- Singapore

- /

- Retail Distributors

- /

- SGX:BFU

With EPS Growth And More, Tye Soon (SGX:BFU) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tye Soon (SGX:BFU). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Tye Soon

How Fast Is Tye Soon Growing Its Earnings Per Share?

Over the last three years, Tye Soon has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Tye Soon's EPS skyrocketed from S$0.051 to S$0.072, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 41%.

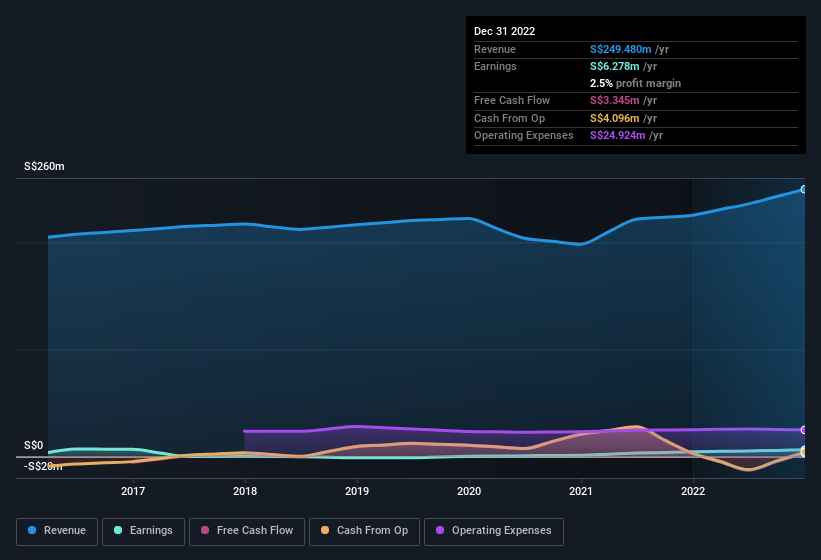

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Tye Soon achieved similar EBIT margins to last year, revenue grew by a solid 11% to S$249m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Tye Soon isn't a huge company, given its market capitalisation of S$36m. That makes it extra important to check on its balance sheet strength.

Are Tye Soon Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the MD & Executive Director, Tek Yew Chong, paid S$264k to buy shares at an average price of S$0.40. Purchases like this clue us in to the to the faith management has in the business' future.

Is Tye Soon Worth Keeping An Eye On?

You can't deny that Tye Soon has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; Tye Soon is a strong candidate for your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Tye Soon (1 is concerning!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Tye Soon, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tye Soon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BFU

Tye Soon

Imports, exports, and distributes automotive spare parts in Singapore, Malaysia, Australia, Thailand, Indonesia, Hong Kong/China, South Korea, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026