- Thailand

- /

- Capital Markets

- /

- SET:AIRA

Asian Penny Stocks Under US$200M Market Cap To Watch

Reviewed by Simply Wall St

Asian markets have been navigating a complex landscape, influenced by global trade tensions and economic policy shifts. Despite these challenges, the search for investment opportunities continues, with penny stocks remaining a compelling area of interest. Though often associated with speculative trading, penny stocks can offer significant potential when supported by robust financials and strategic growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.70 | HK$42.48B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.42 | SGD9.56B | ★★★★★☆ |

| T.A.C. Consumer (SET:TACC) | THB4.16 | THB2.5B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.20 | HK$761.75M | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.86 | HK$640.48M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.02 | CN¥3.5B | ★★★★★★ |

| Newborn Town (SEHK:9911) | HK$4.50 | HK$6.35B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| Hong Leong Asia (SGX:H22) | SGD0.93 | SGD695.72M | ★★★★★☆ |

| China Lilang (SEHK:1234) | HK$4.01 | HK$4.8B | ★★★★★☆ |

Click here to see the full list of 1,179 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Boyaa Interactive International (SEHK:434)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in China and internationally, with a market cap of HK$2.77 billion.

Operations: The company generates revenue of CN¥418.46 million from its operations in the PRC, including Hong Kong.

Market Cap: HK$2.77B

Boyaa Interactive International, with a market cap of HK$2.77 billion, has shown promising financial performance despite high share price volatility. The company reported significant earnings growth of 116.5% over the past year, driven by increased digital asset value and optimized gaming operations. Its net profit margins have improved to 58.4%, supported by strong revenue generation from its online games in China and Hong Kong, totaling CN¥418.46 million. Boyaa is debt-free with robust short-term assets exceeding liabilities significantly, but its return on equity remains modest at 13.3%. The board's seasoned experience adds stability amidst volatile conditions.

- Get an in-depth perspective on Boyaa Interactive International's performance by reading our balance sheet health report here.

- Examine Boyaa Interactive International's past performance report to understand how it has performed in prior years.

Productive Technologies (SEHK:650)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Productive Technologies Company Limited is an investment holding company involved in manufacturing equipment for the semiconductor and solar power industries in China, with a market cap of HK$1.67 billion.

Operations: The company's revenue is primarily derived from the pan-semiconductor segment, which generated HK$200.60 million, and the oil and gas sector, contributing HK$168.77 million.

Market Cap: HK$1.67B

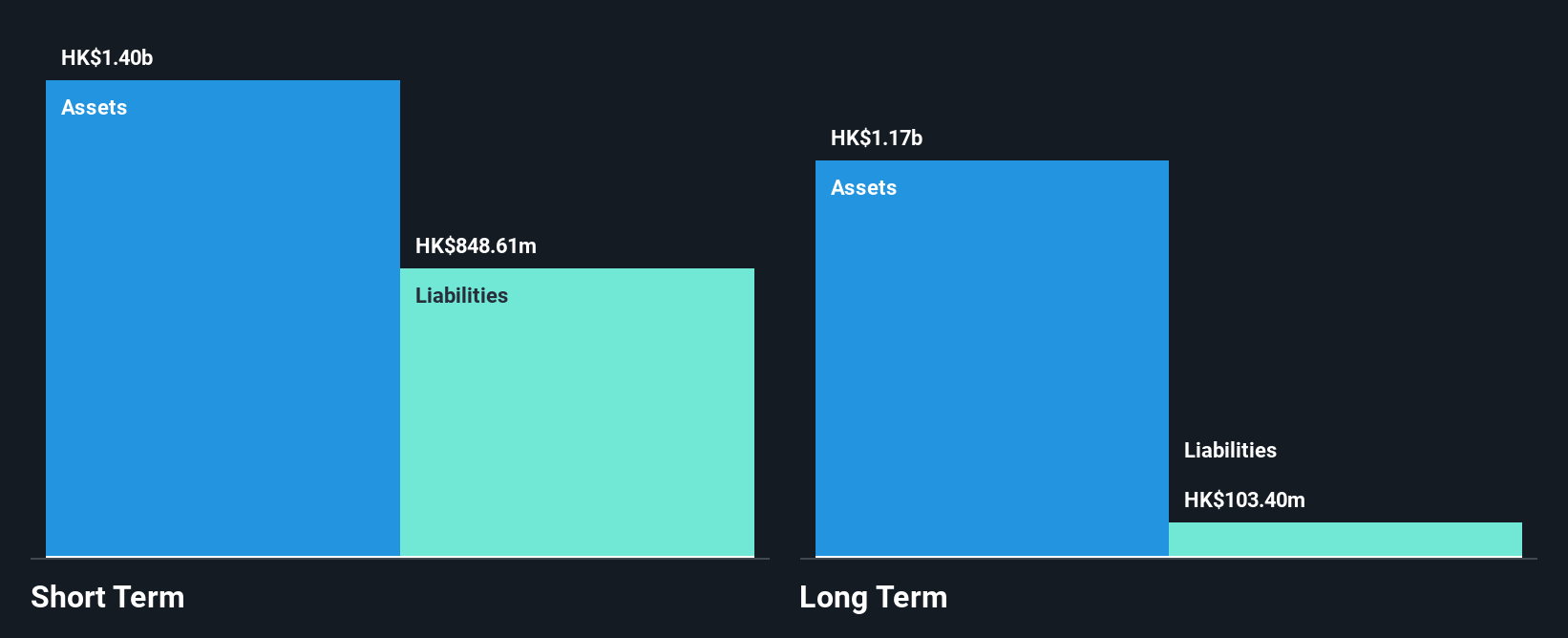

Productive Technologies Company Limited, with a market cap of HK$1.67 billion, operates in the semiconductor and solar power sectors in China. Despite being unprofitable, it maintains a solid financial position with short-term assets of HK$1.4 billion exceeding both its short and long-term liabilities. The company has more cash than debt, providing a sufficient cash runway for over a year even as free cash flow declines historically by 39.5% annually. Recent amendments to its corporate bylaws suggest strategic shifts are underway; however, share buybacks have been minimal at 0.01%, indicating limited capital return to shareholders recently.

- Take a closer look at Productive Technologies' potential here in our financial health report.

- Understand Productive Technologies' track record by examining our performance history report.

AIRA Capital (SET:AIRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIRA Capital Public Company Limited, along with its subsidiaries, offers financial advisory services in Thailand and has a market capitalization of THB6.82 billion.

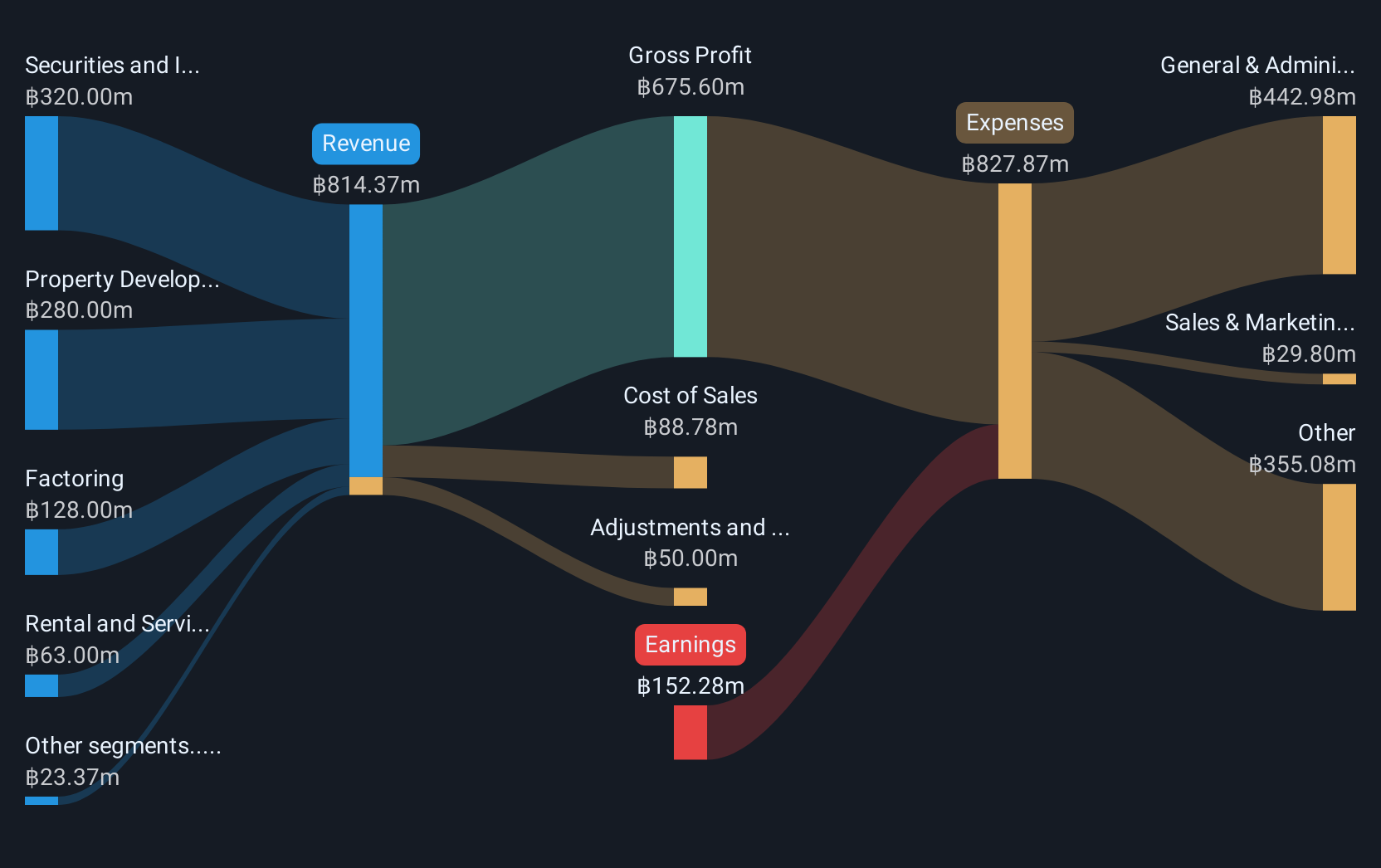

Operations: AIRA Capital's revenue is primarily derived from its Securities and Investment Business (THB350 million), Property Development (THB272 million), Factoring (THB140 million), Rental and Service Business excluding Property Development (THB70 million), and Advisory and Investment Banking services (THB21 million).

Market Cap: THB6.82B

AIRA Capital, with a market cap of THB6.82 billion, recently reported annual revenue growth to THB1.15 billion but remains unprofitable with a net loss of THB136.25 million for 2024. Despite this, the company possesses strong short-term assets totaling THB5.3 billion that surpass both its short and long-term liabilities, ensuring financial stability in the near term. AIRA's experienced board and management team support its operations; however, high debt levels and increased volatility present challenges. The company's cash runway is robust for over three years if free cash flow continues to grow at historical rates despite ongoing profitability issues.

- Click to explore a detailed breakdown of our findings in AIRA Capital's financial health report.

- Review our historical performance report to gain insights into AIRA Capital's track record.

Summing It All Up

- Investigate our full lineup of 1,179 Asian Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AIRA Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AIRA

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives