3 Value Stocks Estimated To Be Trading At Discounts Of Up To 47.3%

Reviewed by Simply Wall St

As global markets navigate higher-than-expected inflation data and fluctuating interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this environment, identifying undervalued stocks can offer investors potential opportunities to capitalize on market inefficiencies, particularly when these stocks are trading at significant discounts relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.48 | US$36.92 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$55.32 | US$110.32 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$14.90 | MX$29.71 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.02 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96047.78 | 49.7% |

| F-Secure Oyj (HLSE:FSECURE) | €1.706 | €3.41 | 49.9% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €3.285 | €6.57 | 50% |

| Hindustan Foods (BSE:519126) | ₹572.85 | ₹1143.64 | 49.9% |

Here's a peek at a few of the choices from the screener.

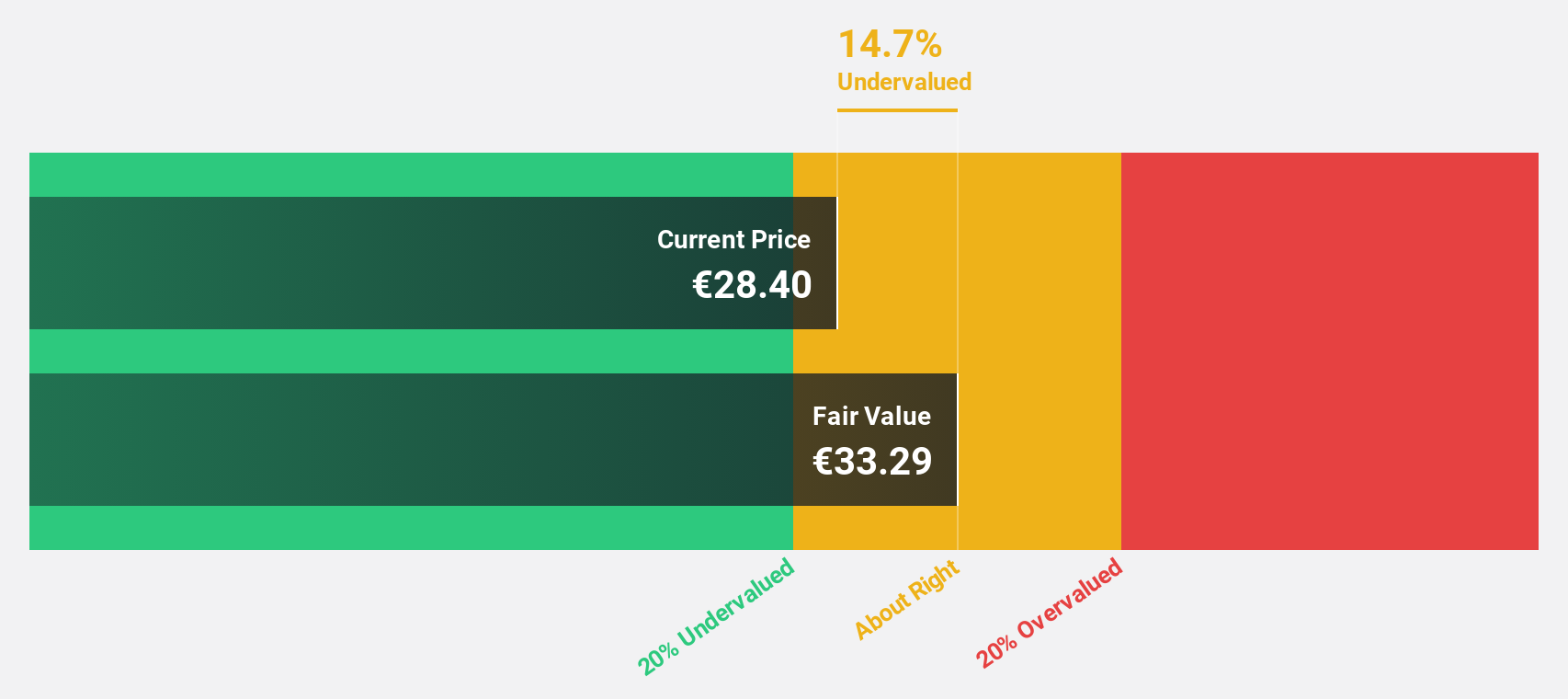

Ponsse Oyj (HLSE:PON1V)

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations across Northern Europe, Central and Southern Europe, North and South America, and internationally, holding a market cap of €711.15 million.

Operations: Revenue Segments (in millions of €): null

Estimated Discount To Fair Value: 36%

Ponsse Oyj, trading at 36% below its estimated fair value of €39.66, presents a compelling case for being undervalued based on cash flows. Despite a drop in sales to €223.5 million in Q4 2024, net income rose to €12.18 million from the previous year. Earnings are projected to grow significantly at 43.7% annually over the next three years, outpacing the Finnish market's growth rate of 11.8%.

- Insights from our recent growth report point to a promising forecast for Ponsse Oyj's business outlook.

- Click to explore a detailed breakdown of our findings in Ponsse Oyj's balance sheet health report.

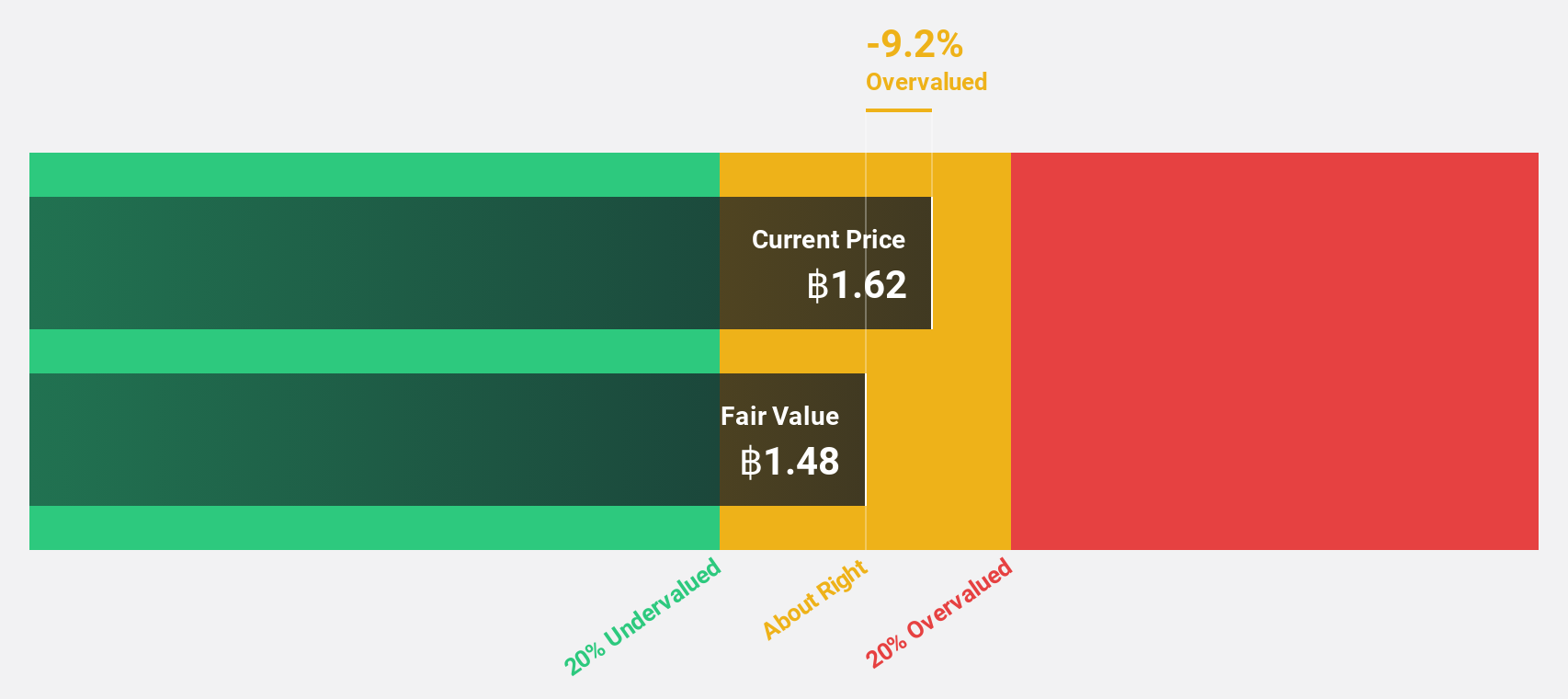

Ratchthani Leasing (SET:THANI)

Overview: Ratchthani Leasing Public Company Limited, along with its subsidiary, offers hire-purchase and leasing services in Thailand and has a market cap of THB9.84 billion.

Operations: Ratchthani Leasing generates revenue primarily through its hire-purchase and leasing services in Thailand.

Estimated Discount To Fair Value: 47.3%

Ratchthani Leasing is trading at 47.3% below its fair value estimate of THB3, highlighting its undervaluation based on cash flows. Despite a volatile share price recently, earnings are expected to grow significantly at 26% annually, outpacing the Thai market's growth rate. However, the company faces challenges with high debt levels and a recent decline in revenue and net income for 2024 compared to the previous year.

- Our comprehensive growth report raises the possibility that Ratchthani Leasing is poised for substantial financial growth.

- Get an in-depth perspective on Ratchthani Leasing's balance sheet by reading our health report here.

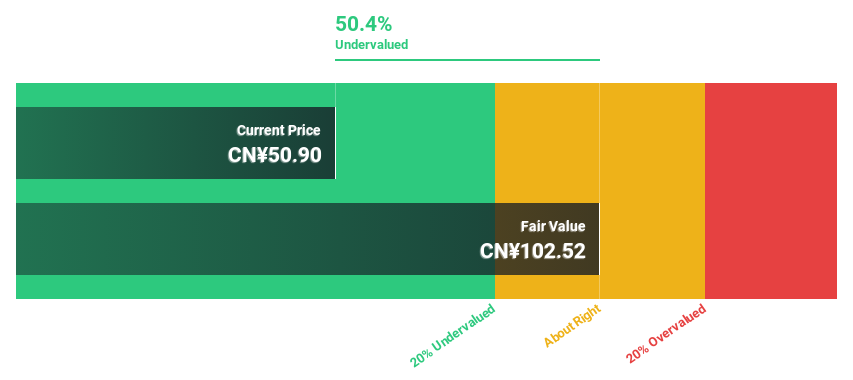

Guangdong Mingyang ElectricLtd (SZSE:301291)

Overview: Guangdong Mingyang Electric Co., Ltd. focuses on the research, development, production, and sale of high/low voltage switchgear, transformers, and power transmission and distribution equipment in China with a market cap of CN¥16.60 billion.

Operations: Guangdong Mingyang Electric Co., Ltd. generates revenue through its operations in high/low voltage switchgear, transformers, and power transmission and distribution equipment within China.

Estimated Discount To Fair Value: 44.3%

Guangdong Mingyang Electric Ltd. is trading 44.3% below its estimated fair value of CN¥95.45, highlighting its undervaluation based on cash flows. Despite recent share price volatility, earnings are forecast to grow significantly at 24.06% annually, though slower than the CN market's growth rate of 25%. Revenue growth is strong at 22.5%, surpassing market expectations, but the company faces challenges with a low projected return on equity of 17.5%.

- According our earnings growth report, there's an indication that Guangdong Mingyang ElectricLtd might be ready to expand.

- Navigate through the intricacies of Guangdong Mingyang ElectricLtd with our comprehensive financial health report here.

Turning Ideas Into Actions

- Investigate our full lineup of 927 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PON1V

Ponsse Oyj

Operates as manufacturer of cut-to-length forest machines Nordic and Baltic countries, Central and Southern Europe, South America and North America, Asia, Australia, and Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives