Parkson Retail Asia Limited's (SGX:O9E) Price Is Right But Growth Is Lacking After Shares Rocket 115%

Parkson Retail Asia Limited (SGX:O9E) shareholders would be excited to see that the share price has had a great month, posting a 115% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 87% in the last year.

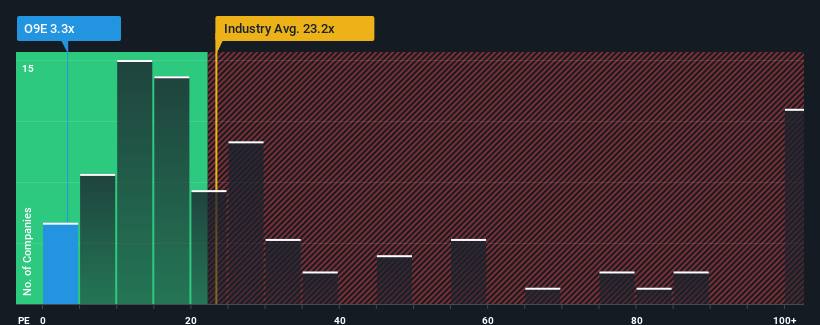

In spite of the firm bounce in price, Parkson Retail Asia's price-to-earnings (or "P/E") ratio of 3.3x might still make it look like a strong buy right now compared to the market in Singapore, where around half of the companies have P/E ratios above 13x and even P/E's above 22x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

For instance, Parkson Retail Asia's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Parkson Retail Asia

How Is Parkson Retail Asia's Growth Trending?

Parkson Retail Asia's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. As a result, earnings from three years ago have also fallen 62% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Parkson Retail Asia is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Parkson Retail Asia's P/E?

Parkson Retail Asia's recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Parkson Retail Asia maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Parkson Retail Asia (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Parkson Retail Asia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:O9E

Parkson Retail Asia

An investment holding company, operates and manages retail department stores in Malaysia, Vietnam, Myanmar, and Cambodia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives