Zhongmin Baihui Retail Group (SGX:5SR) Is Paying Out A Dividend Of CN¥0.01

Zhongmin Baihui Retail Group Ltd.'s (SGX:5SR) investors are due to receive a payment of CN¥0.01 per share on 18th of November. This means that the annual payment will be 2.0% of the current stock price, which is in line with the average for the industry.

Zhongmin Baihui Retail Group's Projected Earnings Seem Likely To Cover Future Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. However, prior to this announcement, Zhongmin Baihui Retail Group's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 0.3% if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio will be 4.0%, which is in the range that makes us comfortable with the sustainability of the dividend.

Check out our latest analysis for Zhongmin Baihui Retail Group

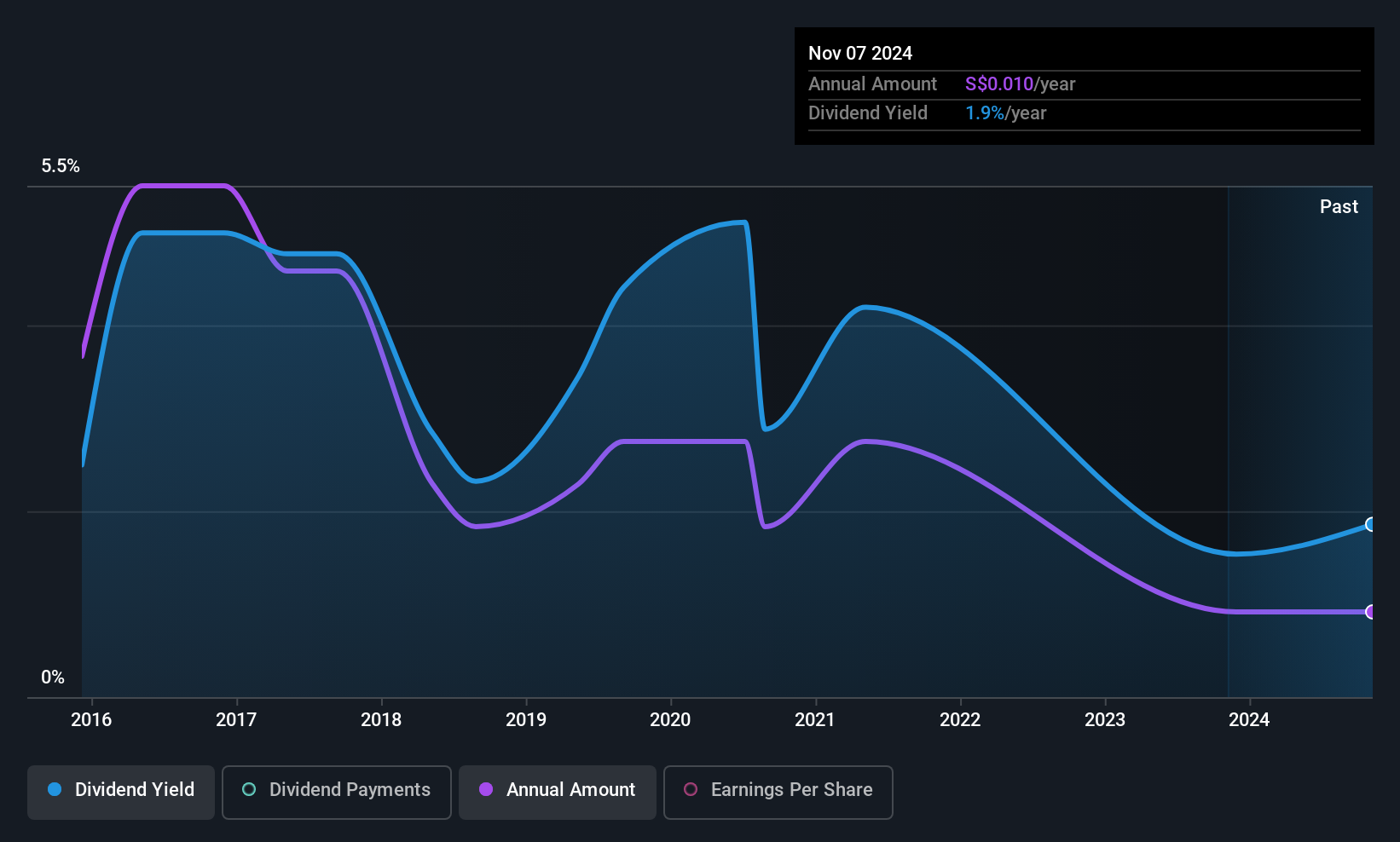

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of CN¥0.0892 in 2015 to the most recent total annual payment of CN¥0.0548. Doing the maths, this is a decline of about 4.8% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Zhongmin Baihui Retail Group May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Zhongmin Baihui Retail Group hasn't seen much change in its earnings per share over the last five years. While growth may be thin on the ground, Zhongmin Baihui Retail Group could always pay out a higher proportion of earnings to increase shareholder returns.

In Summary

Overall, a consistent dividend is a good thing, and we think that Zhongmin Baihui Retail Group has the ability to continue this into the future. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for Zhongmin Baihui Retail Group (of which 1 is significant!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhongmin Baihui Retail Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5SR

Zhongmin Baihui Retail Group

An investment holding company, owns, operates, and manages a chain of department stores and supermarkets in the People’s Republic of China.

Moderate risk with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)