SGX August 2024's Top 3 Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

The Singapore market is abuzz with innovation as DBS successfully completes a pilot using blockchain technology for programmable government grant disbursements. This milestone underscores the nation's commitment to leveraging advanced technologies for enhanced efficiency and governance. In this evolving landscape, identifying undervalued stocks can offer substantial opportunities for investors looking to capitalize on market inefficiencies.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.50 | SGD8.95 | 49.7% |

| LHN (SGX:41O) | SGD0.335 | SGD0.41 | 18.3% |

| Winking Studios (Catalist:WKS) | SGD0.29 | SGD0.54 | 46.5% |

| Digital Core REIT (SGX:DCRU) | US$0.615 | US$0.84 | 27.1% |

| Seatrium (SGX:5E2) | SGD1.48 | SGD2.84 | 47.9% |

Let's review some notable picks from our screened stocks.

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries and has a market cap of SGD5.04 billion.

Operations: The company's revenue segments include Ship Chartering at SGD24.71 million and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding at SGD8.39 billion.

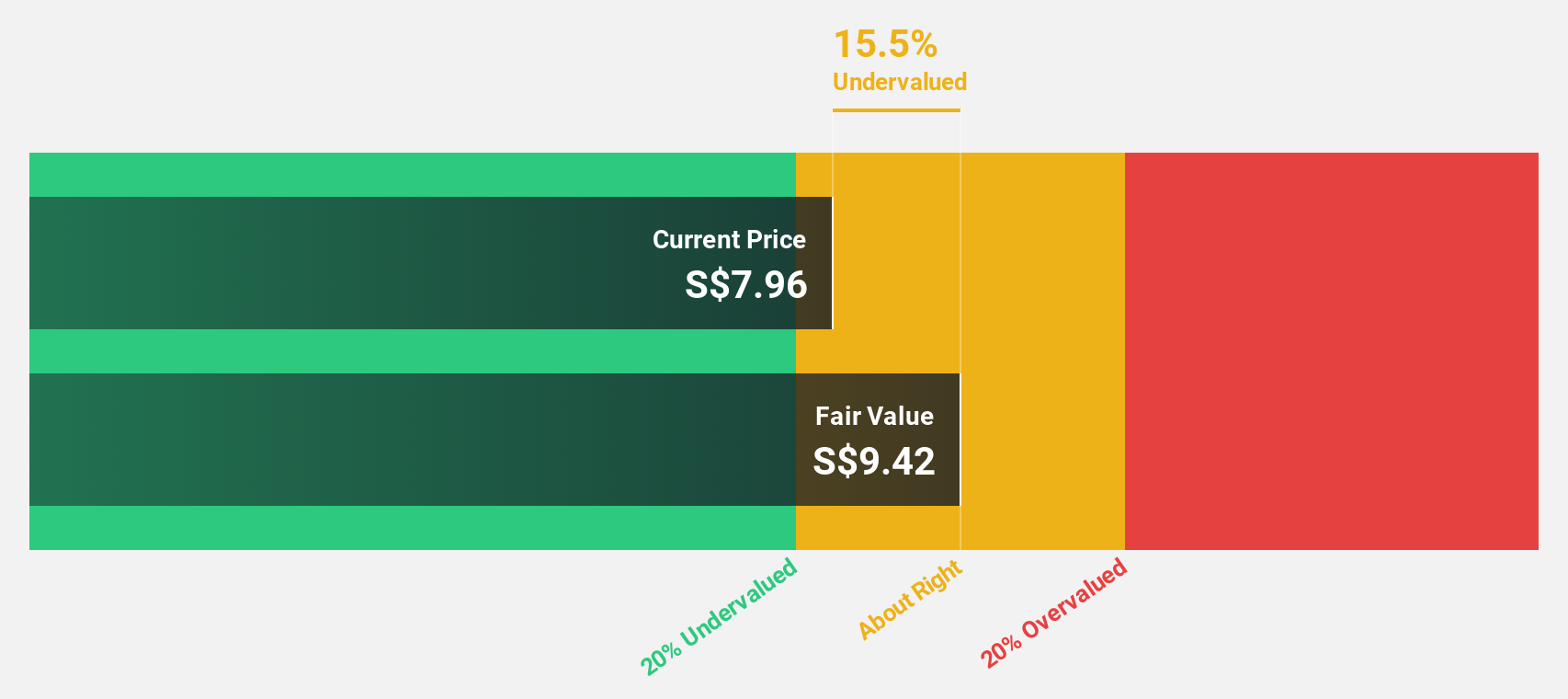

Estimated Discount To Fair Value: 47.9%

Seatrium Limited has shown significant improvement in its financials, reporting a net income of S$35.97 million for H1 2024 compared to a net loss the previous year. The recent successful delivery of the Vali jackup rig ahead of schedule underscores its operational efficiency. Despite ongoing regulatory investigations, Seatrium's stock is trading at 47.9% below its estimated fair value, suggesting it may be undervalued based on cash flows and future earnings potential.

- Insights from our recent growth report point to a promising forecast for Seatrium's business outlook.

- Take a closer look at Seatrium's balance sheet health here in our report.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX:DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $799.77 million.

Operations: Revenue from Digital Core REIT's commercial data centres totals $70.76 million.

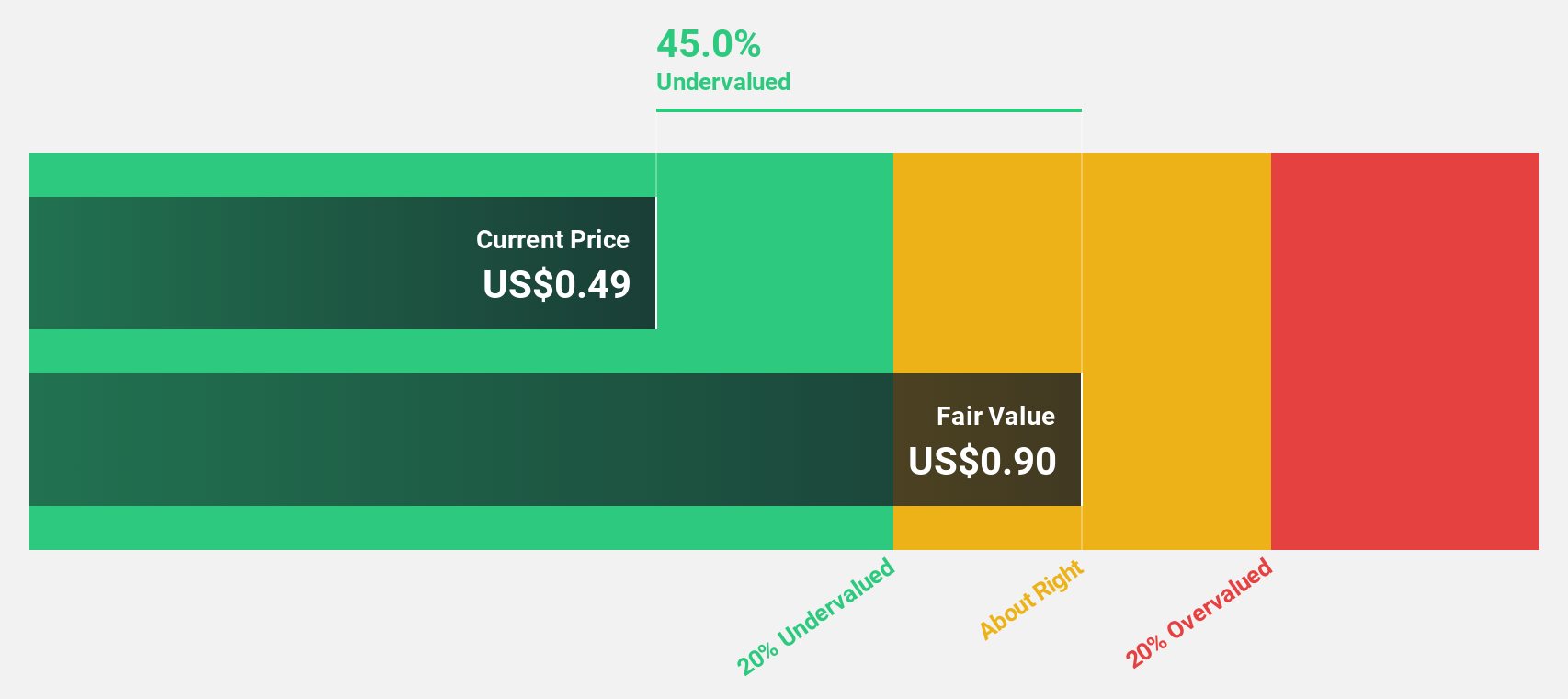

Estimated Discount To Fair Value: 27.1%

Digital Core REIT is trading at 27.1% below its estimated fair value of US$0.84, making it highly undervalued based on discounted cash flow analysis. Despite a dip in revenue to US$48.26 million for H1 2024, net income rose to US$18.63 million from US$9.07 million a year ago, showing strong earnings growth potential. However, the company has an unstable dividend track record and low forecasted return on equity (4.8%) in three years' time.

- Our earnings growth report unveils the potential for significant increases in Digital Core REIT's future results.

- Get an in-depth perspective on Digital Core REIT's balance sheet by reading our health report here.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd operates as a global technology, defense, and engineering company with a market cap of approximately SGD14.03 billion.

Operations: The company generates revenue primarily from three segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

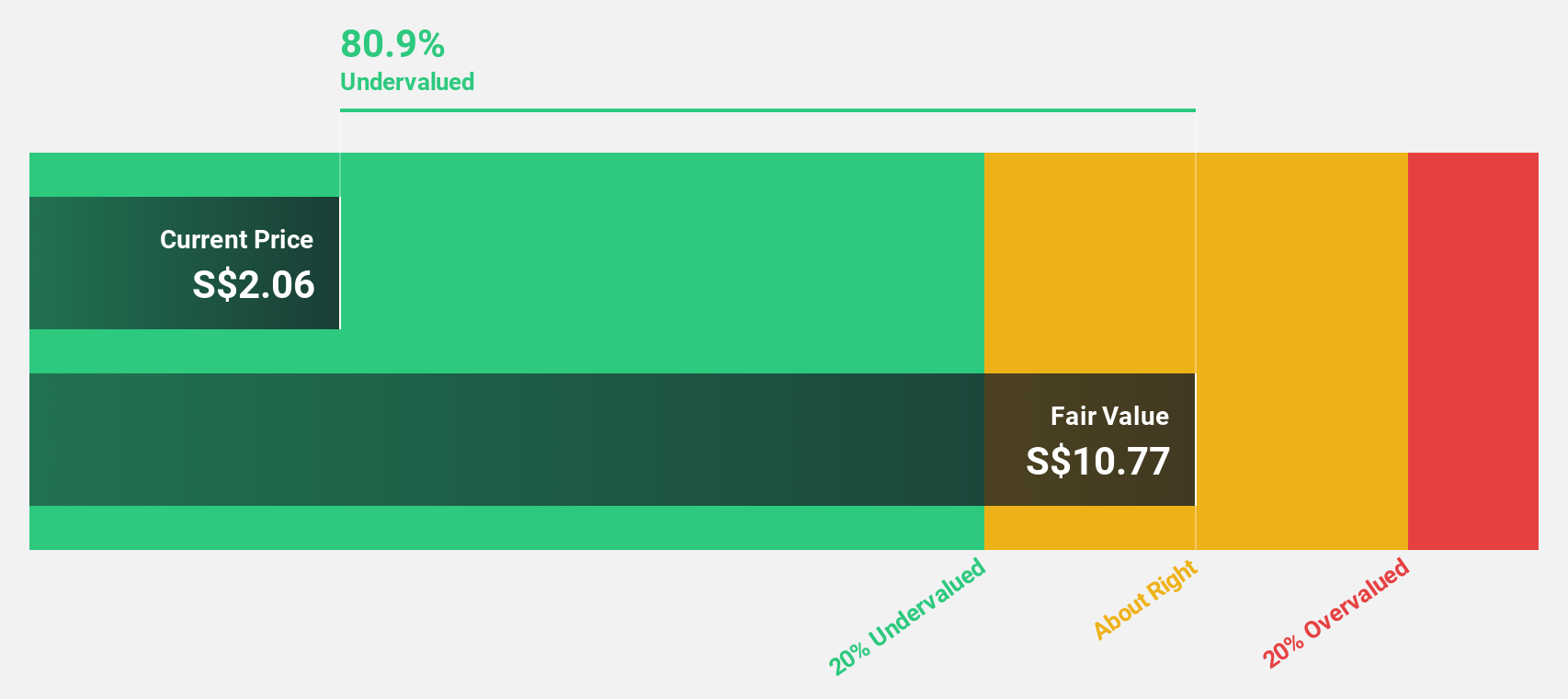

Estimated Discount To Fair Value: 49.7%

Singapore Technologies Engineering (SGD4.5) is trading at 49.7% below its estimated fair value of SGD8.95, indicating significant undervaluation based on discounted cash flow analysis. The company reported H1 2024 sales of SGD5.52 billion, up from SGD4.86 billion a year ago, and net income increased to SGD336.53 million from SGD280.62 million in the same period last year, reflecting robust earnings growth of 19.9%. However, debt coverage by operating cash flow remains a concern despite strong revenue forecasts and high return on equity projections (23.1%).

- In light of our recent growth report, it seems possible that Singapore Technologies Engineering's financial performance will exceed current levels.

- Click here to discover the nuances of Singapore Technologies Engineering with our detailed financial health report.

Turning Ideas Into Actions

- Investigate our full lineup of 5 Undervalued SGX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Seatrium, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5E2

Seatrium

Provides engineering solutions to the offshore, marine, and energy industries.

Adequate balance sheet and fair value.