- Singapore

- /

- Real Estate

- /

- SGX:F1E

Here's Why We Think Low Keng Huat (Singapore) (SGX:F1E) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Low Keng Huat (Singapore) (SGX:F1E). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Low Keng Huat (Singapore)

How Fast Is Low Keng Huat (Singapore) Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud Low Keng Huat (Singapore)'s stratospheric annual EPS growth of 40%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

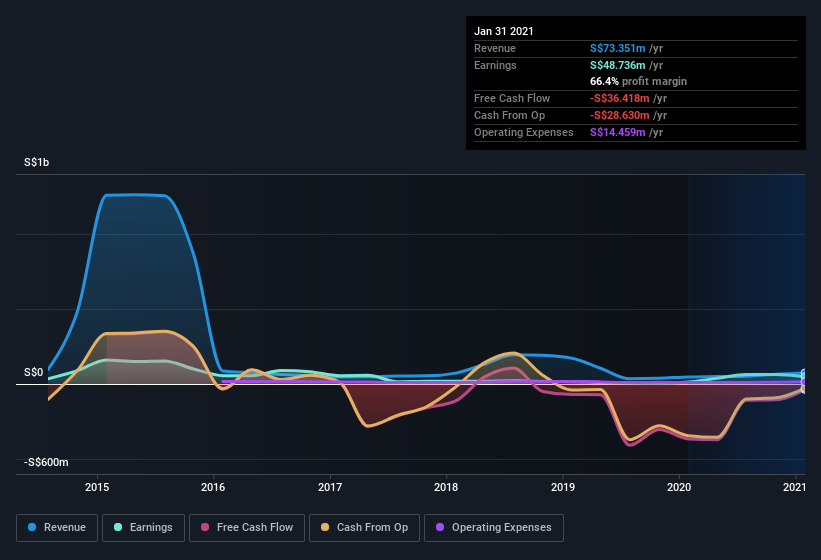

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Low Keng Huat (Singapore) did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Low Keng Huat (Singapore) is no giant, with a market capitalization of S$369m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Low Keng Huat (Singapore) Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Low Keng Huat (Singapore) insiders reported share sales in the last twelve months. But the really good news is that Executive Director Poh Kheng Teo spent S$467k buying stock stock, at an average price of around S$0.47. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

Along with the insider buying, another encouraging sign for Low Keng Huat (Singapore) is that insiders, as a group, have a considerable shareholding. Indeed, they hold S$60m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 16% of the company; visible skin in the game.

Should You Add Low Keng Huat (Singapore) To Your Watchlist?

Low Keng Huat (Singapore)'s earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Low Keng Huat (Singapore) belongs on the top of your watchlist. Before you take the next step you should know about the 3 warning signs for Low Keng Huat (Singapore) (2 are a bit concerning!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Low Keng Huat (Singapore), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Low Keng Huat (Singapore), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:F1E

Low Keng Huat (Singapore)

An investment holding company, engages in property development, hotel, and investment business in Singapore, Australia, and Malaysia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026