- Singapore

- /

- Industrial REITs

- /

- SGX:BWCU

Investors Who Bought EC World Real Estate Investment Trust (SGX:BWCU) Shares A Year Ago Are Now Up 18%

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the EC World Real Estate Investment Trust (SGX:BWCU) share price is up 18% in the last year, clearly besting the market return of around 12% (not including dividends). So that should have shareholders smiling. In contrast, the longer term returns are negative, since the share price is 4.1% lower than it was three years ago.

See our latest analysis for EC World Real Estate Investment Trust

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, EC World Real Estate Investment Trust actually saw its earnings per share drop 77%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We haven't seen EC World Real Estate Investment Trust increase dividend payments yet, so the yield probably hasn't helped drive the share higher. It seems far more likely that the 11% boost to the revenue over the last year, is making the difference. After all, it's not necessarily a bad thing if a business sacrifices profits today in pursuit of profit tomorrow (metaphorically speaking).

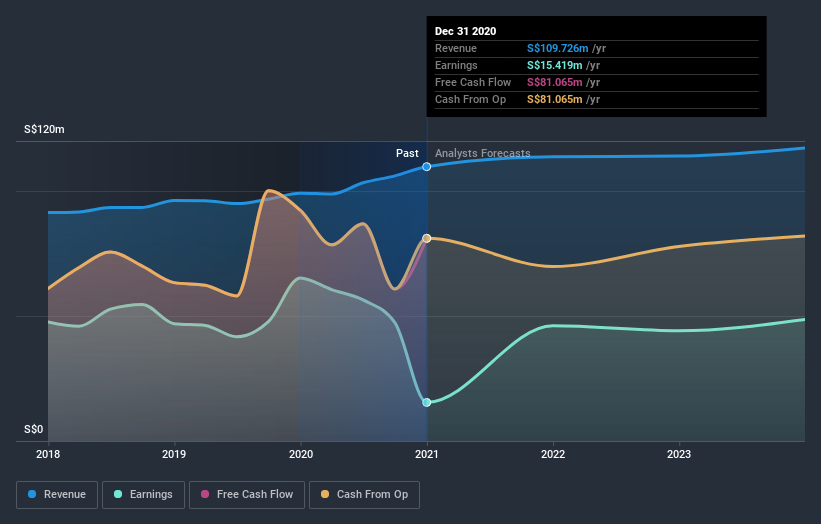

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, EC World Real Estate Investment Trust's TSR for the last year was 28%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that EC World Real Estate Investment Trust rewarded shareholders with a total shareholder return of 28% over the last year. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 7%. Given the track record of solid returns over varying time frames, it might be worth putting EC World Real Estate Investment Trust on your watchlist. It's always interesting to track share price performance over the longer term. But to understand EC World Real Estate Investment Trust better, we need to consider many other factors. For instance, we've identified 4 warning signs for EC World Real Estate Investment Trust (1 is concerning) that you should be aware of.

EC World Real Estate Investment Trust is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

When trading EC World Real Estate Investment Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade EC World Real Estate Investment Trust, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EC World Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BWCU

EC World Real Estate Investment Trust

Listed on 28 July 2016, EC World REIT is the first Chinese specialised logistics and e-commerce logistics REIT listed on Singapore Exchange Securities Trading Limited ("SGX-ST").

Good value average dividend payer.

Market Insights

Community Narratives