Why It Might Not Make Sense To Buy PNE Industries Ltd (SGX:BDA) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see PNE Industries Ltd (SGX:BDA) is about to trade ex-dividend in the next 3 days. If you purchase the stock on or after the 28th of January, you won't be eligible to receive this dividend, when it is paid on the 26th of February.

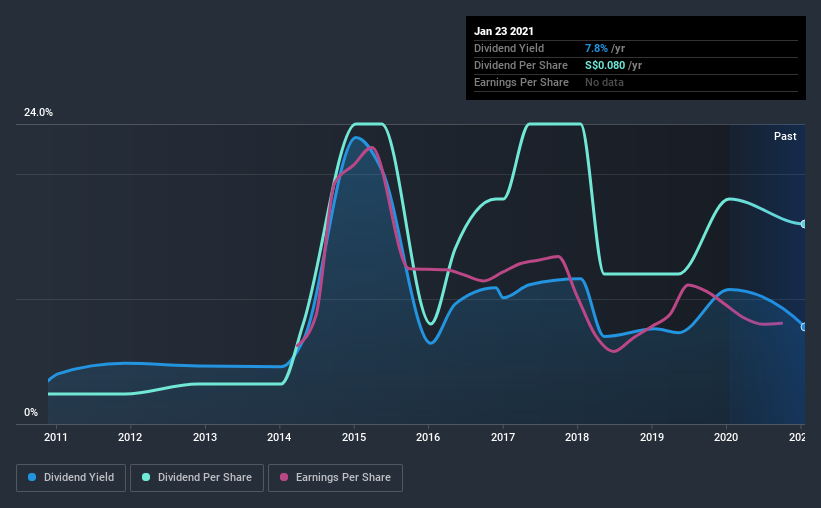

PNE Industries's upcoming dividend is S$0.05 a share, following on from the last 12 months, when the company distributed a total of S$0.08 per share to shareholders. Based on the last year's worth of payments, PNE Industries has a trailing yield of 7.8% on the current stock price of SGD1.03. If you buy this business for its dividend, you should have an idea of whether PNE Industries's dividend is reliable and sustainable. As a result, readers should always check whether PNE Industries has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for PNE Industries

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. PNE Industries paid out more than half (68%) of its earnings last year, which is a regular payout ratio for most companies. A useful secondary check can be to evaluate whether PNE Industries generated enough free cash flow to afford its dividend. It paid out 79% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's positive to see that PNE Industries's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit PNE Industries paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by PNE Industries's 8.3% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. PNE Industries has delivered 21% dividend growth per year on average over the past 10 years. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

To Sum It Up

Is PNE Industries worth buying for its dividend? While earnings per share are shrinking, it's encouraging to see that at least PNE Industries's dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Although, if you're still interested in PNE Industries and want to know more, you'll find it very useful to know what risks this stock faces. For example, PNE Industries has 3 warning signs (and 1 which is potentially serious) we think you should know about.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade PNE Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BDA

PNE Industries

Manufactures, assembles, and trades in electrical and electronic products primarily in Romania, the Netherlands, Europe, Malaysia, Singapore, and the People’s Republic of China.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026