- Singapore

- /

- Hotel and Resort REITs

- /

- SGX:Q5T

Increases to Far East Hospitality Trust's (SGX:Q5T) CEO Compensation Might Cool off for now

The share price of Far East Hospitality Trust (SGX:Q5T) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. The upcoming AGM on 22 April 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for Far East Hospitality Trust

How Does Total Compensation For Gerald Lee Compare With Other Companies In The Industry?

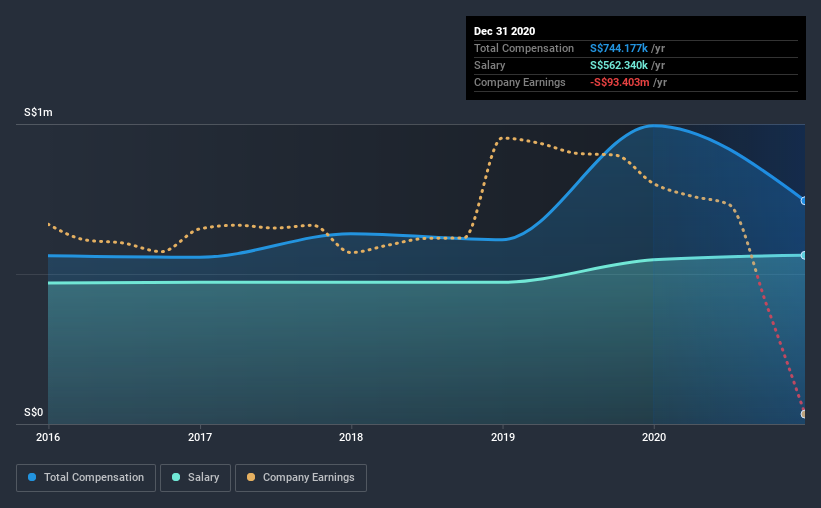

According to our data, Far East Hospitality Trust has a market capitalization of S$1.2b, and paid its CEO total annual compensation worth S$744k over the year to December 2020. We note that's a decrease of 25% compared to last year. In particular, the salary of S$562.3k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between S$534m and S$2.1b had a median total CEO compensation of S$396k. Accordingly, our analysis reveals that Far East Hospitality Trust pays Gerald Lee north of the industry median. What's more, Gerald Lee holds S$840k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | S$562k | S$547k | 76% |

| Other | S$182k | S$447k | 24% |

| Total Compensation | S$744k | S$994k | 100% |

Talking in terms of the industry, salary represented approximately 28% of total compensation out of all the companies we analyzed, while other remuneration made up 72% of the pie. Far East Hospitality Trust is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Far East Hospitality Trust's Growth Numbers

Far East Hospitality Trust has reduced its earnings per share by 31% a year over the last three years. Its revenue is down 27% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Far East Hospitality Trust Been A Good Investment?

With a total shareholder return of 9.7% over three years, Far East Hospitality Trust has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Far East Hospitality Trust (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Far East Hospitality Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:Q5T

Far East Hospitality Trust

Far East H-Trust is a Singapore-Focused Hotel and Serviced Residence Hospitality Trust listed on the Main Board of The Singapore Exchange Securities Trading Limited (“SGX-ST”).

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives