Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Silverlake Axis Ltd. (SGX:5CP) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Silverlake Axis

What Is Silverlake Axis's Net Debt?

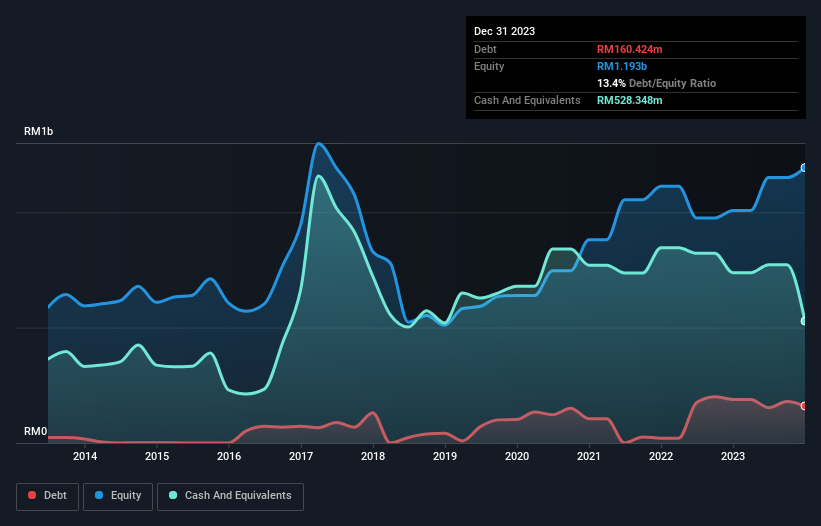

As you can see below, Silverlake Axis had RM160.4m of debt at December 2023, down from RM188.5m a year prior. But on the other hand it also has RM528.3m in cash, leading to a RM367.9m net cash position.

How Strong Is Silverlake Axis' Balance Sheet?

The latest balance sheet data shows that Silverlake Axis had liabilities of RM242.3m due within a year, and liabilities of RM208.6m falling due after that. Offsetting these obligations, it had cash of RM528.3m as well as receivables valued at RM312.3m due within 12 months. So it actually has RM389.8m more liquid assets than total liabilities.

This excess liquidity suggests that Silverlake Axis is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Silverlake Axis boasts net cash, so it's fair to say it does not have a heavy debt load!

But the other side of the story is that Silverlake Axis saw its EBIT decline by 5.9% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Silverlake Axis's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Silverlake Axis has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Silverlake Axis produced sturdy free cash flow equating to 58% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Silverlake Axis has net cash of RM367.9m, as well as more liquid assets than liabilities. So we don't think Silverlake Axis's use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Silverlake Axis's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5CP

Silverlake Axis

An investment holding company, provides software solutions and services.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026