- Singapore

- /

- Real Estate

- /

- SGX:U14

Exploring Three SGX Dividend Stocks With Yields Starting At 3.7%

Reviewed by Simply Wall St

In recent years, the Singapore market has reflected broader global economic trends, with varying impacts on publicly traded corporations and privately held companies. As interest rates have trended downward globally, financing costs for businesses have decreased, yet this has not uniformly translated into higher profit rates across all sectors. When considering dividend stocks in this environment, a good stock typically offers a stable yield that can provide investors with consistent returns despite broader market fluctuations.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.62% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.99% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.57% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.86% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.13% | ★★★★★☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.94% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.64% | ★★★★☆☆ |

| Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 18 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

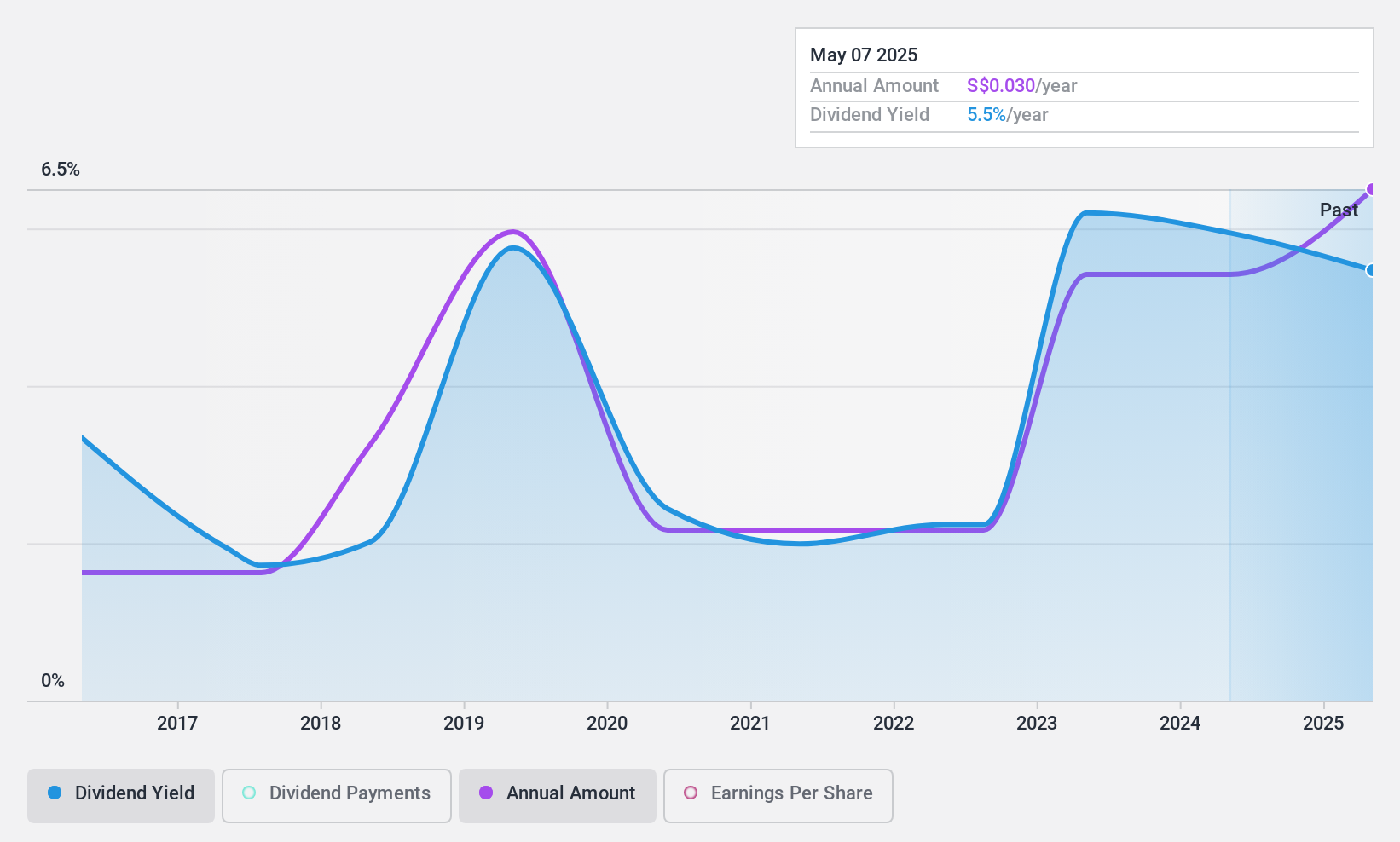

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that specializes in manufacturing and selling specialty chemicals across the People’s Republic of China, other parts of Asia, the United States, and Europe, with a market capitalization of SGD 382.58 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily through its Rubber Chemicals segment, which contributed CN¥4.38 billion, along with smaller contributions from Heating Power and Waste Treatment segments totaling CN¥221.29 million and CN¥29.76 million respectively.

Dividend Yield: 6.2%

China Sunsine Chemical Holdings has a history of unstable dividend payments over the past decade, with significant annual fluctuations. However, its dividends are well-supported financially, evidenced by a low payout ratio of 20.8% and a cash payout ratio of 30.2%, suggesting that earnings and cash flows sufficiently cover the dividend payments. Recent corporate actions include a share buyback program initiated on May 13, 2024, and board changes aimed at enhancing governance. Despite these positives, the dividend yield is slightly below the top quartile in Singapore's market at 6.18%.

- Navigate through the intricacies of China Sunsine Chemical Holdings with our comprehensive dividend report here.

- The analysis detailed in our China Sunsine Chemical Holdings valuation report hints at an deflated share price compared to its estimated value.

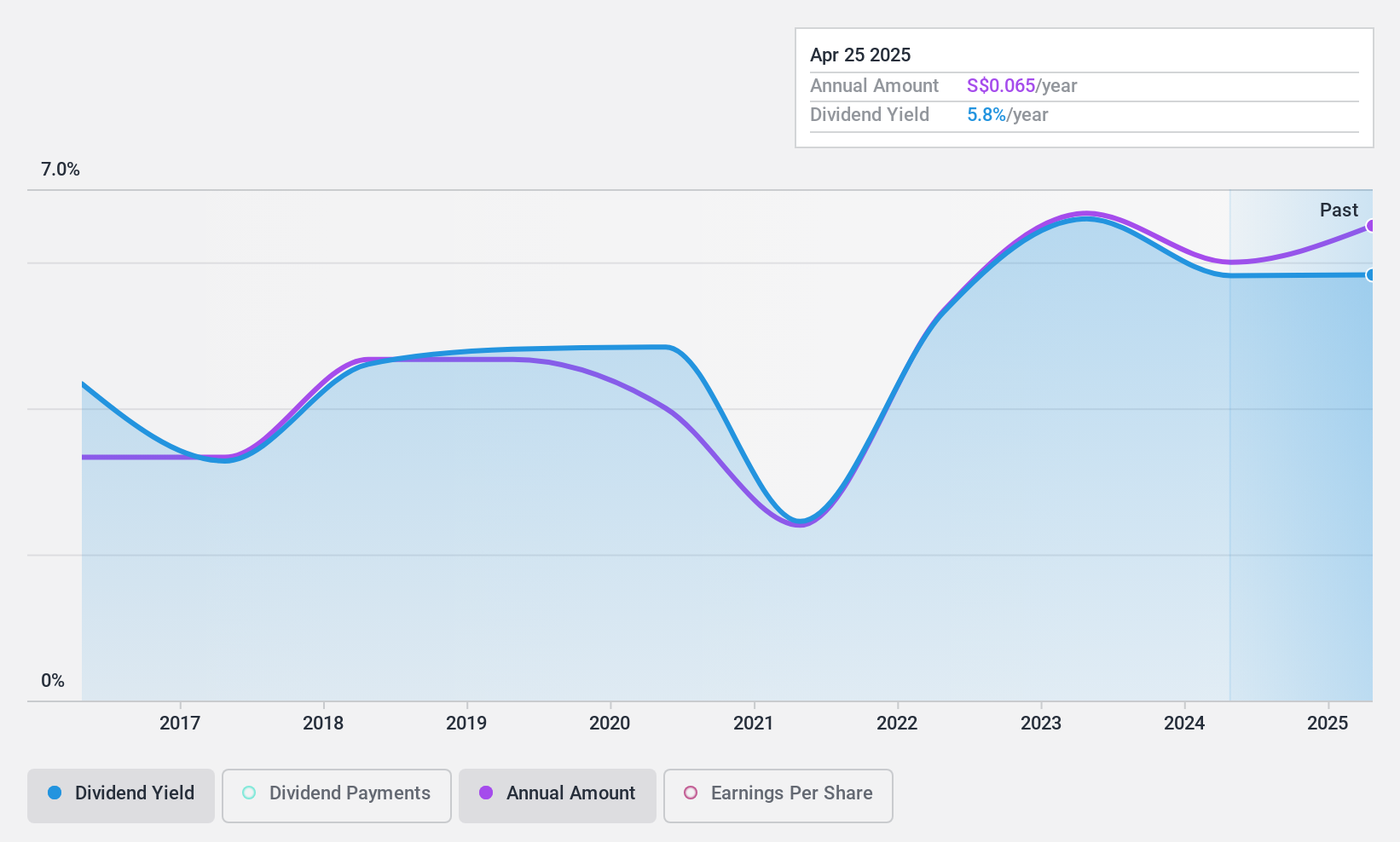

Sing Investments & Finance (SGX:S35)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sing Investments & Finance Limited offers financing services to both individuals and corporations in Singapore, with a market capitalization of approximately SGD 235.26 million.

Operations: Sing Investments & Finance Limited generates its revenue primarily through credit and lending activities, amounting to SGD 68.26 million.

Dividend Yield: 6%

Sing Investments & Finance exhibits a mixed performance in dividend reliability, with a history of volatile dividends over the past decade. Despite this, its dividends are financially sustainable with an earnings coverage payout ratio of 42.7% and a low cash payout ratio of 9.6%, indicating strong coverage by both profits and cash flows. However, its dividend yield at 6.03% is slightly below the top quartile for Singapore's market. Recently, it proposed a final dividend of S$0.06 per share for FY2023 during its upcoming AGM on April 25, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Sing Investments & Finance.

- Our expertly prepared valuation report Sing Investments & Finance implies its share price may be lower than expected.

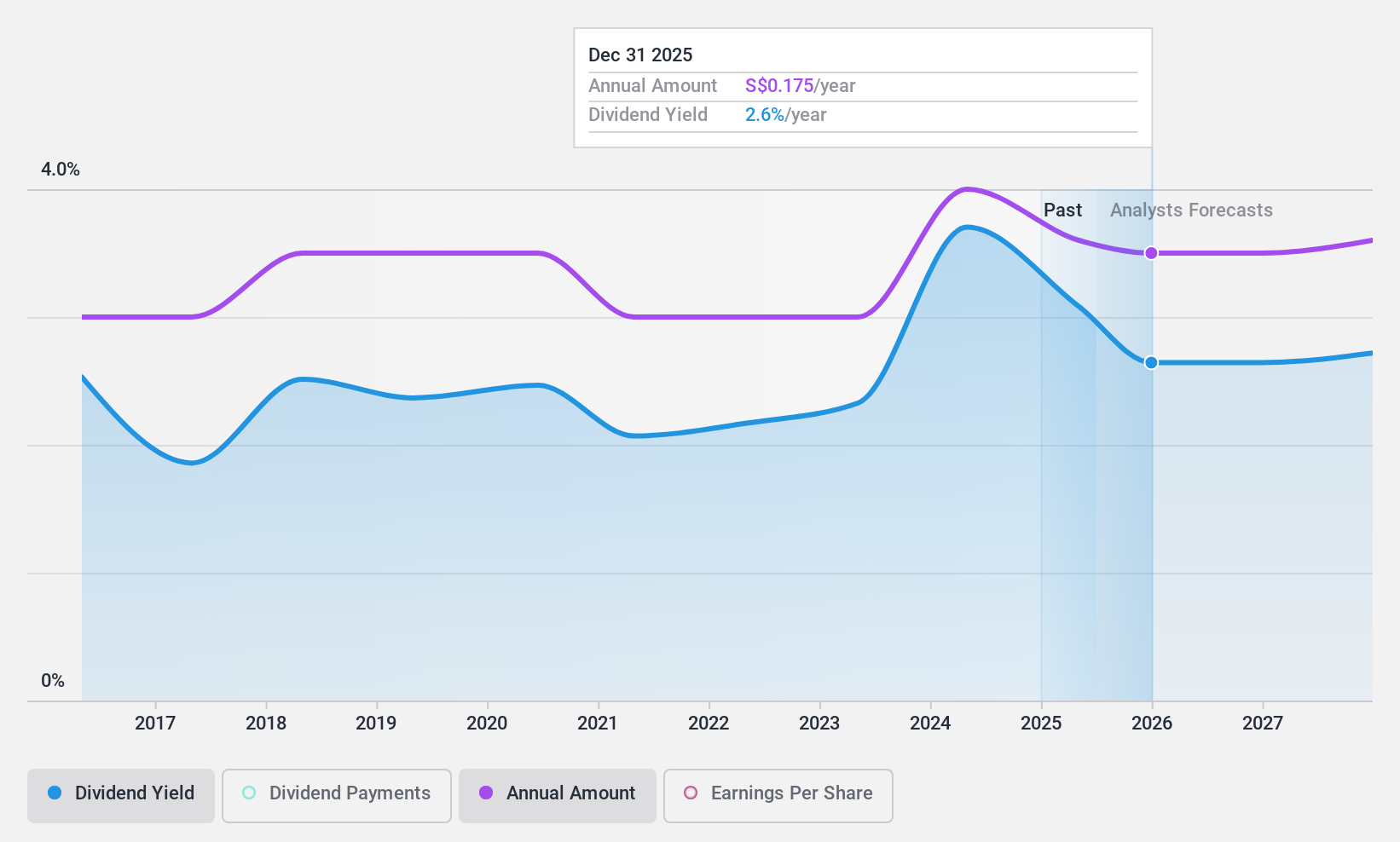

UOL Group (SGX:U14)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property development and hospitality sectors across various countries including Singapore, Australia, the UK, China, and the US, with a market capitalization of approximately SGD 4.45 billion.

Operations: UOL Group Limited generates revenue primarily through property development in Singapore (SGD 1.16 billion), property investments (SGD 518.93 million), and hotel operations across Singapore (SGD 464.93 million), Australia (SGD 125.64 million), and other locations (SGD 172.40 million), along with technology operations contributing SGD 110.08 million, and smaller investments totaling SGD 67.79 million.

Dividend Yield: 3.8%

UOL Group Limited offers a stable dividend yield of 3.8%, supported by a conservative payout ratio of 17.9% and cash payout ratio of 59.3%, ensuring dividends are well-covered by earnings and cash flows. The company has maintained consistent dividend payments over the past decade, with recent increases reflecting its financial health. However, it's important to note that UOL's dividend yield is below the top quartile in Singapore's market, where yields average around 6.2%. Additionally, recent executive changes with the appointment of Mr. Ng Tiang Poh as CFO could influence future financial strategies.

- Click to explore a detailed breakdown of our findings in UOL Group's dividend report.

- Our comprehensive valuation report raises the possibility that UOL Group is priced lower than what may be justified by its financials.

Summing It All Up

- Access the full spectrum of 18 Top SGX Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U14

UOL Group

UOL Group Limited (UOL) is a leading Singapore-listed property and hospitality group with total assets of about $23 billion.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives