- Singapore

- /

- Specialty Stores

- /

- SGX:528

Are Second Chance Properties's (SGX:528) Statutory Earnings A Good Reflection Of Its Earnings Potential?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Second Chance Properties (SGX:528).

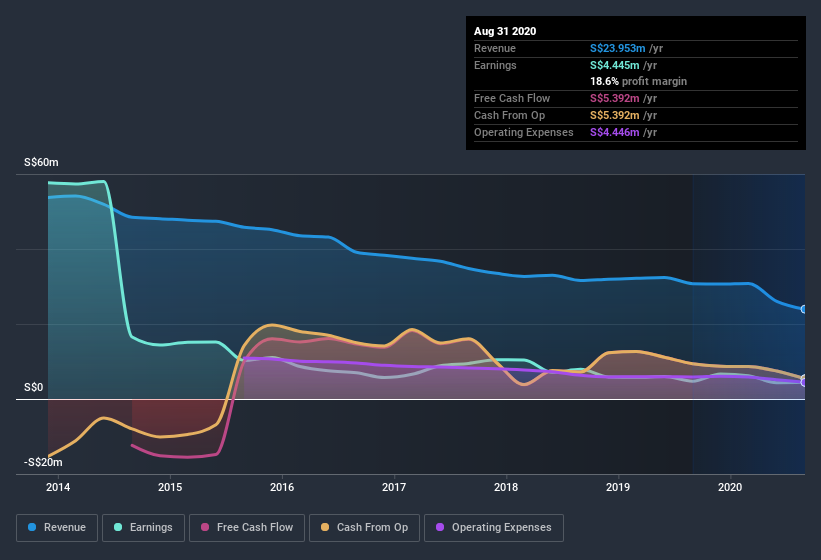

While Second Chance Properties was able to generate revenue of S$24.0m in the last twelve months, we think its profit result of S$4.45m was more important. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

Check out our latest analysis for Second Chance Properties

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article, will discuss how unusual items and a tax benefit have impacted Second Chance Properties' most recent bottom line results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Second Chance Properties.

The Impact Of Unusual Items On Profit

To properly understand Second Chance Properties' profit results, we need to consider the S$5.1m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. In the twelve months to August 2020, Second Chance Properties had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Second Chance Properties received a tax benefit which contributed S$719k to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Second Chance Properties' Profit Performance

In the last year Second Chance Properties received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. But on the other hand, it also saw an unusual item depress its profit. Considering all the aforementioned, we'd venture that Second Chance Properties' profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 4 warning signs for Second Chance Properties you should be mindful of and 1 of them is a bit unpleasant.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Second Chance Properties, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:528

Second Chance Properties

An investment holding company, operates in the retail of gold and jewelries, and ready-made garments in Singapore and Malaysia.

Mediocre balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)