- China

- /

- Entertainment

- /

- SHSE:600892

May 2025's Asian Market Highlights: Promising Penny Stocks

Reviewed by Simply Wall St

As May 2025 unfolds, the Asian markets are experiencing renewed optimism following a significant de-escalation in trade tensions between the U.S. and China, which has positively impacted global indices. In this context, investors are increasingly interested in exploring diverse opportunities that extend beyond established market leaders. Penny stocks, despite their somewhat outdated moniker, still hold appeal for those seeking to uncover potential gems among smaller or newer companies with solid financial foundations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| T.A.C. Consumer (SET:TACC) | THB4.52 | THB2.71B | ✅ 3 ⚠️ 3 View Analysis > |

| North East Rubber (SET:NER) | THB4.34 | THB8.02B | ✅ 5 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.405 | SGD164.14M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.183 | SGD36.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.54B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.51 | HK$51.63B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.24 | HK$2.07B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,162 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

PSG Corporation (SET:PSG)

Simply Wall St Financial Health Rating: ★★★★★★

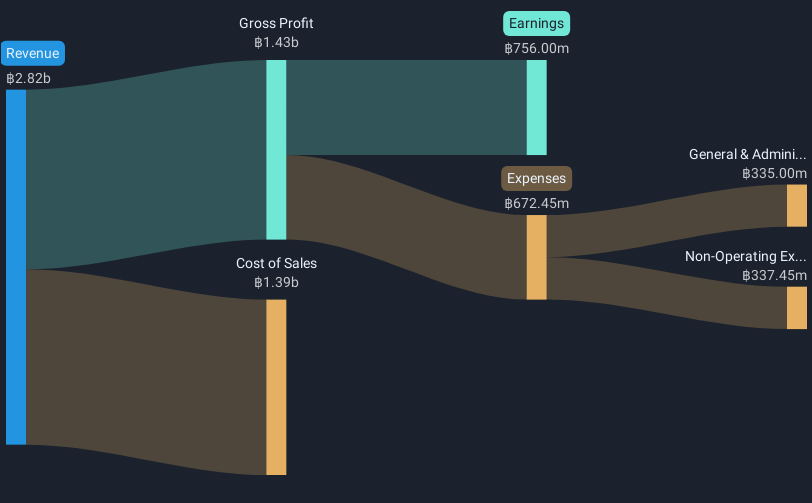

Overview: PSG Corporation Public Company Limited, along with its subsidiary, operates in turnkey engineering, procurement, and construction (EPC) as well as large-scale construction projects in Thailand and the Lao People's Democratic Republic, with a market cap of THB20.47 billion.

Operations: No revenue segments are reported for PSG Corporation.

Market Cap: THB20.47B

PSG Corporation has seen a significant decline in its financial performance, with first-quarter 2025 revenues of THB 642.96 million, down from THB 1,489.42 million the previous year, and net income dropping to THB 98.76 million from THB 781.52 million. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company faces challenges with increased volatility and negative earnings growth over the past year (-61.4%). Recent corporate actions include a stock split and changes in par value through reverse stock split processes aimed at capital restructuring without diluting shareholder value significantly.

- Click here to discover the nuances of PSG Corporation with our detailed analytical financial health report.

- Learn about PSG Corporation's historical performance here.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: V V Food & Beverage Co., Ltd operates in the research, development, production, and sale of food and beverage products both in China and internationally, with a market cap of approximately CN¥5.89 billion.

Operations: There are no reported revenue segments for V V Food & Beverage Co., Ltd.

Market Cap: CN¥5.89B

V V Food & Beverage Co., Ltd has demonstrated a mixed financial performance. Despite a decline in first-quarter 2025 revenue to CN¥852.53 million from CN¥1,108.72 million the previous year, the company maintains strong financial health with short-term assets of CN¥1.9 billion exceeding both short and long-term liabilities significantly. Its debt is well-covered by operating cash flow, and it boasts high-quality earnings with improved profit margins at 10.5%. However, its share price remains highly volatile, and its return on equity is considered low at 9.8%. The board's experience averages 3.4 years, indicating seasoned oversight amidst an unstable dividend track record.

- Unlock comprehensive insights into our analysis of V V Food & BeverageLtd stock in this financial health report.

- Evaluate V V Food & BeverageLtd's historical performance by accessing our past performance report.

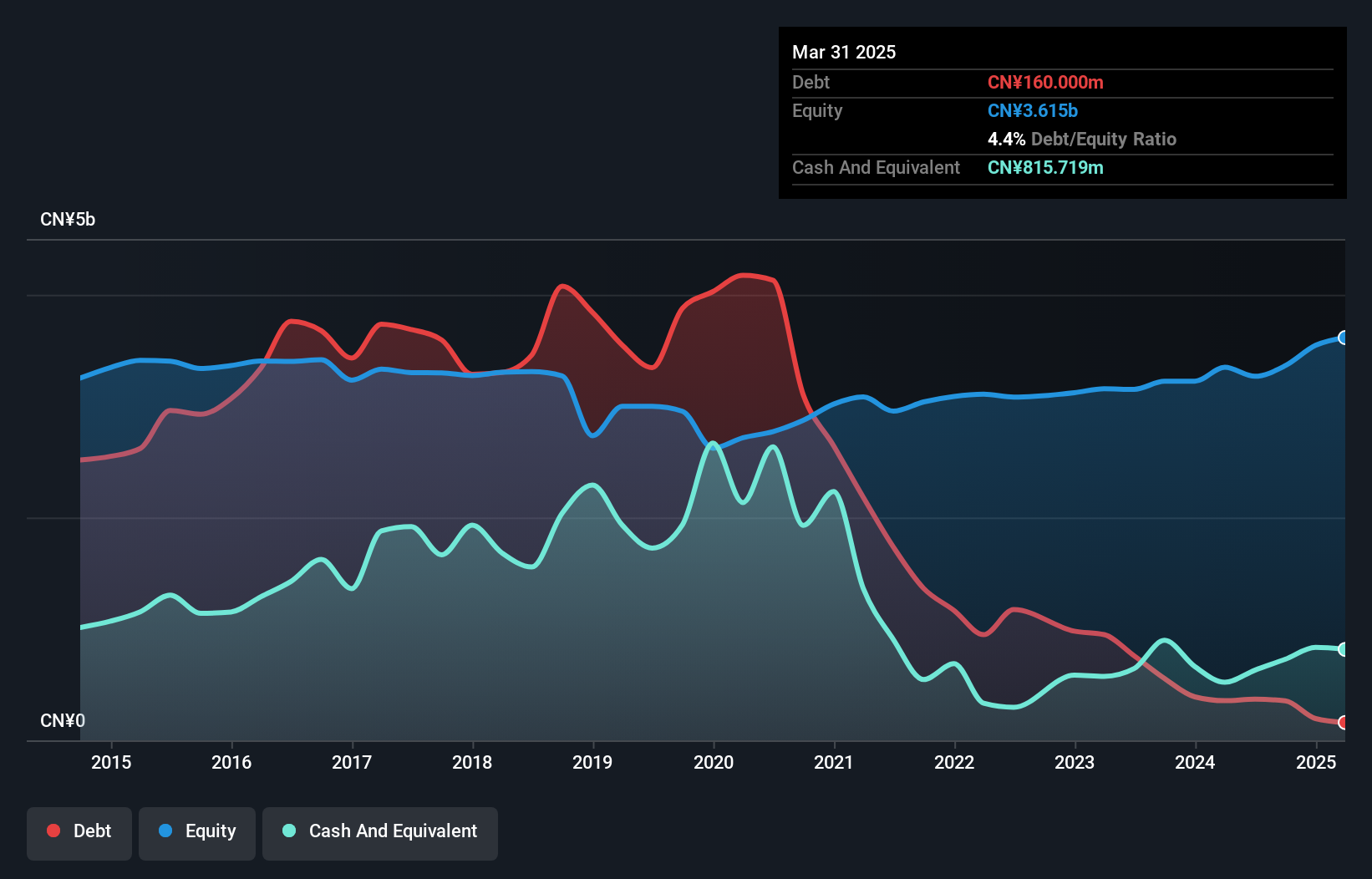

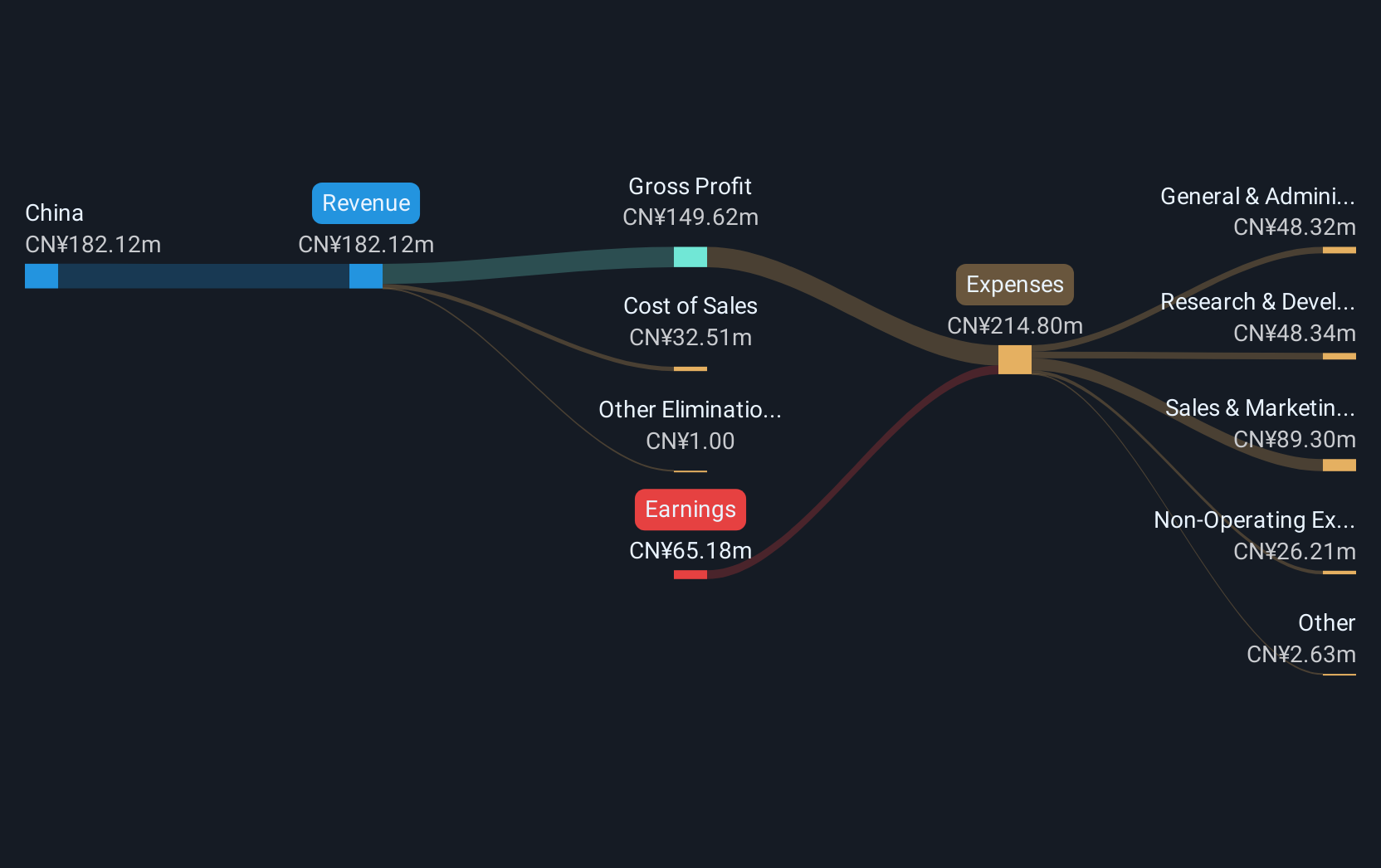

Dasheng Times Cultural Investment (SHSE:600892)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dasheng Times Cultural Investment Co., Ltd. operates in the cultural and entertainment industry, with a market cap of CN¥1.75 billion.

Operations: The company generates its revenue primarily from China, amounting to CN¥177.92 million.

Market Cap: CN¥1.75B

Dasheng Times Cultural Investment Co., Ltd. faces challenges as it remains unprofitable, with a negative return on equity of -31.44%. Despite this, the company has reduced its losses by 72.6% annually over five years and reported first-quarter 2025 revenue growth to CN¥55.89 million from CN¥40.59 million a year ago, though net losses increased to CN¥10.14 million from CN¥8.65 million. The company benefits from more cash than debt and an experienced board with an average tenure of 4.4 years but struggles with high share price volatility and short-term liabilities exceeding assets by CN¥5.7M.

- Click here and access our complete financial health analysis report to understand the dynamics of Dasheng Times Cultural Investment.

- Review our historical performance report to gain insights into Dasheng Times Cultural Investment's track record.

Key Takeaways

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,159 more companies for you to explore.Click here to unveil our expertly curated list of 1,162 Asian Penny Stocks.

- Seeking Other Investments? AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dasheng Times Cultural Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600892

Dasheng Times Cultural Investment

Dasheng Times Cultural Investment Co., Ltd.

Mediocre balance sheet very low.

Market Insights

Community Narratives