely from its SaaS offerings, totaling HK$2.40 billion.

Market Cap: HK$7.83B

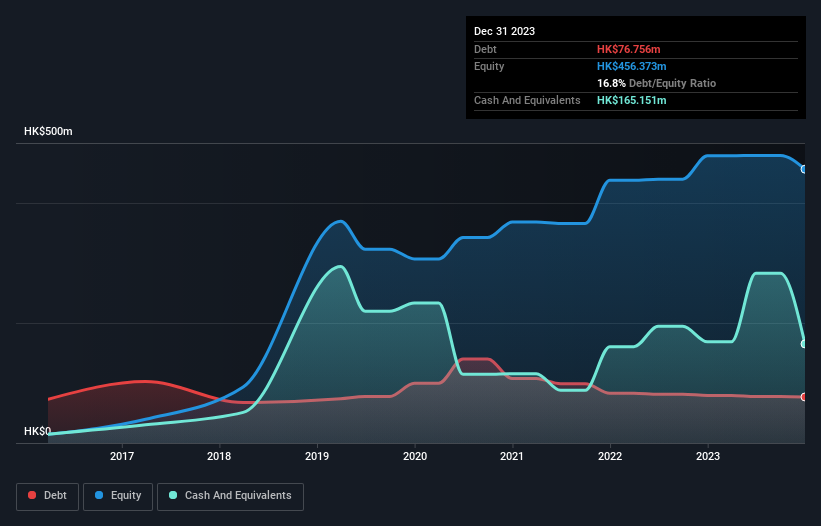

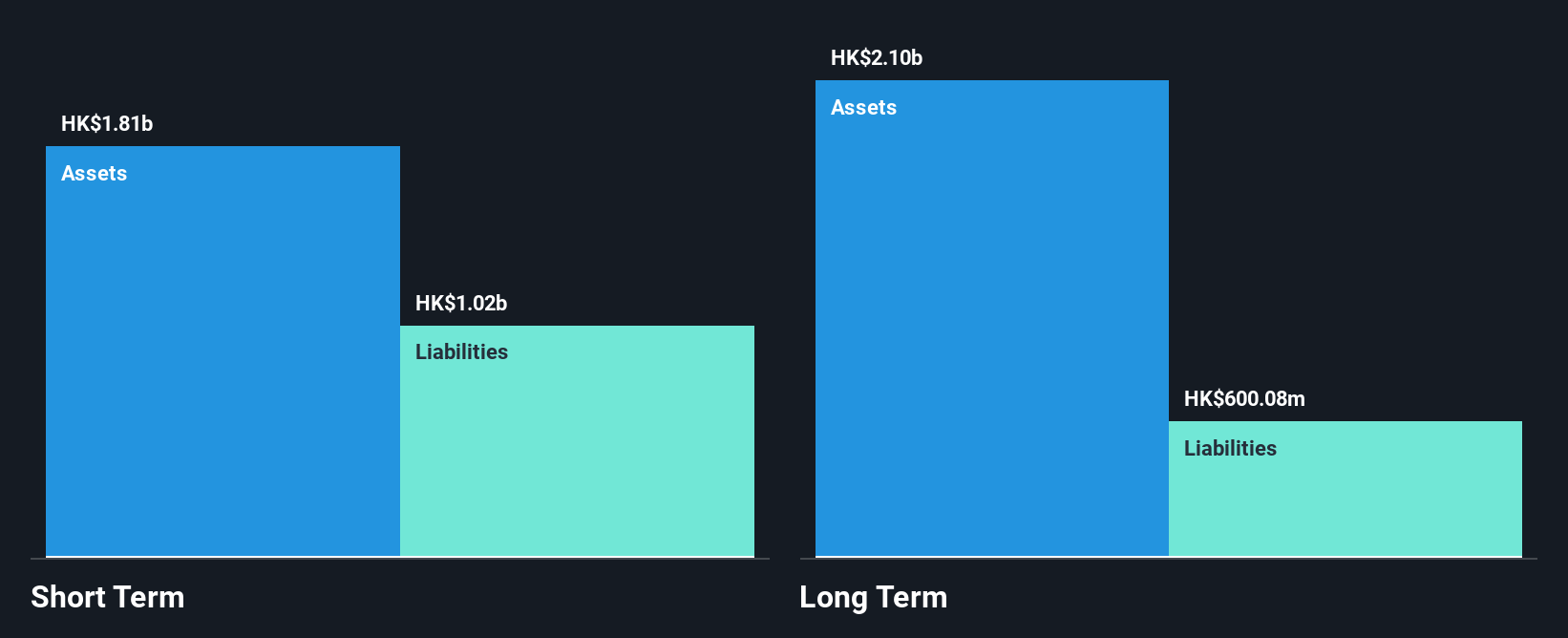

Vobile Group has shown financial resilience with its HK$7.83 billion market cap, transitioning to profitability with HK$142.73 million net income in 2024 from a prior loss. The company's short-term assets of HK$1.8 billion comfortably cover both short- and long-term liabilities, showcasing solid liquidity management. Its debt-to-equity ratio has improved significantly over five years, now at a satisfactory 32%. Recent capital raising activities include a follow-on equity offering and convertible bonds issuance, enhancing financial flexibility for growth initiatives like the AI-driven DreamMaker platform aimed at boosting revenue streams for content creators through integrated copyright protection and monetization solutions.

- Click here to discover the nuances of Vobile Group with our detailed analytical financial health report.

- Gain insights into Vobile Group's outlook and expected performance with our report on the company's earnings estimates.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand and has a market capitalization of THB22.27 billion.

Operations: Sansiri generates revenue primarily from real estate at THB31.52 billion, supplemented by building management, project management, and real estate brokerage at THB2.50 billion, and hotel business operations contributing THB593 million.

Market Cap: THB22.27B

Sansiri Public Company Limited, with a market cap of THB22.27 billion, faces challenges with declining revenue and net income compared to the previous year. The company's debt levels remain high, as evidenced by a net debt to equity ratio of 137.9%, although its short-term assets significantly exceed liabilities, indicating strong liquidity management. Despite stable weekly volatility and no significant shareholder dilution recently, Sansiri's earnings growth has been negative over the past year and profit margins have decreased from last year’s figures. Recent developments include plans for issuing unsecured subordinated perpetual debentures to bolster financial flexibility amidst an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Sansiri stock in this financial health report.

- Review our growth performance report to gain insights into Sansiri's future.

Seize The Opportunity

- Unlock our comprehensive list of 1,020 Asian Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives