- Singapore

- /

- Industrial REITs

- /

- SGX:BUOU

SGX's Top Value Stock Opportunities For September 2024

Reviewed by Simply Wall St

The Singapore market has shown resilience amidst global economic uncertainties, with the Straits Times Index (STI) reflecting steady performance. In this environment, identifying undervalued stocks can offer significant opportunities for investors to capitalize on potential growth.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.62 | SGD7.31 | 36.8% |

| Digital Core REIT (SGX:DCRU) | US$0.615 | US$0.83 | 25.7% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.835 | SGD1.42 | 41.4% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.17 | SGD1.59 | 26.6% |

| Seatrium (SGX:5E2) | SGD1.73 | SGD2.95 | 41.3% |

Here we highlight a subset of our preferred stocks from the screener.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust managing 107 industrial and commercial properties valued at approximately S$6.4 billion, with a market cap of around S$4.40 billion, diversified across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Operations: FLCT's revenue segments include industrial and commercial properties across Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

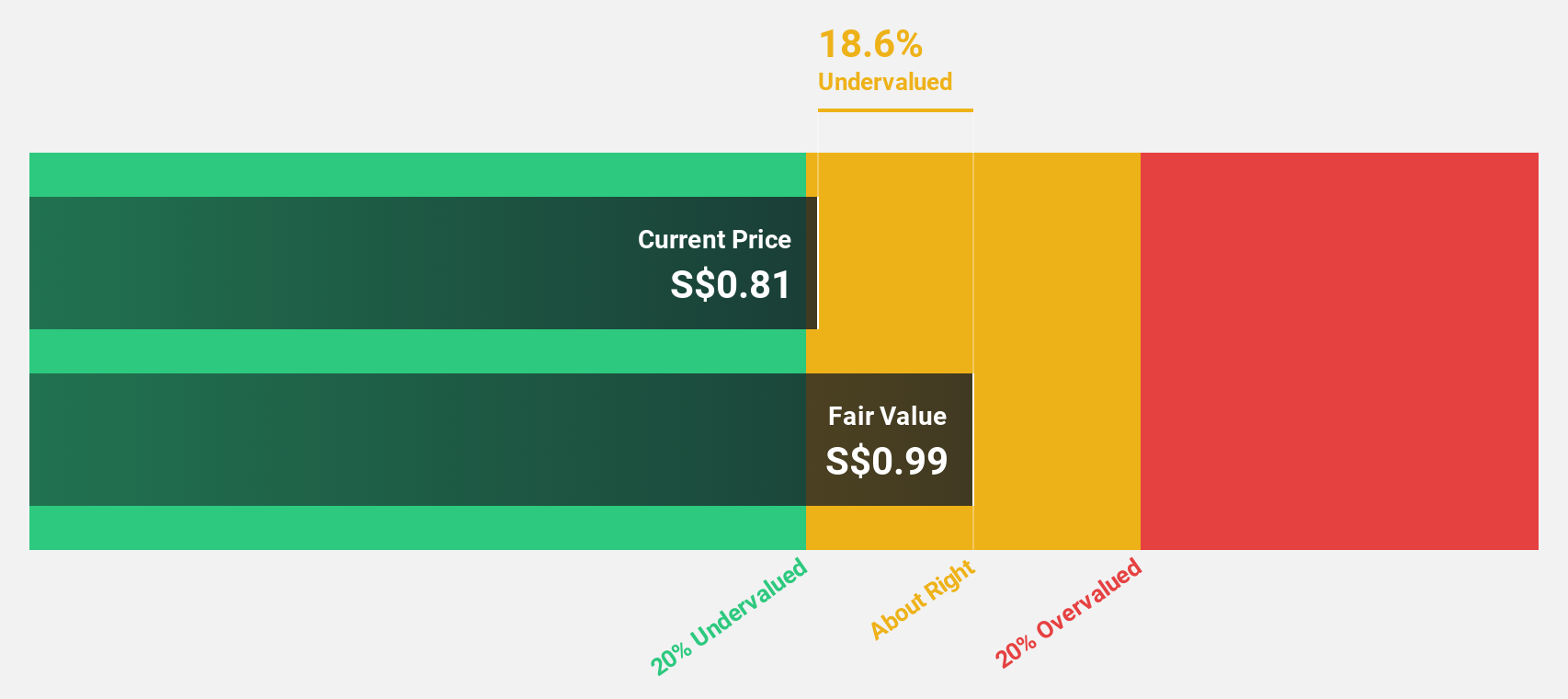

Estimated Discount To Fair Value: 26.6%

Frasers Logistics & Commercial Trust is trading at S$1.17, which is 26.6% below its estimated fair value of S$1.59, suggesting it may be undervalued based on cash flows. Despite a low forecasted return on equity (5.8%) and an unstable dividend track record, the trust's earnings are expected to grow 39.37% annually, and revenue growth (6.4% per year) outpaces the Singapore market average of 3.6%. Recent board changes aim to strengthen governance and strategic oversight.

- Our comprehensive growth report raises the possibility that Frasers Logistics & Commercial Trust is poised for substantial financial growth.

- Click here to discover the nuances of Frasers Logistics & Commercial Trust with our detailed financial health report.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $797.39 million.

Operations: Digital Core REIT generates revenue primarily from its commercial data centre operations, amounting to $70.76 million.

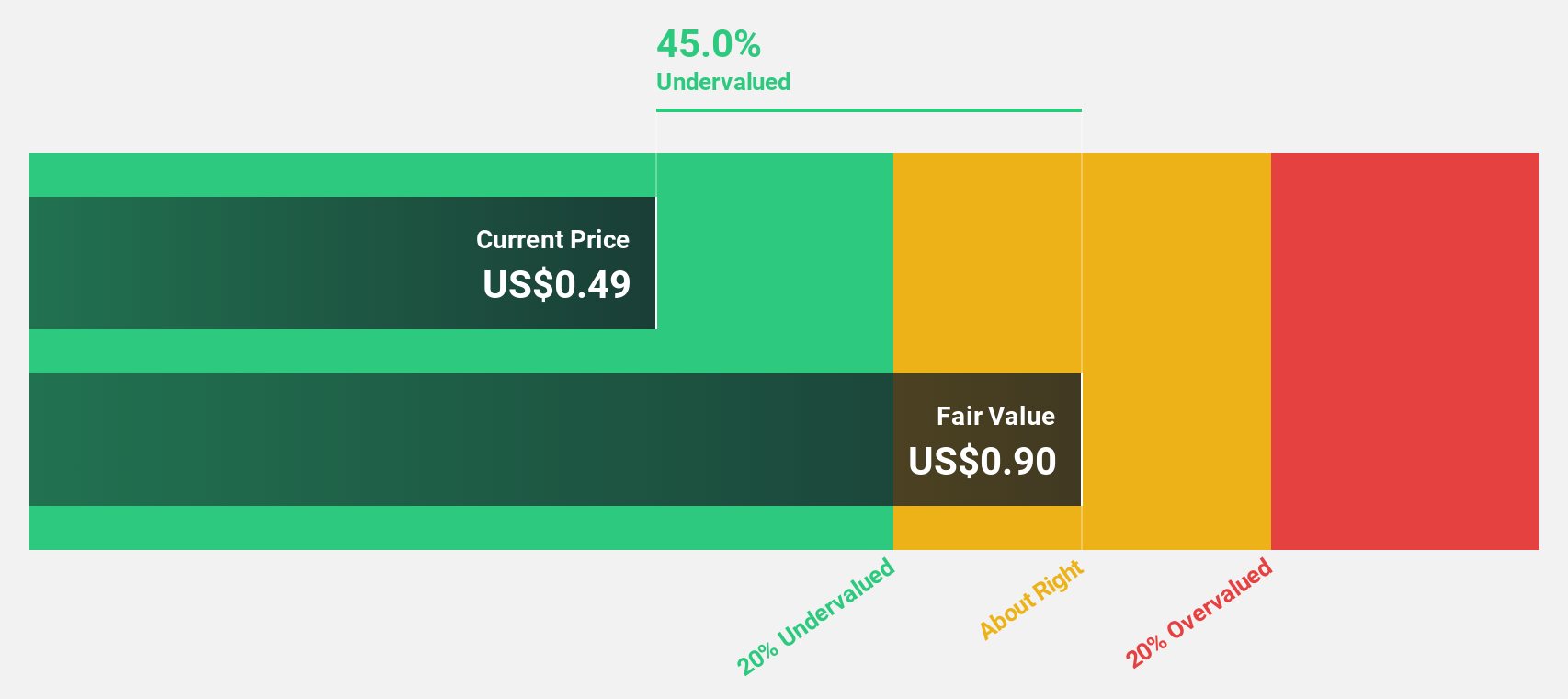

Estimated Discount To Fair Value: 25.7%

Digital Core REIT is trading at US$0.62, 25.7% below its estimated fair value of US$0.83, indicating it may be undervalued based on cash flows. Despite a recent decrease in dividends and past shareholder dilution, the REIT's net income for H1 2024 more than doubled to US$18.63 million from the previous year. Revenue growth of 12% per year is expected to outpace the Singapore market average of 3.6%.

- Our growth report here indicates Digital Core REIT may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Digital Core REIT's balance sheet health report.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD543.65 million, provides nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: Nanofilm Technologies International Limited generates revenue from four main segments: Sydrogen (SGD1.40 million), Nanofabrication (SGD18.37 million), Advanced Materials (SGD153.32 million), and Industrial Equipment (SGD28.71 million).

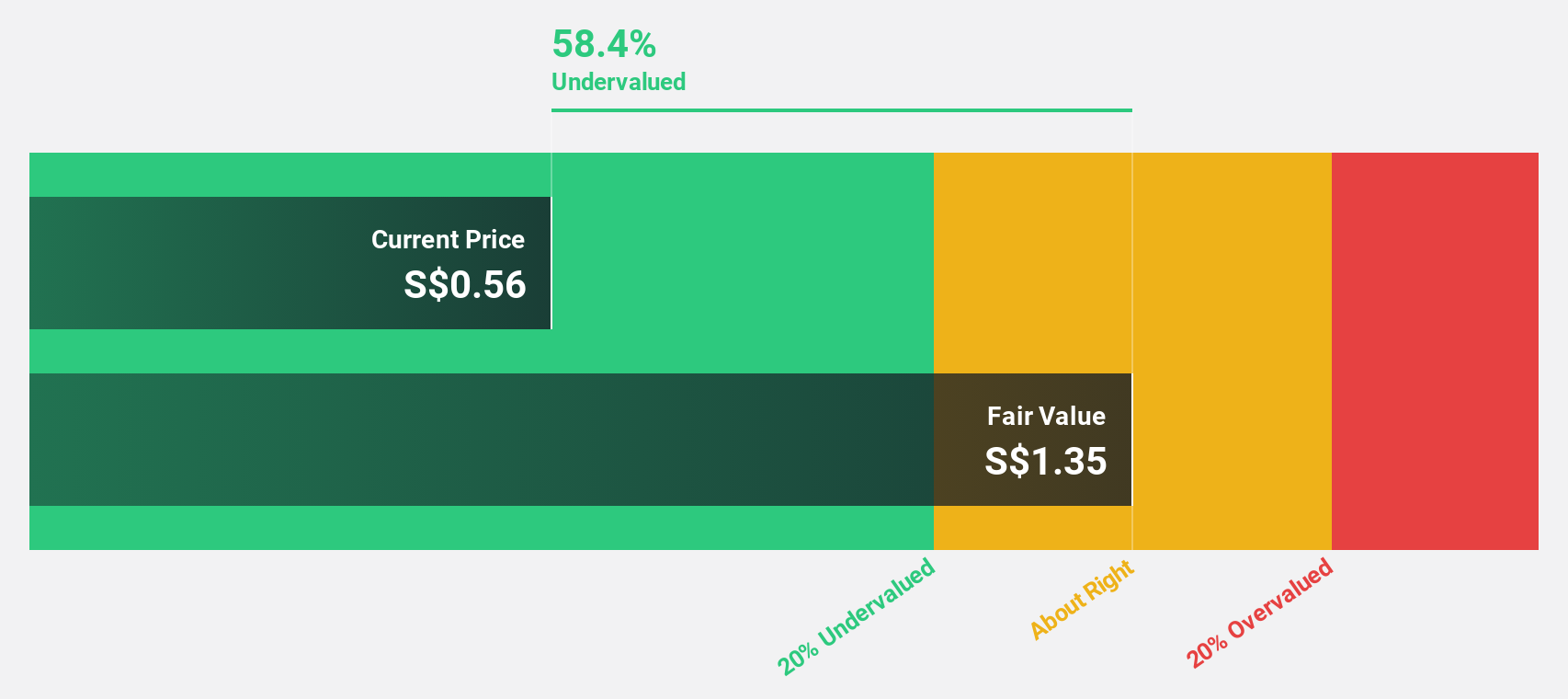

Estimated Discount To Fair Value: 41.4%

Nanofilm Technologies International is trading at SGD 0.84, significantly below its estimated fair value of SGD 1.42, suggesting it may be undervalued based on cash flows. The company reported H1 2024 sales of SGD 82.65 million and a net loss of SGD 3.74 million, an improvement from the previous year's loss of SGD 7.65 million. Despite recent board changes and lower profit margins, earnings are forecasted to grow substantially over the next three years.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Nanofilm Technologies International's balance sheet by reading our health report here.

Make It Happen

- Investigate our full lineup of 5 Undervalued SGX Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BUOU

Frasers Logistics & Commercial Trust

Frasers Logistics & Commercial Trust ("FLCT") is a Singapore-listed real estate investment trust with a portfolio comprising 107 industrial and commercial properties, worth approximately S$6.4 billion, diversified across five major developed markets - Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Average dividend payer and fair value.