- Saudi Arabia

- /

- Banks

- /

- SASE:1060

Samyang And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, buoyed by a mix of economic optimism and strategic policy decisions. In this dynamic environment, dividend stocks like Samyang offer investors potential stability and income, making them an attractive option for those seeking to balance growth with reliable returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1989 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

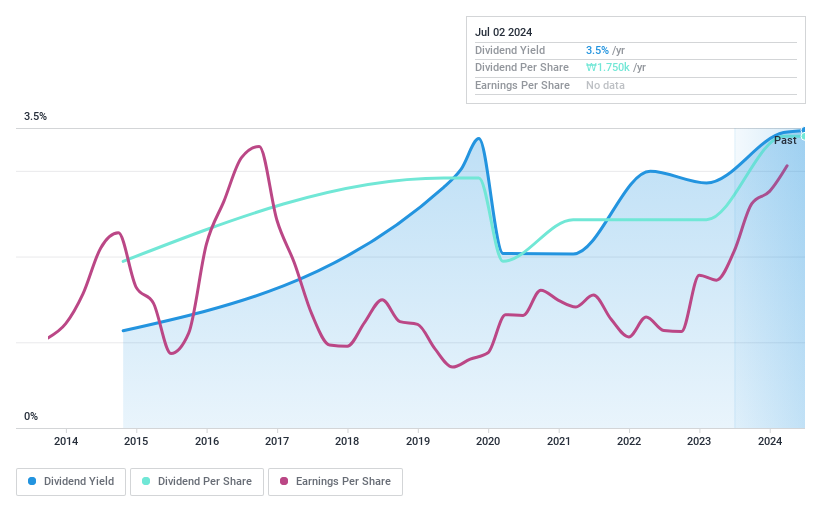

Samyang (KOSE:A145990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Corporation operates in the chemicals and food sectors across Korea, China, Japan, other parts of Asia, Europe, and globally with a market cap of ₩450.77 billion.

Operations: Samyang Corporation's revenue is primarily derived from its food segment, contributing ₩1.59 trillion, and its chemicals segment, generating ₩1.11 trillion.

Dividend Yield: 3.8%

Samyang's dividend payments are well supported by earnings and cash flows, with low payout ratios of 15.1% and 13.3%, respectively. Despite a history of volatility in its dividends over the past decade, the company has managed to grow its dividend payments during this period. However, its current yield of 3.8% is slightly below the top quartile in South Korea's market, indicating room for improvement in terms of competitive yield offerings.

- Delve into the full analysis dividend report here for a deeper understanding of Samyang.

- Our valuation report here indicates Samyang may be undervalued.

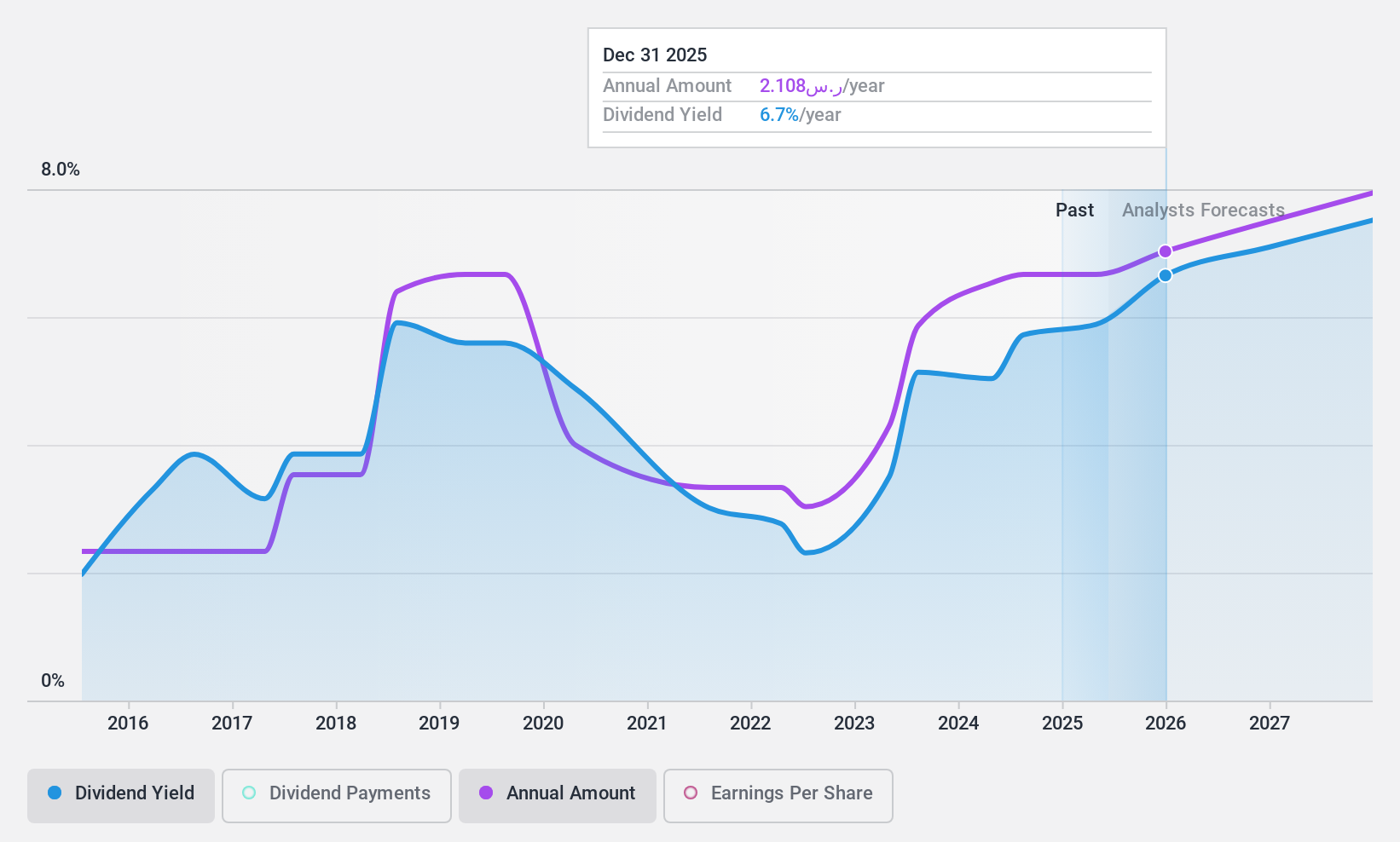

Saudi Awwal Bank (SASE:1060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Awwal Bank, with a market cap of SAR74.90 billion, offers banking and financial services in the Kingdom of Saudi Arabia through its subsidiaries.

Operations: Saudi Awwal Bank generates revenue through its segments, including Treasury (SAR1.93 billion), Capital Markets (SAR445.67 million), Wealth & Personal Banking (SAR3.92 billion), and Corporate and Institutional Banking (SAR7.17 billion).

Dividend Yield: 5.4%

Saudi Awwal Bank's dividend yield is in the top 25% of Saudi Arabia's market, supported by a reasonable payout ratio of 52.9%, ensuring coverage by earnings. Despite past volatility and an unstable dividend track record, dividends have increased over the last decade. Recent earnings growth, with net income reaching SAR 8.07 billion for 2024, bolsters its capacity to sustain payouts. The bank’s strategic initiatives and fixed-income offerings further enhance its financial stability.

- Click to explore a detailed breakdown of our findings in Saudi Awwal Bank's dividend report.

- Our valuation report unveils the possibility Saudi Awwal Bank's shares may be trading at a discount.

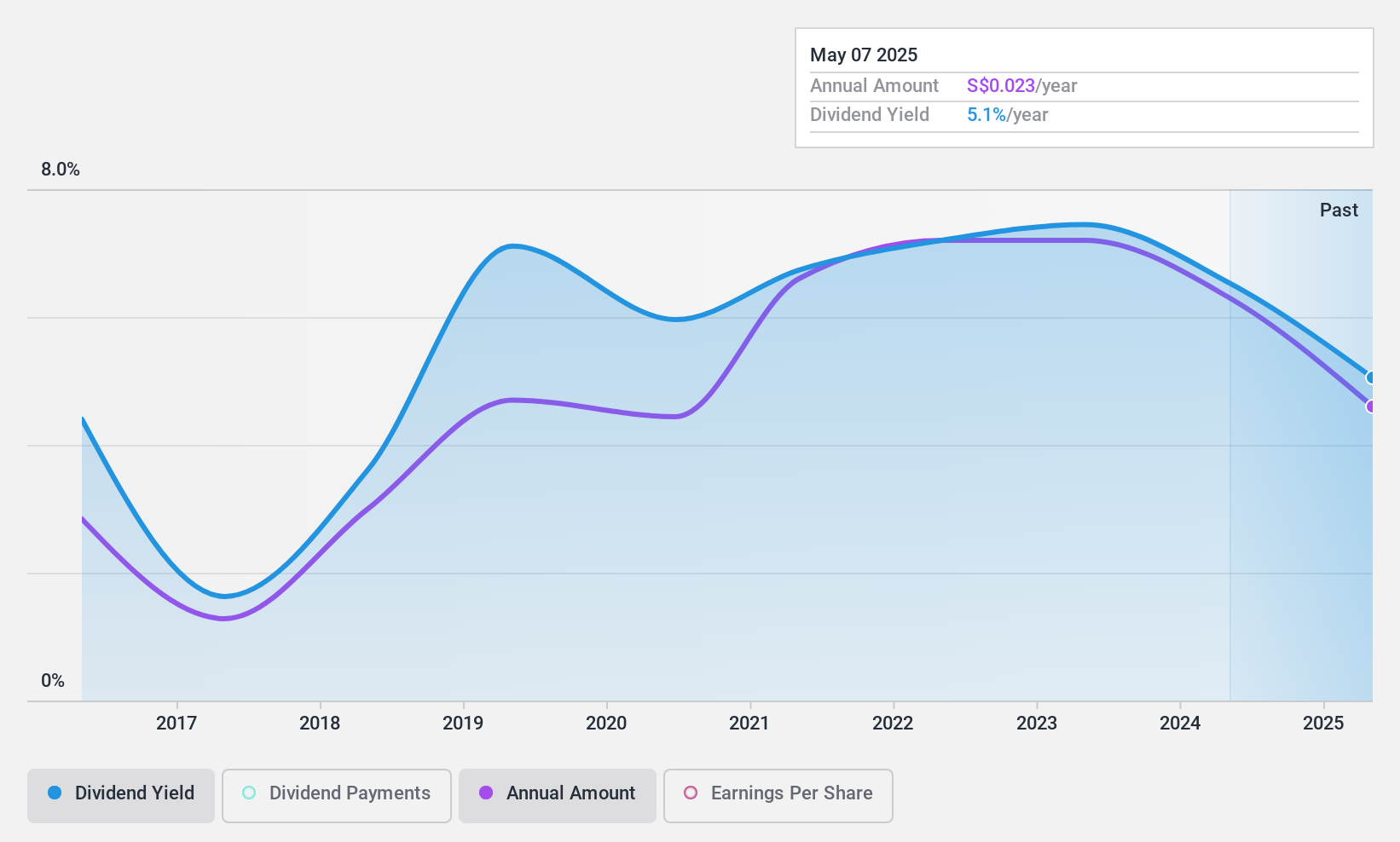

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across various regions including Singapore, Malaysia, China, and more; it has a market cap of SGD141.48 million.

Operations: YHI International Limited generates revenue through several segments, including Distribution - ASEAN (SGD119.40 million), Distribution - Other (SGD33.31 million), Manufacturing - ASEAN (SGD55.05 million), Distribution - Oceania (SGD140.24 million), Distribution - North East Asia (SGD17.99 million), and Manufacturing - North East Asia excluding rental (SGD57.20 million).

Dividend Yield: 6.4%

YHI International's dividend yield ranks in the top 25% of the Singapore market, backed by a payout ratio of 68.9%, indicating coverage by earnings. Despite a history of volatility and an unstable dividend track record, dividends have grown over the past decade. The cash payout ratio stands at 43.3%, suggesting strong coverage by cash flows. Trading at nearly half its estimated fair value, YHI offers potential value for dividend-focused investors amid modest earnings growth.

- Get an in-depth perspective on YHI International's performance by reading our dividend report here.

- The analysis detailed in our YHI International valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Unlock our comprehensive list of 1989 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1060

Saudi Awwal Bank

Provides banking and financial services in the Kingdom of Saudi Arabia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives