- Singapore

- /

- Specialized REITs

- /

- SGX:DCRU

SGX Stocks Estimated To Be Undervalued By Up To 47.1%

Reviewed by Simply Wall St

The Singapore market has shown resilience amid global economic uncertainties, with investors seeking stable opportunities amidst the volatility of cryptocurrency-related frauds and scams. In this environment, identifying undervalued stocks becomes crucial as they offer potential for growth and stability in a fluctuating market.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.46 | SGD7.37 | 39.5% |

| LHN (SGX:41O) | SGD0.34 | SGD0.41 | 17.5% |

| Digital Core REIT (SGX:DCRU) | US$0.595 | US$0.82 | 27.7% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.15 | SGD2.17 | 47.1% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.81 | SGD1.43 | 43.5% |

| Seatrium (SGX:5E2) | SGD1.57 | SGD2.91 | 46% |

Let's take a closer look at a couple of our picks from the screened companies.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust that manages a portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion, with a market cap of around S$4.32 billion, diversified across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Operations: FLCT generates revenue from its portfolio of 107 industrial and commercial properties, valued at approximately S$6.4 billion, across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

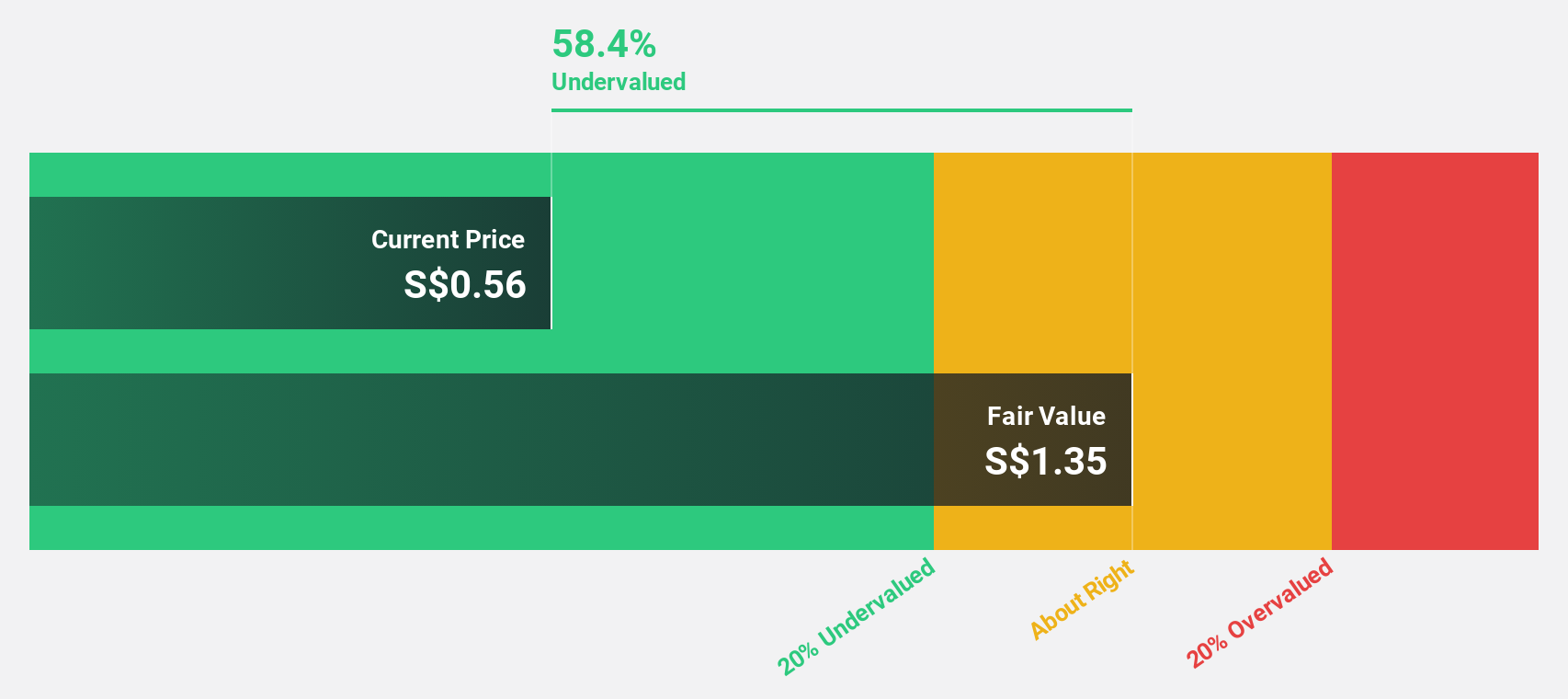

Estimated Discount To Fair Value: 47.1%

Frasers Logistics & Commercial Trust is trading at S$1.15, significantly below its estimated fair value of S$2.17, indicating it is highly undervalued based on discounted cash flow analysis. Despite a low forecasted return on equity of 5.8% in three years, the trust is expected to become profitable within the same period and has an anticipated annual revenue growth rate of 6.3%, outpacing the Singapore market's average growth rate of 3.7%.

- The analysis detailed in our Frasers Logistics & Commercial Trust growth report hints at robust future financial performance.

- Take a closer look at Frasers Logistics & Commercial Trust's balance sheet health here in our report.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $773.61 million.

Operations: The company's revenue segment is primarily derived from its commercial REIT operations, totaling $70.76 million.

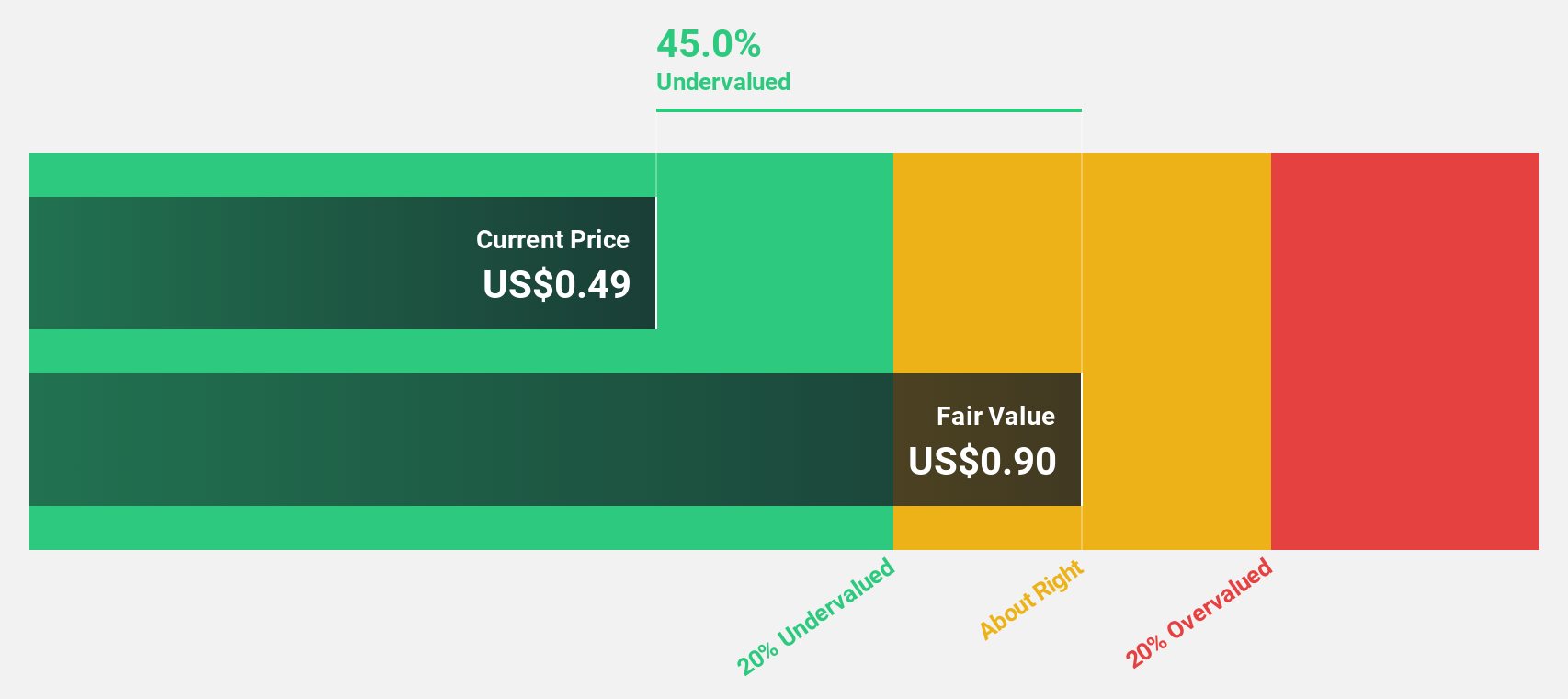

Estimated Discount To Fair Value: 27.7%

Digital Core REIT is trading at US$0.60, significantly below its estimated fair value of US$0.82, highlighting its undervaluation based on discounted cash flow analysis. Despite a recent decrease in revenue and an unstable dividend track record, the REIT's net income has more than doubled year-over-year to US$18.63 million. Analysts forecast robust annual earnings growth of 95.91%, with expected profitability within three years and revenue growth outpacing the Singapore market average.

- Our comprehensive growth report raises the possibility that Digital Core REIT is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Digital Core REIT.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD527.37 million, provides nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: Nanofilm Technologies International Limited generates revenue from four main segments: Sydrogen (SGD1.40 million), Nanofabrication (SGD18.37 million), Advanced Materials (SGD153.32 million), and Industrial Equipment (SGD28.71 million).

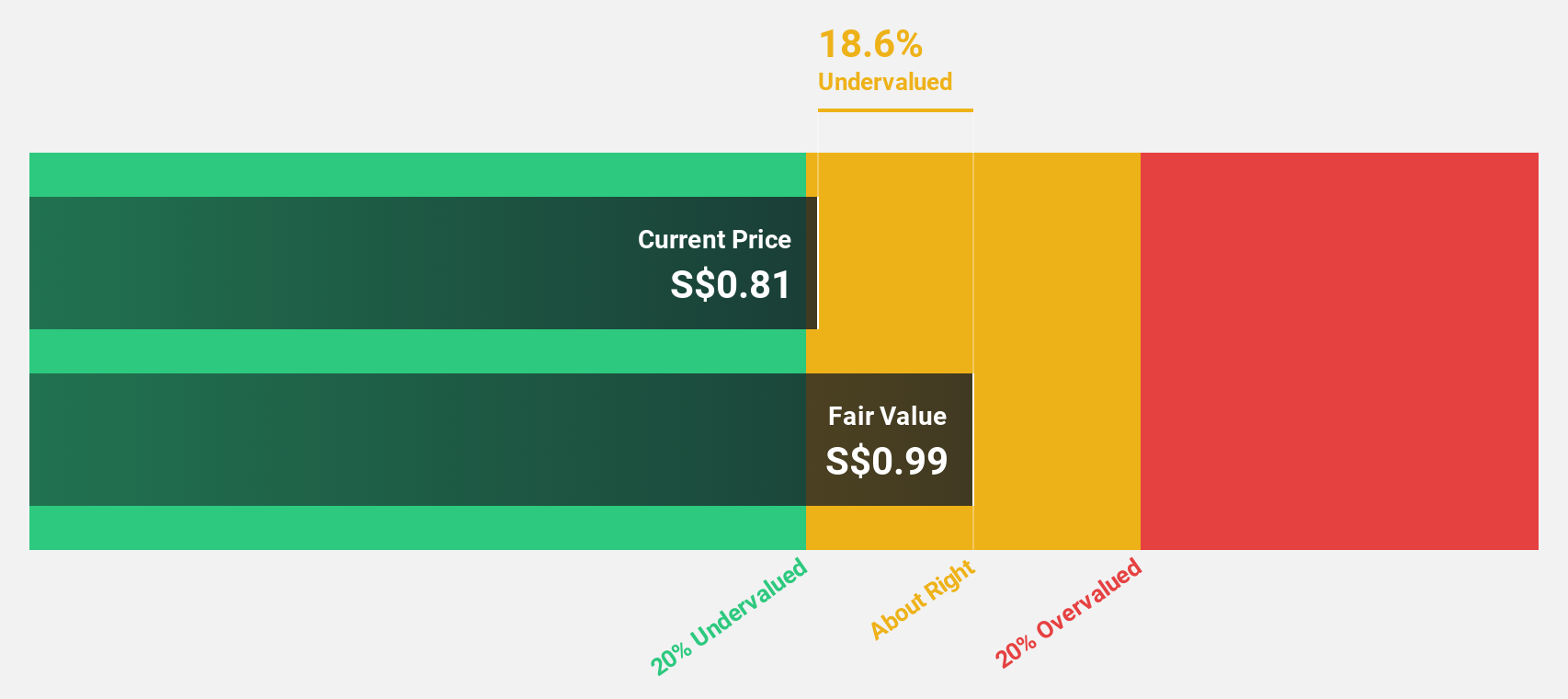

Estimated Discount To Fair Value: 43.5%

Nanofilm Technologies International is trading at S$0.81, well below its estimated fair value of S$1.43, indicating significant undervaluation based on discounted cash flow analysis. Despite a net loss of S$3.74 million for the first half of 2024, the company expects improved earnings in the second half. Revenue growth is forecasted at 16.1% per year, outpacing the Singapore market average, though profit margins have decreased from last year’s 8.7% to 3.8%.

- The growth report we've compiled suggests that Nanofilm Technologies International's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Nanofilm Technologies International.

Make It Happen

- Click through to start exploring the rest of the 3 Undervalued SGX Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:DCRU

Digital Core REIT

Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore and sponsored by Digital Realty, the largest global data centre owner and operator.

High growth potential average dividend payer.