- Singapore

- /

- Retail REITs

- /

- SGX:ODBU

Earnings are growing at United Hampshire US Real Estate Investment Trust (SGX:ODBU) but shareholders still don't like its prospects

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by United Hampshire US Real Estate Investment Trust (SGX:ODBU) shareholders over the last year, as the share price declined 21%. That's well below the market decline of 3.4%. United Hampshire US Real Estate Investment Trust may have better days ahead, of course; we've only looked at a one year period.

Since United Hampshire US Real Estate Investment Trust has shed US$32m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for United Hampshire US Real Estate Investment Trust

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the United Hampshire US Real Estate Investment Trust share price fell, it actually saw its earnings per share (EPS) improve by 137%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

United Hampshire US Real Estate Investment Trust's dividend seems healthy to us, so we doubt that the yield is a concern for the market. The revenue trend doesn't seem to explain why the share price is down. Of course, it could simply be that it simply fell short of the market consensus expectations.

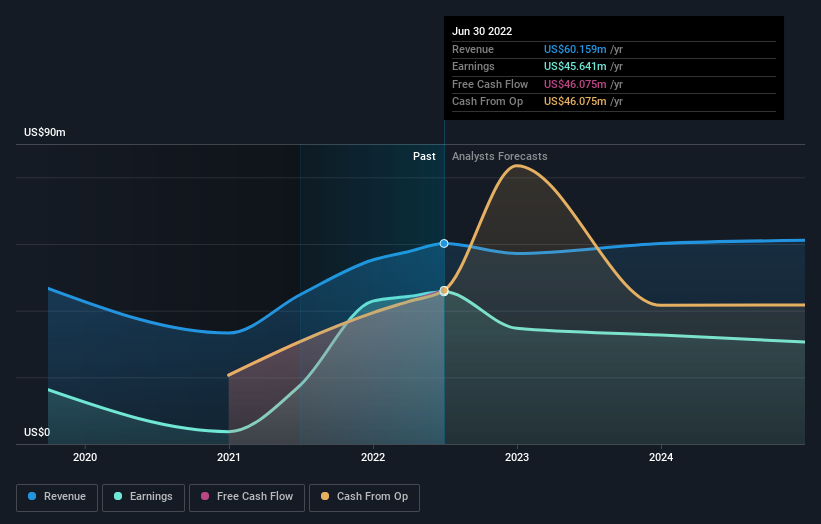

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for United Hampshire US Real Estate Investment Trust in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for United Hampshire US Real Estate Investment Trust the TSR over the last 1 year was -14%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While United Hampshire US Real Estate Investment Trust shareholders are down 14% for the year (even including dividends), the market itself is up 3.4%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's worth noting that the last three months did the real damage, with a 14% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. It's always interesting to track share price performance over the longer term. But to understand United Hampshire US Real Estate Investment Trust better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with United Hampshire US Real Estate Investment Trust (at least 2 which are concerning) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:ODBU

United Hampshire US Real Estate Investment Trust

Listed on the Main Board of the Singapore Exchange on 12 March 2020, UHREIT is a Singapore real estate investment trust established with the principal investment strategy of investing in a diversified portfolio of stabilised income-producing (i) grocery-anchored and necessity-based retail properties (“Grocery & Necessity Properties”), and (ii) modern, climate-controlled self-storage facilities (“Self-Storage Properties”), located in the U.S.

Undervalued with proven track record.

Market Insights

Community Narratives