In recent times, the Singapore market has shown a steady, flat performance both over the past week and year, with expectations of earnings growth at an annual rate of 9.2% in the coming years. In such a stable market environment, dividend stocks like Singapore Airlines offer potential for consistent returns, making them an attractive option for investors seeking regular income streams.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.96% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.72% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.47% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.93% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.73% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.51% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.49% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.12% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.90% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Singapore Airlines (SGX:C6L)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Airlines Limited operates passenger and cargo air transportation services globally under the Singapore Airlines and Scoot brands, with a market cap of approximately SGD 24.95 billion.

Operations: Singapore Airlines Limited generates revenue primarily through its Full Service Carrier segment at SGD 16.18 billion, followed by its Low-Cost Carrier operations at SGD 2.45 billion, and Engineering Services contributing SGD 1.09 billion.

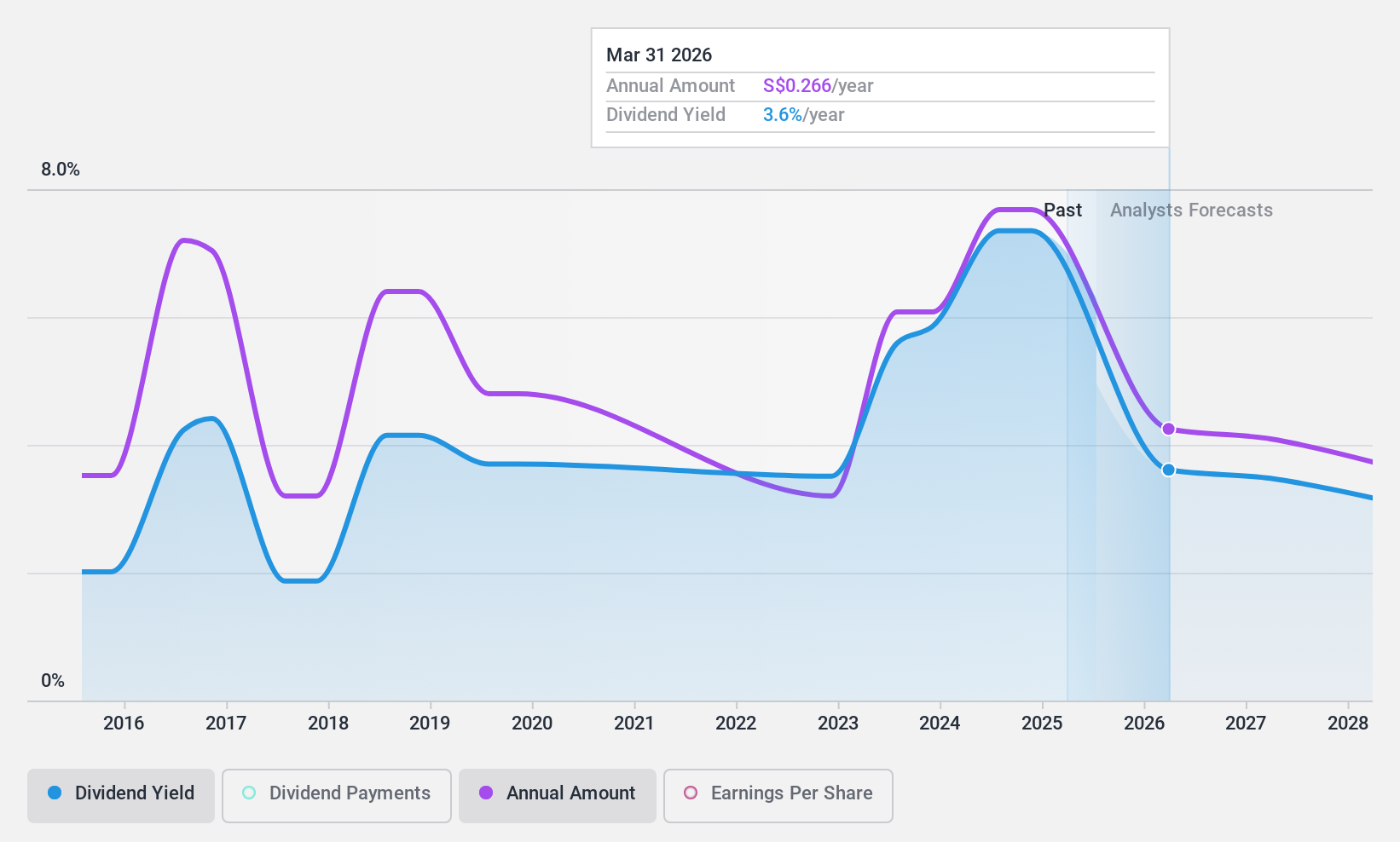

Dividend Yield: 6.9%

Singapore Airlines has proposed a final dividend of S$0.38 per share, signaling a positive gesture to shareholders despite its history of volatile dividends. Recent operational expansions and the establishment of Singapore Airlines Foundation suggest strategic growth, although earnings are expected to decline by an average of 20.2% annually over the next three years. Trading at a P/E ratio below market average and with dividends covered by both earnings and cash flows, the stock offers mixed prospects for dividend investors seeking stability and growth.

- Navigate through the intricacies of Singapore Airlines with our comprehensive dividend report here.

- Our expertly prepared valuation report Singapore Airlines implies its share price may be lower than expected.

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company specializing in the manufacturing, marketing, distribution, and sale of chocolate and chocolate confectionery products across Indonesia, Philippines, Malaysia, Singapore, and internationally, with a market capitalization of approximately SGD 0.50 billion.

Operations: Delfi Limited generates revenue primarily through its operations in Indonesia, which brought in SGD 370.41 million, and its regional markets, contributing SGD 185.07 million.

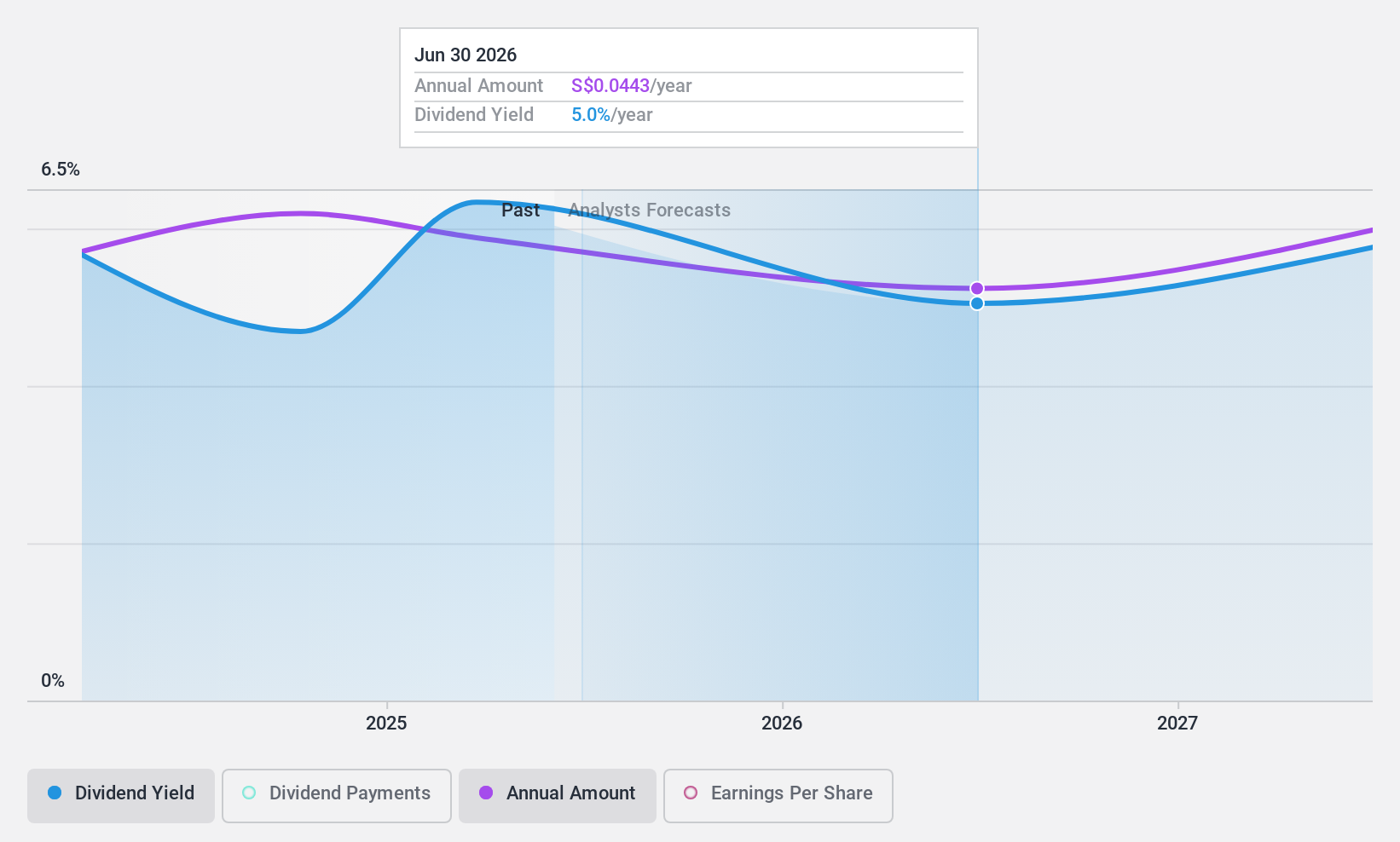

Dividend Yield: 7.1%

Delfi Limited's dividend yield of 7.13% ranks well above the Singapore market average, yet its sustainability is questionable with a cash payout ratio of 1776.7%, indicating dividends are not adequately covered by cash flows. Despite trading at 44.4% below estimated fair value and potential price growth forecasted at 36.5%, both earnings and dividends face coverage issues, as evidenced by a high non-cash earnings level and unstable dividend history over the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Delfi.

- The analysis detailed in our Delfi valuation report hints at an deflated share price compared to its estimated value.

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company based in Australia, offers construction and engineering services across various sectors including energy, resources, infrastructure, and marine and defense, with a market capitalization of SGD 482.21 million.

Operations: Civmec Limited generates revenue from three primary segments: Energy (A$46.02 million), Resources (A$752.82 million), and Infrastructure, Marine & Defence (A$105.52 million).

Dividend Yield: 5.1%

Civmec Limited, while trading at 36.9% below its estimated fair value, shows a moderate dividend yield of 5.12%, lower than the top quartile of Singapore dividend stocks at 6.27%. Dividends are well-supported with a payout ratio of 45.4% and an even more conservative cash payout ratio of 27%, ensuring sustainability from both earnings and cash flow perspectives. Recent contracts worth A$174 million boost its business stability, though its dividend growth is modest compared to peers with higher yields and faster growth rates in dividends over the past decade.

- Click here to discover the nuances of Civmec with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Civmec's share price might be too pessimistic.

Seize The Opportunity

- Investigate our full lineup of 21 Top SGX Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P34

Delfi

An investment holding company, manufactures, markets, distributes, and sells chocolate, chocolate confectionery, and consumer products in Indonesia, the Philippines, Malaysia, Singapore, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives